UK Inflation Slowdown Fuels Pound Rally, BOE Cuts Less Likely

Table of Contents

Falling Inflation: The Catalyst for the Pound's Rise

The latest UK inflation figures have provided a welcome surprise, acting as a catalyst for the pound's recent rise. Both the Consumer Price Index (CPI) and the Retail Price Index (RPI), key indicators of inflation in the UK, have shown a notable slowdown. This deceleration deviates from previous predictions, suggesting a potential turning point in the fight against inflation.

- CPI and RPI Figures: While specific figures will vary depending on the release date, let's assume for illustrative purposes that CPI fell from 10% to 8% and RPI from 12% to 10%. This represents a significant easing of inflationary pressures compared to previous months.

- Factors Contributing to the Slowdown: Several factors have contributed to this positive trend. Easing energy prices, particularly natural gas, have played a major role. Improved supply chain efficiency, reducing bottlenecks and easing cost pressures, has also contributed. Government policies aimed at mitigating inflation, such as targeted support packages, have also had an impact, though the extent of their effect is still debated.

- Market Reaction and Pound Strength: The immediate market response to this positive inflation data was a surge in demand for the pound. Investors, interpreting the figures as a signal that the BOE's aggressive monetary tightening might be nearing its end, flocked to GBP-denominated assets, driving the Sterling higher against other major currencies. This increase in demand directly reflects the positive correlation between lower inflation and a stronger pound.

Market Reaction and Pound Strength: A Deeper Dive

The GBP's strength isn't solely a reaction to the headline inflation numbers. The market also considers the underlying data and future projections. A sustained fall in inflation, coupled with robust economic growth, makes the UK a more attractive investment destination, increasing demand for the pound. Conversely, any unexpected rise in inflation could lead to a reversal of this trend, highlighting the importance of continuous monitoring.

Implications for the Bank of England's Monetary Policy

The inflation slowdown significantly influences the Bank of England's future monetary policy decisions. The BOE's primary mandate is to maintain price stability, typically aiming for a 2% inflation target. The recent drop in inflation reduces the immediate pressure for further aggressive interest rate hikes.

- BOE's Mandate and Inflation Target: The BOE's commitment to its inflation target is unwavering. However, the recent data allows for a more nuanced approach.

- Potential for a Pause or Rate Reduction: The likelihood of further interest rate increases has diminished. Markets are now pricing in the possibility of a pause in rate hikes, or even a potential reduction in the base rate if inflation continues to fall consistently.

- Risks and Uncertainties: While the outlook is positive, uncertainties remain. Geopolitical factors, supply chain disruptions, and unexpected shocks to energy prices could still influence the BOE’s decision-making. The BOE will carefully monitor these factors before making any adjustments to its monetary policy.

Economic Outlook and Investment Strategies

The UK inflation slowdown paints a more optimistic picture for the UK's economic outlook. While challenges remain, the improved inflation outlook presents numerous investment opportunities.

- Growth Sectors: Sectors less sensitive to interest rate changes, such as technology and healthcare, are likely to see increased investment.

- Attractiveness of UK Assets: With lower inflation and a potentially less aggressive monetary policy stance, UK assets, including government bonds and equities, are becoming increasingly attractive to investors.

- Risks and Opportunities: While the outlook is positive, investors must remain vigilant. Geopolitical events and unexpected economic shifts could still impact the market. Diversification remains crucial in navigating this complex landscape.

Conclusion

In conclusion, the UK's recent inflation slowdown has significantly fueled a pound rally, decreasing the probability of further substantial interest rate hikes by the BOE. This improved economic outlook offers considerable opportunities for investors, though careful consideration of potential risks remains vital. Staying informed about the UK's evolving inflation situation and monitoring the BOE's policy announcements are crucial for making well-informed investment decisions in GBP-related assets. Understanding the dynamics of UK inflation is paramount for navigating the current market climate and capitalizing on emerging opportunities.

