UK Economy: Carney's Bold Plan For Transformation

Table of Contents

Forward Guidance and Monetary Policy Innovation

Carney's introduction of forward guidance as a core component of monetary policy represented a significant departure from traditional approaches. This innovative strategy aimed to improve transparency and stability within the UK economy by clearly communicating the BoE's intentions regarding future interest rate decisions. This involved explicitly linking future interest rate adjustments to specific economic indicators, such as inflation and unemployment targets.

-

Explanation of forward guidance and its mechanics: Forward guidance works by influencing market expectations. By providing clear signals about future policy actions, the BoE aimed to anchor inflation expectations and reduce uncertainty in financial markets. This, in theory, should lead to smoother economic adjustments.

-

Analysis of its effectiveness in influencing market expectations: Empirical evidence suggests that forward guidance was largely successful in influencing market expectations. The transparency it provided helped to stabilize bond yields and reduce volatility in the currency markets. However, its effectiveness varied depending on the economic climate and the clarity of the communication.

-

Discussion of its limitations and potential drawbacks: One limitation of forward guidance lies in its dependence on accurate economic forecasting. Unexpected economic shocks or changes in the economic outlook could render the guidance ineffective or even counterproductive. Furthermore, excessive reliance on forward guidance could lead to a loss of flexibility in responding to unforeseen events.

-

Comparison with traditional monetary policy approaches: Unlike traditional monetary policy, which often relies on reactive adjustments to interest rates, forward guidance employs a more proactive and communicative approach. This shift aimed to improve the effectiveness and predictability of monetary policy.

Tackling the Aftermath of the 2008 Financial Crisis

The aftermath of the 2008 financial crisis presented a significant challenge for the UK economy. Carney played a crucial role in navigating this period of instability. His leadership saw the significant implementation of unconventional monetary policies, most notably quantitative easing (QE).

-

Detail on the scale and impact of quantitative easing programs: The BoE's QE programs involved purchasing large quantities of government bonds and other assets to inject liquidity into the financial system and lower long-term interest rates. These programs were implemented on an unprecedented scale, significantly increasing the BoE's balance sheet.

-

Analysis of its effectiveness in stimulating economic growth: QE arguably played a vital role in preventing a deeper recession and supporting economic recovery. By lowering borrowing costs, it encouraged investment and consumption, thus stimulating economic activity. However, the precise extent of its impact remains a subject of ongoing debate.

-

Discussion of the potential risks and side effects of quantitative easing: Critics argue that QE could lead to asset bubbles, increased inflation, and a distortion of financial markets. While inflation remained relatively subdued during the period of QE implementation, the long-term effects are still being assessed.

-

Examination of the role of fiscal policy in supporting economic recovery: It is crucial to acknowledge that the economic recovery following the 2008 crisis was also supported by significant fiscal policy measures implemented by the government, including fiscal stimulus packages.

Financial Stability and Regulatory Reform

Carney prioritized enhancing the stability of the UK's financial system through significant regulatory reforms. This involved strengthening bank capital requirements, conducting stress tests, and implementing macroprudential policies.

-

Overview of key regulatory changes implemented during Carney's tenure: These included increasing capital requirements for banks, enhancing bank supervision, and implementing stricter rules for financial institutions. These measures aimed to improve the resilience of the UK's financial sector to future shocks.

-

Discussion of the impact of stress tests on the resilience of UK banks: Regular stress tests provided a valuable assessment of the resilience of UK banks to various economic scenarios. This allowed regulators to identify vulnerabilities and take proactive measures to strengthen the banking system.

-

Analysis of the role of macroprudential policy in maintaining financial stability: Macroprudential policy focuses on addressing systemic risks within the financial system as a whole, rather than individual institutions. This approach played a significant role in preventing future crises.

-

Evaluation of the success of these reforms in preventing future crises: While it's impossible to definitively prove that these reforms prevented future crises, they certainly improved the resilience of the UK financial system, making it better equipped to weather economic storms.

Brexit and its Economic Implications

Brexit posed unprecedented challenges to the UK economy. Carney and the BoE had to navigate significant economic uncertainty, impacting the pound sterling, trade, and investment.

-

Overview of the economic challenges presented by Brexit: Brexit introduced substantial uncertainty regarding the UK's future trading relationships, regulatory framework, and access to the single market. This uncertainty negatively affected business investment and consumer confidence.

-

Analysis of the Bank of England's response to Brexit-related uncertainty: The BoE responded to Brexit-related uncertainty by employing various measures, including providing additional liquidity to the financial system and lowering interest rates.

-

Discussion of the impact of Brexit on inflation and economic growth: Brexit contributed to inflationary pressures through supply chain disruptions and a weaker pound. The economic growth rate was also negatively impacted by Brexit-related uncertainty.

-

Evaluation of the effectiveness of the Bank's strategies during this period: The BoE's response to Brexit was largely reactive, aiming to mitigate the negative consequences of the decision rather than preventing it. The effectiveness of these strategies remains a subject of ongoing debate and analysis.

Conclusion

This article has explored the key aspects of Mark Carney's transformative impact on the UK economy. His bold introduction of forward guidance, his management of the post-2008 crisis, his focus on financial stability, and his navigation of the Brexit challenge all left a lasting mark. His innovative monetary policies reshaped the BoE's approach and continue to influence the UK's economic trajectory.

To further understand the complexities of the UK economy and the legacy of Mark Carney, explore additional resources and continue your research into the ongoing effects of his policies on the UK Economy. Learn more about the impact of Carney's strategies and how they continue to shape the UK's economic trajectory today.

