U.S. Dollar Performance Under Scrutiny: A Comparison To Nixon's Presidency

Table of Contents

The Nixon Shock and its Impact on the U.S. Dollar

Closing the Gold Window

In August 1971, President Nixon made the momentous decision to close the gold window, ending the Bretton Woods system where the U.S. dollar was pegged to gold. This "Nixon Shock" sent ripples throughout the global monetary system, fundamentally altering the U.S. dollar's role in the world economy.

- Short-term consequences: Immediate market volatility and uncertainty as currencies fluctuated against each other.

- Long-term consequences: The shift from a fixed exchange rate to a floating exchange rate system, leading to increased currency fluctuations and the rise of foreign exchange markets.

- Stabilization (or lack thereof): While the initial shock subsided, the period following saw considerable instability in the dollar's value, influenced heavily by macroeconomic factors.

Inflation and the Devaluation of the Dollar

The Nixon Shock was followed by a period of significant inflation in the United States. This inflation directly impacted the U.S. dollar's purchasing power, eroding its value both domestically and internationally.

- Oil prices and inflation: The 1973 oil crisis exacerbated inflationary pressures, further weakening the dollar.

- Inflation statistics: Inflation rates soared to double digits in the mid-1970s, representing a dramatic decline in the dollar's value.

- Policy responses: The government implemented various policy measures, including wage and price controls, but these were largely ineffective in curbing inflation.

Current U.S. Dollar Performance: A Comparative Analysis

The Current Economic Landscape

The current U.S. dollar performance is shaped by a complex interplay of macroeconomic factors:

- Interest rates: The Federal Reserve's aggressive interest rate hikes aim to combat inflation but also strengthen the dollar, potentially slowing economic growth.

- Inflation: Persistently high inflation rates, though showing signs of cooling, continue to be a major concern, impacting the dollar's purchasing power and investor confidence.

- Geopolitical events: The war in Ukraine, ongoing trade tensions, and global supply chain disruptions contribute to market volatility and influence the dollar's value.

Similarities and Differences with the Nixon Era

Comparing the current situation to the post-Nixon era reveals both striking similarities and crucial differences:

- Inflation levels: While current inflation is not yet at the double-digit levels of the 1970s, the sustained inflationary pressure presents a parallel challenge.

- Global economic landscape: Globalization is far more advanced now, making the impact of U.S. economic policies far-reaching and interlinked.

- Government strategies: Current policy responses differ from the Nixon era, focusing more on monetary policy adjustments than direct controls on wages and prices.

Potential Future Scenarios

Based on the historical precedent of the Nixon era and current economic indicators, several future scenarios are plausible for the U.S. dollar:

- Dollar devaluation: Continued high inflation and geopolitical instability could lead to further devaluation of the dollar.

- Dollar appreciation: Aggressive interest rate hikes could strengthen the dollar in the short-term, albeit at the expense of domestic economic growth.

- Federal Reserve response: The Federal Reserve's actions will play a crucial role in determining the future trajectory of the U.S. dollar.

Conclusion

The comparison between the U.S. dollar's performance under Nixon and the current economic climate reveals both continuity and change. While the circumstances differ, the underlying challenges – inflation, geopolitical instability, and the intricate interplay of domestic and international economic factors – echo across decades. The key takeaway is that maintaining U.S. dollar strength requires a nuanced understanding of these multifaceted issues. To stay informed about ongoing developments affecting U.S. dollar performance and future U.S. dollar prospects, diligent monitoring of reliable financial news sources and economic indicators is essential. Engage in further research and analysis to gain a comprehensive perspective on the future of the U.S. dollar and its role in the global economy.