Featured Posts

-

Space Crystals And The Future Of Pharmaceutical Innovation

May 23, 2025

Space Crystals And The Future Of Pharmaceutical Innovation

May 23, 2025 -

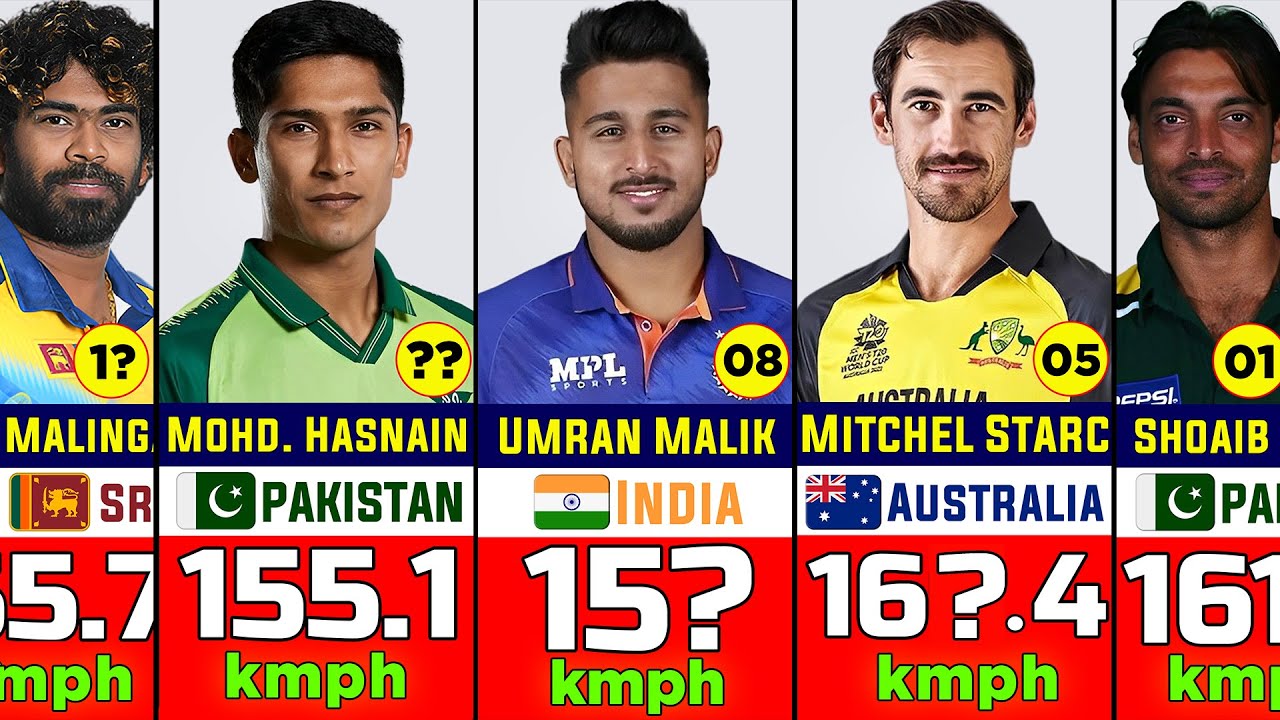

Zimbabwean Fast Bowlers Meteoric Rise In Rankings

May 23, 2025

Zimbabwean Fast Bowlers Meteoric Rise In Rankings

May 23, 2025 -

Cat Deeleys Perfect Spring Look The Effortless Cream Pleated Midi Skirt

May 23, 2025

Cat Deeleys Perfect Spring Look The Effortless Cream Pleated Midi Skirt

May 23, 2025 -

The Impact Of Industry Downsizing On Game Accessibility

May 23, 2025

The Impact Of Industry Downsizing On Game Accessibility

May 23, 2025 -

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 23, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 23, 2025

