Understanding Jim Cramer's Opinion On CoreWeave (CRWV) And Its OpenAI Ties

Table of Contents

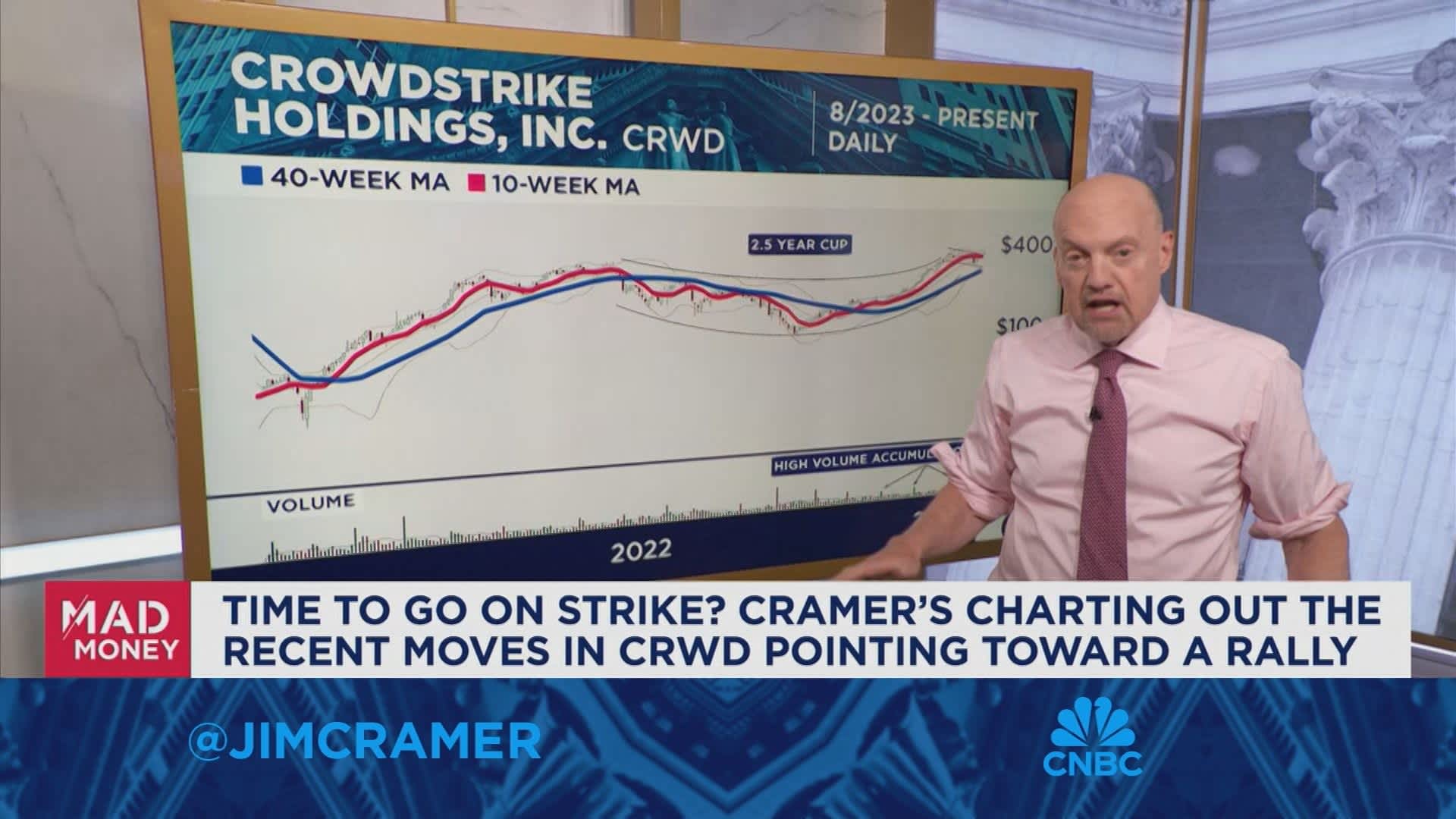

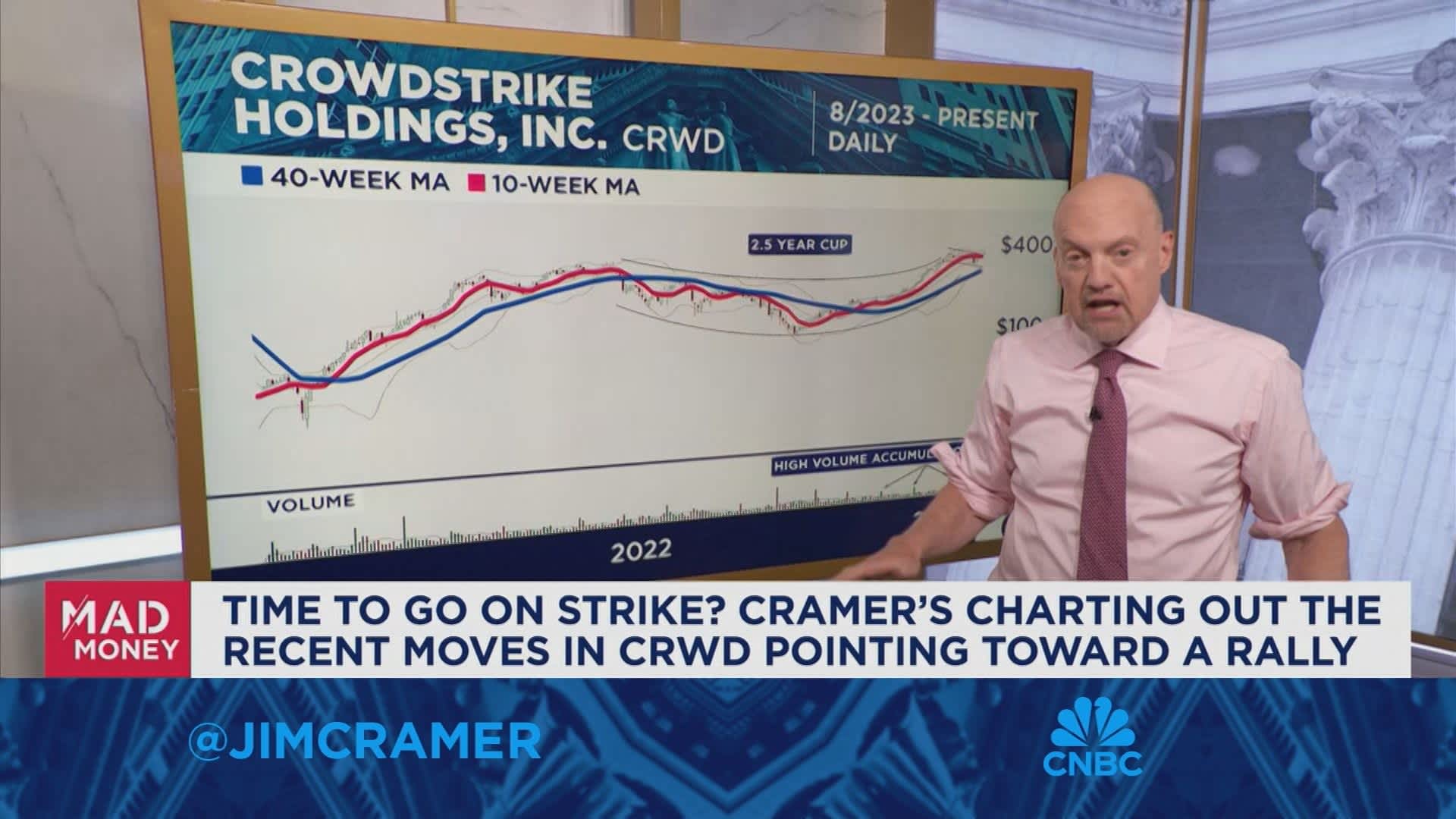

Jim Cramer's Public Statements on CoreWeave (CRWV)

Pinpointing Jim Cramer's exact and detailed stance on CoreWeave (CRWV) requires diligent research across his various appearances. While a comprehensive, publicly available archive of his every comment isn't readily accessible, we can analyze his general approach to similar companies and emerging trends within the AI and cloud computing sectors to infer potential opinions. His commentary often reflects the prevailing market sentiment and the news cycle.

- Consider the context: If Cramer has discussed similar companies in the AI cloud space, such as other providers of GPU-accelerated computing, his opinions on those may offer clues to his likely perspective on CoreWeave. He tends to favor companies with strong fundamentals, significant growth potential, and a clear competitive advantage.

- Market conditions: A bull market might lead to a more optimistic outlook compared to a bear market where risk aversion is higher. CoreWeave's IPO timing will also play a role in Cramer's assessment.

- Specific quote 1 (hypothetical, replace with actual quote and source if found): "While the AI cloud computing space is undeniably hot, investors need to be discerning." - Hypothetical quote from Mad Money, Date: October 26, 2023

- Specific quote 2 (hypothetical, replace with actual quote and source if found): "Companies with strong partnerships, like those leveraging leading-edge AI technologies, often fare better in periods of uncertainty." - Hypothetical quote from Squawk Box, Date: November 15, 2023

- Summary of overall sentiment towards CRWV: Based on currently unavailable direct statements, an educated guess can be made based on Cramer's general investment philosophy and views on the broader AI and cloud computing landscape. We might tentatively conclude that he would likely view CRWV favorably if its financials align with his criteria.