Featured Posts

-

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

Apr 28, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

Apr 28, 2025 -

Assessing The Damage The Economic Impact Of A Canadian Travel Boycott On The Us

Apr 28, 2025

Assessing The Damage The Economic Impact Of A Canadian Travel Boycott On The Us

Apr 28, 2025 -

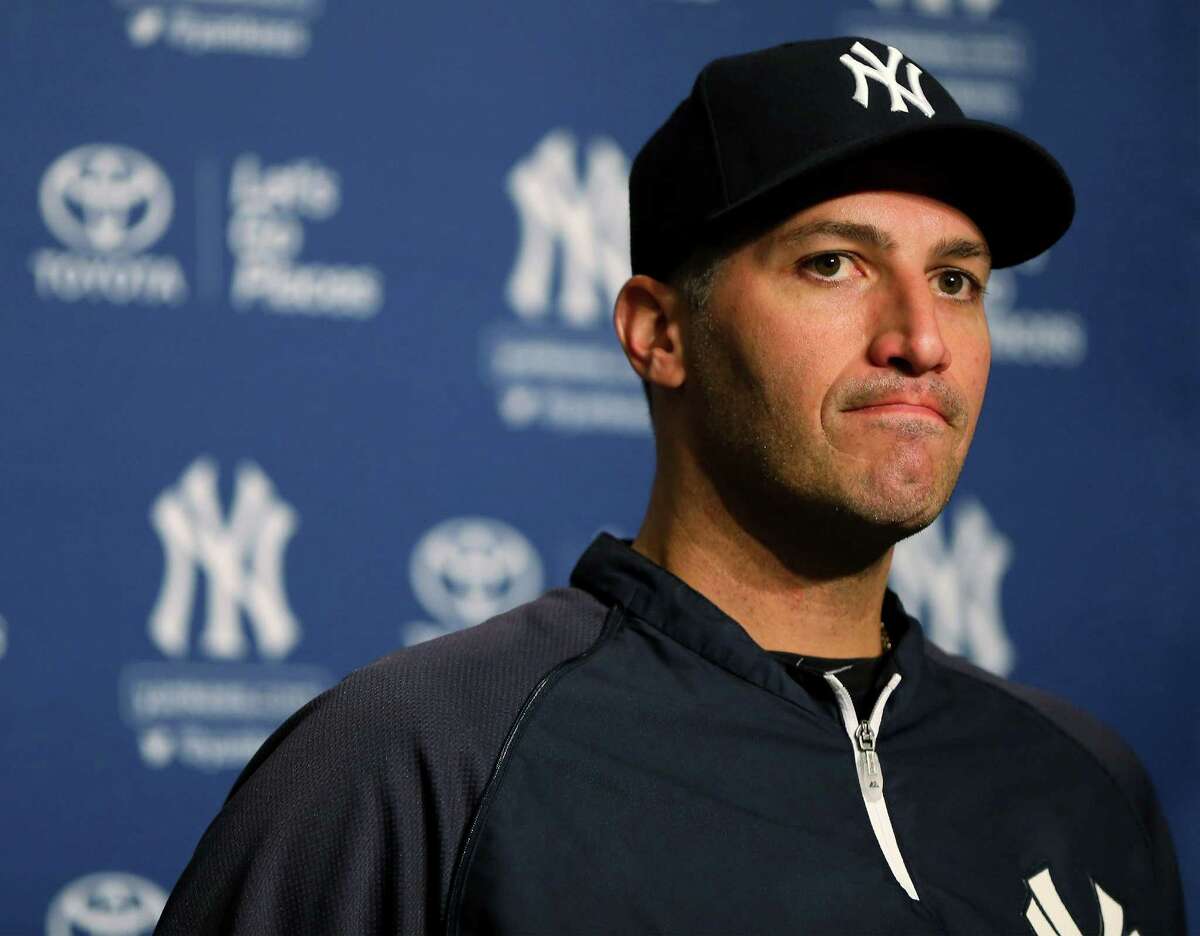

