Understanding High Stock Market Valuations: BofA's View

Table of Contents

BofA's Key Indicators of High Valuations

Bank of America, a leading financial institution, employs several key indicators to assess the overall valuation of the stock market. These indicators provide a comprehensive picture, allowing for a more nuanced understanding of current market conditions than any single metric could offer.

Price-to-Earnings Ratio (P/E):

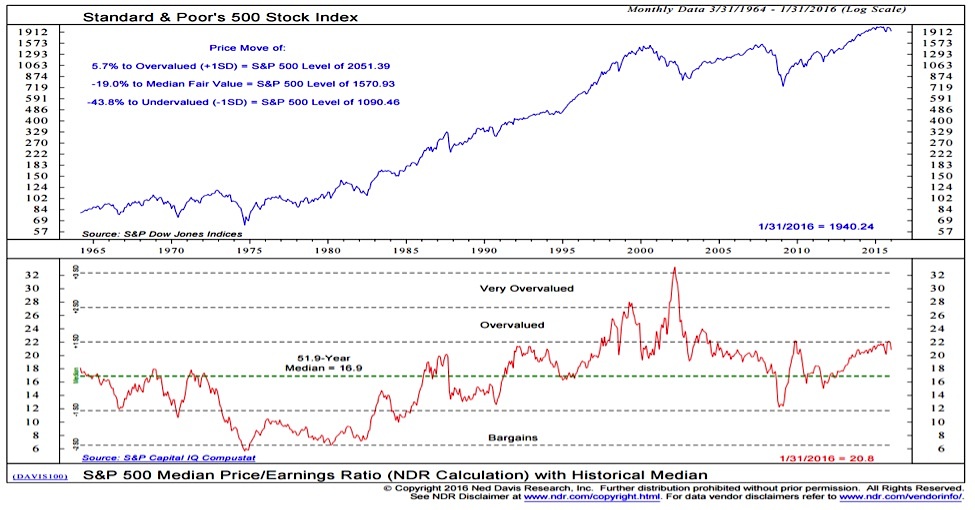

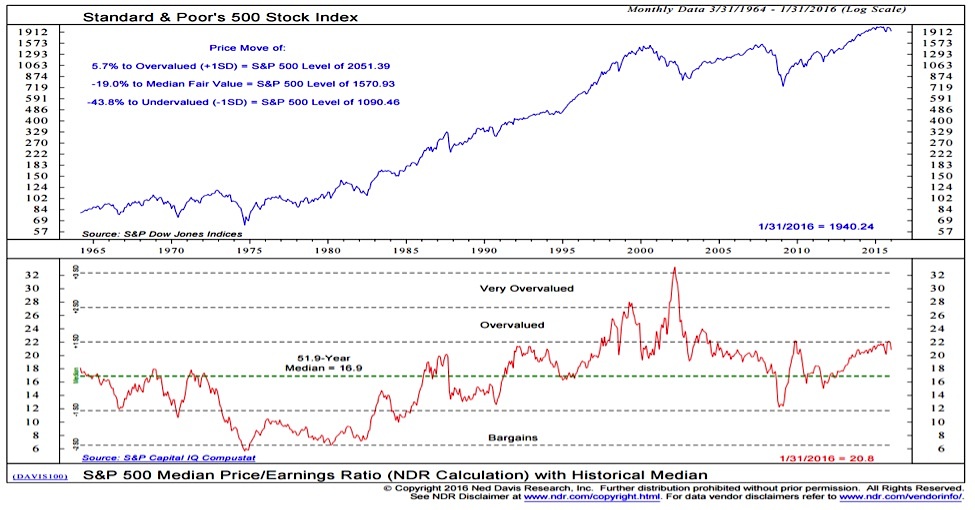

The Price-to-Earnings ratio is a fundamental valuation metric calculated by dividing a company's stock price by its earnings per share (EPS). A higher P/E ratio generally suggests that investors are willing to pay more for each dollar of earnings, implying higher expectations for future growth. BofA uses both trailing P/E (based on past earnings) and forward P/E (based on projected future earnings) to gauge current valuations and future expectations.

