Understanding High Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Key Findings on High Stock Market Valuations

BofA's analysis of current market conditions reveals several key factors contributing to high stock market valuations. These factors, when considered together, paint a complex picture that requires careful consideration by investors.

Elevated Price-to-Earnings (P/E) Ratios

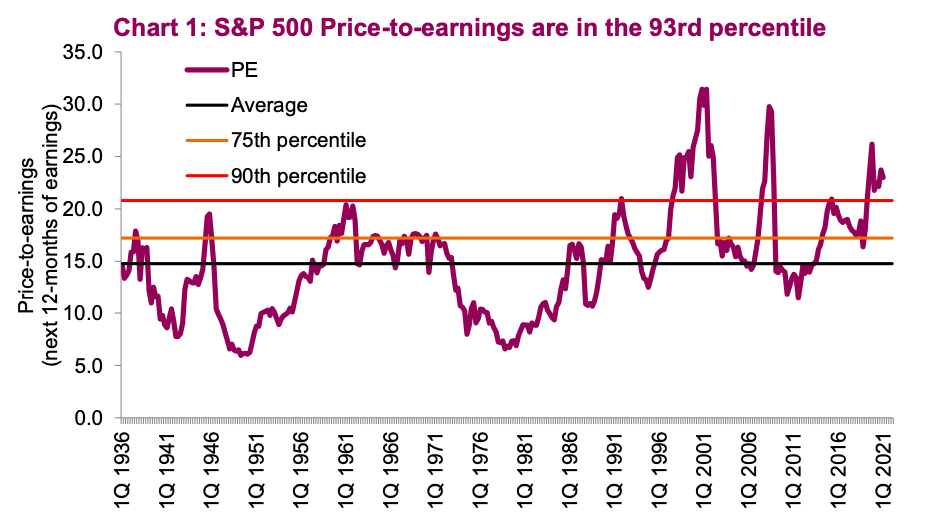

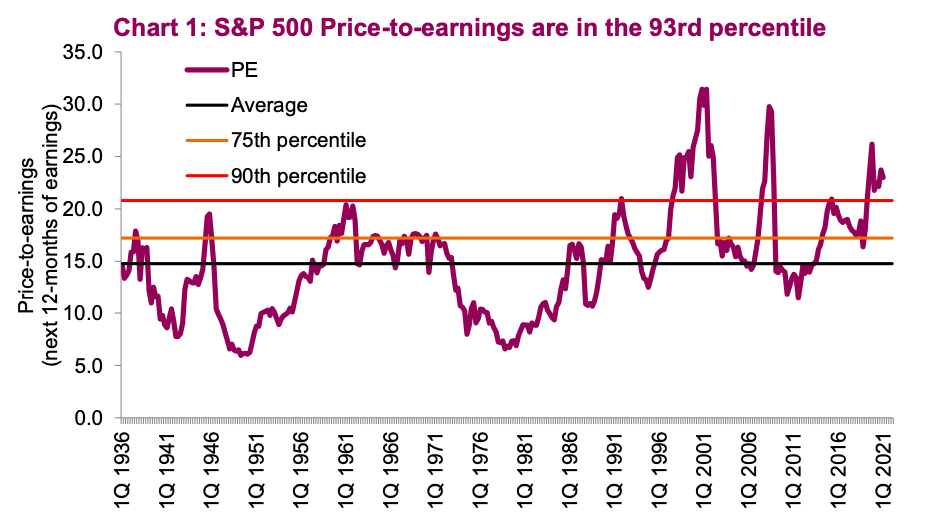

One of the most significant indicators of high valuations is the elevated Price-to-Earnings (P/E) ratio.

- What are P/E ratios? The P/E ratio is a valuation metric calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, indicating potentially high growth expectations or a perceived low-risk investment.

- BofA's Data on P/E Ratios: BofA's research often highlights that current P/E ratios across various sectors are significantly higher than historical averages. Specific data points would need to be referenced from their current reports for accuracy. However, generally, higher P/E ratios are seen in technology and growth stocks compared to value stocks.

- Historical Comparison: Comparing current P/E ratios to historical highs and lows provides crucial context. While past performance is not indicative of future results, this comparison helps investors gauge the extent to which current valuations deviate from historical norms. Periods of exceptionally high P/E ratios have often been followed by market corrections.

