Uber's Self-Driving Push: ETFs For Investing In The Autonomous Vehicle Revolution

Table of Contents

Understanding Uber's Self-Driving Initiatives and Their Market Impact

Uber's ambition in the autonomous vehicle space is significant, and understanding its progress is crucial for any investor.

Uber's ATG (Advanced Technologies Group): A Deep Dive

Uber's Advanced Technologies Group (ATG) is spearheading its self-driving efforts. While facing initial challenges, ATG has made considerable progress. Its development and deployment of self-driving technology are shaping the future of ride-sharing and beyond.

- Key Milestones Achieved: ATG has successfully completed extensive testing miles in various cities, refining its autonomous driving systems. They've iterated through different generations of self-driving technology, continuously improving performance and safety.

- Partnerships with Other Companies: Collaboration with other technology companies and mapping providers is crucial to ATG's success. These partnerships contribute valuable expertise and data.

- Geographic Areas of Focus for Testing and Deployment: ATG's testing and deployment are geographically diverse, allowing them to gather data in varied environments and regulatory landscapes.

- Challenges Faced in Regulation and Public Perception: Navigating regulatory hurdles and overcoming public concerns regarding safety and job displacement remain significant challenges.

The RoboTaxi Market Potential: A Game Changer

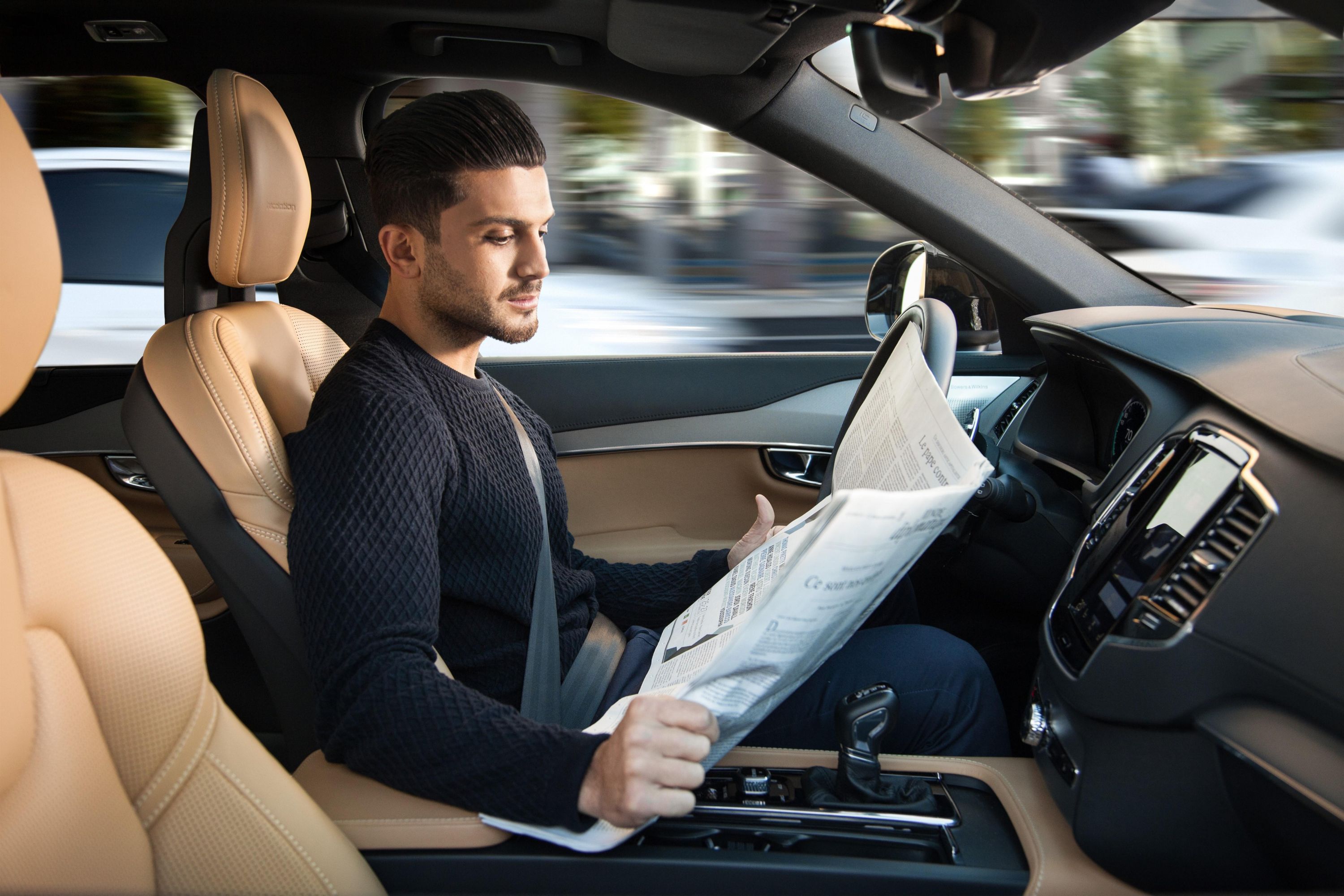

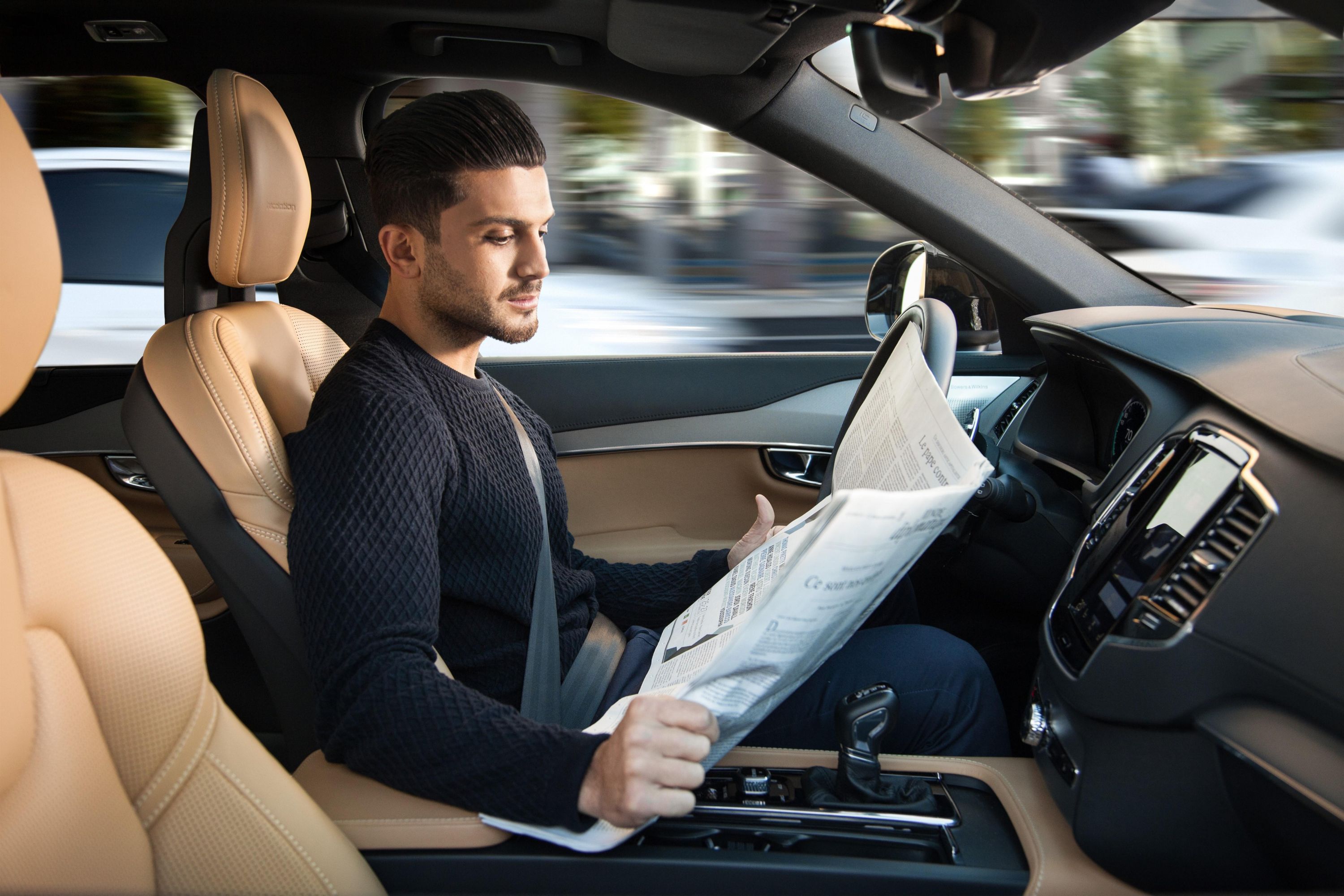

