Understanding HMRC's Nudge Letters For Online Sellers (eBay, Vinted, Depop)

Table of Contents

What are HMRC Nudge Letters?

HMRC nudge letters are informal communications from Her Majesty's Revenue and Customs (HMRC), the UK's tax authority. Their purpose is to gently remind online sellers of their tax responsibilities and encourage voluntary disclosure of any undeclared income. They are not a formal tax assessment or demand for payment, but rather a warning indicating that HMRC has identified potential discrepancies between your declared income and their records. Receiving a nudge letter is an opportunity to rectify any issues before facing more serious consequences.

- A gentle reminder of your tax obligations.

- An encouragement for voluntary disclosure of income.

- An opportunity to avoid immediate penalties.

- A sign that HMRC has access to your sales data from online marketplaces.

These letters are typically sent to individuals who may be under-declaring their income from online selling activities. HMRC uses data-matching techniques to compare information received from online marketplaces like eBay, Vinted, and Depop against the tax returns filed by sellers.

Why You Might Receive an HMRC Nudge Letter (eBay, Vinted, Depop)

HMRC sends nudge letters to online sellers for various reasons, primarily due to inconsistencies between declared income and the data they hold from online marketplaces. This data-matching process allows HMRC to identify potential discrepancies and initiate contact.

- Discrepancies between declared profits and sales data: If your declared profit on your Self Assessment tax return is significantly lower than your reported sales on platforms like eBay, Vinted, or Depop, HMRC may send a nudge letter.

- Lack of tax returns filed: Failure to file a Self Assessment tax return, even if your sales are small, can lead to a nudge letter.

- Suspected under-reporting of income from online sales: Even seemingly minor omissions can trigger HMRC's attention.

- Examples: This could include unreported eBay selling fees, overlooked Vinted transaction details, or unaccounted-for Depop sales records. Failure to account for these accurately will trigger these letters.

What to Do if You Receive an HMRC Nudge Letter

Receiving an HMRC nudge letter should prompt immediate action. Don't ignore it; prompt and accurate responses are vital.

- Review the letter carefully: Understand the specific concerns raised by HMRC.

- Gather all relevant sales records: Compile your transaction history from eBay, Vinted, and Depop. Ensure you have records for all sales, including dates, amounts, and any relevant fees.

- Calculate your taxable profits accurately: Use your records to accurately calculate your taxable profits, taking account of all allowable expenses.

- Contact HMRC if you have questions or need clarification: If anything is unclear, contact HMRC directly for assistance.

- Consider seeking professional advice from an accountant: An accountant specializing in online seller tax can help you navigate the complexities of tax regulations and ensure compliance. They are especially helpful if you are unsure of how to correctly account for expenses.

Preventing Future HMRC Nudge Letters

Proactive measures will significantly reduce the risk of receiving future HMRC nudge letters.

- Maintain accurate records of all income and expenses: Use spreadsheets or accounting software designed for online sellers to meticulously track every transaction and expense.

- File your Self Assessment tax returns on time: Ensure all tax returns are completed and submitted by the deadline.

- Use accounting software tailored for online sellers: Software specifically designed for online businesses can simplify record-keeping and tax calculations.

- Understand your tax obligations: Familiarize yourself with the tax rules relevant to your online selling activities.

- Regularly review your tax position: Periodically check your records to ensure they are accurate and up-to-date.

Conclusion

HMRC nudge letters serve as a crucial reminder of your tax responsibilities as an online seller on platforms like eBay, Vinted, and Depop. Accurate record-keeping is paramount to avoid future issues. Prompt action and accurate calculations are essential to resolve any concerns raised in an HMRC nudge letter. Don't ignore HMRC's nudge letters! Understanding your tax responsibilities as an online seller is crucial. Take proactive steps to ensure compliance and avoid future issues with HMRC nudge letters and related tax issues. If you are unsure about your tax obligations, seek professional advice. (Keywords: HMRC nudge letters, online seller tax, tax compliance)

Featured Posts

-

Hamiltonin Ferrarin Siirto Kariutui Syyt Ja Seuraukset

May 20, 2025

Hamiltonin Ferrarin Siirto Kariutui Syyt Ja Seuraukset

May 20, 2025 -

Dzhenifr Lorns I Neynoto Vtoro Dete

May 20, 2025

Dzhenifr Lorns I Neynoto Vtoro Dete

May 20, 2025 -

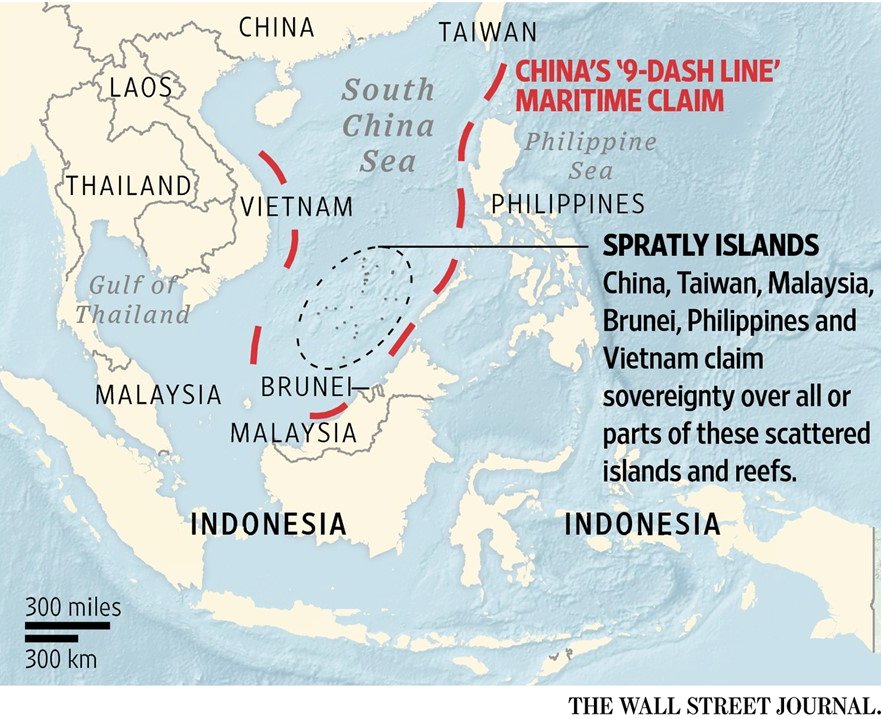

Philippines Unyielding Missile System Dispute With China

May 20, 2025

Philippines Unyielding Missile System Dispute With China

May 20, 2025 -

Familia Schumacher Se Mareste Nasterea Nepoatei Lui Michael Schumacher

May 20, 2025

Familia Schumacher Se Mareste Nasterea Nepoatei Lui Michael Schumacher

May 20, 2025 -

Michael Schumacher Viaje En Helicoptero De Mallorca A Suiza Para Ver A Su Nieta

May 20, 2025

Michael Schumacher Viaje En Helicoptero De Mallorca A Suiza Para Ver A Su Nieta

May 20, 2025

Latest Posts

-

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025 -

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025 -

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025