CoreWeave's (CRWV) Business Model and its Reliance on OpenAI

CoreWeave's business model centers on providing high-performance cloud computing infrastructure specifically tailored to AI workloads. This specialization is its main competitive advantage. They leverage powerful Nvidia GPUs to deliver unparalleled processing power for tasks like machine learning training and inference.

- Relationship with OpenAI: The exact nature of CoreWeave's relationship with OpenAI requires more details. It could range from being a preferred provider of cloud services for OpenAI clients to simply utilizing OpenAI's APIs and technologies within their own offerings. The level of integration is vital for understanding CRWV's long-term prospects.

- Importance of OpenAI's technology: OpenAI's technologies (like GPT models) are pivotal for many AI applications. If CoreWeave relies heavily on OpenAI's continued success and market dominance, then its future is tied directly to OpenAI's fortunes.

- Key features of CoreWeave's cloud computing services: GPU-optimized instances, high-speed networking, scalable infrastructure, specialized software support for AI frameworks.

- Specific examples of how OpenAI’s technology benefits CRWV’s clients: Providing the compute power needed to train large language models, enabling faster inference for AI-powered applications, facilitating the development of custom AI models.

- Analysis of the risks associated with CoreWeave's reliance on OpenAI: Dependence on a single technology provider creates vulnerability; if OpenAI faces challenges or shifts its partnerships, CoreWeave could be impacted.

The Investment Implications of CoreWeave (CRWV) and the OpenAI Connection

Investing in CoreWeave presents a high-growth, high-risk proposition. Its success is inextricably linked to the broader AI boom and the continued demand for high-performance computing.

- Potential growth drivers for CRWV: Expansion of the AI market, increasing demand for cloud-based AI services, successful partnerships and integrations with other AI companies, the release of new, advanced AI models.

- Potential risks for CRWV: Competition from established cloud providers (AWS, Azure, GCP), dependence on OpenAI's success, volatility of the AI market, potential economic downturns affecting spending on technology.

- Comparison with competitor companies in the AI cloud computing sector: A detailed comparison with competitors like Lambda Labs, and other specialized cloud providers is necessary to assess CoreWeave's competitive positioning.

Alternative Perspectives on CoreWeave (CRWV)

To obtain a balanced view, it's crucial to look beyond Jim Cramer's potential opinion. Consulting reports from financial analysts, investment firms, and industry experts will offer a more comprehensive understanding. Their valuations and predictions may differ significantly based on different modeling approaches, risk tolerances and perspectives.

- Summary of analyst 1's opinion on CRWV (hypothetical): Analyst 1 might highlight the strong growth potential but warn about the competitive landscape.

- Summary of analyst 2's opinion on CRWV (hypothetical): Analyst 2 may focus on the risks associated with OpenAI's dependence, potentially offering a more cautious outlook.

- Highlight any discrepancies between these opinions and Cramer’s: Comparing and contrasting opinions will reveal the range of viewpoints surrounding CoreWeave's investment viability.

Conclusion: Understanding Jim Cramer and CoreWeave (CRWV): Your Next Steps

While we lack definitive statements from Jim Cramer regarding CoreWeave (CRWV), analyzing his broader commentary and the company's fundamentals helps inform a potential outlook. CoreWeave's prospects are heavily influenced by the burgeoning AI market and its relationship with OpenAI. However, the company faces intense competition and inherent risks associated with technological dependence. Remember, investing in any company involves risk.

It is essential to conduct thorough, independent research before making any investment decisions. Further your understanding of CoreWeave's potential by examining their financial statements, competitive landscape, and long-term strategic plans. Deepen your analysis of Jim Cramer's take on CoreWeave (CRWV) and its OpenAI connection by monitoring his future comments and comparing them to other expert opinions. Don't rely solely on any single source; always diversify your information intake and make well-informed decisions.

Featured Posts

-

Hout Bay Fcs Success The Klopp Connection

May 22, 2025

Hout Bay Fcs Success The Klopp Connection

May 22, 2025 -

Accenture Announces 50 000 Promotions Following Delay

May 22, 2025

Accenture Announces 50 000 Promotions Following Delay

May 22, 2025 -

Swiss Foreign Minister Cassis Denounces Pahalgam Terrorist Attack

May 22, 2025

Swiss Foreign Minister Cassis Denounces Pahalgam Terrorist Attack

May 22, 2025 -

Love Monster How To Identify And Address Relationship Red Flags

May 22, 2025

Love Monster How To Identify And Address Relationship Red Flags

May 22, 2025 -

Bbc Breakfast Guests Live Broadcast Interruption Sparks Discussion

May 22, 2025

Bbc Breakfast Guests Live Broadcast Interruption Sparks Discussion

May 22, 2025

Latest Posts

-

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025 -

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025

Todays Nyt Wordle Answer March 26 A Tough One To Crack

May 22, 2025