Understanding Indian Crypto Exchange Compliance In 2025

Table of Contents

The Current Regulatory Landscape for Crypto Exchanges in India

The regulatory framework for cryptocurrencies in India remains fluid, presenting ongoing challenges for exchanges. Understanding the current landscape is crucial for ensuring compliance.

The 2023 Cryptocurrency Bill

The proposed Cryptocurrency and Regulation of Official Digital Currency Bill, 2023, significantly impacts Indian crypto exchanges. While the exact details are still emerging, its potential implications are far-reaching.

- Key provisions impacting exchanges: The bill aims to create a robust regulatory framework for crypto assets, potentially including licensing requirements for exchanges, stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) rules, and clear guidelines on taxation.

- KYC/AML requirements: The bill is expected to strengthen KYC/AML norms for exchanges, potentially mirroring those for traditional financial institutions. This will require rigorous identity verification procedures and transaction monitoring.

- Tax implications: The bill may introduce specific tax treatments for cryptocurrency transactions, clarifying the taxability of gains and losses for both exchanges and users.

- Penalties for non-compliance: Strict penalties are likely to be imposed for violations of the bill's provisions, ranging from hefty fines to license revocation.

RBI Guidelines and Enforcement

The Reserve Bank of India (RBI) has historically expressed caution regarding cryptocurrencies, issuing warnings against their use and impacting banking relationships for exchanges.

- RBI circulars: Several RBI circulars have cautioned banks against facilitating cryptocurrency transactions, indirectly affecting the operations of crypto exchanges.

- Warnings against crypto investments: The RBI has consistently highlighted the risks associated with cryptocurrency investments, urging caution among investors.

- Impact on banking relationships: The RBI's stance has made it challenging for crypto exchanges to establish banking relationships, hindering their operations. This necessitates exploring alternative banking solutions or payment gateways.

State-Level Regulations

While the central government sets the overarching framework, variations exist in state-level regulations impacting crypto exchanges.

- Examples of state-specific regulations: Some states may have specific tax policies or regulations regarding cryptocurrency transactions, potentially adding another layer of complexity for exchanges operating across multiple states. This necessitates staying updated on individual state regulations.

Key Compliance Areas for Indian Crypto Exchanges

Beyond the overarching regulatory framework, several key compliance areas are paramount for Indian crypto exchanges:

Know Your Customer (KYC) and Anti-Money Lauundering (AML) Compliance

Stringent KYC/AML norms are crucial for preventing illicit activities. Indian crypto exchanges must adhere to the Prevention of Money Laundering Act, 2002 (PMLA) and other relevant regulations.

- Required documentation: Exchanges must diligently collect and verify identity documents from users, including Aadhaar cards, PAN cards, and other official identification.

- Verification processes: Robust verification processes, including biometric verification and address verification, are crucial for ensuring compliance.

- Reporting obligations: Exchanges are obligated to report suspicious transactions to the relevant authorities, adhering to strict timelines and reporting formats.

- Penalties for non-compliance: Non-compliance with KYC/AML regulations can lead to significant penalties, including hefty fines and potential legal action.

Tax Compliance for Crypto Transactions

The taxation of cryptocurrency transactions is a crucial aspect of Indian crypto exchange compliance. The Income Tax Act, 1961, and the Goods and Services Tax Act, 2017 (GST), apply differently based on the nature of transactions.

- Tax rates for capital gains: Capital gains from cryptocurrency trading are currently taxed as income from other sources, based on the holding period of the asset.

- GST applicability: The GST implications for cryptocurrency transactions are still debated; however, exchanges need to ensure they comply with prevailing GST regulations.

- Tax reporting requirements for exchanges: Exchanges have an obligation to maintain accurate records of transactions and report relevant tax information to the authorities.

Data Security and Privacy

Protecting user data and maintaining privacy are fundamental to building trust. Indian crypto exchanges must comply with the Personal Data Protection Bill, 2023 (once enacted) and other relevant data protection laws.

- Data breach protocols: Robust data breach protocols are critical for mitigating the risk of data loss and ensuring compliance with data protection laws.

- Compliance with data protection laws: Adherence to the Personal Data Protection Bill, focusing on user consent, data minimization, and data security, is crucial.

- Cybersecurity measures: Implementing strong cybersecurity measures, including encryption and regular security audits, is vital for protecting user data.

Advertising and Marketing Regulations

Promoting crypto services requires adherence to advertising standards and regulations to avoid misleading claims and potential legal issues.

