U.S. Tariff Plan Pause Sends Euronext Amsterdam Stocks Up 8%

Table of Contents

Understanding the U.S. Tariff Plan and its Initial Impact

The paused U.S. tariff plan targeted several sectors, primarily aiming to increase import duties on various goods from Europe. This plan, initially announced with considerable fanfare, threatened to significantly disrupt international trade and negatively affect European businesses. The sectors most impacted by the proposed tariffs included technology, manufacturing, and agriculture. These industries feared substantial losses in revenue due to increased costs and reduced competitiveness.

- Affected Sectors: Technology companies reliant on EU component imports, European manufacturers exporting to the U.S., and agricultural producers supplying European goods to the American market.

- Initial Market Downturn: Before the pause, Euronext Amsterdam experienced a noticeable dip, with the overall index falling by approximately 3% in the weeks leading up to the announcement, reflecting investor concern over the potential economic impact.

- Government Statements: Several press releases from European government bodies expressed concern about the potential negative impact on their economies, and calls for negotiation and resolution were prominent in the weeks before the pause.

The Sudden Pause and Market Response

The unexpected pause in the U.S. tariff plan was announced on [Insert Date], sending shockwaves through the global stock market. The decision, reportedly driven by [Insert Reason for Pause, e.g., ongoing negotiations, political pressure], led to an almost immediate and dramatic upswing in Euronext Amsterdam. The 8% surge in stock prices happened within hours of the announcement, showcasing the market's sensitivity to U.S. trade policy.

- Announcement Timing: The announcement came at [Insert Time] on [Insert Date], immediately influencing trading patterns.

- Market Reaction Graph: [Insert a graph or chart visually representing the 8% increase in Euronext Amsterdam stocks].

- Analyst Quotes: "The swift reversal demonstrates the market's inherent volatility and how sensitive it is to shifts in U.S. trade policy," stated [Insert Name of Market Analyst], Senior Analyst at [Insert Company Name]. "Investors reacted positively due to the lessened uncertainty."

Key Companies and Sectors Affected on Euronext Amsterdam

Several companies listed on Euronext Amsterdam experienced significant gains following the U.S. tariff plan pause. Companies heavily reliant on U.S. exports or those producing goods directly impacted by the proposed tariffs saw the most significant increases.

- Top Performers:

- [Company Name 1]: [Percentage Gain]

- [Company Name 2]: [Percentage Gain]

- [Company Name 3]: [Percentage Gain]

- Benefiting Sectors: The technology and manufacturing sectors saw the most significant gains, reflecting their high exposure to the proposed tariffs.

- Long-Term Effects: While the immediate impact is positive, the long-term effects depend heavily on whether the tariffs are reinstated or if a new trade agreement is reached.

Potential Long-Term Implications for Euronext Amsterdam and the Global Market

The pause in the U.S. tariff plan provides temporary relief, but the long-term outlook for Euronext Amsterdam and the global market remains uncertain. The possibility of the tariffs being reinstated looms, adding to the inherent volatility of the stock market. Furthermore, the impact on investor confidence and future investment decisions needs careful consideration.

- Expert Opinions: [Insert quote from an expert predicting future scenarios].

- Risks and Opportunities: Investors need to carefully assess both the opportunities created by the pause and the risks associated with potential future policy changes.

- Global Comparison: The reaction of Euronext Amsterdam to the pause needs to be compared with the reactions from other major stock exchanges, such as the New York Stock Exchange or London Stock Exchange, to provide a more comprehensive overview of market sentiment.

Conclusion: Navigating the Future After the U.S. Tariff Plan Pause

The U.S. tariff plan pause has undeniably had a significant positive impact on Euronext Amsterdam stocks, resulting in an impressive 8% surge. This event underscores the considerable influence of U.S. trade policy on global markets and the inherent volatility of the stock market. The key takeaway is the need for continuous monitoring of U.S. trade policy and its effects on international markets.

Stay updated on the latest developments concerning the U.S. tariff plan and its effects on Euronext Amsterdam stocks. Learn more about investing in the post-pause market and how to navigate this dynamic environment by researching specific companies and sectors potentially affected by future U.S. tariff decisions.

