Uber Stock Soars: A Deep Dive Into April's Double-Digit Gains

Table of Contents

Strong Q1 2024 Earnings Report Fuels Uber Stock Growth

Uber's Q1 2024 earnings report was a significant catalyst for the April stock price increase. The release revealed figures that exceeded market expectations, triggering a positive market reaction and boosting investor confidence in the company's future. Key highlights from the report included:

- Robust Revenue Growth: Uber reported a substantial year-over-year increase in revenue, demonstrating strong growth across its core business segments. This exceeded analyst predictions and signaled a healthy financial position.

- Improved Earnings Per Share (EPS): The company announced a significant improvement in EPS, a key indicator of profitability. This positive trend demonstrated Uber's ability to translate revenue growth into increased earnings.

- Accelerated User Growth: Uber experienced a notable increase in both ride-hailing and food delivery users, indicating strong market demand and successful user acquisition strategies. This growth underlines the increasing popularity and adoption of Uber's services.

- Exceptional Ride-Sharing Performance: The ride-sharing segment displayed particularly strong performance, reflecting a recovery in travel and a growing preference for convenient transportation solutions.

- Eats Segment Momentum: Uber's food delivery segment, Uber Eats, also contributed positively to the overall financial results, maintaining its trajectory of growth and solidifying its position in the competitive food delivery market.

The market responded enthusiastically to these positive financial results, interpreting them as a sign of Uber's increasing operational efficiency and strong growth potential. This positive sentiment translated directly into a significant increase in Uber stock price.

Increased Efficiency and Cost-Cutting Measures

In addition to strong Q1 earnings, Uber's proactive approach to operational efficiency and cost-cutting played a significant role in boosting investor confidence. The company implemented several strategies designed to enhance profitability and improve its bottom line. These included:

- Optimized Driver Incentives: Uber refined its driver incentive programs to improve cost efficiency without compromising service quality.

- Technological Advancements: Investments in technology and data analytics have streamlined operations, leading to increased efficiency and reduced operational costs.

- Streamlined Operations: Uber implemented various initiatives to streamline its internal processes, minimizing redundancies and optimizing resource allocation.

- Marketing Optimization: Uber focused its marketing efforts on high-return strategies, maximizing the impact of its campaigns and improving marketing ROI.

These measures demonstrably impacted Uber's profitability, showcasing the company's commitment to fiscal responsibility and long-term sustainability. This enhanced profitability, in turn, significantly contributed to the positive market sentiment surrounding Uber stock.

Positive Market Sentiment and Industry Trends

The surge in Uber stock wasn't solely driven by internal factors. April also saw a positive market sentiment towards the ride-sharing and food delivery industries, influenced by several broader trends:

- Economic Recovery: Signs of economic recovery fueled increased consumer spending, translating into greater demand for ride-hailing and food delivery services.

- Increased Consumer Spending: A rise in consumer confidence and discretionary spending contributed to increased demand for Uber's services, boosting revenue and profits.

- Easing of Pandemic Restrictions: The continued easing of pandemic-related restrictions globally further stimulated travel and social activities, positively impacting the ride-sharing sector.

- Competitive Landscape: While competition remains strong, Uber’s strategic moves and improved performance relative to its competitors likely contributed to the positive market sentiment.

These favorable industry trends further reinforced investor confidence in Uber's growth prospects, pushing Uber stock price even higher.

Analyst Upgrades and Target Price Increases

Several prominent financial analysts upgraded their ratings and target prices for Uber stock in April, adding to the positive momentum. These upgrades reflected a growing belief in the company's strong fundamentals and positive future outlook.

- Positive Analyst Ratings: Major investment firms issued positive ratings and commentary on Uber stock, citing the strong earnings report and positive industry trends as reasons for their bullish outlook.

- Increased Target Prices: Many analysts significantly increased their target prices for Uber stock, indicating their expectation of further price appreciation in the near future. These increases fueled buying pressure and contributed to the rapid rise in Uber stock price.

These analyst upgrades played a significant role in influencing investor sentiment and driving trading activity, accelerating the upward trend of the Uber stock price.

