Two Days Of Crypto Chaos: A Party Report

Table of Contents

Day 1: The Bull Run Begins (and Ends?)

The first day dawned with the infectious energy of a crypto bull run. Market sentiment was overwhelmingly positive, fueled by a confluence of factors that sent Bitcoin and altcoins soaring. The air crackled with excitement, a palpable sense of FOMO (Fear Of Missing Out) hanging heavy in the air.

- Bitcoin Price Surge: Bitcoin experienced a dramatic surge, climbing over 15% in the early hours, reaching a high of $X,XXX (replace with actual price if available).

- Altcoin Rally: The excitement wasn't limited to Bitcoin. Ethereum followed suit, seeing a 12% increase, while smaller altcoins like Solana and Cardano experienced even more significant gains, some exceeding 20%.

- Celebratory Atmosphere: The atmosphere was electric. Traders were jubilant, sharing their gains and excitedly discussing their trading strategies. The air buzzed with conversations about the latest crypto news and predictions of further gains.

- Impending Correction?: Despite the euphoria, some experienced investors voiced concerns. Whispers of an impending correction circulated as certain technical indicators flashed warning signs. The initial euphoria began to fade slightly as the day progressed, hinting at the volatility to come.

Day 2: The Bear Takes Over – A Market Correction

The second day brought a stark contrast to the previous day's exuberance. The crypto bear market descended, triggering a significant market correction. The celebratory mood evaporated, replaced by a palpable sense of fear and uncertainty.

- Bitcoin Price Drop: Bitcoin plummeted, shedding over 10% of its value within hours, erasing much of the previous day’s gains. This triggered a domino effect across the market.

- Market Crash Panic: The sudden downturn caused widespread panic selling. Many investors, caught off guard, rushed to liquidate their holdings to minimize losses.

- Reasons for the Correction: Several factors contributed to the sharp downturn. Rumours of increased regulatory scrutiny in a specific country, coupled with a significant sell-off by a large institutional investor ("whale activity"), created a perfect storm for a market crash. Market manipulation was also a widely discussed (though unproven) possibility.

- Risk Management: The market correction highlighted the crucial role of risk management in cryptocurrency trading. Those who had diversified their portfolios and employed stop-loss orders were able to mitigate their losses more effectively.

Notable Moments & Key Players

The event saw appearances from several prominent crypto influencers, whose opinions and actions significantly impacted market sentiment. One notable influencer, [Name of Influencer], advocated for a cautious approach, urging investors to avoid impulsive trades. Their words seemed to resonate with some, while others dismissed the warnings. Observations of large trading volumes from what were suspected to be institutional investors ("whales") added another layer to the narrative of the two days. The event highlighted the interconnected nature of the crypto community and how news, sentiment, and whale activity can ripple through the market.

Lessons Learned from the Crypto Chaos

The two days of crypto chaos provided valuable lessons for investors of all levels. The unpredictable nature of the cryptocurrency market is undeniable, underscoring the need for responsible investing practices and a long-term perspective.

- Diversification: The importance of a diversified portfolio, spread across different cryptocurrencies and asset classes, cannot be overstated. This mitigates the impact of price fluctuations in any single asset.

- FOMO and Panic Selling: The event demonstrated the dangers of FOMO (Fear Of Missing Out) and panic selling. Impulsive decisions based on emotions often lead to significant losses.

- Risk Mitigation: Implementing strategies like stop-loss orders and position sizing are crucial for mitigating risks in volatile markets.

- Thorough Research: Conducting thorough research before investing in any cryptocurrency is paramount. Understanding the underlying technology, team, and market dynamics is essential for making informed investment decisions.

Conclusion:

The two days of crypto chaos served as a stark reminder of the inherent volatility in the cryptocurrency market. The rapid shifts in market sentiment, fueled by news, speculation, and the actions of major players, highlight the importance of informed decision-making, risk management, and a long-term investment strategy. Navigating this crypto chaos requires education, discipline, and a deep understanding of the risks involved. Stay updated on future crypto events and avoid future periods of crypto chaos by following [link to relevant resource/blog/newsletter] to master crypto investing and understand crypto market volatility.