Featured Posts

-

Canadian Automotive Sector Seeks Stronger Stance Amidst Trump Trade Threats

May 24, 2025

Canadian Automotive Sector Seeks Stronger Stance Amidst Trump Trade Threats

May 24, 2025 -

Job Offer Negotiation Strategies For A Best And Final Offer

May 24, 2025

Job Offer Negotiation Strategies For A Best And Final Offer

May 24, 2025 -

Jack Draper Wins Indian Wells A Masters 1000 Milestone

May 24, 2025

Jack Draper Wins Indian Wells A Masters 1000 Milestone

May 24, 2025 -

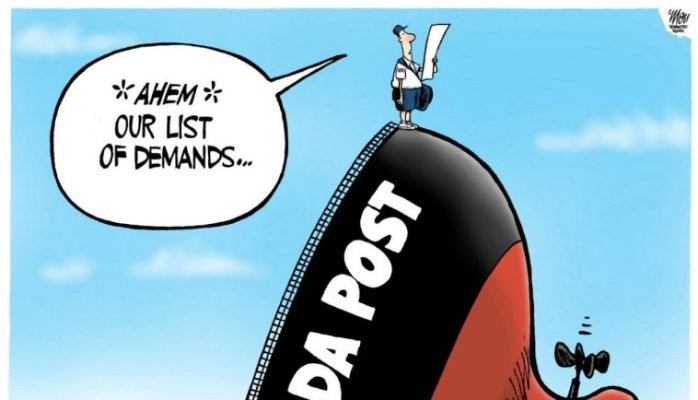

Last Minute Canada Post Offers As Strike Looms

May 24, 2025

Last Minute Canada Post Offers As Strike Looms

May 24, 2025 -

Trogatelniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025

Trogatelniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025

Latest Posts

-

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025 -

Sylvester Stallones Tulsa King Season 2 Blu Ray Release Date And Sneak Peek

May 24, 2025

Sylvester Stallones Tulsa King Season 2 Blu Ray Release Date And Sneak Peek

May 24, 2025 -

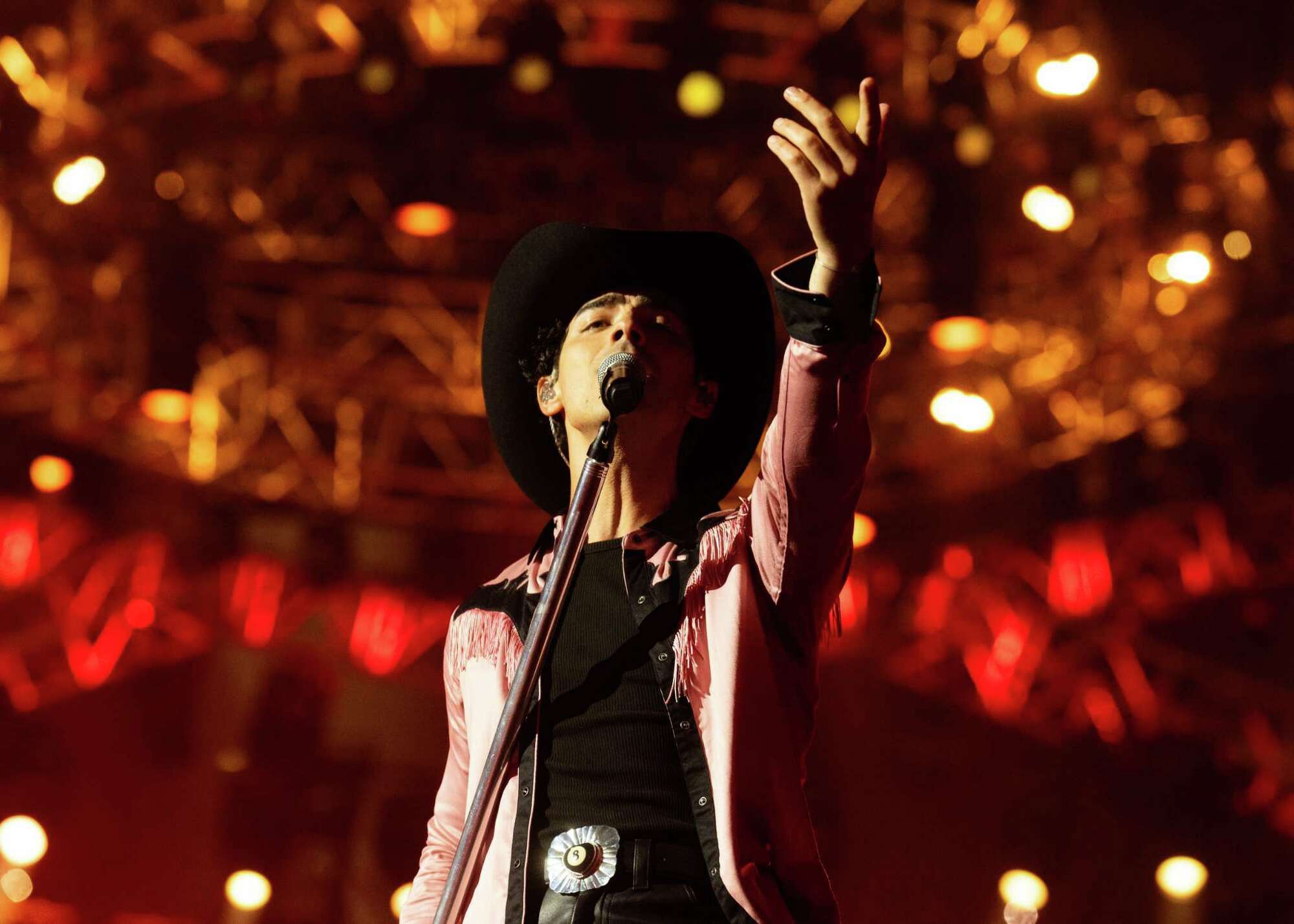

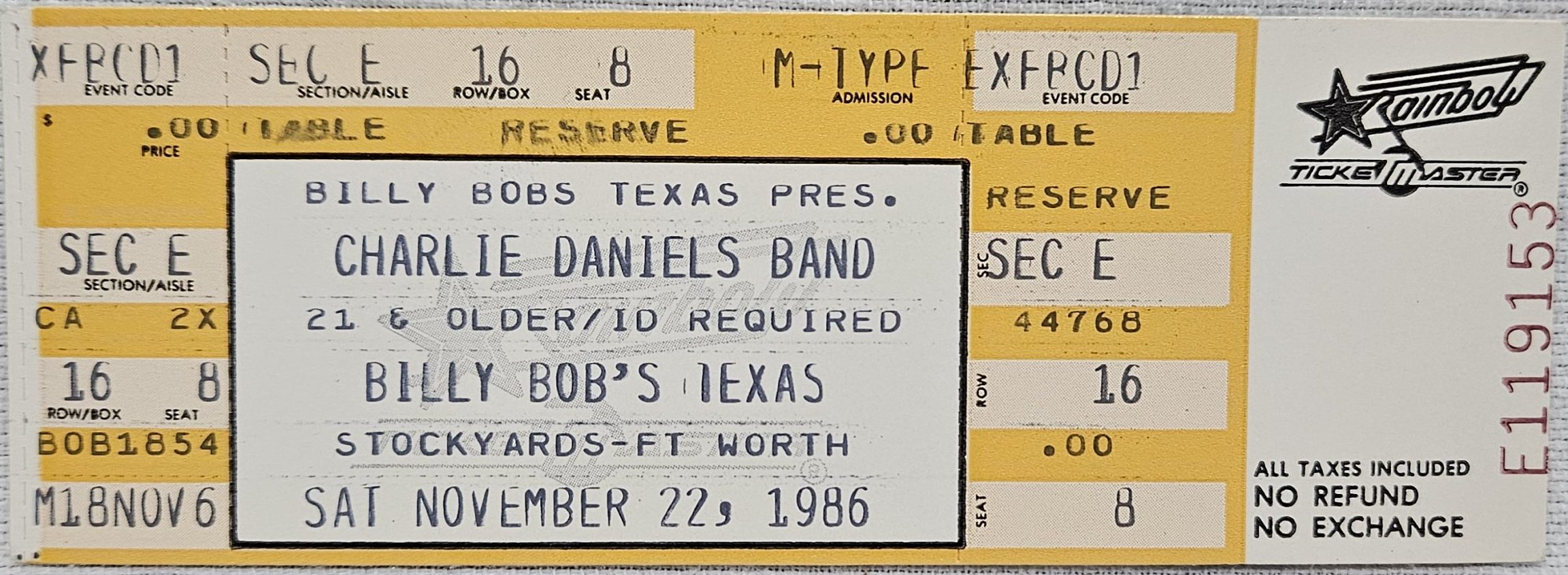

Surprise Joe Jonas Plays Unannounced Concert At Fort Worth Stockyards

May 24, 2025

Surprise Joe Jonas Plays Unannounced Concert At Fort Worth Stockyards

May 24, 2025 -

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025 -

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025

Fort Worth Stockyards Joe Jonas Delivers Surprise Show

May 24, 2025