Understanding The Current CoreWeave Stock Situation

Table of Contents

CoreWeave's Business Model and Recent Performance

CoreWeave's business model centers around providing GPU cloud computing solutions. This specialization caters to the exploding demand for high-performance computing power, particularly in the burgeoning fields of artificial intelligence (AI) and machine learning (ML). While specific financial details may change rapidly, recent reports suggest strong revenue growth, driven by increased adoption of its services. Key performance indicators (KPIs) to watch include revenue growth rate, customer acquisition cost, and average revenue per user (ARPU).

-

Recent Revenue Figures: While precise figures are subject to change and should be verified from official sources, publicly available information suggests significant quarter-over-quarter growth. This growth is largely attributed to the increasing demand for CoreWeave's specialized GPU cloud services.

-

Significant Partnerships: CoreWeave has forged strategic alliances with major players in the tech industry, further solidifying its market position and driving revenue. These partnerships provide access to wider customer bases and accelerate growth.

-

Market Share Growth: CoreWeave is actively gaining market share in the GPU cloud computing segment, competing with established giants. Its focus on specialized services and a strong technological foundation is a key contributor to this success.

-

Competitive Landscape Analysis: The competitive landscape includes established cloud providers like AWS, Google Cloud, and Microsoft Azure, who are also investing heavily in GPU-based services. CoreWeave's success hinges on its ability to maintain its competitive advantage through innovation and strategic partnerships. Keywords: CoreWeave financials, CoreWeave revenue, GPU cloud computing market, CoreWeave competitive advantage.

Factors Influencing CoreWeave Stock Price

Several factors contribute to the fluctuations in CoreWeave stock price. Macroeconomic conditions, such as interest rate hikes and inflationary pressures, significantly impact the tech sector, including CoreWeave. Furthermore, industry trends, especially the rapid advancement and adoption of AI and the subsequent increased demand for GPU computing power, are major drivers. Finally, competitive activities and market saturation play crucial roles.

-

Impact of AI Hype: The current excitement surrounding AI significantly boosts demand for CoreWeave's GPU-powered cloud services, positively influencing its stock price.

-

Competition from AWS, Google Cloud, Microsoft Azure: The intense competition from established cloud giants poses a significant challenge. CoreWeave needs to maintain its differentiation and innovation to remain competitive.

-

Regulatory Concerns: Changes in regulatory landscapes concerning data privacy and cloud computing could impact CoreWeave's operations and profitability, consequently affecting its stock price.

-

Potential Future Acquisitions: The possibility of CoreWeave being acquired by a larger technology company could drastically influence its stock price, creating either substantial gains or losses for investors. Keywords: CoreWeave stock price, AI impact on CoreWeave, CoreWeave competitors, cloud computing market trends.

Analyst Ratings and Future Outlook for CoreWeave Stock

Analyst ratings for CoreWeave stock vary, reflecting the inherent uncertainties associated with a rapidly growing company in a dynamic market. While some analysts express bullish sentiment, highlighting the company's strong growth potential and strategic position in the GPU cloud computing market, others offer more cautious projections. It's crucial to analyze these ratings critically, considering the individual analyst's methodology and potential biases.

-

Summary of Major Investment Bank Ratings: A summary of the major investment banks' ratings, including their price targets, provides a general overview of market sentiment towards CoreWeave stock. However, it's essential to remember that these are opinions and not guaranteed outcomes.

-

Potential Catalysts for Stock Price Movement: Significant events, such as new partnerships, product launches, or strong financial results, can significantly impact the stock price.

-

Long-Term Growth Projections: Long-term growth projections vary depending on the analyst and their assumptions about future market conditions and CoreWeave's competitive landscape. Keywords: CoreWeave stock forecast, CoreWeave analyst ratings, CoreWeave future prospects, CoreWeave investment outlook.

Risks and Potential Downsides of Investing in CoreWeave Stock

Investing in CoreWeave stock, or any growth stock, involves inherent risks. The company operates in a highly competitive market, and technological disruption is always a possibility. Economic downturns can significantly impact demand for cloud services, potentially affecting CoreWeave's profitability. Diversification is essential to mitigate these risks.