- Advertising guidelines: Exchanges must comply with advertising standards set by the Advertising Standards Council of India (ASCI) and other relevant bodies.

- Restrictions on misleading claims: Exchanges must avoid making false or misleading claims about the returns or risks associated with crypto investments.

- Compliance with advertising standards: Accurate and transparent advertising is crucial for building trust and avoiding regulatory scrutiny.

Future Trends and Predictions for Indian Crypto Exchange Compliance

The regulatory landscape for crypto exchanges in India is constantly evolving. Predicting future trends requires understanding the interplay of technological advancements and legislative changes.

Potential Changes in Legislation

Further amendments to existing laws or entirely new legislation concerning cryptocurrencies are highly probable. Exchanges must actively monitor legislative developments.

Technological Advancements and their Impact on Compliance

Blockchain technology and related advancements will necessitate adapting compliance practices to accommodate new technologies and their associated risks.

International Best Practices and their Applicability to India

India might increasingly align with international best practices for crypto regulation, influencing domestic compliance requirements for exchanges.

Conclusion

Successfully navigating the complex regulatory landscape of Indian crypto exchange compliance in 2025 requires proactive and comprehensive measures. Staying abreast of evolving legislation, implementing robust KYC/AML procedures, and ensuring data security are paramount. Understanding and adhering to tax regulations and advertising guidelines are equally crucial for maintaining compliance. By proactively addressing these key areas, Indian crypto exchanges can foster a secure and trustworthy environment for both users and the overall growth of the Indian crypto market. For further guidance on Indian cryptocurrency exchange compliance, consult legal professionals specializing in fintech regulations.

Featured Posts

-

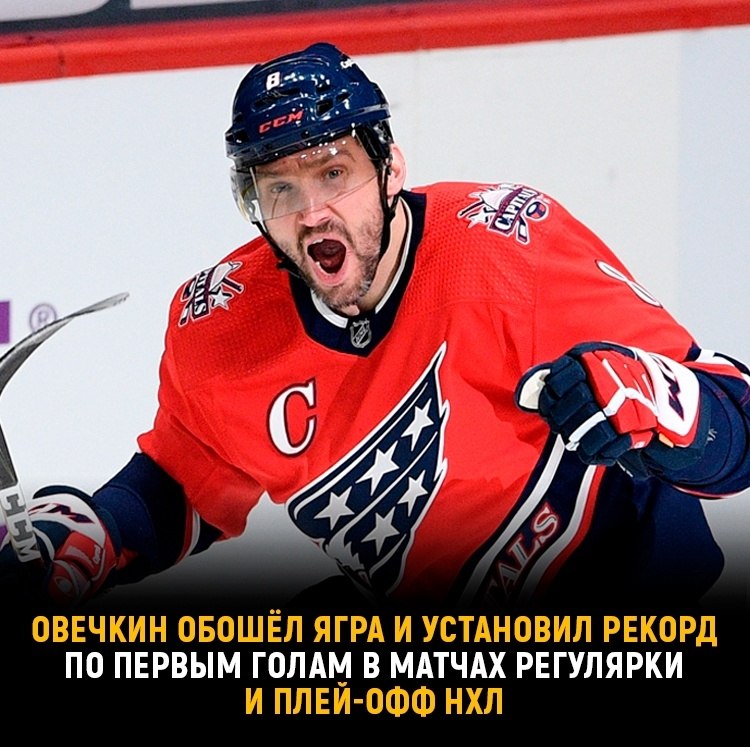

Ovechkin Noviy Rekord N Kh L Po Golam V Pley Off

May 15, 2025

Ovechkin Noviy Rekord N Kh L Po Golam V Pley Off

May 15, 2025 -

Analyzing The Public Response To The Revised Nhl Draft Lottery Rules

May 15, 2025

Analyzing The Public Response To The Revised Nhl Draft Lottery Rules

May 15, 2025 -

Ufc 314 Pimbletts Path To A Championship Opportunity

May 15, 2025

Ufc 314 Pimbletts Path To A Championship Opportunity

May 15, 2025 -

Cloudflare Vs La Liga Court Case Highlights Fight Against Illegal Website Blocking

May 15, 2025

Cloudflare Vs La Liga Court Case Highlights Fight Against Illegal Website Blocking

May 15, 2025 -

Paddy Pimblett Ufc 314 Champion Goat Legends Backing Fuels Prediction

May 15, 2025

Paddy Pimblett Ufc 314 Champion Goat Legends Backing Fuels Prediction

May 15, 2025