- Implications for Future Returns: High P/E ratios can suggest that future returns may be lower than average, as investors have already priced in significant future growth. This doesn't necessarily mean negative returns, but it implies potentially lower returns compared to investing when valuations are lower.

The Role of Low Interest Rates

Low interest rates are a significant factor influencing high stock market valuations.

- Incentivizing Stock Investment: Low interest rates make bonds and other fixed-income investments less attractive, pushing investors towards higher-yielding assets, such as stocks. This increased demand for stocks contributes to higher prices and valuations.

- Impact on Bond Yields: Low interest rates suppress bond yields, making stocks relatively more appealing. The inverse relationship between bond yields and stock valuations is a well-established phenomenon.

- BofA's Interest Rate Forecast: BofA's forecasts on interest rate changes are crucial for assessing the future trajectory of stock valuations. Rising interest rates typically lead to lower stock valuations as investors shift their capital towards higher-yielding bonds.

Impact of Quantitative Easing (QE) and Monetary Policy

BofA's analysis likely incorporates the effects of quantitative easing (QE) and broader monetary policies on asset prices.

- Quantitative Easing Defined: QE involves central banks injecting liquidity into the market by purchasing assets, increasing the money supply. This increased liquidity can inflate asset prices across various markets, including stocks.

- BofA's Analysis of QE and Valuations: BofA's research would likely demonstrate a correlation between periods of QE and subsequent increases in stock market valuations.

- Long-Term Consequences: The long-term consequences of QE are a subject of ongoing debate. While it can stimulate economic growth in the short term, some economists express concerns about potential inflation and market instability in the long run.

Growth Expectations and Future Earnings

BofA's projections for future corporate earnings significantly impact their assessment of current valuations.

- Economic Growth and Profitability: BofA's forecasts for economic growth directly influence their expectations for corporate profitability. Strong economic growth generally translates to higher corporate earnings, supporting higher stock valuations.

- Influence on Stock Prices: Future earnings expectations are a primary driver of current stock prices. Investors discount future earnings back to the present value, influencing their willingness to pay a premium for a company's stock.

- Sensitivity to Changes: Valuations are highly sensitive to changes in earnings expectations. Even small revisions to future earnings forecasts can significantly impact stock prices and overall market valuations.

Potential Risks and Market Corrections

BofA's analysis should also address the risks associated with high valuations and the possibility of a market correction.

- Triggers for a Correction: Several factors could trigger a market correction, including rising interest rates, unexpected economic downturns, geopolitical events, or simply a reassessment of growth expectations.

- BofA's View on Corrections: BofA likely offers insights into the timing and magnitude of a potential correction, although precise predictions are challenging. Their analysis might highlight potential vulnerability points in the market.

- Risk Mitigation Strategies: The article should discuss strategies for mitigating risk in a high-valuation market, such as diversification, hedging, or focusing on undervalued assets.

Conclusion

This article summarized BofA's analysis of high stock market valuations, highlighting key factors like elevated P/E ratios, low interest rates, and the impact of monetary policy. We examined BofA's perspective on future growth expectations and the potential risks associated with these high valuations, including the possibility of market corrections. Understanding high stock market valuations is crucial for informed investment decisions. Use BofA's insights to refine your investment strategy and navigate the complexities of the current market. Continue your research into high stock market valuations and explore other expert opinions to make well-informed choices. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Senate Education Cuts Spark Lawsuit Threat From Universities

May 19, 2025

Senate Education Cuts Spark Lawsuit Threat From Universities

May 19, 2025 -

Investissement Immobilier Poitiers 46 Appartements D Exception

May 19, 2025

Investissement Immobilier Poitiers 46 Appartements D Exception

May 19, 2025 -

Portugal Election A Nations Choice

May 19, 2025

Portugal Election A Nations Choice

May 19, 2025 -

Johnny Mathis 89 Retires From Touring Due To Memory Issues

May 19, 2025

Johnny Mathis 89 Retires From Touring Due To Memory Issues

May 19, 2025 -

El Almuerzo Que Cambio La Vida De Mensik El Campeon De Miami Y Su Misterio

May 19, 2025

El Almuerzo Que Cambio La Vida De Mensik El Campeon De Miami Y Su Misterio

May 19, 2025