-

Market Volatility Risk: The stock market is inherently volatile, and CoreWeave stock is no exception. Significant price fluctuations are to be expected.

-

Competition Risks: Intense competition from established players could limit CoreWeave's market share and revenue growth.

-

Technological Obsolescence: Rapid technological advancements in the cloud computing sector could render CoreWeave's technology obsolete, negatively impacting its business.

-

Financial Risks: CoreWeave, like any company, faces financial risks including debt levels and potential cash flow issues.

-

Regulatory Risks: Changes in regulatory environments could impact CoreWeave's operations and profitability. Keywords: CoreWeave stock risks, CoreWeave investment risks, growth stock risks, cloud computing risks.

Conclusion: Making Informed Decisions About CoreWeave Stock

Understanding the current CoreWeave stock situation requires careful consideration of its business model, recent performance, influencing factors, analyst predictions, and inherent risks. Remember that thorough research is crucial before making any investment decisions. It is advisable to consult with a qualified financial advisor to receive personalized guidance tailored to your investment goals and risk tolerance. Staying informed about CoreWeave stock and the broader cloud computing market is essential for making sound investment choices. Consider exploring further CoreWeave stock analysis to refine your understanding before investing in CoreWeave stock.

Featured Posts

-

Pittsburgh Steelers Draft Strategy Will A Quarterback Be The Pick

