Ultra-Low Growth Forecast For Canada: Expert Analysis By David Dodge

Table of Contents

David Dodge's Analysis: Key Factors Driving Ultra-Low Growth in Canada

David Dodge, a highly respected figure in Canadian economics, has expressed significant concern regarding the country's economic trajectory. His analysis points to a confluence of global and domestic factors contributing to the ultra-low growth forecast. He emphasizes the need for proactive policy responses to mitigate the negative impacts on Canadian households and businesses.

Global Economic Slowdown and its Impact on Canada

The global economy is experiencing a significant slowdown, impacting Canada's growth prospects. Several key factors are at play:

- Impact of inflation on consumer spending in Canada: High inflation rates erode purchasing power, leading to reduced consumer spending, a key driver of economic growth. This dampens demand for both domestic and imported goods and services.

- Disruptions to Canadian exports due to global supply chain issues: Ongoing supply chain disruptions globally have hampered Canadian exports, impacting key sectors like manufacturing and agriculture. These disruptions increase costs and limit the ability of Canadian businesses to compete internationally.

- Geopolitical risks and their effect on Canadian investment: Geopolitical instability, including the war in Ukraine and rising tensions in other regions, creates uncertainty and reduces investor confidence, leading to lower investment levels in Canada. This uncertainty makes long-term planning and investment decisions more challenging.

Domestic Challenges: Housing Market Correction and Interest Rate Hikes

Canada faces significant domestic challenges, further exacerbating the ultra-low growth forecast. The cooling housing market and rising interest rates are key factors:

- Impact of higher borrowing costs on consumer spending and investment: Increased interest rates make borrowing more expensive, reducing consumer spending on big-ticket items like homes and cars, and decreasing business investment. This directly impacts economic activity.

- The effect of a housing market correction on overall economic activity: A correction in the overheated housing market, while necessary for long-term stability, can have short-term negative impacts on economic growth, affecting construction, related industries, and consumer confidence.

- Analysis of the Bank of Canada's monetary policy and its influence on growth: The Bank of Canada's monetary policy tightening, aimed at controlling inflation, has contributed to higher interest rates, potentially slowing economic growth in the short term. Balancing inflation control with economic growth remains a key challenge.

Labour Market Dynamics and Productivity

Canada's labour market dynamics also play a crucial role in the ultra-low growth forecast.

- Discussion of current employment rates and potential future trends: While employment rates remain relatively strong, there are concerns about potential future slowdowns in job creation due to reduced economic activity. This uncertainty impacts consumer confidence and investment decisions.

- Analysis of productivity levels and their impact on economic growth: Slowing productivity growth limits the potential for long-term economic expansion. Addressing this requires investment in innovation, technology, and human capital.

- Potential for labour shortages to hinder economic expansion: While a strong labor market is generally positive, certain sectors face labour shortages which can hinder economic expansion. Addressing skill gaps and attracting and retaining talent is crucial.

Implications of Ultra-Low Growth for the Canadian Economy

Prolonged ultra-low growth carries significant implications for the Canadian economy:

Impact on Government Finances and Fiscal Policy

Ultra-low growth significantly impacts government finances:

- Potential challenges in funding social programs: Reduced economic activity leads to lower tax revenues, making it challenging to fund essential social programs and services. Difficult choices regarding government spending priorities may be necessary.

- Pressure on government to implement fiscal stimulus measures: The government may face pressure to implement fiscal stimulus measures to boost economic activity, potentially increasing government debt levels. Balancing fiscal responsibility with the need for stimulus is a delicate act.

- Impact on government debt levels: Reduced revenue and increased spending on stimulus measures can lead to higher government debt levels, creating long-term fiscal challenges.

Effects on Canadian Households and Businesses

Ultra-low growth directly impacts Canadian households and businesses:

- Impact on household disposable income and spending patterns: Reduced economic activity can lead to lower wages, job losses, and reduced disposable income, impacting consumer spending and overall economic activity. This can create a cycle of reduced demand and further economic slowdown.

- Challenges faced by businesses in a slow-growth environment: Businesses face challenges in a slow-growth environment, including reduced demand, lower profits, and difficulties in securing financing. This can lead to business closures and job losses.

- Potential for increased job losses or slower job creation: Ultra-low growth can lead to job losses or slower job creation, increasing unemployment and impacting household income and consumer confidence.

Potential Mitigation Strategies and Policy Responses

Addressing the ultra-low growth forecast requires a multi-pronged approach:

Government Initiatives and Fiscal Policy Options

The government can play a crucial role in mitigating the negative impacts:

- Investment in infrastructure projects: Investing in infrastructure projects can stimulate economic activity, create jobs, and improve long-term productivity. Strategic infrastructure investment can have a significant positive impact.