The potential market for robotaxi services is enormous. Uber's vision of a future dominated by autonomous ride-sharing promises to revolutionize personal transportation.

- Market Projections for RoboTaxi Services: Analysts predict a massive market for autonomous ride-sharing services, with substantial growth expected over the next decade. This includes both individual rides and fleet-based solutions for businesses.

- Potential Cost Reductions Compared to Human-Driven Rides: Automation promises to significantly reduce operational costs, potentially translating to lower fares for consumers and higher profit margins for providers.

- Impact on Employment and Transportation Infrastructure: The widespread adoption of robotaxis will undoubtedly impact employment in the transportation sector and reshape urban planning and infrastructure development.

Competition and Technological Landscape: A Dynamic Field

Uber faces stiff competition from established players and innovative startups. The technological approaches used vary widely.

- Brief Profiles of Key Competitors: Waymo, Tesla, Cruise, and other companies are actively developing and deploying autonomous vehicle technologies, creating a highly competitive landscape.

- Discussion of Different Sensor Technologies (LiDAR, radar, cameras): Various sensor technologies play crucial roles in enabling autonomous driving capabilities. Each has its own advantages and disadvantages.

- Variations in AI Approaches: Different companies employ diverse AI algorithms and machine-learning techniques to power their self-driving systems. These differences in approach lead to varied levels of performance and safety.