Featured Posts

-

Wb Weather Update Heavy Rainfall Predicted For North Bengal

May 04, 2025

Wb Weather Update Heavy Rainfall Predicted For North Bengal

May 04, 2025 -

White House Meeting Mark Carney And Trump To Discuss Key Issues

May 04, 2025

White House Meeting Mark Carney And Trump To Discuss Key Issues

May 04, 2025 -

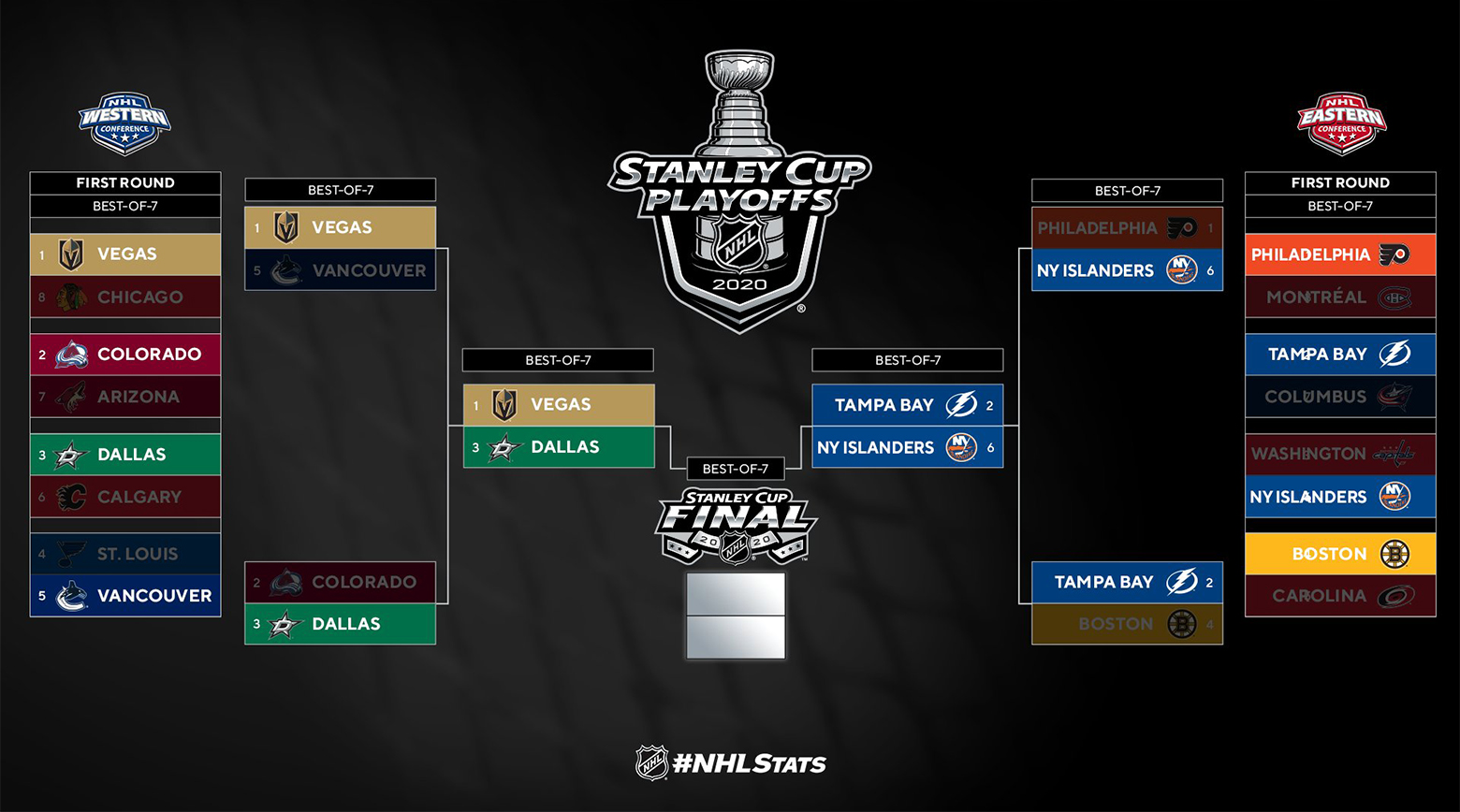

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 04, 2025

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 04, 2025 -

Watch The Chicago Cubs Vs La Dodgers Mlb Tokyo Series Online

May 04, 2025

Watch The Chicago Cubs Vs La Dodgers Mlb Tokyo Series Online

May 04, 2025 -

Ufc 314 Fight Card Complete Results Winners And Losers From Volkanovski Vs Lopes