- Different Types of P/E Ratios: Understanding the difference between trailing and forward P/E is crucial. Trailing P/E reflects past performance, while forward P/E reflects future expectations, which can be more volatile.

- Limitations of P/E Ratios: Using P/E ratios in isolation can be misleading. Factors such as industry differences, growth rates, and accounting practices can significantly impact P/E levels.

- BofA's P/E Thresholds: While BofA doesn't publicly declare specific P/E thresholds for "high" valuations, their analysts likely compare current P/E levels to historical averages and industry benchmarks to determine whether valuations are elevated. Analyzing the relationship between the current P/E and the historical average helps to contextualize the current valuation level.

Cyclically Adjusted Price-to-Earnings Ratio (CAPE):

The CAPE ratio, also known as the Shiller P/E ratio, smooths out short-term earnings fluctuations by using average inflation-adjusted earnings over the past 10 years. This makes it a useful tool for evaluating long-term valuations and identifying potential market bubbles. BofA likely incorporates CAPE into its analysis to gain a longer-term perspective on market valuations, complementing the insights from the standard P/E ratio.

- Strengths and Weaknesses of CAPE: CAPE offers a smoother picture of valuations compared to standard P/E, reducing the impact of short-term earnings volatility. However, it relies on historical data, which may not always accurately predict future performance.

- Historical CAPE Levels: Comparing the current CAPE ratio to historical averages provides a crucial context. Periods of high CAPE ratios in the past have often been followed by market corrections, highlighting a potential risk associated with high valuations.

- BofA's Interpretation: BofA's analysis will likely consider the current CAPE level in relation to historical data and the overall economic outlook to assess whether current valuations are justified.

Other Valuation Metrics:

BofA likely employs a multifaceted approach, using additional valuation metrics to obtain a holistic view of the market.

- Price-to-Sales (P/S): This metric compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings or those in high-growth industries.

- Price-to-Book (P/B): This ratio compares a company's market value to its book value (assets minus liabilities). It's useful for valuing asset-heavy companies.

- Dividend Yield: This is the annual dividend per share divided by the stock price. It indicates the return an investor receives from dividends.

Underlying Factors Driving High Stock Market Valuations According to BofA

Several factors contribute to the current high stock market valuations, many of which are interconnected. BofA's analysis likely considers these factors in its overall assessment.

Low Interest Rates:

Low interest rates significantly impact stock valuations. When interest rates are low, the yield on bonds falls, making stocks a relatively more attractive investment option, especially for long-term investors seeking higher returns. BofA likely analyzes the relationship between interest rates, bond yields, and stock prices to assess the extent to which low rates are driving current valuations.

- Impact on Bond Yields: Low interest rates make bonds less appealing, pushing investors towards higher-yielding assets like stocks. This increased demand for stocks contributes to higher prices.

- Risks of Prolonged Low Rates: While low rates stimulate the economy in the short-term, prolonged periods of low rates can lead to asset bubbles and increased financial instability.

Strong Corporate Earnings:

Robust corporate earnings are a fundamental driver of high stock prices. When companies report strong earnings, investors generally have higher confidence in the company's future prospects, which can drive up demand for the stock and increase its valuation. BofA likely assesses the quality and sustainability of these earnings to understand whether this growth is sustainable in the long term.

- Factors Driving Strong Earnings: Factors like technological advancements, increased consumer spending, and successful cost-cutting measures can contribute to strong corporate earnings.

- Concerns about Slowing Growth: Sustaining high growth rates is challenging. BofA's analysis likely includes forecasts for future earnings growth and potential risks that could lead to slower growth.