Riding the Wave: Understanding Uber Stock's April Surge and Future Outlook

Uber's impressive double-digit gains in April were a result of a confluence of factors: strong Q1 2024 earnings exceeding expectations, improved operational efficiency and cost-cutting measures, positive market sentiment and industry trends, and positive analyst upgrades. While the future always holds uncertainties, Uber’s current trajectory suggests a positive outlook. However, potential risks, such as increased competition and economic downturns, should be considered.

The April performance underscores the importance of monitoring Uber stock performance. Stay informed about Uber stock performance and consider its potential as an investment. Learn more about investing in Uber stock and consider Uber stock for your portfolio. Conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

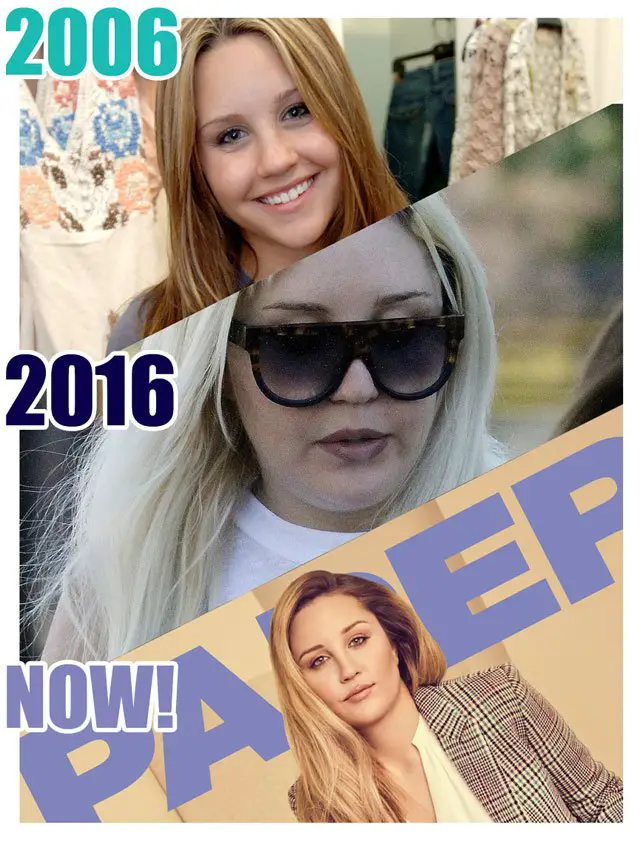

Amanda Bynes Showbiz Comeback A New Project After 15 Years Away

May 18, 2025

Amanda Bynes Showbiz Comeback A New Project After 15 Years Away

May 18, 2025 -

Dodgers Conforto Following Hernandezs Path To Success

May 18, 2025

Dodgers Conforto Following Hernandezs Path To Success

May 18, 2025 -

Film No Other Land Kemenangan Oscar Dan Realita Konflik Palestina Israel

May 18, 2025

Film No Other Land Kemenangan Oscar Dan Realita Konflik Palestina Israel

May 18, 2025 -