Judge And Goldschmidts Performances Secure A Win For The Yankees

Apr 28, 2025

Judge And Goldschmidts Performances Secure A Win For The Yankees

Apr 28, 2025 -

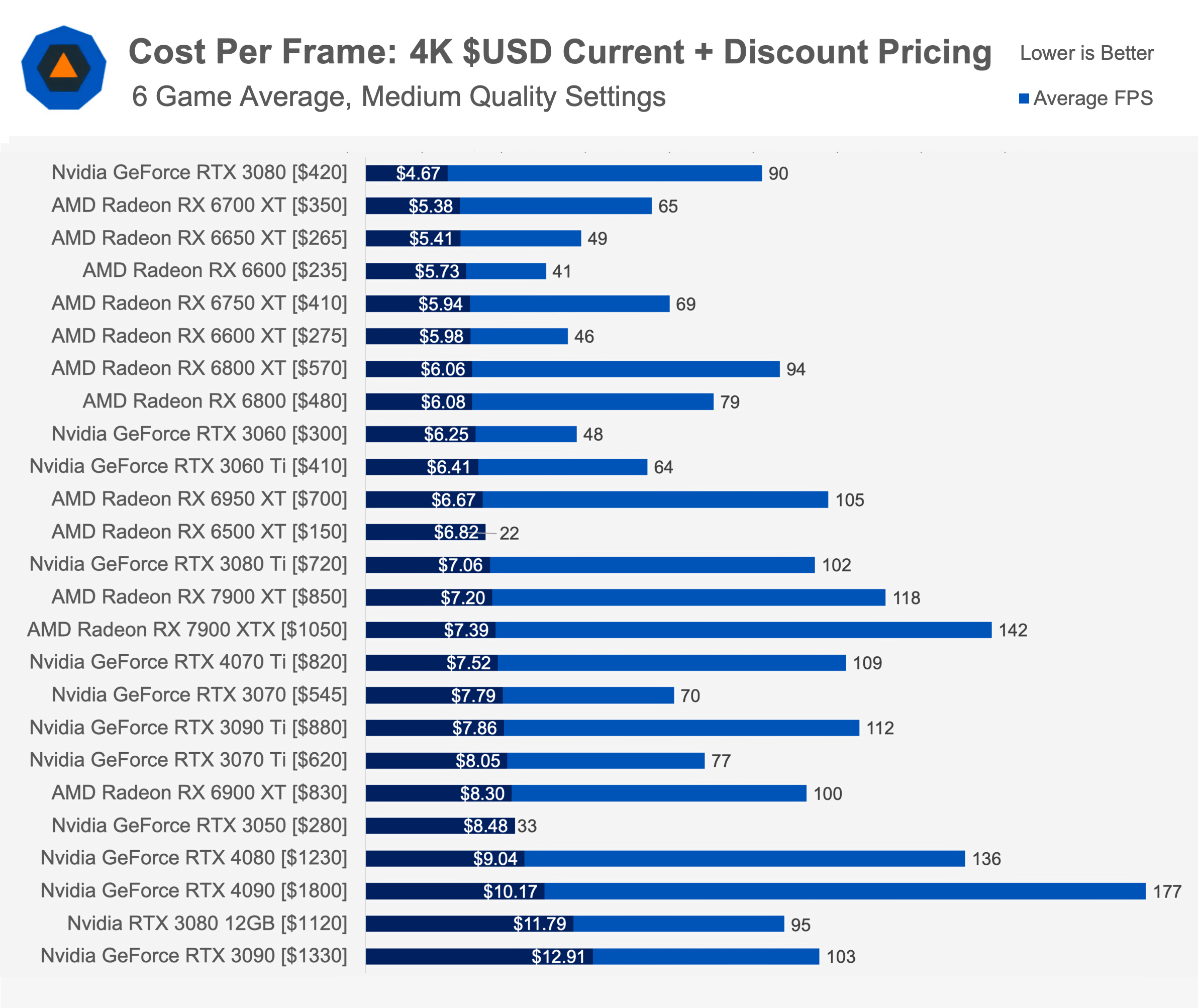

The Current State Of Gpu Pricing

Apr 28, 2025

The Current State Of Gpu Pricing

Apr 28, 2025 -

Metro Vancouver Housing Market Update Slower Rent Growth Persistent Cost Increases

