Understanding The Bond Market's Sensitivity To Tariff Changes

Table of Contents

Impact of Tariffs on Inflation Expectations

Tariffs, essentially taxes on imported goods, directly increase the price of those imports. This increase in import prices fuels inflationary pressures across the economy. This is because businesses face higher production costs due to more expensive raw materials and components. Consequently, consumers face reduced purchasing power as the cost of goods and services rises. This inflationary environment has a significant impact on the bond market, particularly bond yields. There exists an inverse relationship between bond yields and inflation: as inflation rises, bond yields generally rise as well, to compensate investors for the decreased purchasing power of their future bond payments.

- Increased production costs due to tariffs: Businesses pass on increased costs to consumers, leading to higher prices.

- Reduced consumer purchasing power: Higher prices reduce consumer spending, potentially slowing economic growth.

- Central bank response to inflation: Central banks may respond to rising inflation by increasing interest rates, further impacting bond yields.

- Impact on inflation-indexed bonds: Inflation-indexed bonds, designed to protect against inflation, see their value and yields adjust according to inflation rates, offering a hedge in this environment.

The Flight to Safety Phenomenon and Tariff Uncertainty

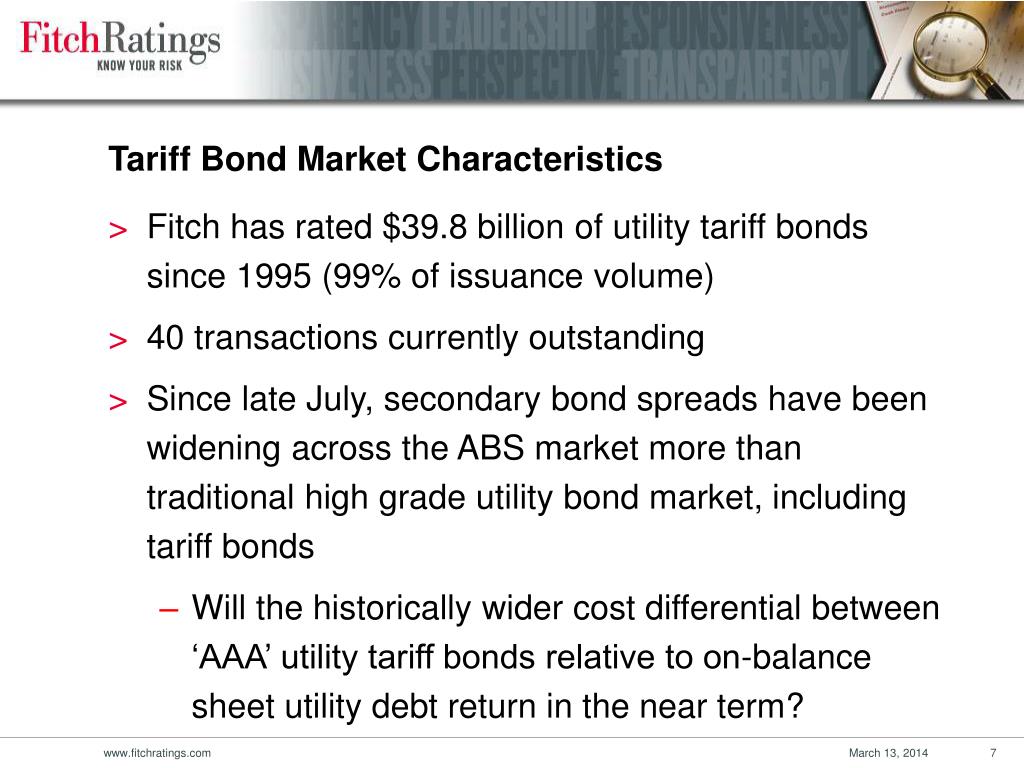

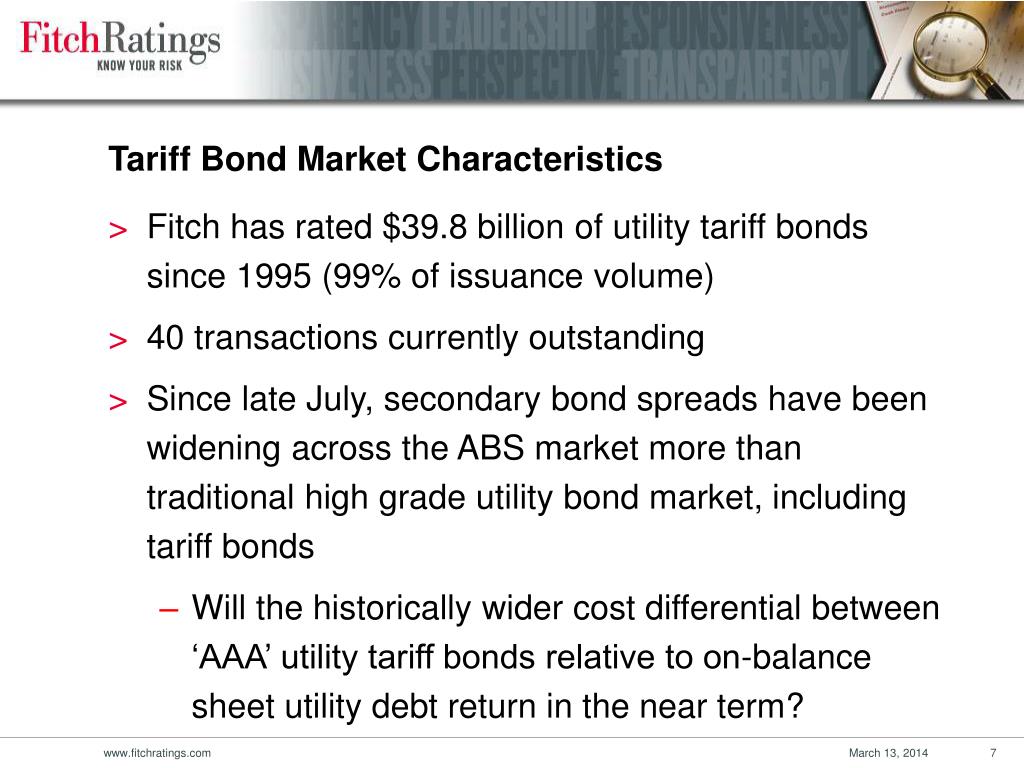

Increased trade tensions and the uncertainty surrounding future tariff policies create significant market volatility. This uncertainty prompts a "flight to safety," a phenomenon where investors shift their capital from riskier assets (like stocks) towards safer havens, such as government bonds. This surge in demand for government bonds drives down their yields. The flight to safety isn't limited to government bonds; it can also influence corporate bond spreads, widening the difference between yields on corporate bonds and government bonds as investors demand a higher premium for the increased risk associated with corporate debt.

- Increased demand for government bonds: Investors seek the perceived safety and stability of government debt during times of uncertainty.

- Decreased bond yields (due to increased demand): Higher demand pushes bond prices up, leading to lower yields.

- Impact on corporate bond spreads: The spread between corporate and government bond yields widens as investors demand a higher risk premium for corporate bonds.

- Geopolitical risk and its influence on bond markets: Global political instability, often intertwined with trade disputes, further exacerbates the flight to safety, impacting global bond markets significantly.