Identifying Suitable Autonomous Vehicle ETFs

Investing in the autonomous vehicle sector can be challenging. ETFs provide a diversified approach to manage risk.

Selecting ETFs with Exposure to Autonomous Vehicle Technology: A Strategic Choice

ETFs offer a simple way to gain exposure to multiple companies involved in the self-driving revolution.

- Types of ETFs to Consider (sector-specific, thematic ETFs, etc.): Investors can choose from various ETFs that focus on technology, transportation, or specifically autonomous vehicles.

- Key Factors to Consider When Selecting ETFs (expense ratio, tracking error, asset allocation): Analyze the expense ratio, tracking error, and asset allocation to choose an ETF that aligns with your investment goals and risk tolerance.

- Examples of Relevant ETFs (mention specific ETF tickers if appropriate, with disclaimers): Disclaimer: Mentioning specific ETF tickers here would constitute financial advice, which is beyond the scope of this article. Consult with a financial advisor for personalized recommendations.

Analyzing ETF Holdings and Risk Factors: Due Diligence is Key

Thoroughly analyze the holdings of any ETF before investing.

- Analyzing Top Holdings: Understand which companies contribute the most to the ETF's performance and assess the risks associated with those companies.

- Understanding the Geographical and Technological Diversity Within the ETF: A well-diversified ETF will have exposure to various companies employing different technologies and operating in different geographical regions.