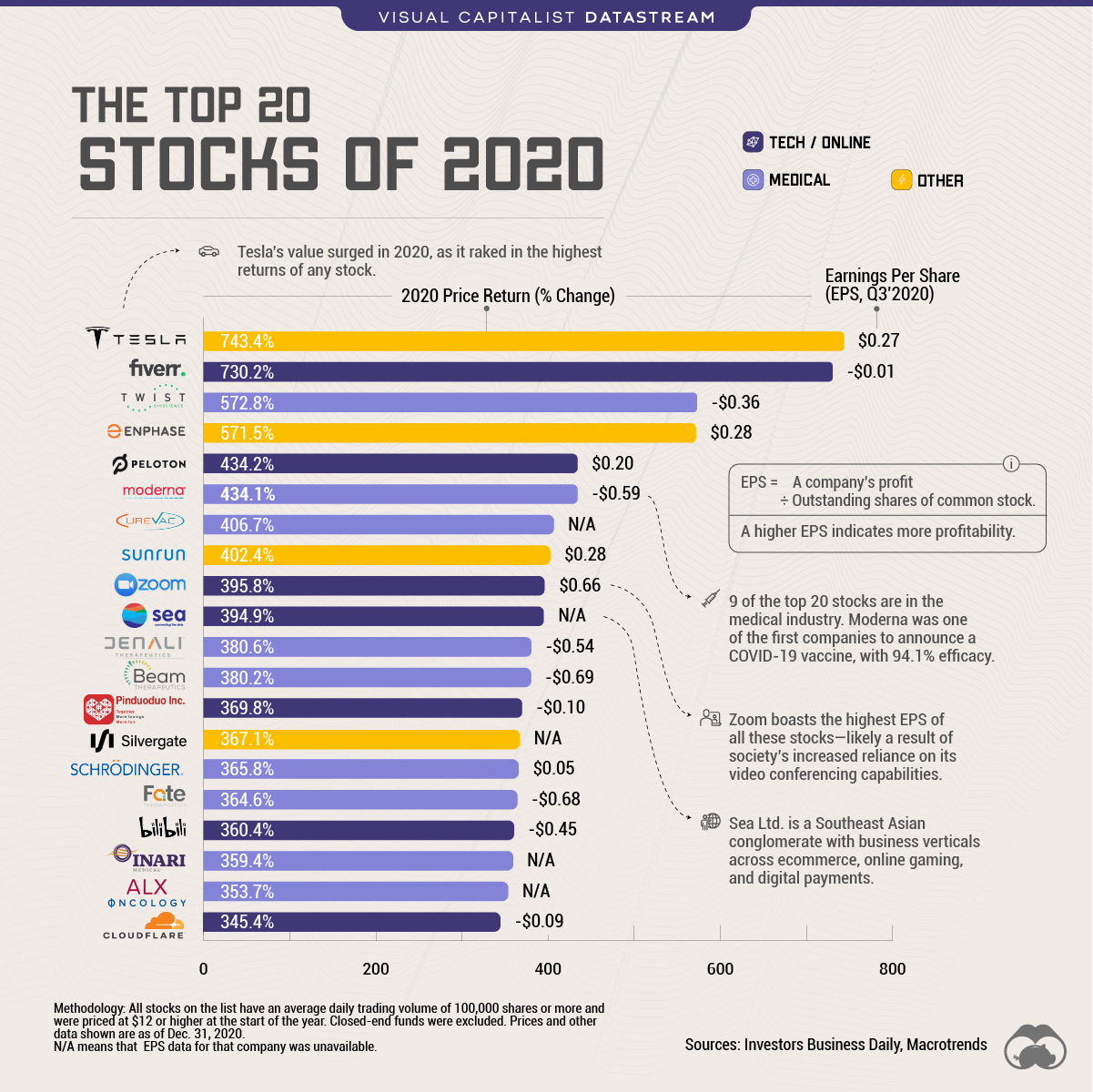

Technological Innovation and Growth:

Technological advancements are a powerful engine for economic growth and stock market valuations. The rise of disruptive technologies and the growth of innovative companies are major contributors to higher market valuations, especially in sectors such as technology, healthcare, and renewable energy. BofA’s analysis will weigh this factor carefully, analyzing which specific sectors are driving the growth.

- Sectors Driving Growth: Technology, renewable energy, and biotechnology sectors are experiencing rapid innovation and growth, attracting substantial investment and driving valuations higher. BofA's analysis likely identifies and assesses these sectors in detail.