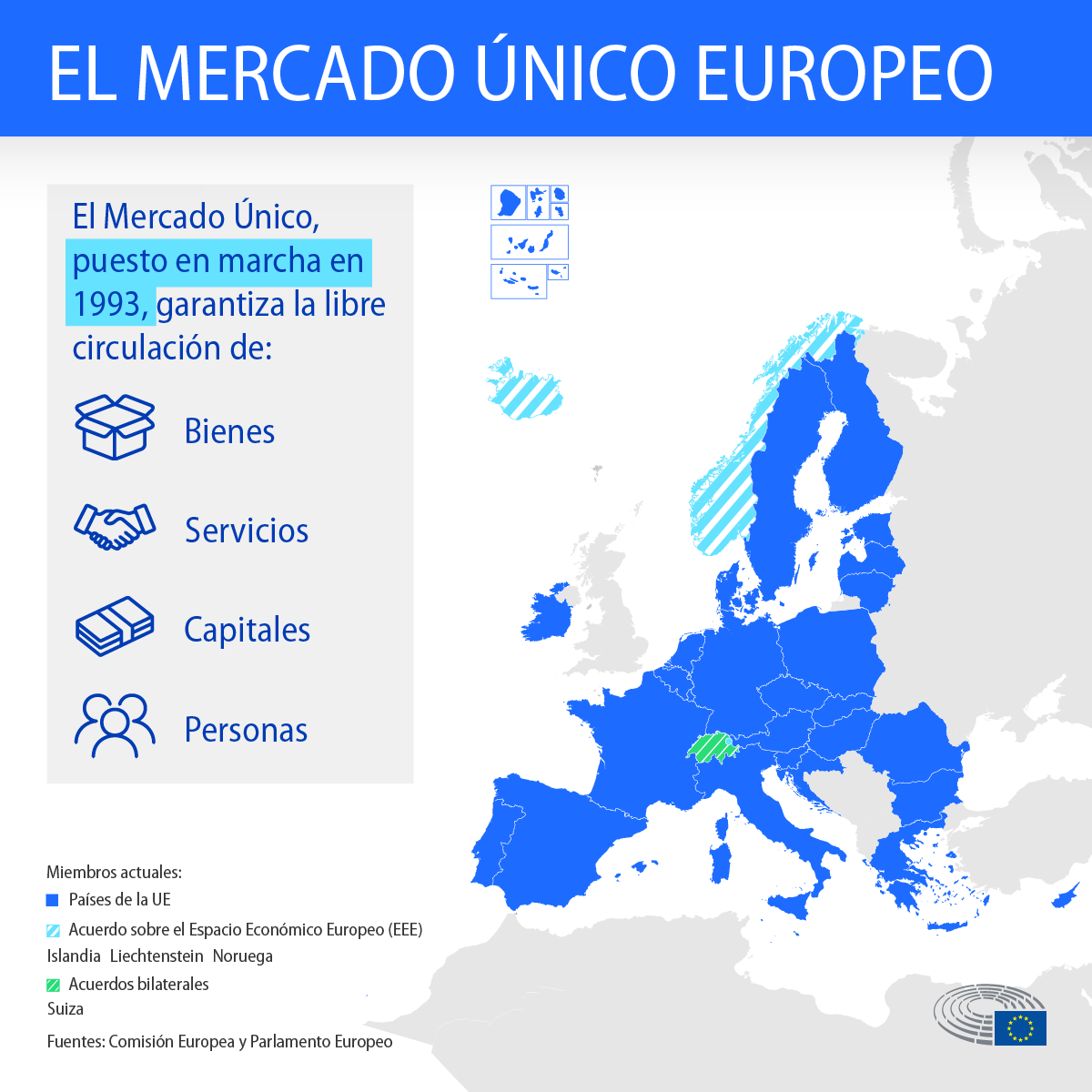

Currency Fluctuations and Their Effect on International Bond Markets

Tariffs can significantly impact currency exchange rates. For example, if a country imposes tariffs on imports, its currency may depreciate as the country's trade balance deteriorates. This currency fluctuation affects the returns of international bond investments. Investors holding bonds denominated in a depreciating currency will see their returns reduced when translated back into their domestic currency. Conversely, those holding bonds in a strengthening currency will benefit.

- Devaluation/appreciation of currencies: Tariff-induced trade imbalances can lead to currency fluctuations.

- Impact on foreign bond yields when translated into domestic currency: Currency movements alter the actual return experienced by investors.

- Hedging strategies for international bond investors: Investors can utilize hedging strategies, such as currency forwards or options, to mitigate currency risk.

- The role of currency risk in global bond market volatility: Currency fluctuations add another layer of complexity and risk to international bond investing.