Featured Posts

-

A Wild Crypto Party Two Days Of Crypto Chaos

May 05, 2025

A Wild Crypto Party Two Days Of Crypto Chaos

May 05, 2025 -

Transportation Departments Planned Workforce Cuts In May

May 05, 2025

Transportation Departments Planned Workforce Cuts In May

May 05, 2025 -

Ufc 314 Fight Card Main Event Prelims And Bout Order Announced

May 05, 2025

Ufc 314 Fight Card Main Event Prelims And Bout Order Announced

May 05, 2025 -

Lizzo Opens Up About Her Weight Loss A Look At Her Methods

May 05, 2025

Lizzo Opens Up About Her Weight Loss A Look At Her Methods

May 05, 2025 -

Tampa Bay Derby Odds And Field 2025 Your Complete Kentucky Derby Preview

May 05, 2025

Tampa Bay Derby Odds And Field 2025 Your Complete Kentucky Derby Preview

May 05, 2025

Latest Posts

-

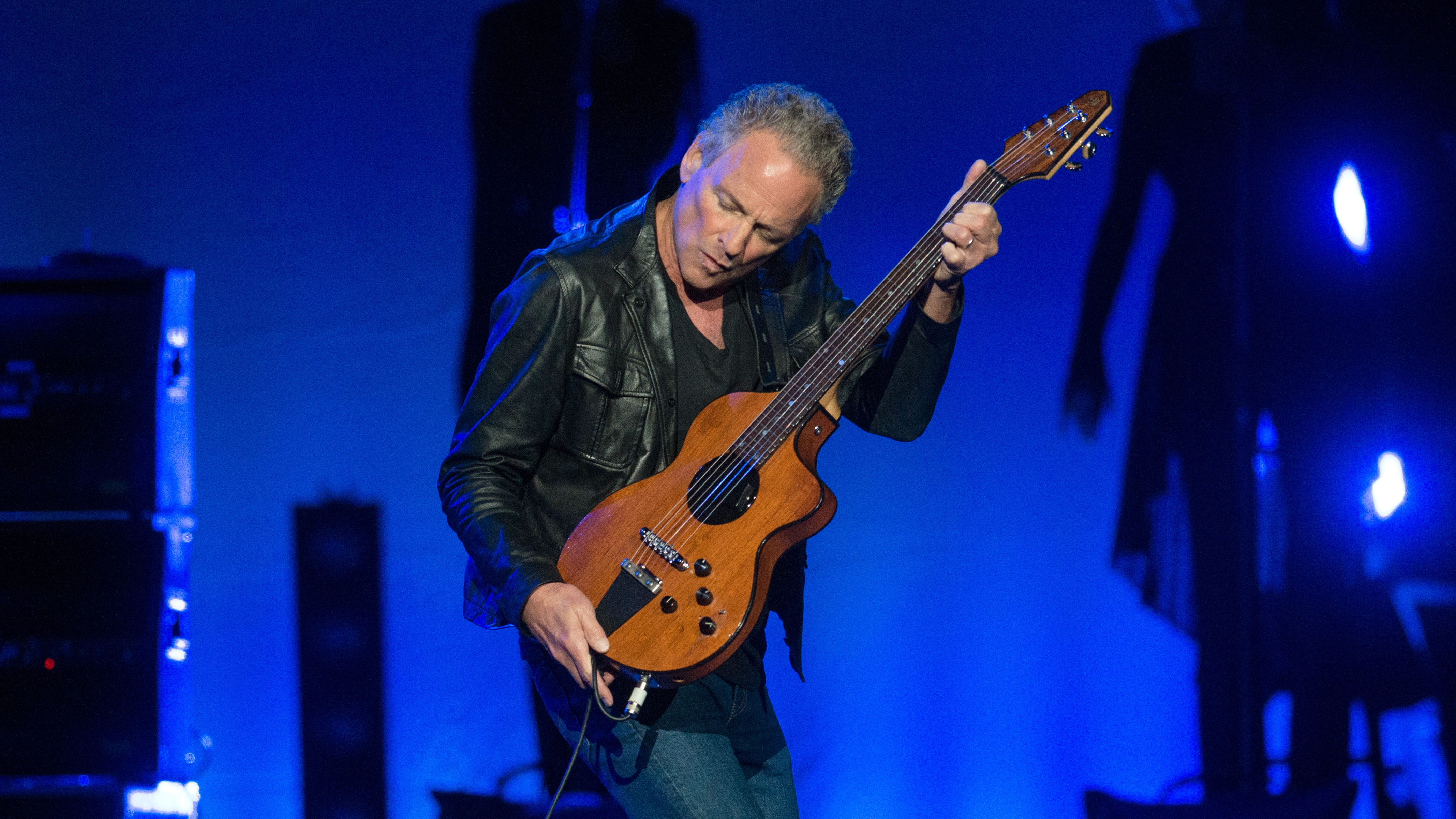

The Future Of Fleetwood Mac Lindsey Buckingham And Mick Fleetwoods Renewed Partnership

May 05, 2025

The Future Of Fleetwood Mac Lindsey Buckingham And Mick Fleetwoods Renewed Partnership

May 05, 2025 -

Gibonnijev Koncert U Puli Gdje Kupiti Karte

May 05, 2025

Gibonnijev Koncert U Puli Gdje Kupiti Karte

May 05, 2025 -

Pula Ceka Gibonnija Najava Koncerta

May 05, 2025

Pula Ceka Gibonnija Najava Koncerta

May 05, 2025 -

Fleetwood Mac Reunion Speculation Buckingham And Fleetwoods Collaboration

May 05, 2025

Fleetwood Mac Reunion Speculation Buckingham And Fleetwoods Collaboration

May 05, 2025 -

Gibonni Novi Koncert U Puli Detalji I Informacije

May 05, 2025

Gibonni Novi Koncert U Puli Detalji I Informacije

May 05, 2025