Understanding Stock Market Valuations: BofA's Rationale For Investor Confidence

Table of Contents

BofA's Key Valuation Metrics and Their Significance

Understanding stock market valuations requires familiarity with key financial metrics. BofA, like other financial institutions, relies on a range of indicators to assess market health and potential for growth. Let's examine some of the most important:

-

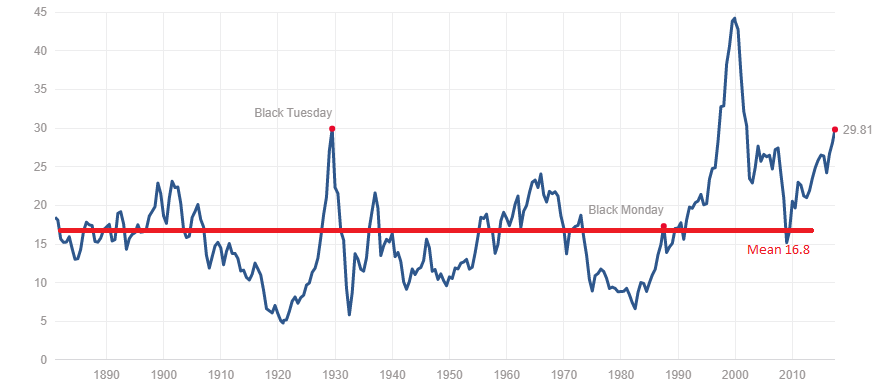

Price-to-Earnings (P/E) Ratio: This classic valuation metric compares a company's stock price to its earnings per share (EPS). It's calculated by dividing the market value per share by the earnings per share. A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating high growth expectations or market optimism. Conversely, a low P/E ratio might signal undervaluation or concerns about future earnings.

-

Price-to-Sales (P/S) Ratio: The P/S ratio measures the market capitalization relative to the company's revenue. It's calculated by dividing the market capitalization by the company's total revenue. This metric is particularly useful for valuing companies with no or negative earnings, such as many young, high-growth technology firms. A high P/S ratio often implies high growth potential, but it also carries higher risk.

-

Other Relevant Metrics: BofA's analysis likely incorporates other valuation metrics, such as Price-to-Book (P/B) ratio, which compares a company's market value to its book value of assets, and Dividend Yield, which represents the annual dividend payment relative to the stock price. These metrics provide a more comprehensive picture of a company's financial health and market positioning.

-

BofA's Usage: BofA uses these metrics not in isolation, but in conjunction with each other and alongside qualitative factors like management quality and competitive landscape. Their analysts compare P/E and P/S ratios across industries and against historical averages to identify potential overvaluation or undervaluation. By benchmarking against comparable companies and historical trends, BofA aims to identify attractive investment opportunities. For example, a relatively low P/E ratio compared to the industry average might suggest a company is undervalued.

Economic Factors Driving BofA's Positive Outlook

BofA's positive market valuation assessment is underpinned by several macroeconomic factors:

-

Interest Rates: The current state of interest rates significantly impacts valuations. Lower interest rates typically stimulate economic activity and encourage investment, potentially leading to higher stock prices. Conversely, rising interest rates can dampen economic growth and reduce valuations. BofA's analysis considers the trajectory of interest rates and their potential impact on corporate earnings and investor sentiment.

-

Inflationary Pressures: Inflation erodes purchasing power and can affect corporate profitability. High inflation can squeeze profit margins, negatively impacting stock valuations. BofA's outlook incorporates projections for inflation and its potential effects on various sectors. They analyze how companies are managing inflationary pressures and adapting their pricing strategies.

-

Economic Growth Potential: BofA's positive outlook is tied to projections of future economic growth. Strong economic growth typically fuels corporate earnings, leading to higher stock valuations. The bank's economists provide forecasts for GDP growth, employment rates, and consumer spending, all of which influence their assessment of the stock market.

-

BofA Projections: BofA's projections incorporate a range of factors, including government policies, geopolitical events, and technological advancements. Their economists and analysts develop comprehensive models to predict future economic trends and their effect on stock market valuations. Their reports typically include detailed explanations and supporting data for their projections. (Note: Specific data and charts would be included here in a real-world article).

Sector-Specific Analysis: BofA's Top Picks and Why

BofA's positive outlook is not uniform across all sectors. Their analysts identify specific sectors that they believe are poised for outperformance. For example:

-

Technology: BofA may highlight specific areas within the technology sector, such as artificial intelligence or cloud computing, as potentially undervalued or positioned for significant growth, citing factors like increasing adoption rates and technological advancements. They would analyze the valuations of individual companies within these segments and compare them to their historical performance and industry peers.

-

Healthcare: This sector is often viewed as defensive, meaning that it tends to perform relatively well even during economic downturns. BofA's analysts might point to specific segments within healthcare, such as pharmaceutical innovation or medical technology, as areas with strong growth potential. They would justify this assessment by examining factors like aging populations and the ongoing need for medical innovation.

(Note: This section would include specific company examples and detailed financial data from BofA's research in a full article.)