The Role of Central Banks in Mitigating Tariff Impacts on the Bond Market

Central banks play a crucial role in responding to the economic consequences of tariff changes. If tariffs lead to inflation, central banks may raise interest rates to cool the economy. Conversely, if tariffs trigger a significant economic slowdown, central banks might implement quantitative easing (QE) programs, purchasing bonds to increase money supply and stimulate the economy. Forward guidance, or communication of future monetary policy intentions, helps shape market expectations and can mitigate some of the volatility. However, central banks have limitations in fully offsetting the effects of trade-related shocks; their tools are more effective at managing macroeconomic factors than directly addressing trade disputes.

- Interest rate adjustments and their impact on bond yields: Interest rate hikes increase bond yields, while rate cuts lower them.

- Quantitative easing programs and their influence on bond markets: QE programs can lower long-term interest rates and boost bond prices.

- Forward guidance and its role in shaping market expectations: Clear communication helps manage market expectations and reduce uncertainty.

- Limitations of central bank interventions in addressing trade-related issues: Central banks' ability to mitigate the impact of tariffs is limited, as trade policy is primarily a fiscal, not a monetary, issue.

Conclusion: Understanding and Navigating the Bond Market's Sensitivity to Tariff Changes

In summary, tariff changes have a significant and multifaceted impact on the bond market. They influence inflation expectations, triggering shifts in bond yields; they fuel uncertainty, driving flight-to-safety phenomena; and they create currency fluctuations that affect international bond investments. Central banks play a role in mitigating these effects, but their tools are not a panacea for trade-related shocks. Understanding these intricate relationships is vital for both investors and policymakers. By understanding the bond market's sensitivity to tariff changes, investors can better manage their risk and potentially capitalize on market opportunities. Stay informed about global trade policies and their impact on the bond market to make informed investment decisions.

Featured Posts

-

Smith Mountain Lake Hosts B And W Trailer Hitches Heavy Hitters Tournament 100 K Prize

May 12, 2025

Smith Mountain Lake Hosts B And W Trailer Hitches Heavy Hitters Tournament 100 K Prize

May 12, 2025 -

Senator Collins Re Election Campaign Will Democrats Mount A Serious Challenge In 2026

May 12, 2025

Senator Collins Re Election Campaign Will Democrats Mount A Serious Challenge In 2026

