Uber Stock And Recession: Why Analysts Remain Bullish

Table of Contents

Uber's Diversified Revenue Streams Mitigate Recessionary Risks

Uber's success isn't solely reliant on its flagship ride-sharing service. Its strategic diversification into various sectors significantly reduces its vulnerability to economic downturns. This multi-pronged approach offers a safety net, ensuring consistent revenue generation even if one sector experiences a temporary slowdown.

Ride-Sharing Remains a Key Driver

Despite economic uncertainty, the demand for ride-sharing services remains robust. Ride-sharing offers a convenient and often cost-effective alternative to car ownership, particularly in urban areas.

- Essential Transportation: Ride-sharing provides crucial transportation for essential workers, commuters, and those without personal vehicles. This consistent demand acts as a buffer against economic fluctuations.

- Cost-Effectiveness: Compared to owning and maintaining a car, ride-sharing can be significantly cheaper, especially considering fuel costs, insurance, and maintenance. This makes it an attractive option even during periods of economic hardship.

- Increasing Urbanization: Global urbanization continues to drive demand for efficient and accessible transportation solutions, further bolstering the ride-sharing market.

Data from previous economic slowdowns indicates that while ride-sharing usage might dip slightly, it generally remains relatively resilient, showcasing the service’s essential nature.

Uber Eats: A Growing Force in Food Delivery

Uber Eats has emerged as a significant revenue generator for Uber, and its growth trajectory remains impressive. The convenience of food delivery, particularly during economic uncertainty when people may be less inclined to cook, fuels its continuous expansion.

- Increased Demand for Convenience: Busy schedules and the desire for convenience drive the demand for food delivery services, regardless of the overall economic climate.

- Competitive Pricing Strategies: Uber Eats leverages competitive pricing and promotional offers to attract and retain customers, ensuring its continued market share.

- Expansion into New Markets: The platform continuously expands into new geographic markets, tapping into untapped potential and diversifying its revenue base.

- Partnerships with Restaurants: Strategic partnerships with restaurants bolster Uber Eats' offerings and expand its reach, strengthening its position in the competitive food delivery landscape.

Uber Eats' market share is steadily increasing, highlighting its potential to drive significant revenue growth for Uber in the coming years.

Freight and Other Emerging Businesses

Uber isn't resting on its laurels. Uber Freight, its freight transportation arm, represents a significant diversification strategy, offering potential for substantial future growth. This expansion into new sectors lessens Uber’s dependence on the ride-sharing market.

- Expanding into New Markets: Uber Freight is actively expanding into new markets and logistics solutions, further diversifying Uber's revenue streams and reducing its reliance on ride-sharing.

- Potential for Significant Growth: The freight transportation sector presents significant opportunities for growth, providing a buffer against potential downturns in other sectors.

- Mitigating Risk: By diversifying beyond ride-sharing and food delivery, Uber is strategically mitigating risk and ensuring a more robust and stable business model.

Future growth areas like autonomous vehicle technology and other emerging transportation solutions will only further solidify Uber's position as a resilient player in a dynamic market.

Cost-Cutting Measures and Operational Efficiency

Uber has demonstrated a strong commitment to improving profitability through strategic cost-cutting and operational efficiency enhancements. This focus on financial prudence strengthens its resilience in challenging economic conditions.

Focus on Profitability

Uber has implemented various initiatives aimed at streamlining operations and enhancing profitability. These efforts are crucial for weathering economic downturns.

- Streamlining Operations: Uber continuously refines its operational processes to reduce costs and improve efficiency across all its services.

- Improving Driver Retention: Reducing driver turnover through improved benefits and support systems minimizes recruitment and training costs.

- Optimizing Pricing Strategies: Data-driven pricing strategies ensure optimal revenue generation while maintaining competitiveness.

Recent announcements indicate a clear focus on profitability, underscoring Uber’s proactive approach to managing its finances during uncertain times.

Technological Advancements and Automation

Leveraging technology is key to Uber’s strategy for increased efficiency and reduced costs. AI and automation play a crucial role in this endeavor.

- AI-Powered Routing: AI optimizes driver routes, reducing fuel consumption and improving delivery times.

- Automated Driver Onboarding: Automating onboarding processes streamlines recruitment and reduces administrative overhead.

- Data-Driven Decision-Making: Data analytics inform strategic decisions, optimizing operations and resource allocation.

The long-term impact of these technological advancements will significantly enhance Uber’s operational efficiency and resilience.

Long-Term Growth Potential and Market Dominance

Uber’s long-term growth potential is substantial, fueled by global expansion and its strong competitive advantage.

Global Expansion Opportunities

Uber continues to explore and penetrate new markets globally, expanding its reach and solidifying its position as a leading player in the transportation and delivery sectors.

- Untapped Markets in Developing Countries: Significant growth opportunities exist in developing countries with rapidly growing populations and increasing urbanization.

- Expansion into New Transportation Modalities: Exploring new transportation modalities like micromobility (e-scooters, e-bikes) and autonomous vehicles will further diversify Uber's offerings and tap into new revenue streams.

- Potential for Strategic Acquisitions: Strategic acquisitions can accelerate growth and expand Uber's market share, solidifying its dominance.

Recent expansions into new geographic locations and strategic partnerships highlight Uber's ongoing commitment to global growth.

Network Effects and Competitive Advantage

Uber’s extensive network of drivers and riders creates a significant competitive advantage, known as network effects. This makes it incredibly challenging for competitors to replicate Uber's success.

- Higher Convenience for Users: A large network ensures quicker ride availability and broader service coverage for users.

- Greater Efficiency for Drivers: A large network provides drivers with more ride requests, increasing their earning potential and retention.