Latest Posts

-

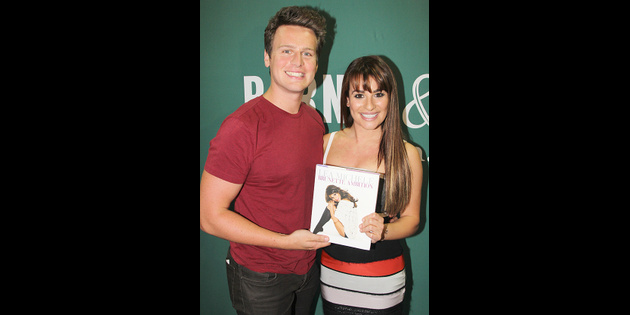

Jonathan Groffs Just In Time Opening Night Lea Michele And Fellow Stars Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Night Lea Michele And Fellow Stars Celebrate

May 23, 2025 -

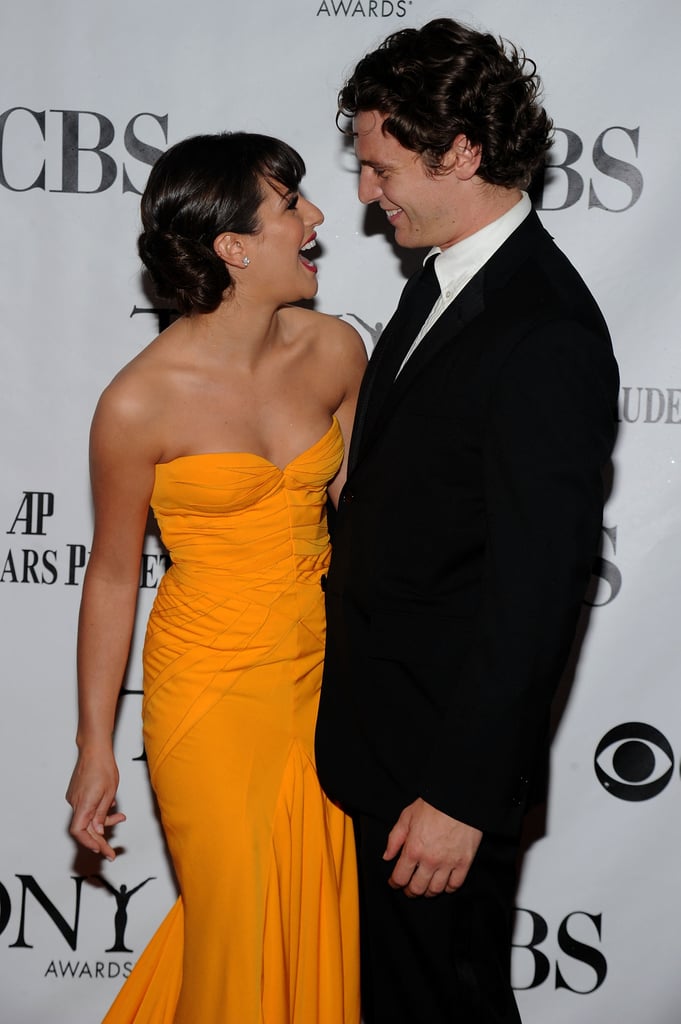

Etoile A Spring Awakening Reunion Brings Laughter With Glick And Groff

May 23, 2025

Etoile A Spring Awakening Reunion Brings Laughter With Glick And Groff

May 23, 2025 -

Jonathan Groffs Broadway Opening Lea Michele And Friends Offer Support

May 23, 2025

Jonathan Groffs Broadway Opening Lea Michele And Friends Offer Support

May 23, 2025 -

Gideon Glick And Jonathan Groffs Etoile Reunion A Hilarious Spring Awakening Callback

May 23, 2025

Gideon Glick And Jonathan Groffs Etoile Reunion A Hilarious Spring Awakening Callback

May 23, 2025 -

Jonathan Groffs Just In Time Success Supported By Lea Michele And Cast

May 23, 2025

Jonathan Groffs Just In Time Success Supported By Lea Michele And Cast

May 23, 2025