Understanding Personal Loan Interest Rates Today: A Borrower's Guide

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several key factors determine the interest rate you'll receive on a personal loan. Understanding these factors is crucial for securing the best possible terms.

Credit Score: The Cornerstone of Creditworthiness

Your credit score is arguably the most significant factor influencing your personal loan interest rates. Lenders use your credit score, a three-digit number reflecting your creditworthiness, to assess your risk as a borrower. A higher credit score indicates lower risk, leading to lower interest rates.

- FICO Scoring System: The FICO score is the most widely used credit scoring model. It considers factors like payment history, amounts owed, length of credit history, new credit, and credit mix.

- Checking Your Credit Score: You can access your credit report and score for free from AnnualCreditReport.com. Regularly checking your score helps you monitor your financial health.

- Improving Your Credit Score: Improving your credit score takes time and effort, but it's well worth it. Focus on paying bills on time, keeping credit utilization low, and maintaining a long credit history.

Loan Amount and Term: The Repayment Equation

The amount you borrow and the repayment period (loan tenure) significantly impact your personal loan interest rates. Generally, larger loans and longer terms result in higher interest rates because they represent a greater risk to the lender.

- Example 1: A $5,000 loan over 24 months will likely have a lower interest rate than a $20,000 loan over 60 months.

- Example 2: A shorter loan term means higher monthly payments but less total interest paid over the life of the loan. Conversely, a longer loan term means lower monthly payments but more total interest paid. Carefully consider your budget and financial goals when choosing a loan term. Efficient loan repayment planning is essential.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying personal loan interest rates. Understanding the nuances of each type of lender can significantly impact your borrowing experience.

- Banks: Typically offer a wide range of loan products but might have stricter lending criteria and higher interest rates compared to credit unions.

- Credit Unions: Often offer more competitive interest rates and better customer service, but membership requirements may apply.

- Online Lenders: Provide a convenient and fast application process, but it's crucial to thoroughly research their reputation and fees before borrowing. They may have variable rates and fees attached to bank loans.

Current Economic Conditions: The Macroeconomic Influence

Prevailing economic conditions, particularly interest rates set by the central bank (like the federal reserve's prime rate) and inflation, significantly influence personal loan interest rates. Higher inflation generally leads to higher interest rates.

- Prime Rate: The prime rate is a benchmark interest rate that influences other interest rates, including those on personal loans. Changes in the prime rate directly or indirectly impact the personal loan interest rates you see.

- Inflation's Impact: When inflation is high, lenders raise interest rates to compensate for the decreased purchasing power of money.

How to Find the Best Personal Loan Interest Rates

Securing the most favorable personal loan interest rates requires proactive steps.

Shop Around and Compare: The Power of Comparison

Comparing offers from multiple lenders is paramount. Don't settle for the first offer you receive.

- Loan Comparison Websites: Utilize online tools and comparison websites to streamline the process of comparing APRs (Annual Percentage Rate) and fees.

- Check the Fine Print: Carefully review all loan terms and conditions, including any hidden fees or prepayment penalties, before committing to a loan. Conduct thorough APR comparison to ensure you get the most value for money.

Negotiate with Lenders: Don't Be Afraid to Ask

Don't hesitate to negotiate with lenders, particularly if you have a strong credit score and a stable financial history.

- Highlight Strengths: Emphasize your positive financial attributes to negotiate a lower interest rate.

- Explore Options: Inquire about any available discounts or promotions that could further reduce your interest rate. Effective loan negotiation can significantly reduce your total borrowing cost.

Improve Your Credit Score Before Applying: A Proactive Approach

A higher credit score significantly improves your chances of obtaining favorable personal loan interest rates.

- Pay Bills on Time: This is the single most important factor affecting your credit score.

- Keep Credit Utilization Low: Maintain a low credit utilization ratio (the amount of credit you're using compared to your total available credit).

- Build Credit: If you have a limited credit history, consider establishing credit responsibly through credit-builder loans or secured credit cards. Effective credit score improvement is a long-term investment in your financial well-being.

