Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA's stance on current stock market valuations is nuanced. While not explicitly declaring the market as drastically overvalued, their analyses consistently highlight elevated price levels relative to historical norms. They caution investors about the risks associated with these high valuations, emphasizing the need for careful consideration and a diversified approach. Specific data points from BofA reports often vary, but their concerns are consistently reflected in their valuation metrics.

-

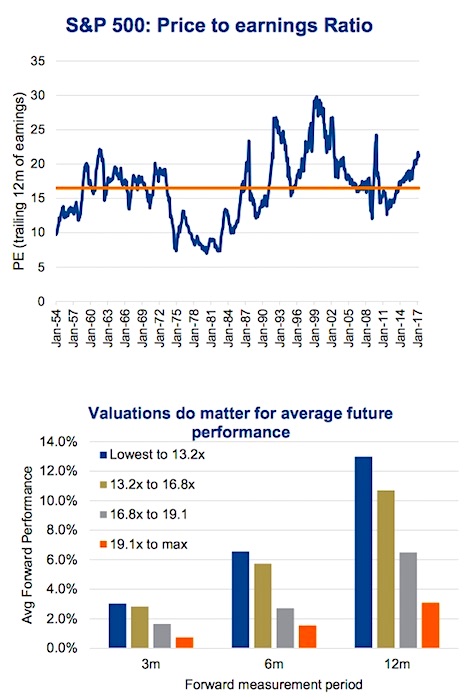

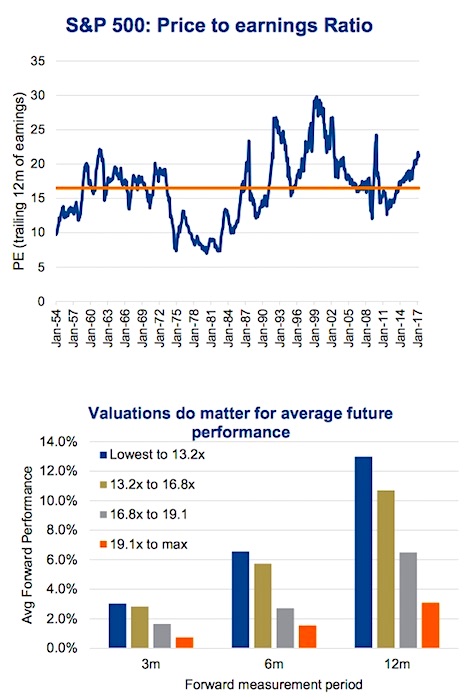

Specific valuation metrics used by BofA: BofA utilizes a range of metrics to assess market valuations, including the widely-followed Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various sector-specific valuation ratios. They often compare these metrics to historical averages and industry benchmarks.

-

Comparison to historical valuations: BofA's research frequently points to current valuations exceeding long-term averages for many indices and sectors. This suggests that the market may be pricing in optimistic future growth projections, potentially leaving less room for error.

-

BofA's assessment of the impact of interest rates on valuations: Rising interest rates are a significant concern for BofA. Higher rates increase the cost of borrowing, impacting corporate profitability and making alternative investments like bonds more attractive, potentially putting downward pressure on stock valuations.

-

Specific sectors BofA highlights as particularly overvalued or undervalued: BofA's analysis often identifies specific sectors showing signs of overvaluation or undervaluation relative to their fundamentals. This information is crucial for investors seeking to optimize their portfolio allocation and manage risk. For example, specific technology sub-sectors might be identified as overvalued, while others in the energy or cyclical sectors may be viewed as undervalued. These specifics change frequently and should be sought from current BofA reports.

Key Factors Driving High Stock Market Valuations

Several factors contribute to the high stock market valuations, according to BofA's research:

-

Low interest rates and their effect on the cost of capital: Prolonged periods of low interest rates have reduced the cost of borrowing for corporations, enabling increased investment and boosting earnings. This low cost of capital also encourages companies to take on more debt, potentially fueling further growth, but also increasing vulnerability to interest rate hikes.

