U.S. Investment In Canada: A Call For Diversification

Table of Contents

Current State of U.S. Investment in Canada

The historical relationship between the U.S. and Canada has fostered significant U.S. foreign direct investment (FDI) in various sectors. Traditionally, U.S. investment in Canada has concentrated heavily on energy, real estate, and technology. This established pattern, while historically successful, presents vulnerabilities in the face of evolving global economic conditions.

-

Total value of U.S. foreign direct investment (FDI) in Canada: While precise figures fluctuate, the total value represents a substantial portion of Canada's overall FDI, signifying the considerable U.S. presence in the Canadian economy. Official data from sources like Statistics Canada and the U.S. Bureau of Economic Analysis provide detailed breakdowns.

-

Top sectors attracting U.S. investment: Energy (oil and gas, particularly in Alberta and Saskatchewan), real estate (primarily in major urban centers like Toronto and Vancouver), and technology (concentrated in Ontario and British Columbia) have historically been the dominant recipients of U.S. investment.

-

Geographic distribution of U.S. investment within Canada: Investment has tended to be concentrated in specific provinces and urban areas, leaving other regions with less direct involvement in this crucial economic relationship.

-

Key players and influential corporations involved: Numerous Fortune 500 companies have significant investments in Canada, reflecting the enduring appeal of the Canadian market for U.S. businesses. These companies play a crucial role in shaping the landscape of US FDI in Canada.

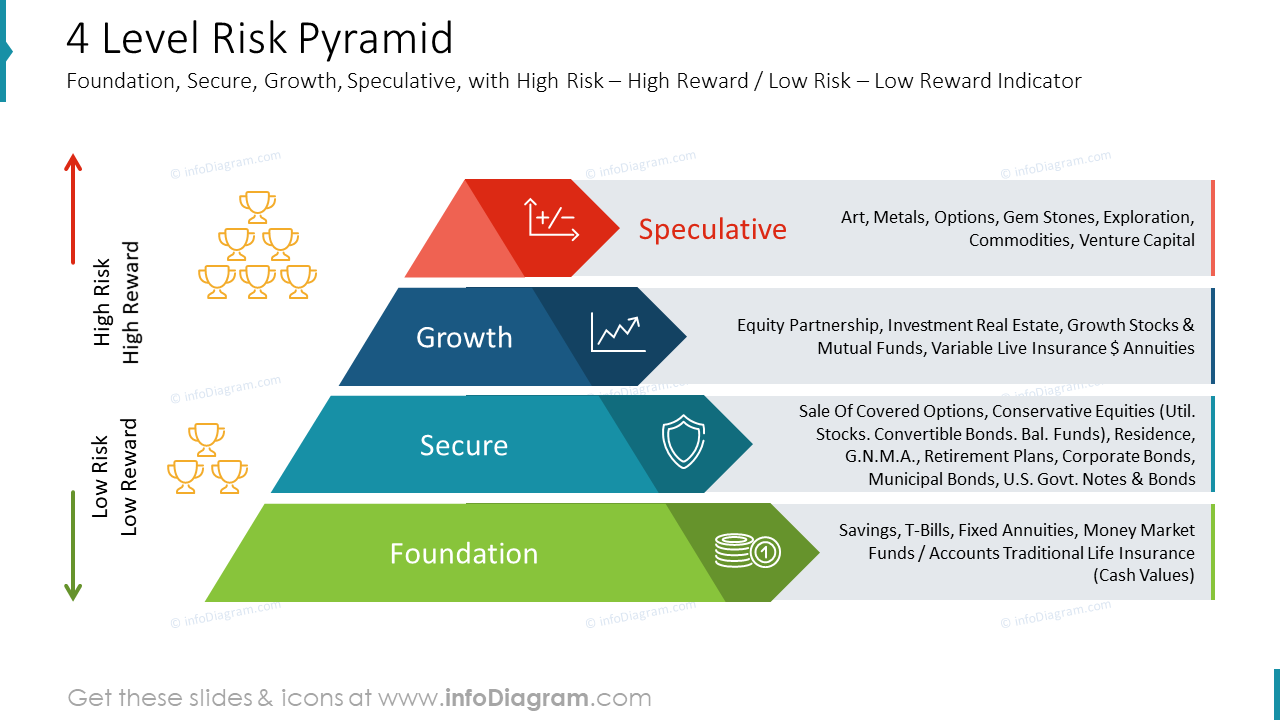

Risks Associated with Concentrated Investment

Over-reliance on specific sectors or geographical areas exposes U.S. investors to significant risks. A concentrated investment strategy, while potentially lucrative in the short term, lacks the resilience needed to navigate unpredictable economic shifts.