Conclusion

Securing the best personal loan interest rates depends on several interconnected factors, including your credit score, the loan amount and term, the lender you choose, and prevailing economic conditions. By understanding these factors and actively comparing offers, negotiating with lenders, and improving your credit score, you can significantly improve your chances of obtaining a loan with favorable terms. Take action today and compare personal loan interest rates from different lenders to secure the lowest personal loan interest rate, or find the best personal loan rates today. Empower yourself to navigate the personal loan market confidently and successfully!

Featured Posts

-

Underrated Chicago Med Duo Returns In Season 10s One Chicago Crossover

May 28, 2025

Underrated Chicago Med Duo Returns In Season 10s One Chicago Crossover

May 28, 2025 -

Yamal And Raphinha Barcelonas Winning Combination In Champions League

May 28, 2025

Yamal And Raphinha Barcelonas Winning Combination In Champions League

May 28, 2025 -

7 Potret Keseruan Ria Ricis Dan Moana Di Bali Dan Sumba Liburan Lebaran Penuh Ceria

May 28, 2025

7 Potret Keseruan Ria Ricis Dan Moana Di Bali Dan Sumba Liburan Lebaran Penuh Ceria

May 28, 2025 -

Zverevs Early Monte Carlo Exit Boosts Sinner To Top Ranking

May 28, 2025

Zverevs Early Monte Carlo Exit Boosts Sinner To Top Ranking

May 28, 2025 -

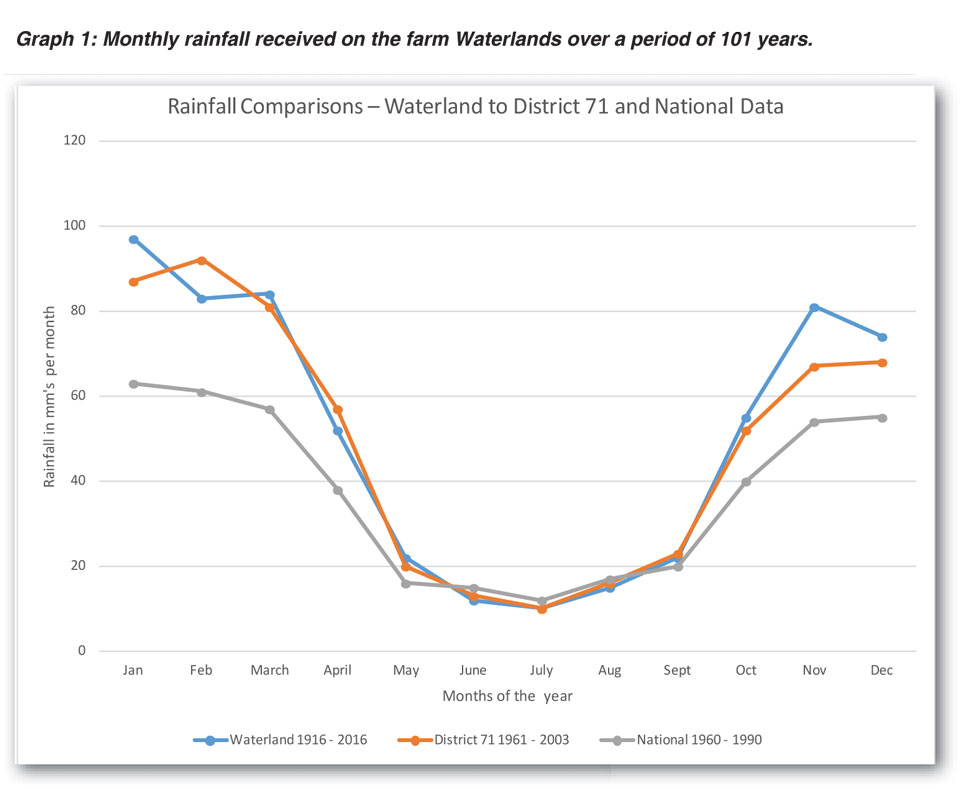

Analyzing April Rainfall Records And Trends

May 28, 2025

Analyzing April Rainfall Records And Trends

May 28, 2025