-

Strong corporate earnings growth (or projections): Sustained or anticipated strong corporate earnings growth supports higher stock valuations. However, BofA's analyses scrutinize the sustainability of these earnings growth projections, particularly in light of macroeconomic factors.

-

Investor sentiment and market psychology (e.g., FOMO): The fear of missing out (FOMO) and general positive investor sentiment can drive asset prices beyond levels supported by underlying fundamentals. BofA's analysis often considers this psychological element alongside financial metrics.

-

Impact of quantitative easing and other monetary policies: Monetary policies like quantitative easing (QE) have injected significant liquidity into the market, driving up asset prices, including stocks. BofA's analysis acknowledges the impact of these policies on valuations and their potential long-term consequences.

-

Technological advancements and growth in specific sectors: Rapid technological advancements and the growth of certain sectors, particularly technology and healthcare, have propelled valuations higher. This has concentrated market capitalization gains in these specific growth sectors, often leaving other sectors with relatively lower valuations.

Potential Risks Associated with High Valuations

Investing in a highly valued market presents several risks:

-

Increased risk of market correction or crash: High valuations make the market more susceptible to corrections or even crashes, as any negative news or shift in investor sentiment can trigger sharp declines.

-

Potential for lower returns compared to historically lower valuations: Starting from a high valuation point implies lower potential returns compared to investing at lower valuations. This doesn't guarantee low returns, but it does reduce the margin for error.

-

Vulnerability to interest rate hikes: As mentioned earlier, rising interest rates pose a substantial threat to high valuations by increasing borrowing costs and impacting corporate profitability.

-

Impact of geopolitical events and economic uncertainty: Geopolitical events and unexpected economic downturns can significantly impact market sentiment and trigger sharp declines in highly valued markets.

Investment Strategies in a High Valuation Environment

Navigating high stock market valuations requires a prudent investment strategy:

-

Diversification strategies: Diversifying across asset classes (stocks, bonds, real estate, etc.) and sectors reduces overall portfolio risk.

-

Focus on value investing or specific undervalued sectors: Identifying undervalued companies or sectors can offer potentially higher returns. BofA's research can provide insights into which sectors might be attractive for value investing, but such information changes quickly.

-

Importance of risk management and portfolio rebalancing: Regular portfolio rebalancing and risk management are crucial to mitigate potential losses and maintain the desired level of risk exposure.

-

Consideration of alternative asset classes: Exploring alternative asset classes, such as real estate or commodities, can provide diversification benefits and potentially offer better risk-adjusted returns.

-

Importance of long-term investment horizon: Maintaining a long-term investment horizon allows investors to ride out short-term market volatility and potentially benefit from long-term growth.

Conclusion

Understanding high stock market valuations is crucial for making informed investment decisions. BofA's analysis provides valuable insights into the contributing factors and potential risks associated with the current market environment. By carefully considering the factors discussed and employing a well-diversified investment strategy focused on risk management, investors can navigate the complexities of high stock market valuations and potentially achieve their long-term financial goals. Continue to stay informed about high stock market valuations and consult with a financial advisor to develop a personalized investment plan that aligns with your risk tolerance and financial objectives.

