Understanding Stock Market Valuations: BofA's Analysis And Investor Guidance

Table of Contents

Key Valuation Metrics: Understanding the Numbers

Understanding how to value stocks is fundamental to successful investing. Several key metrics help investors gauge whether a stock is overvalued, undervalued, or fairly priced. Let's explore some of the most important.

Price-to-Earnings Ratio (P/E):

The Price-to-Earnings ratio (P/E ratio) is perhaps the most widely used valuation metric. It represents the market price per share divided by the earnings per share (EPS). A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating high growth expectations or market enthusiasm. Conversely, a low P/E ratio might suggest the stock is undervalued.

- Illustrative Examples: A P/E ratio of 20 means investors are willing to pay $20 for every $1 of earnings. A lower P/E ratio, say 10, suggests a potentially cheaper stock.

- Factors Influencing P/E Ratios: Growth prospects significantly influence P/E ratios. Companies with high growth potential often command higher P/E ratios. Industry comparisons are also crucial; a high P/E ratio might be normal within a fast-growing sector but unusually high in a mature industry.

- Limitations: Relying solely on the P/E ratio can be misleading. It's essential to consider other factors like debt levels, future earnings projections, and overall market conditions when assessing stock valuation.

Price-to-Book Ratio (P/B):

The Price-to-Book ratio (P/B ratio) compares a company's market capitalization to its book value of equity. Book value represents the net asset value of a company, calculated by subtracting liabilities from assets. A high P/B ratio may suggest the market values the company's intangible assets (brand reputation, intellectual property) highly. A low P/B ratio could signal undervaluation or potential financial distress.

- Interpretation: A P/B ratio above 1 indicates the market values the company more than its net asset value. A ratio below 1 might indicate undervaluation, but it's crucial to understand the reasons behind it.

- Industry-Specific Considerations: The P/B ratio's relevance varies across industries. Capital-intensive industries (e.g., manufacturing) might have lower P/B ratios than technology companies with significant intangible assets. Comparing a company's P/B ratio to its industry peers provides a more accurate context.

- Tangible Book Value: Comparing the market value to the tangible book value (excluding intangible assets) provides a more conservative assessment of asset valuation.

Other Important Metrics:

Several other metrics contribute to a comprehensive stock valuation analysis:

- Price-to-Sales Ratio (P/S): Compares a company's market capitalization to its revenue. Useful for valuing companies with negative earnings or those in early growth stages.

- Dividend Yield: Represents the annual dividend per share divided by the stock price. Attractive to income-oriented investors.

- Free Cash Flow (FCF): The cash a company generates after covering operating expenses and capital expenditures. A strong indicator of a company's financial health and ability to reward shareholders. Analyzing stock valuation metrics holistically provides a more robust picture.

BofA's Market Analysis and Outlook

BofA Securities, a leading global financial institution, regularly publishes market analyses and provides insights into stock market valuations. Their reports offer valuable perspectives on current market trends and potential investment strategies.

Current Market Trends:

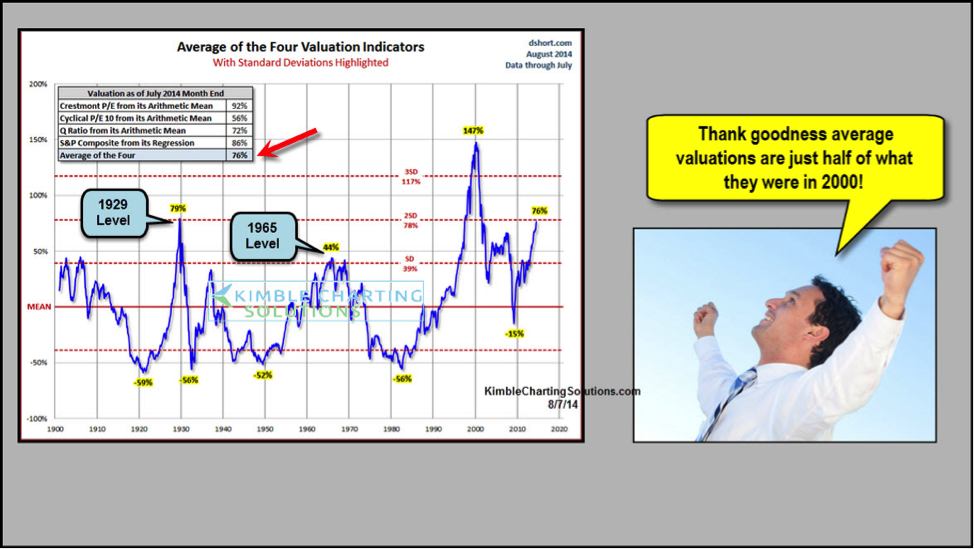

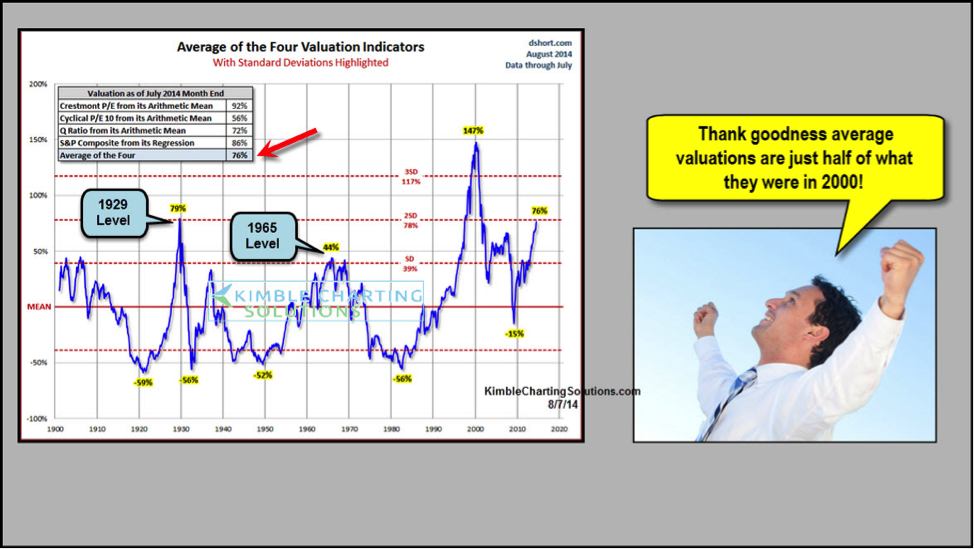

BofA's recent analyses often highlight prevailing market dynamics, including sector-specific trends and potential risks. For example, they may identify sectors poised for growth (e.g., renewable energy, technology) or areas of concern (e.g., rising interest rates impacting certain industries). Their reports frequently incorporate detailed charts and data visualizations that provide a comprehensive understanding of the stock market trends.

- Specific Examples: BofA might highlight the impact of inflation on consumer spending or the influence of geopolitical events on specific sectors. Analyzing these insights in conjunction with BofA market analysis can lead to more informed investment choices.

- Key Sectors: BofA's reports usually delve into sector-specific performance, highlighting opportunities and risks within various industries. This granular level of analysis is crucial for making informed decisions based on stock market valuation and sector-specific performance.

BofA's Investment Strategies:

Based on their valuation analysis, BofA often suggests specific investment strategies, catering to different risk tolerances and investment goals.

- Investment Approaches: Depending on the market conditions, they might advocate for value investing (focusing on undervalued companies), growth investing (targeting high-growth potential companies), or sector rotation (shifting investments between different sectors based on performance). These BofA investment strategies are often rooted in their in-depth analysis of stock market valuation.

- Risk Management: BofA’s recommendations emphasize risk management through diversification and appropriate asset allocation. Their reports usually address the importance of understanding and mitigating potential investment risks.