May 12, 2025 -

La Estrategia Uruguaya Un Regalo Unico Para El Mercado Ganadero Chino

May 12, 2025

La Estrategia Uruguaya Un Regalo Unico Para El Mercado Ganadero Chino

May 12, 2025 -

Un Classique Des Annees 80 Les Regrets De Sylvester Stallone Concernant Cobra

May 12, 2025

Un Classique Des Annees 80 Les Regrets De Sylvester Stallone Concernant Cobra

May 12, 2025 -

New York Yankees Lineup Aaron Boone On Aaron Judges Position

May 12, 2025

New York Yankees Lineup Aaron Boone On Aaron Judges Position

May 12, 2025

Latest Posts

-

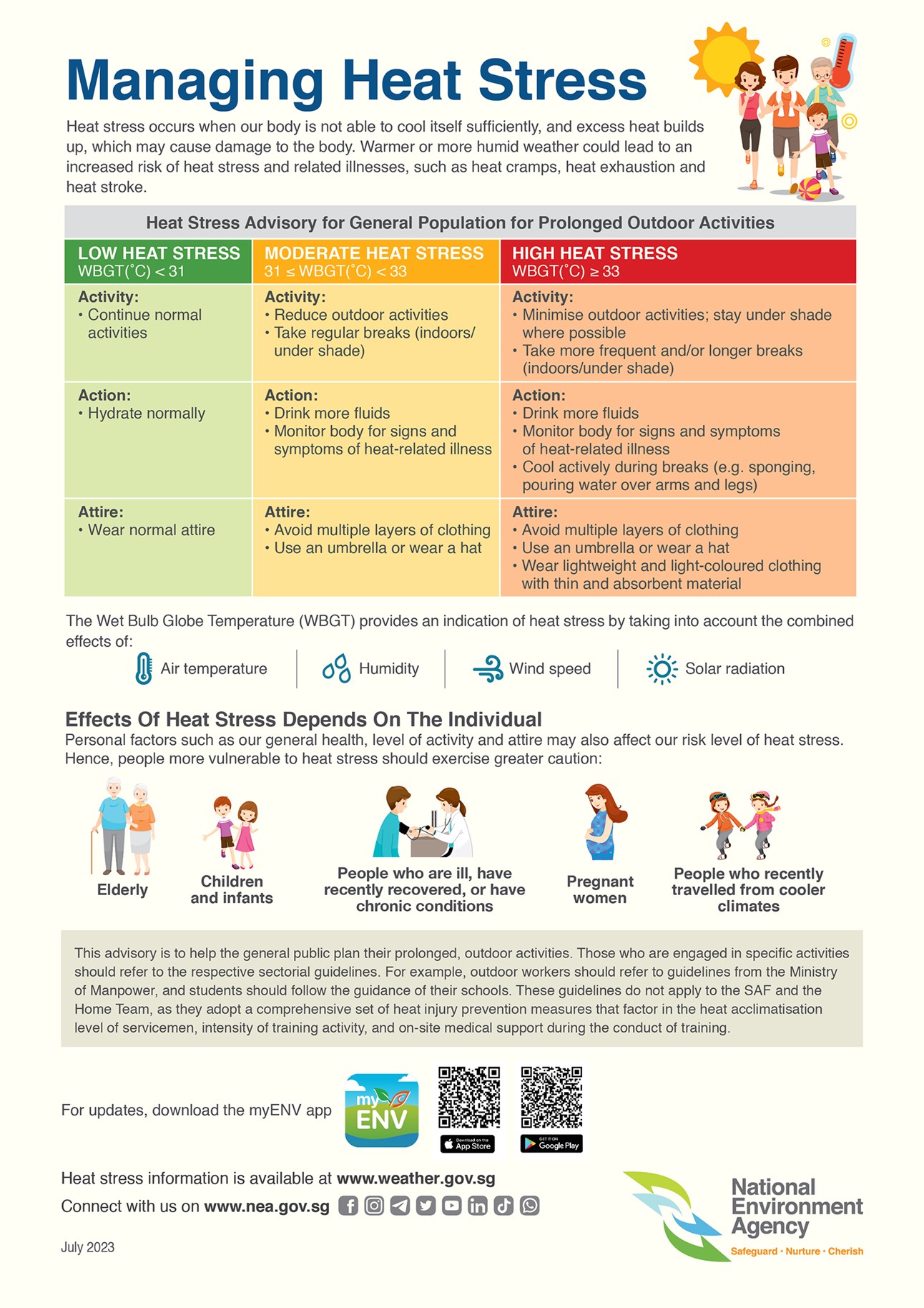

Ghaziabads Heat Advisory Safety Guidelines For Outdoor Workers In Noida

May 13, 2025

Ghaziabads Heat Advisory Safety Guidelines For Outdoor Workers In Noida

May 13, 2025 -

Ghaziabad Issues Advisory For Outdoor Workers Noida News

May 13, 2025

Ghaziabad Issues Advisory For Outdoor Workers Noida News

May 13, 2025 -

Delhi Issues Heatwave Advisory Protect Yourself From Heatstroke Risks

May 13, 2025

Delhi Issues Heatwave Advisory Protect Yourself From Heatstroke Risks

May 13, 2025 -

Heatstroke Alert Delhi Government Issues Advisory Amid Rising Temperatures

May 13, 2025

Heatstroke Alert Delhi Government Issues Advisory Amid Rising Temperatures

May 13, 2025 -

Delhi Mercury Soars Government Issues Heatstroke Warning And Advisory

May 13, 2025

Delhi Mercury Soars Government Issues Heatstroke Warning And Advisory

May 13, 2025