Understanding BCE Inc.'s Dividend Decrease: A Guide For Investors

Table of Contents

The Announcement and Market Reaction

BCE Inc. announced its dividend reduction on [Insert Date of Announcement], decreasing the dividend payout by [Percentage]% to [New Dividend Amount]. This announcement immediately impacted investor sentiment and resulted in significant stock price volatility.

- Stock price before announcement: [Insert Stock Price]

- Stock price immediately after announcement: [Insert Stock Price]

- Analyst reactions: Many analysts [Summarize Analyst Reactions - positive, negative, neutral, and their reasoning]. Some cited concerns about [mention specific concerns raised by analysts], while others viewed the move as a strategic decision to [mention positive interpretations].

- Impact on investor confidence: The decrease caused a decline in investor confidence, with some investors selling their shares and others adopting a wait-and-see approach. The overall impact on investor confidence depends on individual investor's risk tolerance and long-term outlook.

The keywords "BCE Inc. dividend cut," "stock price volatility," and "investor sentiment" accurately reflect the immediate aftermath of the announcement.

Reasons Behind the BCE Inc. Dividend Decrease

BCE Inc. cited several reasons for the dividend reduction, highlighting the need to balance shareholder payouts with strategic investments for future growth. These factors include:

- Increased capital expenditures: Significant investments in expanding and upgrading its 5G network infrastructure require substantial capital. These investments, while crucial for long-term competitiveness in the telecommunications industry, impact short-term profitability and dividend payouts.

- Debt reduction strategies: BCE Inc. may be prioritizing debt reduction to improve its financial health and credit rating. Lowering debt levels can lead to improved financial flexibility and lower interest expenses in the long run.

- Impact of inflation and rising interest rates: The current macroeconomic environment, characterized by high inflation and rising interest rates, impacts the profitability and cash flow of many companies, including BCE Inc. These factors might have constrained the company's ability to maintain its previous dividend level.

- Competitive pressures within the telecommunications industry: Intense competition within the telecommunications sector necessitates continuous investments in network infrastructure and innovative services to retain and attract customers. This competitive landscape might have influenced BCE Inc.'s decision to prioritize investment over dividend payouts.

Understanding these factors is crucial for analyzing BCE Inc.'s financial performance and the rationale behind the dividend payout ratio adjustment. Keywords such as "BCE Inc. financial performance," "dividend payout ratio," "capital investment," and "debt management" are essential in this context.

Analyzing BCE Inc.'s Long-Term Financial Outlook

Despite the dividend decrease, BCE Inc.'s long-term financial outlook remains relatively strong. A careful assessment of the company’s financials is needed to understand the sustainability of the reduced dividend.

- Projected revenue growth and profitability: Analysts predict [Insert Analyst Projections for Revenue Growth and Profitability]. These projections should be considered carefully, acknowledging the inherent uncertainty in future predictions.

- Future investment plans: BCE Inc.'s ongoing investments in 5G network infrastructure are anticipated to drive future revenue growth and improve the company's competitive position in the long term.

- Management's commentary on future dividends: [Summarize Management's statements on future dividend plans and expectations]. Pay close attention to management's guidance on future dividend payments.

- Comparison to competitor dividend policies: Analyzing the dividend policies of BCE Inc.'s competitors within the telecommunications industry can provide valuable context for evaluating the decision.

By focusing on "BCE Inc. financial statements," "future dividend payments," "long-term growth prospects," and "telecommunications industry outlook," investors can gain a clearer perspective on the company's future trajectory.

Investment Strategies Following the BCE Inc. Dividend Decrease

The BCE Inc. dividend decrease requires investors to re-evaluate their investment strategies based on their individual risk tolerance and financial goals.

- Hold, sell, or buy more BCE Inc. stock: Whether to hold, sell, or buy more BCE Inc. stock depends on your individual circumstances and outlook. Holding might be suitable for long-term investors confident in the company's future growth, while selling might be preferable for those seeking higher immediate returns or concerned about the reduced dividend. Buying more stock might be a strategy for investors who believe the current stock price undervalues the company's future potential.

- Diversification strategies: Diversifying your investment portfolio to reduce risk is always a wise strategy. This might involve investing in other sectors or companies with different dividend policies.

- Alternative income-generating investments: Explore alternative investments that can generate income, such as high-yield bonds, preferred stocks, or real estate investment trusts (REITs).

Using keywords like "BCE Inc. stock valuation," "investment strategy," "risk management," and "dividend investing" helps investors approach the situation strategically.