May 22, 2025

Pittsburgh Steelers Draft Strategy Will A Quarterback Be The Pick

May 22, 2025 -

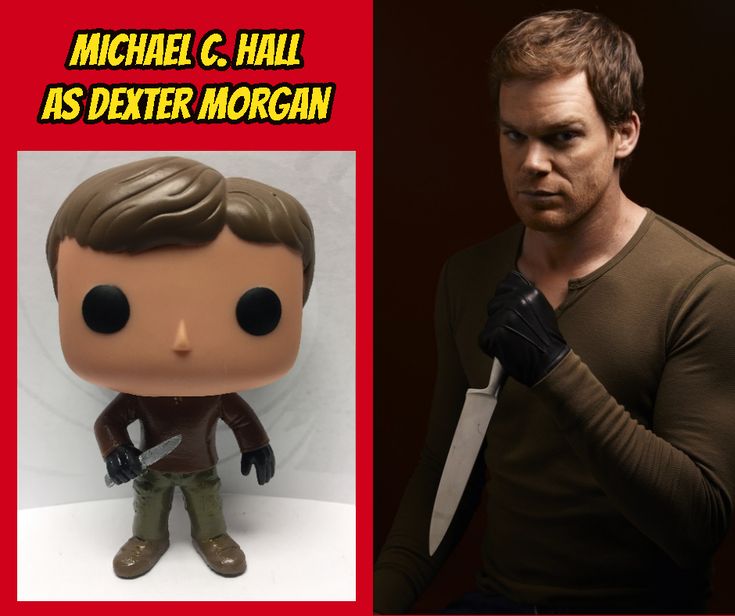

Funkos Dexter Pop Vinyl Figures First Look

May 22, 2025

Funkos Dexter Pop Vinyl Figures First Look

May 22, 2025 -

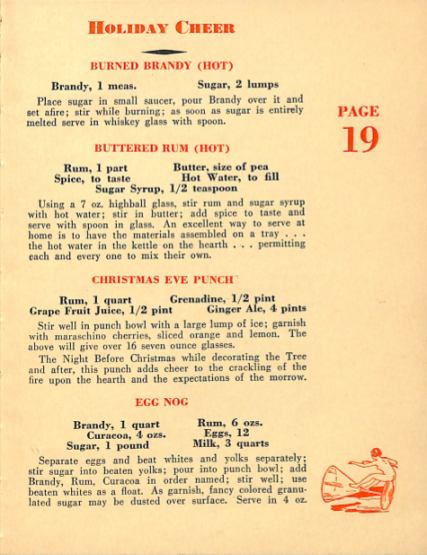

Cassis Blackcurrant Cocktails Creative Recipes And Mixology Tips

May 22, 2025

Cassis Blackcurrant Cocktails Creative Recipes And Mixology Tips

May 22, 2025 -

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025 -

Route 581 Shutdown Box Truck Accident Causes Delays

May 22, 2025

Route 581 Shutdown Box Truck Accident Causes Delays

May 22, 2025

Latest Posts

-

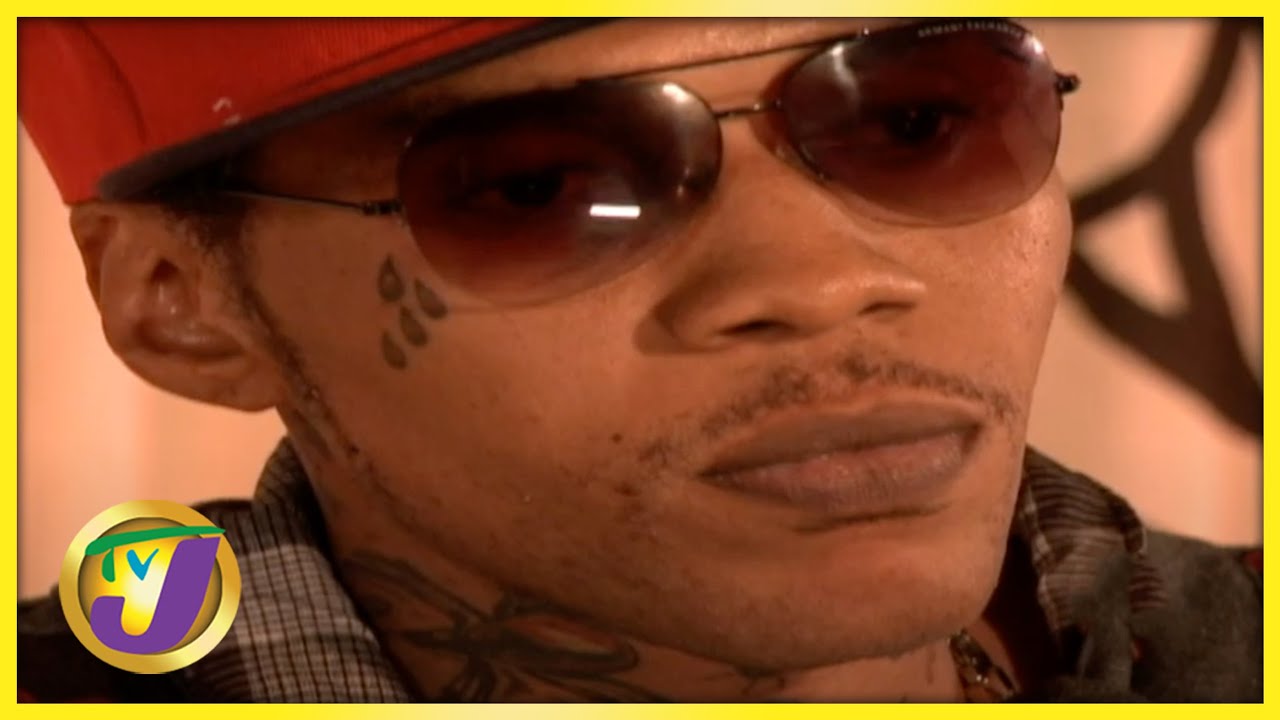

Newsday Report Police Justify Kartels Restrictions For Safety Reasons

May 23, 2025

Newsday Report Police Justify Kartels Restrictions For Safety Reasons

May 23, 2025 -

Kartels Security Police Source Details Safety Protocols In Trinidad And Tobago

May 23, 2025

Kartels Security Police Source Details Safety Protocols In Trinidad And Tobago

May 23, 2025 -

Trinidad And Tobago Newsday Police Explain Kartels Security Restrictions

May 23, 2025

Trinidad And Tobago Newsday Police Explain Kartels Security Restrictions

May 23, 2025 -

Police Cite Safety Concerns Regarding Kartels Restrictions

May 23, 2025

Police Cite Safety Concerns Regarding Kartels Restrictions

May 23, 2025 -

Barclay Center Concert Vybz Kartels April Show In New York City

May 23, 2025

Barclay Center Concert Vybz Kartels April Show In New York City

May 23, 2025