Managing Risk in the Current Valuation Environment

Even with a positive outlook, managing risk is crucial in any market environment. BofA likely emphasizes the following strategies:

-

Diversification: Spreading investments across various sectors and asset classes (stocks, bonds, real estate, etc.) helps reduce the impact of any single investment underperforming. This reduces overall portfolio volatility.

-

Long-Term Investing: Focusing on long-term investment horizons helps weather short-term market fluctuations. Short-term trading carries increased risk compared to a buy-and-hold strategy.

-

Risk Tolerance Assessment: Investors should carefully assess their risk tolerance before making investment decisions. A risk tolerance questionnaire can help determine the appropriate level of risk for their investment portfolio.

-

BofA's Recommendations: BofA likely recommends a combination of these strategies, tailored to different investor profiles and risk appetites. Their wealth management division likely offers personalized advice based on individual client circumstances and financial goals.

Conclusion

This article explored BofA's rationale for maintaining investor confidence, focusing on key valuation metrics, economic factors, sector-specific analysis, and risk management strategies. Understanding stock market valuations is crucial for making informed investment decisions. BofA's analysis provides valuable insights into navigating the current market landscape. However, remember that no analysis guarantees future performance. Always conduct your own thorough research before making investment decisions.

Call to Action: Stay informed about stock market valuations by regularly reviewing financial reports and analyses from reputable sources like Bank of America. Use this understanding to build a diversified investment strategy that aligns with your risk tolerance and long-term financial goals. Further your understanding of stock market valuations today!

Featured Posts

-

Arbitrage Hebdomadaire Analyse Du Portefeuille Bfm Du 17 Fevrier

Apr 23, 2025

Arbitrage Hebdomadaire Analyse Du Portefeuille Bfm Du 17 Fevrier

Apr 23, 2025 -

Aaron Judges Triple Crown Performance Yankees 9 Homer Game Sets New Record

Apr 23, 2025

Aaron Judges Triple Crown Performance Yankees 9 Homer Game Sets New Record

Apr 23, 2025 -

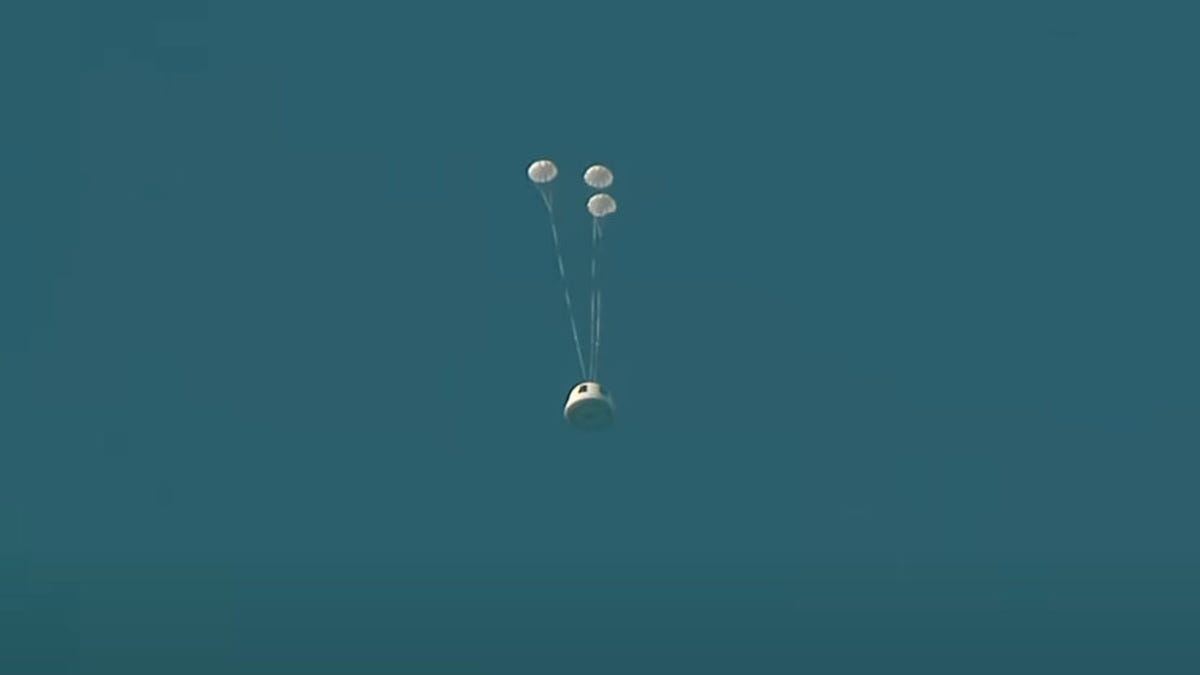

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

Apr 23, 2025

Blue Origin Rocket Launch Postponed Subsystem Issue Identified

Apr 23, 2025 -

Technical Glitch Forces Blue Origin To Abort Rocket Launch

Apr 23, 2025

Technical Glitch Forces Blue Origin To Abort Rocket Launch

Apr 23, 2025 -

Top 10 Cardinal Candidates To Become The Next Pope

Apr 23, 2025

Top 10 Cardinal Candidates To Become The Next Pope

Apr 23, 2025