Featured Posts

-

Municipales Dijon 2026 L Ambition Ecologique

May 10, 2025

Municipales Dijon 2026 L Ambition Ecologique

May 10, 2025 -

Cologne Climbs Above Hamburg In Bundesliga 2 Matchday 27

May 10, 2025

Cologne Climbs Above Hamburg In Bundesliga 2 Matchday 27

May 10, 2025 -

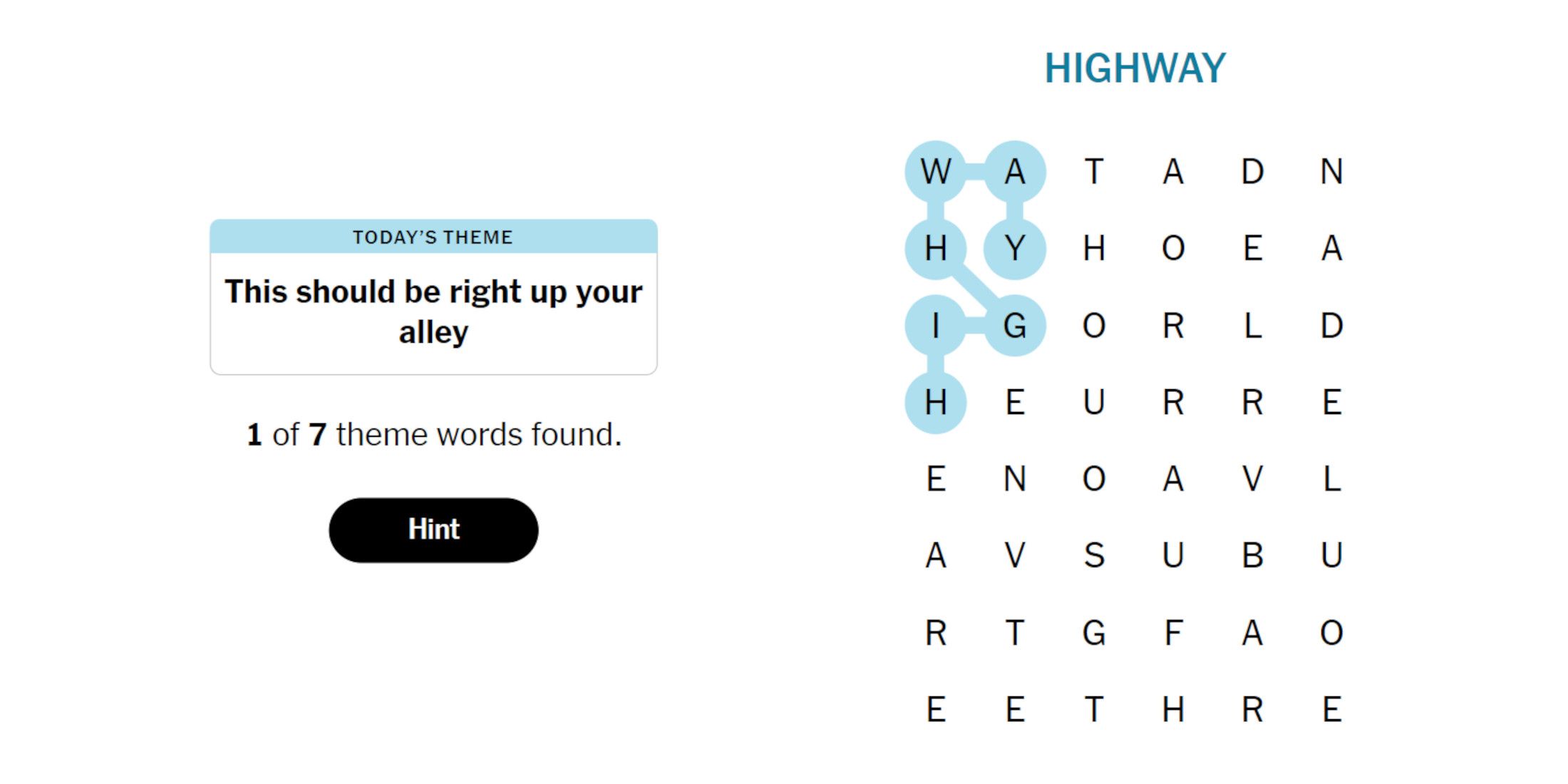

Solutions For Nyt Strands Sunday February 23 2024 Game 357

May 10, 2025

Solutions For Nyt Strands Sunday February 23 2024 Game 357

