Understanding ABUSA: The New Acronym For Ditch-America Trade

Table of Contents

What Does ABUSA Stand For?

ABUSA, a shorthand for "America Business Under Siege Abroad," reflects the increasing relocation of American businesses and manufacturing overseas. It's a colloquialism, capturing the sentiment of companies seeking more favorable conditions elsewhere. This shift isn't about a single industry but spans various sectors, impacting the US economic landscape significantly.

-

Examples of countries/regions benefiting from this shift: China, Vietnam, Mexico, India, and various Southeast Asian nations. Specific industries seeing significant relocation include manufacturing (textiles, electronics), technology (semiconductor production, software development), and customer service (call centers).

-

Supporting data: While precise figures for ABUSA-related relocations are difficult to compile, studies consistently show a decline in US manufacturing jobs and a rise in foreign direct investment in competing nations. Reports from organizations like the Bureau of Economic Analysis consistently track this trend, revealing a net outflow of business activity from the US in specific sectors.

The Drivers Behind ABUSA: Why are Companies Leaving America?

Several factors contribute to the ABUSA trend, pushing companies to seek more attractive business environments abroad.

Labor Costs and Regulations:

Higher labor costs and stringent regulations in the US make it less competitive compared to other countries.

-

Examples of regulations and their effects: Environmental regulations, minimum wage laws, and workplace safety standards, while important, can increase operational costs. These costs can be significantly lower in other nations with less stringent regulations.

-

Comparison of US labor costs: The US average hourly wage is considerably higher than in many developing and emerging economies, significantly affecting manufacturing and labor-intensive industries.

Taxation and Incentives:

Unfavorable US tax policies and a lack of incentives compared to other countries further exacerbate the issue.

-

Examples of tax breaks/subsidies offered by other countries: Many countries offer significant tax breaks, subsidies, and other incentives to attract foreign investment, creating a more appealing environment for businesses.

-

Impact of corporate tax rates: High corporate tax rates in the US can make it less attractive compared to countries with lower rates, driving companies to relocate to benefit from lower tax burdens.

Geopolitical Factors:

Geopolitical events and trade wars have also played a significant role in shaping companies' decisions to relocate.

-

Examples of events and their impact: Trade disputes (like the US-China trade war) have disrupted supply chains and prompted businesses to diversify their manufacturing bases, often leading to relocation outside of the US.

-

Impact of trade agreements: Trade agreements that favor other countries can also contribute to the relocation of businesses seeking access to larger markets or preferential treatment.

The Consequences of ABUSA: Impacts on the US Economy

The consequences of the ABUSA trend are significant and wide-ranging, negatively impacting the US economy in various ways.

-

Job losses: The relocation of businesses leads to substantial job losses in the US, particularly in manufacturing and related sectors.

-

Reduced tax revenue: Fewer businesses operating within the US translates to less tax revenue for the government, potentially impacting public services and infrastructure investments.

-

Decreased domestic production: A decline in domestic production weakens the US economy's overall output and competitiveness on the global stage.

-

Negative effects on specific industries: Entire industries can be negatively affected, leading to a decline in innovation and economic growth within those sectors. Data from the US Census Bureau regularly tracks these negative trends, illustrating the scope of the problem.

Addressing the ABUSA Trend: Strategies for Retaining Businesses in America

Reversing the ABUSA trend requires a multi-pronged approach involving significant policy changes and strategic investments.

-

Tax reforms: Implementing more competitive corporate tax rates and offering targeted tax incentives can make the US a more attractive location for businesses.

-

Regulatory adjustments: Streamlining regulations while maintaining essential standards can reduce operational costs for businesses without compromising public interests.

-

Infrastructure improvements: Investing in modern infrastructure (transportation, communication networks) can improve efficiency and reduce logistical costs for companies.

-

Investment in workforce development: Investing in education and training programs can ensure a skilled workforce, enhancing the US's competitiveness in attracting and retaining businesses.

-

Incentives for domestic manufacturing: Offering incentives for domestic manufacturing, such as grants and tax credits, can encourage companies to keep or expand their operations within the US. Examining successful strategies implemented by other countries – such as targeted investment zones and streamlined permitting processes – can provide valuable insights.

Conclusion

Understanding ABUSA and its implications is critical for the future of the US economy. The "Ditch-America" trade trend, driven by labor costs, taxation, regulations, and geopolitical factors, is having a significant negative impact. Job losses, decreased production, and reduced tax revenue are just some of the concerning consequences. Addressing this requires a concerted effort to create a more competitive business environment in the US through tax reforms, regulatory adjustments, infrastructure improvements, and workforce development initiatives. Understanding ABUSA is the first step in combating the "Ditch-America" trade trend. Stay informed, participate in the conversation, and support policies that bolster US competitiveness.

Featured Posts

-

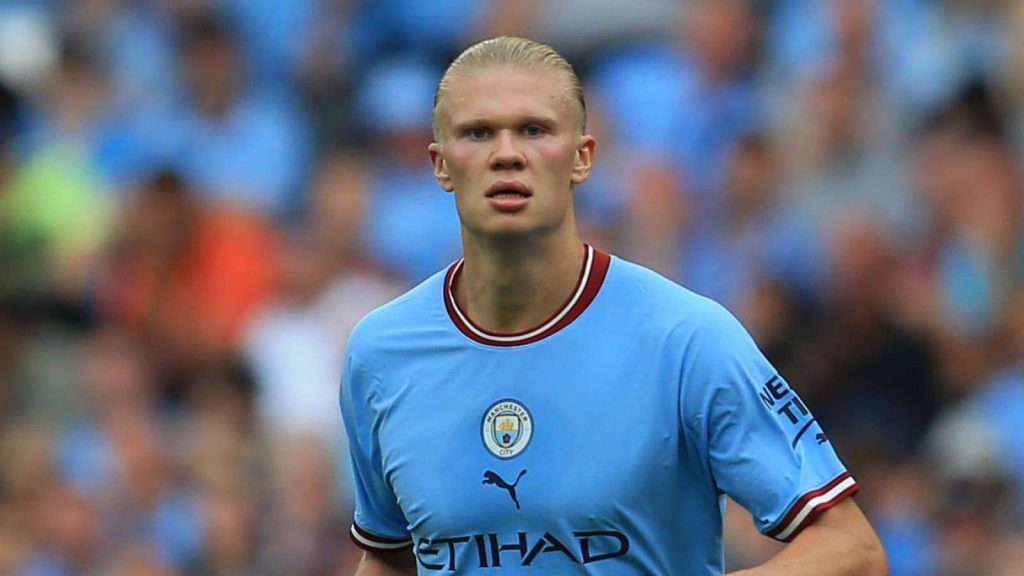

Erling Haalands Future At Man City Could He Really Leave

May 19, 2025

Erling Haalands Future At Man City Could He Really Leave

May 19, 2025 -

Analyzing The Euros Rise Swissquote Banks Perspective On European Futures

May 19, 2025

Analyzing The Euros Rise Swissquote Banks Perspective On European Futures

May 19, 2025 -

Dessert Francais Au Chocolat La Recette Du Salami Chocolate

May 19, 2025

Dessert Francais Au Chocolat La Recette Du Salami Chocolate

May 19, 2025 -

Ufcs Michael Morales A Deep Dive Into The Undefeated Fighter

May 19, 2025

Ufcs Michael Morales A Deep Dive Into The Undefeated Fighter

May 19, 2025 -

A Determined Effort Preserving The Jersey Battle Of Flowers

May 19, 2025

A Determined Effort Preserving The Jersey Battle Of Flowers

May 19, 2025