Understanding Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Current Market Assessment and Key Indicators

BofA's overall view of the current stock market is cautiously optimistic. While acknowledging the present volatility, they believe the market is reasonably valued considering several key economic indicators. They are closely monitoring factors such as inflation, interest rates, and GDP growth to gauge the overall health of the economy and its impact on stock prices. These indicators are crucial for understanding stock market valuations and predicting future trends.

- Inflation: BofA notes that inflation, while still elevated, is showing signs of cooling. This is a positive sign, suggesting that the aggressive interest rate hikes implemented by central banks might be starting to have the desired effect.

- Interest Rates: Interest rate hikes are expected to slow, potentially signaling a pivot towards a more accommodative monetary policy. This could ease pressure on businesses and consumers, boosting economic growth and potentially supporting stock prices.

- GDP Growth: GDP growth remains positive, albeit at a reduced pace. This indicates continued economic expansion, though at a more moderate rate compared to previous periods. This slower, more sustainable growth is viewed favorably by some analysts.

These indicators, while presenting a mixed picture, collectively influence BofA's assessment of stock market valuations. The cooling inflation and anticipated slowdown in interest rate hikes provide a more favorable backdrop for stock market performance, even if growth slows.

Understanding Valuation Metrics: P/E Ratio and Other Key Measures

To accurately assess stock market valuations, BofA, like other analysts, utilizes various key valuation metrics. These metrics help determine whether stocks are trading at a fair price, are overvalued, or are undervalued relative to their underlying fundamentals. Understanding these metrics is crucial for making informed investment decisions.

-

Price-to-Earnings (P/E) Ratio: This is a widely used metric that compares a company's stock price to its earnings per share. A high P/E ratio might suggest the stock is overvalued, while a low P/E ratio could indicate undervaluation. However, the P/E ratio should be interpreted within the context of the company's industry and growth prospects.

-

Price-to-Sales (P/S) Ratio: This ratio compares a company's market capitalization to its revenue. The P/S ratio is particularly useful for valuing companies that are not yet profitable, as it provides a valuation metric even when earnings are negative.

-

Other Valuation Metrics: Beyond P/E and P/S ratios, other metrics such as Price-to-Book (P/B) ratio, dividend yield, and free cash flow yield provide a more comprehensive view of a company’s valuation and overall financial health. A holistic approach using multiple metrics is generally recommended.

BofA likely employs a combination of these metrics to analyze the overall valuation of the market, considering industry-specific benchmarks and long-term growth forecasts.

BofA's Rationale for Investor Calm: Why They Believe the Market is Reasonably Valued

BofA's calm stance is rooted in their analysis of stock market valuations using the metrics discussed above. They believe that, despite the current volatility, the market is reasonably valued based on several key arguments:

-

Current valuations are in line with historical averages: After considering various valuation metrics, BofA suggests that current market valuations are not drastically above historical averages, indicating that the market isn't significantly overvalued.

-

Long-term growth prospects remain positive: Despite near-term uncertainties, BofA likely points to the long-term growth potential of many companies, suggesting that the current market correction might present attractive entry points for long-term investors.

-

Market corrections are a normal part of the investment cycle: BofA likely acknowledges that market corrections are a natural and recurring phenomenon. They view the current situation as a temporary pullback rather than a harbinger of a significant market crash.

Addressing Investor Concerns: Common Worries and BofA's Rebuttals

Several concerns weigh on investors' minds. BofA likely addresses these head-on in its analysis.

-

Recession Fears: BofA might acknowledge recessionary risks but highlight the resilience of the economy and the possibility of a "soft landing."

-

Inflation: The cooling inflation trend, as discussed earlier, forms the core of BofA's counter-argument against excessive inflation fears.

-

Geopolitical Uncertainty: Geopolitical risks are always present. BofA likely accounts for these uncertainties within their valuation models, incorporating diverse scenarios and potential impacts on different sectors.

Navigating Stock Market Valuations: A Path Forward Based on BofA's Insights

BofA's analysis suggests that, despite market volatility, current stock market valuations are not excessively high. Their calm stance is supported by their assessment of key economic indicators and their application of various valuation metrics. However, it's crucial to remember that this is just one perspective.

The key takeaway is the importance of understanding stock market valuations. This understanding empowers investors to make informed decisions based on data and analysis rather than reacting solely to market sentiment. While BofA offers valuable insights, it’s vital to conduct thorough independent research and analysis before making any investment decisions. Explore reputable financial resources and consult with qualified financial advisors to improve your understanding of stock market valuations and develop a well-informed investment strategy.

Featured Posts

-

Rekord Ovechkina 12 Ya Pozitsiya V Spiske Luchshikh Snayperov Pley Off N Kh L

May 15, 2025

Rekord Ovechkina 12 Ya Pozitsiya V Spiske Luchshikh Snayperov Pley Off N Kh L

May 15, 2025 -

Vance Criticizes Bidens Silence On Trump Administrations Russia Ukraine Actions

May 15, 2025

Vance Criticizes Bidens Silence On Trump Administrations Russia Ukraine Actions

May 15, 2025 -

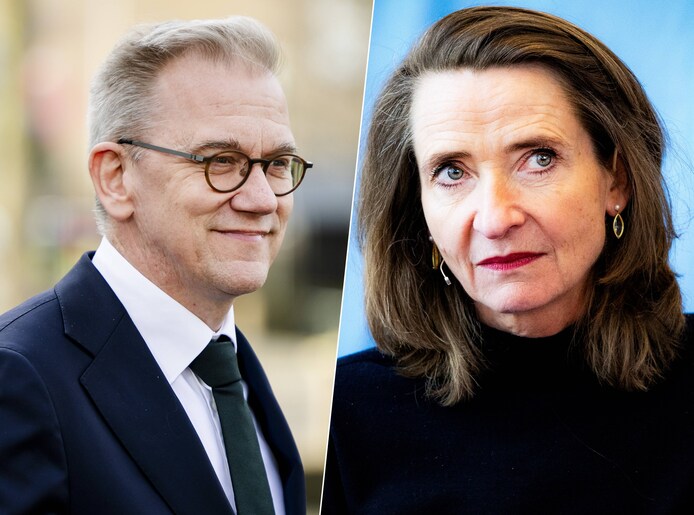

Hamer Affaire Npo Toezichthouder En Bruins In Overleg

May 15, 2025

Hamer Affaire Npo Toezichthouder En Bruins In Overleg

May 15, 2025 -

Npo Toezichthouder En Bruins Gesprek Over Leeflang Noodzakelijk

May 15, 2025

Npo Toezichthouder En Bruins Gesprek Over Leeflang Noodzakelijk

May 15, 2025 -

Kid Cudi Memorabilia Jewelry And Sneakers Command Top Dollar At Auction

May 15, 2025

Kid Cudi Memorabilia Jewelry And Sneakers Command Top Dollar At Auction

May 15, 2025