May 10, 2025 -

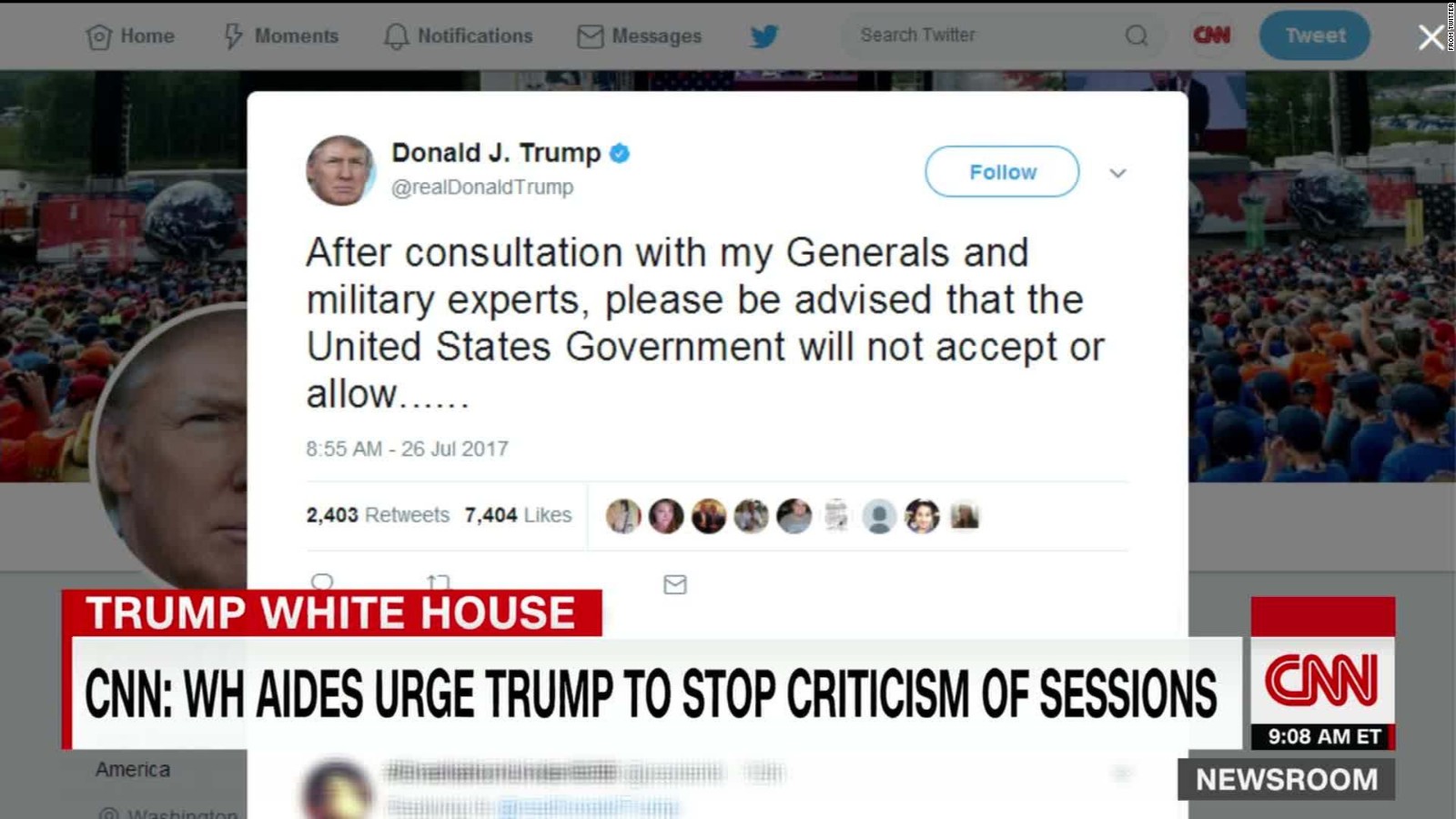

Understanding Trumps Transgender Military Ban Separating Fact From Fiction

May 10, 2025

Understanding Trumps Transgender Military Ban Separating Fact From Fiction

May 10, 2025 -

Operation Sindoors Impact Kse 100 Trading Halted Amidst Market Plunge

May 10, 2025

Operation Sindoors Impact Kse 100 Trading Halted Amidst Market Plunge

May 10, 2025