-

Vulnerability to sector-specific downturns: Fluctuations in oil prices, for example, can significantly impact the returns on energy investments, illustrating the vulnerability of concentrated strategies in the energy sector.

-

Geopolitical risks and their impact on investment returns: Global political instability and trade disputes can disrupt cross-border investments and negatively affect profitability.

-

Currency fluctuations and their effects on investment profitability: Changes in the USD/CAD exchange rate can significantly impact the returns on Canadian investments for U.S. investors, creating uncertainty and risk.

-

Regulatory changes and their potential consequences: Changes in Canadian regulations can affect the profitability and viability of investments, highlighting the importance of thorough due diligence and proactive risk management.

Opportunities for Diversification

Diversifying U.S. investment in Canada offers substantial opportunities for enhanced returns and reduced risk. Exploring sectors beyond the traditional focuses opens doors to innovative and sustainable growth.

Emerging Technologies

The Canadian tech sector presents exciting opportunities in areas like artificial intelligence (AI), clean technology (cleantech), and biotechnology. Investing in these dynamic sectors can yield high returns while contributing to technological advancement.

Sustainable Investments

The growing global demand for environmentally responsible investments presents a lucrative avenue for U.S. investors in Canada. Renewable energy projects and sustainable infrastructure development are attracting significant interest and offer both financial and social benefits.

Regional Diversification

Beyond major urban centers, various Canadian regions offer unique investment opportunities with potential for high returns and positive regional economic impact. Stimulating growth in these areas contributes to a more balanced and resilient Canadian economy.

-

Specific examples of successful investments in these sectors: Case studies of successful ventures in emerging technologies, sustainable investments, and regional development provide valuable insights and inspire further exploration.

-

Government incentives and support programs: Both the Canadian and provincial governments offer various incentives and support programs to attract foreign investment, encouraging diversification and innovation.

-

Potential for high returns and positive social impact: Investing in these areas not only offers the potential for high financial returns but also contributes positively to the social and environmental landscape.

Strategies for Successful Diversification

Implementing a successful diversification strategy requires careful planning and execution. Adopting a proactive and informed approach is critical to maximizing returns while mitigating risks.

-

Conduct thorough due diligence and market research: Understanding the Canadian market, regulatory environment, and specific investment opportunities is vital for making informed decisions.

-

Develop a long-term investment strategy aligned with risk tolerance: A well-defined investment strategy that aligns with your risk appetite and long-term financial goals is essential for sustained success.

-

Partner with local experts and businesses for guidance and support: Collaborating with local experts can provide valuable insights and access to otherwise unavailable opportunities.

-

Utilize available government resources and support programs: Leveraging government resources and programs can significantly enhance the effectiveness and efficiency of your investment strategy.

Conclusion

Diversifying U.S. investment in Canada is not merely advisable; it's essential for long-term success and risk mitigation. Over-reliance on traditional sectors exposes investors to vulnerabilities, while a diversified approach across emerging technologies, sustainable investments, and diverse geographical locations unlocks significant opportunities. The potential for high returns, positive social impact, and reduced risk makes a strategic shift toward diversification a compelling imperative. Explore the diverse investment landscape in Canada and actively seek opportunities that promote both financial gain and sustainable growth. By understanding the nuances of U.S. investment in Canada and embracing a diversified approach, investors can position themselves for lasting success in this vibrant and dynamic market. Research the diverse avenues for U.S. investment in Canada and unlock the potential for long-term prosperity.

Featured Posts

-

Canadians Boycotting Us Impact On American Tourists

May 29, 2025

Canadians Boycotting Us Impact On American Tourists

May 29, 2025 -

Bryan Cranstons Silent Masterclass The Funniest Tv Performance Of 2025

May 29, 2025

Bryan Cranstons Silent Masterclass The Funniest Tv Performance Of 2025

May 29, 2025 -

Moto Gp Sprint Races High Risk Low Reward

May 29, 2025

Moto Gp Sprint Races High Risk Low Reward

May 29, 2025 -

From Scatological Documents To Insightful Podcast The Power Of Ai

May 29, 2025

From Scatological Documents To Insightful Podcast The Power Of Ai

May 29, 2025 -

Dont Miss Out Nike Court Legacy Lift Sneakers Sale

May 29, 2025

Dont Miss Out Nike Court Legacy Lift Sneakers Sale

May 29, 2025