- Targeted tax cuts or incentives: Targeted tax cuts or incentives for businesses and individuals can stimulate investment and spending, boosting economic growth. Well-designed incentives can encourage investment in key sectors.

- Support for specific sectors of the economy: Government support for specific sectors, such as clean technology or advanced manufacturing, can drive innovation and create high-paying jobs. Strategic support can help Canada compete globally.

Bank of Canada's Role in Managing Monetary Policy

The Bank of Canada has a critical role in managing monetary policy:

- Potential adjustments to interest rates: The Bank of Canada may need to adjust interest rates to balance inflation control with economic growth. Finding the right balance is crucial for long-term economic stability.

- Quantitative easing or other monetary policy tools: In addition to interest rate adjustments, the Bank of Canada may consider other monetary policy tools, such as quantitative easing, to stimulate economic activity. These tools require careful consideration and management.

- Coordination with fiscal policy: Effective coordination between monetary and fiscal policy is essential to ensure a consistent and effective response to the economic challenges presented by ultra-low growth.

Conclusion

David Dodge's analysis highlights the significant challenges facing the Canadian economy, with a confluence of global and domestic factors contributing to the ultra-low growth forecast. The implications are far-reaching, impacting government finances, households, and businesses. Addressing this requires a combination of government initiatives, fiscal policy adjustments, and careful management of monetary policy by the Bank of Canada. Strategic investments, targeted support, and coordinated policy responses are crucial to mitigate the negative impacts and foster sustainable economic growth.

Call to Action: Stay informed about the evolving economic landscape and the potential impact of ultra-low growth on your financial planning. Continue to follow expert analysis on ultra-low growth Canada to make informed decisions about your investments and financial future. Understanding the forecast for ultra-low growth in Canada is crucial for navigating the economic challenges ahead.

Featured Posts

-

Tulsa Day Center Seeks Warm Clothing Donations Ahead Of Winter

May 02, 2025

Tulsa Day Center Seeks Warm Clothing Donations Ahead Of Winter

May 02, 2025 -

Borba S Torgovley Lyudmi V Sogde Itogi Obsuzhdeniya

May 02, 2025

Borba S Torgovley Lyudmi V Sogde Itogi Obsuzhdeniya

May 02, 2025 -

Christina Aguileras New Photoshoot Fans Accuse Her Of Excessive Photoshopping

May 02, 2025

Christina Aguileras New Photoshoot Fans Accuse Her Of Excessive Photoshopping

May 02, 2025 -

Is Betting On Natural Disasters Like The La Wildfires A Sign Of The Times

May 02, 2025

Is Betting On Natural Disasters Like The La Wildfires A Sign Of The Times

May 02, 2025 -

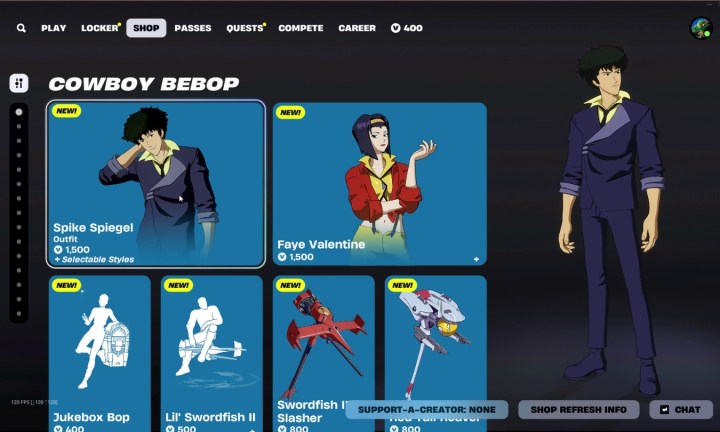

Dont Miss Out Free Cowboy Bebop Items Now In Fortnite

May 02, 2025

Dont Miss Out Free Cowboy Bebop Items Now In Fortnite

May 02, 2025

Latest Posts

-

Understanding The Political Climate Voter Turnout In Florida And Wisconsin

May 02, 2025

Understanding The Political Climate Voter Turnout In Florida And Wisconsin

May 02, 2025 -

Post Election Analysis Abu Jinapor On The Npps 2024 Setback

May 02, 2025

Post Election Analysis Abu Jinapor On The Npps 2024 Setback

May 02, 2025 -

Recent Survey 93 Of Respondents Trust South Carolinas Elections

May 02, 2025

Recent Survey 93 Of Respondents Trust South Carolinas Elections

May 02, 2025 -

Abu Jinapor On The Challenges Facing The Npp After The 2024 Election

May 02, 2025

Abu Jinapor On The Challenges Facing The Npp After The 2024 Election

May 02, 2025 -

Analyzing The Npps 2024 Loss Insights From Abu Jinapor

May 02, 2025

Analyzing The Npps 2024 Loss Insights From Abu Jinapor

May 02, 2025