- Considering Sector-Specific Risks (regulatory hurdles, technological setbacks, competition): Be aware of the regulatory risks, potential technological setbacks, and the intense competition in this emerging sector.

- Discussing the Overall Risk Profile of the Investment: Understand that investing in an emerging technology like autonomous driving involves inherent risks.

Diversification Strategies with Autonomous Vehicle ETFs: Balancing Risk and Return

Autonomous vehicle ETFs should be part of a broader investment strategy.

- Strategies for Balancing Risk and Return: Combine investments in autonomous vehicle ETFs with other assets to reduce overall portfolio risk.

- Incorporating ETFs into a Diversified Portfolio: Don't put all your eggs in one basket. Diversify across different asset classes and sectors.

- Considering Other Relevant Sectors (technology, infrastructure): Autonomous vehicles will impact various sectors, offering further diversification opportunities.

Investing Responsibly in the Autonomous Vehicle Revolution: A Long-Term Perspective

Investing in emerging technologies like autonomous vehicles requires careful planning.

Understanding the Risks Associated with Emerging Technologies: Managing Uncertainty

Emerging technologies come with significant uncertainty.

- Technological Risks: Technological challenges could delay the widespread adoption of autonomous vehicles.

- Regulatory Risks: Changes in regulations could significantly impact the industry.

- Safety Concerns: Public perception of safety will play a vital role in market acceptance.

- Market Volatility: Expect significant price fluctuations in the short term.

- Competition: Intense competition could lead to lower profits for some companies.

Long-Term Investment Horizons: A Patient Approach

A long-term investment strategy is essential.

- Why Long-Term Investment Is Beneficial: The autonomous vehicle market is expected to grow substantially over the long term.

- Expected Timeline for Widespread Adoption of Autonomous Vehicles: Experts predict significant growth and adoption over the next decade.

- Potential for Significant Returns Over the Long Term: Long-term investors have the potential to benefit from the substantial growth anticipated in this sector.

Due Diligence and Professional Advice: Seeking Guidance

Always conduct thorough research and seek professional advice.

- Importance of Independent Research: Don't rely solely on marketing materials. Conduct your own research.

- Seeking Guidance from Financial Advisors: A financial advisor can help you create a personalized investment strategy.

- Understanding Your Risk Tolerance: Invest only what you can afford to lose.

Conclusion: Driving Towards the Future with Autonomous Vehicle ETFs

Uber's self-driving push is a significant catalyst in the autonomous vehicle revolution, presenting exciting investment possibilities. Autonomous vehicle ETFs offer a diversified approach to participate in this growth, but careful consideration of risks is crucial. By understanding the market landscape, selecting appropriate ETFs, and employing a long-term investment strategy, you can potentially capitalize on the transformative potential of this technology. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions. Start exploring investment options in the autonomous vehicle sector today and ride the wave of the Uber self-driving revolution and similar technological advancements!

Featured Posts

-

Agradecimiento De Ana Paola Hall El Apoyo Ciudadano Provoca Declaratoria

May 19, 2025

Agradecimiento De Ana Paola Hall El Apoyo Ciudadano Provoca Declaratoria

May 19, 2025 -

Tragedy At Fsu Exploring The Background Of A Victims Father

May 19, 2025

Tragedy At Fsu Exploring The Background Of A Victims Father

May 19, 2025 -

The Fsu Shooting Unveiling The Story Behind One Victims Family History

May 19, 2025

The Fsu Shooting Unveiling The Story Behind One Victims Family History

May 19, 2025 -

Fallecimiento De Leyenda Del Tenis Nadal Confirma La Triste Noticia Del Campeon De Hamburgo

May 19, 2025

Fallecimiento De Leyenda Del Tenis Nadal Confirma La Triste Noticia Del Campeon De Hamburgo

May 19, 2025 -

Wnba White Guilt Parade Examining The Controversy

May 19, 2025

Wnba White Guilt Parade Examining The Controversy

May 19, 2025