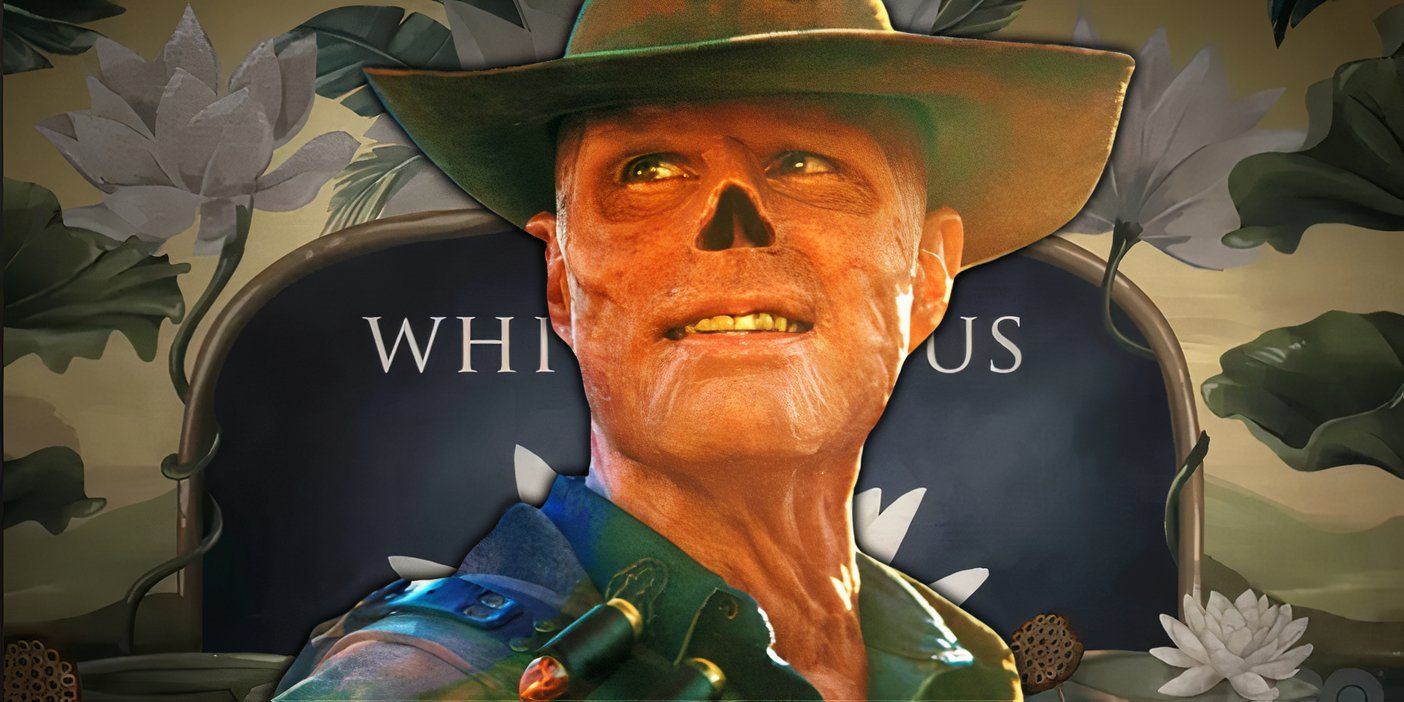

Walton Goggins On Snl Mocking White Lotus Fan Theories

May 18, 2025

Walton Goggins On Snl Mocking White Lotus Fan Theories

May 18, 2025 -

Kanye Wests New Song Diddy North West Collaboration Despite Kim Kardashians Attempt To Block It

May 18, 2025

Kanye Wests New Song Diddy North West Collaboration Despite Kim Kardashians Attempt To Block It

May 18, 2025

Latest Posts

-

Infografis Konflik Israel Palestina Apakah Solusi Dua Negara Masih Mungkin Peran Dan Sikap Indonesia

May 18, 2025

Infografis Konflik Israel Palestina Apakah Solusi Dua Negara Masih Mungkin Peran Dan Sikap Indonesia

May 18, 2025 -

Film No Other Land Raih Oscar Cerminan Konflik Palestina Israel

May 18, 2025

Film No Other Land Raih Oscar Cerminan Konflik Palestina Israel

May 18, 2025 -

Infografis Solusi Dua Negara Pandangan Pesimis Dan Peran Indonesia Dalam Konflik Israel Palestina

May 18, 2025

Infografis Solusi Dua Negara Pandangan Pesimis Dan Peran Indonesia Dalam Konflik Israel Palestina

May 18, 2025 -

Abd Li Dergi Tuerkiye Israil Catismasi Ve Erdogan Netanyahu Karsilasmasi

May 18, 2025

Abd Li Dergi Tuerkiye Israil Catismasi Ve Erdogan Netanyahu Karsilasmasi

May 18, 2025 -

No Other Land Analisis Film Pemenang Oscar Tentang Konflik Palestina Israel

May 18, 2025

No Other Land Analisis Film Pemenang Oscar Tentang Konflik Palestina Israel

May 18, 2025