Practical Guidance for Investors

Applying BofA's analysis and incorporating general valuation principles empowers investors to make more informed decisions.

Evaluating Individual Stocks:

To assess an individual stock's valuation, investors should follow these steps:

- Fundamental Analysis: Carefully examine a company's financial statements (income statement, balance sheet, cash flow statement) to understand its profitability, financial health, and growth prospects.

- Metric Application: Apply the valuation metrics discussed above (P/E, P/B, P/S, etc.) to gauge whether the stock is overvalued, undervalued, or fairly priced relative to its peers and historical performance.

- Stock Screening Tools: Use online screening tools to quickly filter stocks based on specific valuation criteria. Many platforms allow investors to search for stocks meeting certain P/E or P/B ratio thresholds. This streamlines the process of individual stock valuation.

Managing Risk and Diversification:

Effective risk management is crucial for long-term investment success. Diversification across different asset classes (stocks, bonds, real estate) and sectors mitigates the impact of any single investment's poor performance.

- Diversification Strategies: Consider diversifying geographically (investing in international markets) and across different market capitalizations (large-cap, mid-cap, small-cap stocks). A well-diversified portfolio reduces overall portfolio risk.

- Risk Tolerance: Understand your risk tolerance before making investment decisions. Risk tolerance depends on your individual circumstances, investment timeframe, and financial goals. Balancing risk and reward is a critical aspect of investment strategy.

Conclusion

Understanding stock market valuations is crucial for successful investing. BofA's analysis provides valuable insights into current market trends and potential investment opportunities. By utilizing key valuation metrics like the P/E and P/B ratios, understanding BofA's market outlook, and applying practical guidance, investors can make more informed decisions and build a robust investment portfolio. Start analyzing your investment strategy today and master the art of understanding stock market valuations!

Featured Posts

-

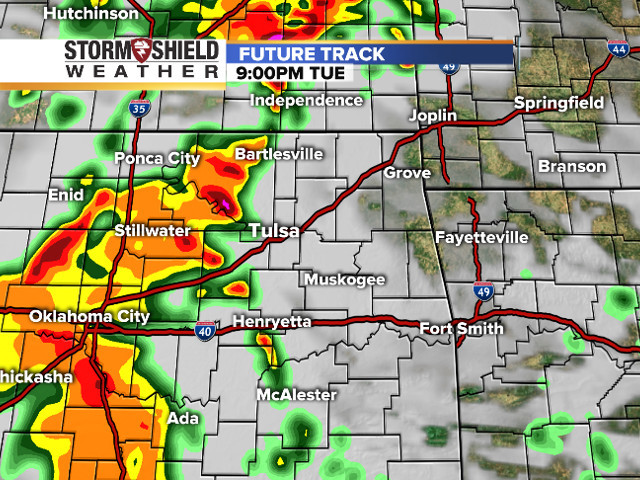

Strong Winds In Oklahoma A Severe Weather Timeline

May 03, 2025

Strong Winds In Oklahoma A Severe Weather Timeline

May 03, 2025 -

Sfynt Astwl Alhryt Wqaye Hjwm Israyyly Jdyd Ela Ghzt

May 03, 2025

Sfynt Astwl Alhryt Wqaye Hjwm Israyyly Jdyd Ela Ghzt

May 03, 2025 -

Kocaeli 1 Mayis Kutlamalari Siddet Ve Gerilim

May 03, 2025

Kocaeli 1 Mayis Kutlamalari Siddet Ve Gerilim

May 03, 2025 -

Foreign Secretary Announces Pm Modis Participation In Frances Ai Summit And Ceo Forum

May 03, 2025

Foreign Secretary Announces Pm Modis Participation In Frances Ai Summit And Ceo Forum

May 03, 2025 -

Graeme Souness On Arsenal And A Top Champions League Contender Off The Charts

May 03, 2025

Graeme Souness On Arsenal And A Top Champions League Contender Off The Charts

May 03, 2025