Apr 28, 2025

Metro Vancouver Housing Market Update Slower Rent Growth Persistent Cost Increases

Apr 28, 2025

Latest Posts

-

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025 -

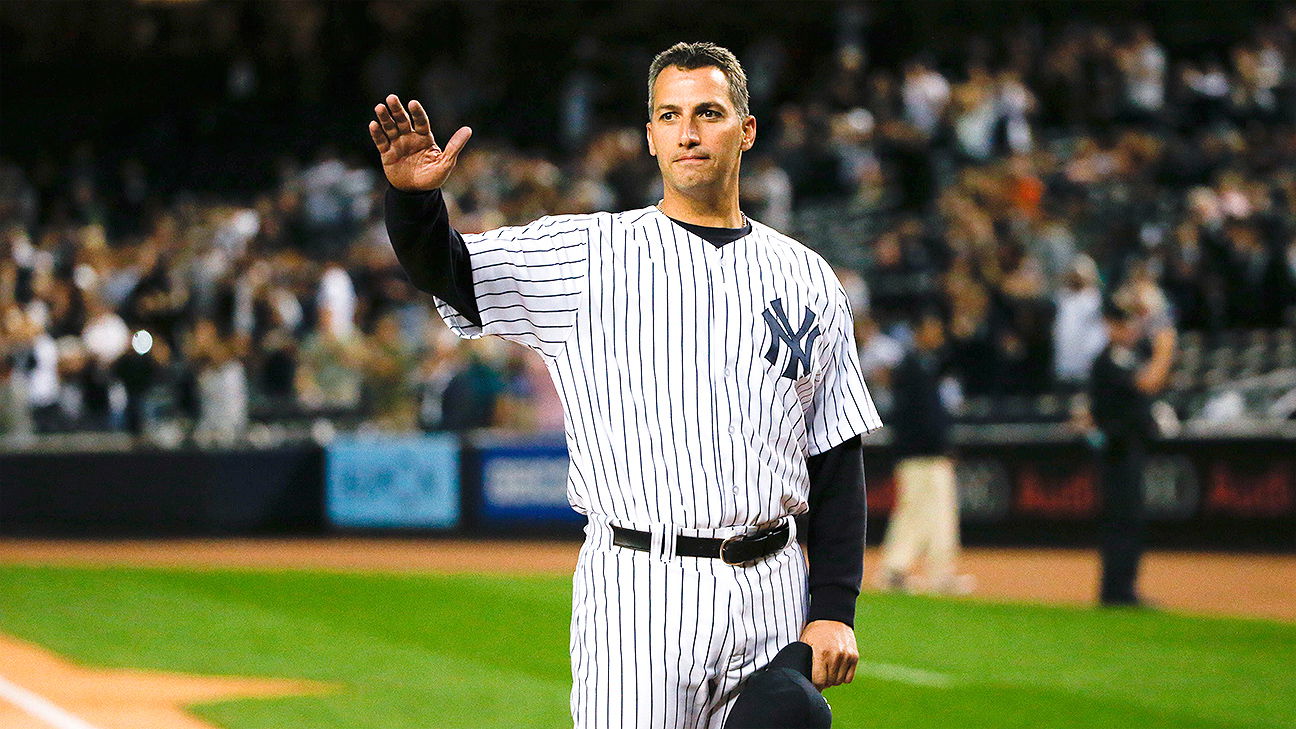

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025 -

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025 -

Early Bats And Rodons Pitching Secure Yankees Victory

Apr 28, 2025

Early Bats And Rodons Pitching Secure Yankees Victory

Apr 28, 2025 -

Yankees Rally Past Astros Rodon Leads The Charge

Apr 28, 2025

Yankees Rally Past Astros Rodon Leads The Charge

Apr 28, 2025