Understanding Proxy Statements (Form DEF 14A): A Comprehensive Guide

Table of Contents

What is a Proxy Statement (Form DEF 14A)?

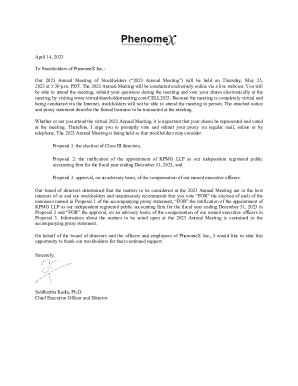

A proxy statement, also known as a DEF 14A, is a crucial legal document that publicly traded companies must file with the Securities and Exchange Commission (SEC) before shareholder meetings. It provides shareholders with essential information needed to make informed decisions on matters to be voted upon at the meeting. The legal significance of the DEF 14A lies in its role in ensuring transparency and facilitating shareholder participation in corporate governance.

Who is required to file a DEF 14A?

- Public companies: All publicly traded companies in the U.S. are obligated to file a DEF 14A.

- Before shareholder meetings: The filing must occur before any shareholder meeting where votes are cast on important company matters.

- Provides information on proposals: The statement details all proposals that will be put to a vote, allowing shareholders to understand the implications of each.

- Enables proxy voting: Proxy statements enable shareholders who cannot attend the meeting to vote by proxy, ensuring their voices are heard.

Key Information Contained in a Proxy Statement

Proxy statements are packed with information vital to investors. Understanding these sections allows for a more comprehensive evaluation of a company's performance and governance.

- Executive compensation (CEO, CFO, etc.): This section details the salaries, bonuses, stock options, and other benefits received by top executives. Analyzing this data helps assess whether compensation aligns with company performance and potential conflicts of interest.

- Director nominations and elections: Proxy statements outline the candidates nominated for the board of directors, providing biographical information and allowing shareholders to assess their qualifications.

- Shareholder proposals: This section lists any proposals submitted by shareholders, covering a wide range of topics from social responsibility initiatives to changes in corporate governance.

- Merger and acquisition information: If a merger or acquisition is being considered, the proxy statement will provide detailed information about the transaction.

- Auditor information: Details about the company's independent auditor are included, allowing shareholders to review their qualifications and independence.

- Company performance summaries: Financial highlights and performance metrics are usually presented, giving investors a concise overview of the company's recent activities.

Understanding Executive Compensation

Analyzing executive compensation is critical to understanding corporate governance. High compensation without corresponding performance may indicate potential issues.

- Salary, bonuses: These are the base components of executive compensation.

- Stock options: These provide incentives linked to company performance.

- Benefits: This includes perks like health insurance, retirement plans, and other benefits.

- Identifying potential conflicts of interest: Careful examination can reveal potential conflicts of interest between executive compensation and company decisions.

Analyzing Shareholder Proposals

Shareholder proposals offer insights into concerns of the company's stakeholders. They can cover a wide array of issues.

- Social responsibility initiatives: Proposals related to environmental sustainability, diversity, and ethical sourcing.

- Corporate governance changes: Proposals aimed at improving board structure, executive compensation, or shareholder rights.

- Executive compensation adjustments: Proposals directly addressing executive pay levels and structures.

How to Read and Interpret a Proxy Statement Effectively

Proxy statements can be complex documents. Here's how to navigate them effectively:

- Focus on key metrics and trends: Don't get bogged down in every detail; focus on the most significant numbers and changes over time.

- Use comparison tools (if available): Many financial websites provide tools to compare executive compensation and other metrics across companies.

- Seek professional advice when needed: If you're unsure about specific aspects, don't hesitate to consult a financial advisor. Understanding the nuances of a DEF 14A can be complex.

The Importance of Proxy Voting

Your vote matters! Proxy voting is a powerful tool for influencing corporate governance.

- Impact on company direction: Your vote helps determine the strategic direction of the company, including major decisions on mergers, acquisitions, and other strategic initiatives.

- Influence on executive compensation: Voting on executive compensation packages ensures accountability for management's performance.

- Holding management accountable: Active proxy voting is a vital mechanism for holding management accountable and promoting good corporate governance.

Conclusion

Understanding proxy statements (Form DEF 14A) empowers you to become a more active and informed investor. These documents offer a wealth of information about a company's performance, governance, and executive compensation. By learning to effectively read and interpret them, you can make more informed investment decisions and influence the direction of the companies you invest in. Take the time to review these crucial documents before the next shareholder meeting! For further information, you can consult the SEC's EDGAR database for access to proxy statements and other regulatory filings. Remember, active engagement with proxy statements (Form DEF 14A) is key to responsible and effective investing.

Featured Posts

-

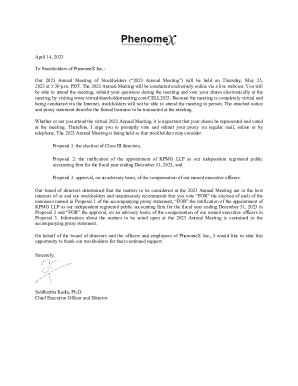

Replacing Stake The Best Casino Alternatives For 2025

May 17, 2025

Replacing Stake The Best Casino Alternatives For 2025

May 17, 2025 -

Ultraviolette Tesseract Electric Scooter Price Specs And Release

May 17, 2025

Ultraviolette Tesseract Electric Scooter Price Specs And Release

May 17, 2025 -

I Teleti Ypodoxis Toy Tramp Sygklonistikes Eikones Apo Tin Saoydiki Aravia

May 17, 2025

I Teleti Ypodoxis Toy Tramp Sygklonistikes Eikones Apo Tin Saoydiki Aravia

May 17, 2025 -

Greenko Founders Explore New Deal To Acquire Orix Stake In India

May 17, 2025

Greenko Founders Explore New Deal To Acquire Orix Stake In India

May 17, 2025 -

Red Carpet Rules And Regulations Why Guests Continue To Break Them Cnn

May 17, 2025

Red Carpet Rules And Regulations Why Guests Continue To Break Them Cnn

May 17, 2025

Latest Posts

-

6 1 Billion Celtics Sale Impact On The Team And Its Future

May 17, 2025

6 1 Billion Celtics Sale Impact On The Team And Its Future

May 17, 2025 -

Boston Celtics Future Uncertain After 6 1 Billion Sale To Private Equity Firm

May 17, 2025

Boston Celtics Future Uncertain After 6 1 Billion Sale To Private Equity Firm

May 17, 2025 -

Boston Celtics Sold For 6 1 Billion Fans React To Private Equity Buyout

May 17, 2025

Boston Celtics Sold For 6 1 Billion Fans React To Private Equity Buyout

May 17, 2025 -

Celtics Vs Pistons A Detailed Game Preview And Prediction

May 17, 2025

Celtics Vs Pistons A Detailed Game Preview And Prediction

May 17, 2025 -

The Trump Family A Generational Overview And Family Dynamics

May 17, 2025

The Trump Family A Generational Overview And Family Dynamics

May 17, 2025