BofA's Outlook and Potential Risks Associated with High Valuations

While high valuations can indicate strong economic conditions, they also carry inherent risks. BofA's outlook likely considers both the potential opportunities and the challenges posed by this environment.

Potential for a Market Correction:

Given the current high valuations, the potential for a market correction is a key concern. A market correction is a significant drop in stock prices, typically 10% or more. BofA's analysis likely identifies potential triggers for such a correction.

- Potential Catalysts: Rising interest rates, higher inflation, geopolitical instability, or a sudden negative economic shock could all trigger a market correction.

- BofA's Assessment: BofA's economists and strategists assess the likelihood of these triggers and the potential impact on the market.

Managing Portfolio Risk:

In a high-valuation environment, effective portfolio risk management is crucial. BofA likely recommends diversification strategies to mitigate the impact of a potential market downturn.

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate) and sectors can reduce portfolio risk.

- Defensive Stocks: Shifting towards more defensive stocks (less volatile stocks in sectors like consumer staples or utilities) may be advisable.

- Alternative Investments: Alternative investments such as gold or real estate can act as a hedge against market volatility.

Opportunities within a High Valuation Market:

Even in a high-valuation market, opportunities exist. BofA's analysis likely identifies sectors or individual companies that may offer better value propositions despite overall high valuations.

- Undervalued Sectors: Certain sectors might be undervalued relative to their growth potential.

- Individual Stock Selection: Careful analysis can reveal individual stocks that are trading below their intrinsic value.

Conclusion

BofA's analysis of high stock market valuations highlights the interplay of several factors, including low interest rates, strong corporate earnings, and technological innovation. While these factors contribute to current market strength, the potential for a market correction remains a significant risk. Understanding these valuations and employing appropriate risk management strategies, such as diversification and careful stock selection, are crucial for navigating the current market environment. To make informed investment decisions in this high stock market valuation environment, further research into BofA's reports and consideration of professional financial advice are strongly recommended. Continue learning about high stock market valuations and stay updated on market trends to make sound investment choices.

Featured Posts

-

Pandemic Fraud Lab Owner Pleads Guilty To Fake Covid Test Results

May 04, 2025

Pandemic Fraud Lab Owner Pleads Guilty To Fake Covid Test Results

May 04, 2025 -

Kivinin Kabugu Yenir Mi Oence Bunlari Bilmelisiniz

May 04, 2025

Kivinin Kabugu Yenir Mi Oence Bunlari Bilmelisiniz

May 04, 2025 -

Where To Invest Mapping The Countrys Top Business Locations

May 04, 2025

Where To Invest Mapping The Countrys Top Business Locations

May 04, 2025 -

Transportation Department Announces Workforce Reduction May Deadline

May 04, 2025

Transportation Department Announces Workforce Reduction May Deadline

May 04, 2025 -

U S Labor Market Report 177 000 Jobs Created In April 4 2 Unemployment

May 04, 2025

U S Labor Market Report 177 000 Jobs Created In April 4 2 Unemployment

May 04, 2025

Latest Posts

-

A Rock Band Featuring Lizzo And Sza The Untold Story

May 04, 2025

A Rock Band Featuring Lizzo And Sza The Untold Story

May 04, 2025 -

Lizzo Launches New Musical Chapter Exclusively On Twitch

May 04, 2025

Lizzo Launches New Musical Chapter Exclusively On Twitch

May 04, 2025 -

The Truth About Lizzos Fitness Her Trainer Speaks Out

May 04, 2025

The Truth About Lizzos Fitness Her Trainer Speaks Out

May 04, 2025 -

The Rock Band That Almost Was Lizzo Sza And A Mystery Musician

May 04, 2025

The Rock Band That Almost Was Lizzo Sza And A Mystery Musician

May 04, 2025 -

Body Positivity And Fitness Defending Lizzos Journey

May 04, 2025

Body Positivity And Fitness Defending Lizzos Journey

May 04, 2025