- Difficulty for Competitors to Replicate: The scale and reach of Uber's network create significant barriers to entry for competitors.

Uber's strong market position and network effects contribute significantly to its resilience and long-term growth potential.

Conclusion

Uber's diversified revenue streams, its cost-cutting measures, and its dominant market position provide compelling reasons for analyst confidence in the stock, even amid recessionary fears. The company's proactive approach to profitability, coupled with its continuous expansion and technological advancements, points towards a strong future. Uber's resilience is not merely a hope but a demonstrable strategy driven by diversification and efficiency. Invest in Uber stock and consider diversifying your portfolio with this potentially recession-proof investment. Learn more about the resilience of Uber stock and its long-term growth potential today!

Featured Posts

-

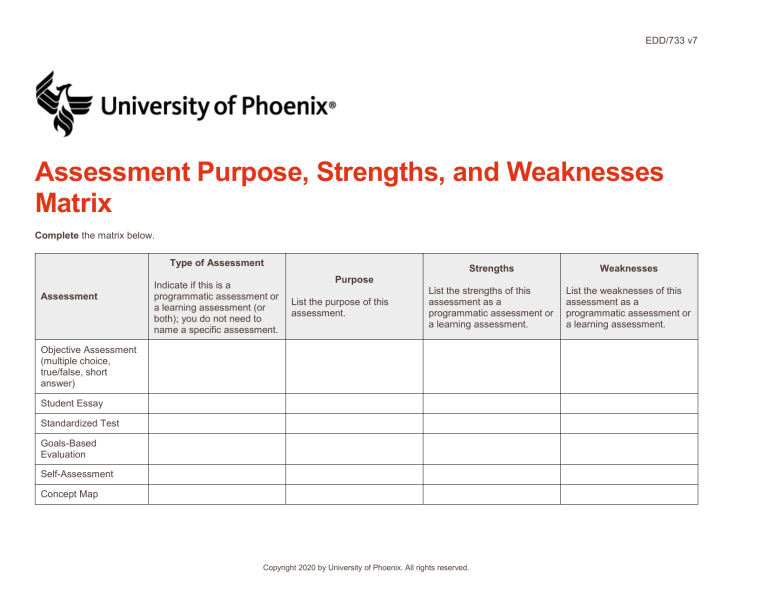

Brooklyn Bridge Assessment Strengths Weaknesses And Future Considerations

May 18, 2025

Brooklyn Bridge Assessment Strengths Weaknesses And Future Considerations

May 18, 2025 -

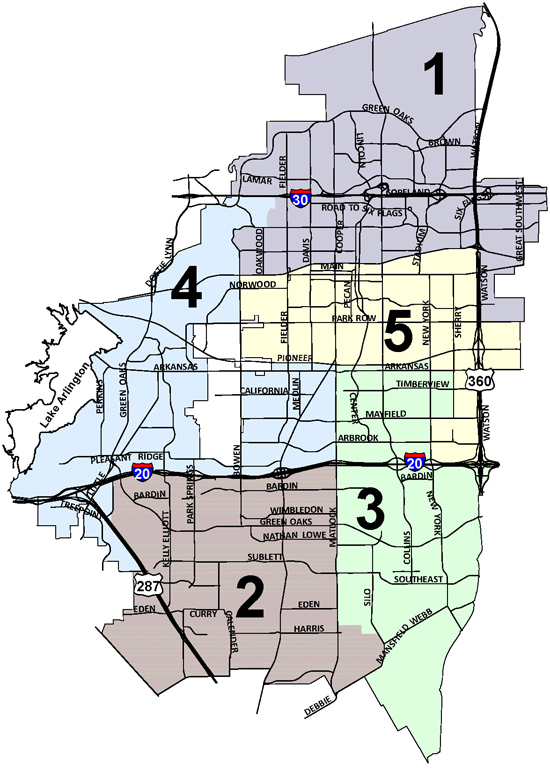

Southeast Texas Municipal Elections May 2025 Candidate Roundup

May 18, 2025

Southeast Texas Municipal Elections May 2025 Candidate Roundup

May 18, 2025 -

Lotto Results Saturday April 12 2025 Official Winning Numbers

May 18, 2025

Lotto Results Saturday April 12 2025 Official Winning Numbers

May 18, 2025 -

60 000 Square Foot City Pickle Pickleball Center Opening In Brooklyn

May 18, 2025

60 000 Square Foot City Pickle Pickleball Center Opening In Brooklyn

May 18, 2025 -

Why Are Las Vegas Casinos Laying Off Workers A Look At The Current Situation

May 18, 2025

Why Are Las Vegas Casinos Laying Off Workers A Look At The Current Situation

May 18, 2025

Latest Posts

-

Pedro Pascal The Last Decades Rise To Hollywood Leading Man

May 18, 2025

Pedro Pascal The Last Decades Rise To Hollywood Leading Man

May 18, 2025 -

Pascal And Aniston Addressing The Dating Rumors

May 18, 2025

Pascal And Aniston Addressing The Dating Rumors

May 18, 2025 -

Is Jennifer Aniston Dating Pedro Pascal Birthday Post Ignites Dating Rumors

May 18, 2025

Is Jennifer Aniston Dating Pedro Pascal Birthday Post Ignites Dating Rumors

May 18, 2025 -

Jennifer Anistons Birthday Tribute To Pedro Pascal A Look At Their Relationship

May 18, 2025

Jennifer Anistons Birthday Tribute To Pedro Pascal A Look At Their Relationship

May 18, 2025 -

Jennifer Anistons Birthday Message For Pedro Pascal Fuels Dating Rumors

May 18, 2025

Jennifer Anistons Birthday Message For Pedro Pascal Fuels Dating Rumors

May 18, 2025