Conclusion

The BCE Inc. dividend decrease reflects a strategic decision influenced by increased capital expenditures, debt management strategies, macroeconomic factors, and competitive pressures. Understanding the company's financial situation and long-term growth prospects is crucial for making informed investment decisions. While the reduced dividend might initially disappoint income-focused investors, the long-term growth potential of BCE Inc. remains a significant factor to consider. Conduct thorough research, analyze BCE Inc.'s financial statements, and consider consulting with a financial advisor to develop a well-informed investment strategy regarding the BCE Inc. dividend decrease and its implications for your portfolio. Remember to consider your risk tolerance and long-term financial goals before making any investment decisions.

Featured Posts

-

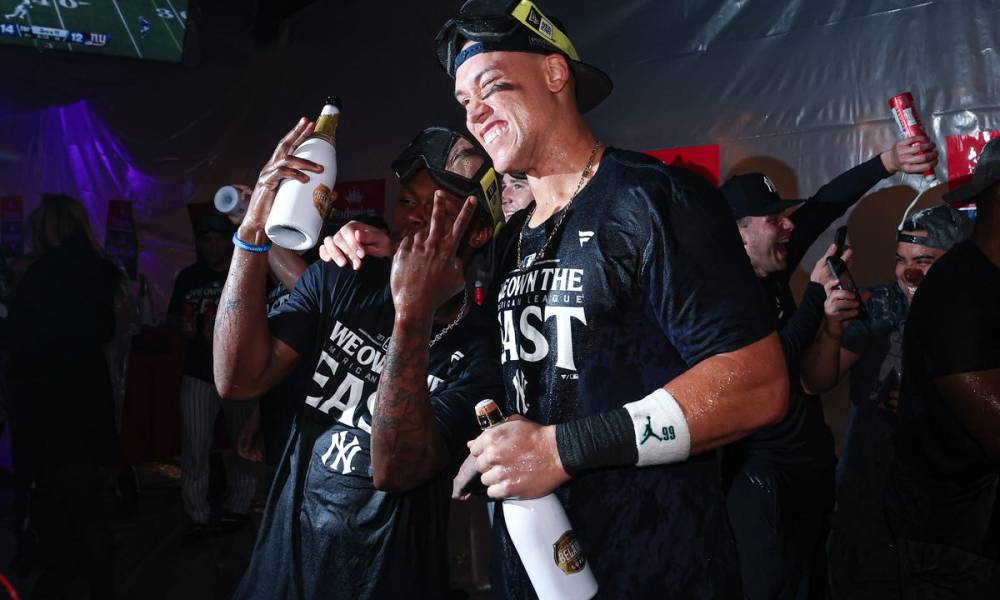

Yankees Dominant Win Over Pirates Judge And Fried Power The Offense And Pitching

May 12, 2025

Yankees Dominant Win Over Pirates Judge And Fried Power The Offense And Pitching

May 12, 2025 -

Payton Pritchard Named Nba Sixth Man Of The Week

May 12, 2025

Payton Pritchard Named Nba Sixth Man Of The Week

May 12, 2025 -

Office365 Security Flaw Hacker Makes Millions From Executive Accounts

May 12, 2025

Office365 Security Flaw Hacker Makes Millions From Executive Accounts

May 12, 2025 -

Bayern Munichs Mueller Weighs Future Options Potential League Destinations

May 12, 2025

Bayern Munichs Mueller Weighs Future Options Potential League Destinations

May 12, 2025 -

Who Should Be The Next James Bond Jeff Bezos Fan Poll Reveals A Clear Winner

May 12, 2025

Who Should Be The Next James Bond Jeff Bezos Fan Poll Reveals A Clear Winner

May 12, 2025

Latest Posts

-

Perkembangan Terbaru Penindakan Judi Online Dan Penipuan Telekomunikasi Di Myanmar

May 13, 2025

Perkembangan Terbaru Penindakan Judi Online Dan Penipuan Telekomunikasi Di Myanmar

May 13, 2025 -

Delovoy Forum Rossiya Myanma V Moskve Perspektivy Ekonomicheskogo Partnerstva

May 13, 2025

Delovoy Forum Rossiya Myanma V Moskve Perspektivy Ekonomicheskogo Partnerstva

May 13, 2025 -

Mengatasi Masalah Judi Online Dan Penipuan Telekomunikasi Di Myanmar

May 13, 2025

Mengatasi Masalah Judi Online Dan Penipuan Telekomunikasi Di Myanmar

May 13, 2025 -

Rossiysko Myanmanskiy Delovoy Forum V Moskve Klyuchevye Temy I Uchastniki

May 13, 2025

Rossiysko Myanmanskiy Delovoy Forum V Moskve Klyuchevye Temy I Uchastniki

May 13, 2025 -

Myanmar Perangi Judi Online Dan Penipuan Telekomunikasi Langkah Langkah Efektif

May 13, 2025

Myanmar Perangi Judi Online Dan Penipuan Telekomunikasi Langkah Langkah Efektif

May 13, 2025