May 04, 2025

Ufc 314 Fight Card Complete Results Winners And Losers From Volkanovski Vs Lopes

May 04, 2025

Latest Posts

-

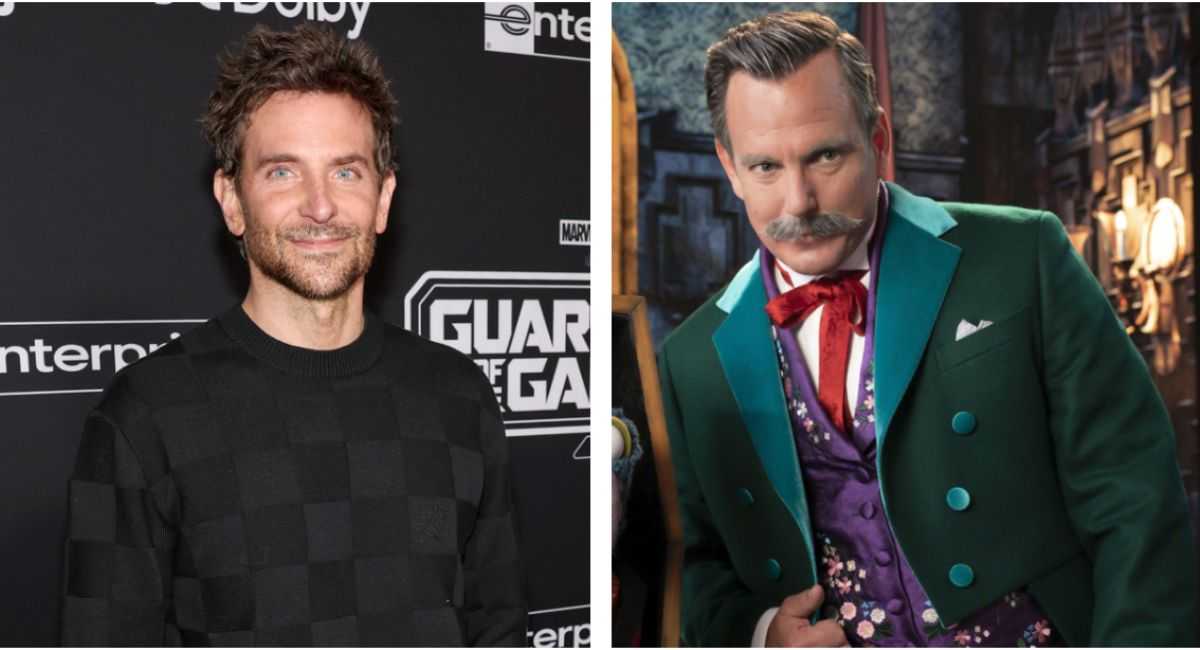

On Set In Nyc Bradley Cooper And Will Arnett Film Is This Thing On

May 04, 2025

On Set In Nyc Bradley Cooper And Will Arnett Film Is This Thing On

May 04, 2025 -

Bradley Cooper Directs Will Arnett Is This Thing On Filming In Nyc

May 04, 2025

Bradley Cooper Directs Will Arnett Is This Thing On Filming In Nyc

May 04, 2025 -

Behind The Scenes Look At Is This Thing On With Bradley Cooper And Will Arnett

May 04, 2025

Behind The Scenes Look At Is This Thing On With Bradley Cooper And Will Arnett

May 04, 2025 -

Will Arnett And Bradley Coopers Is This Thing On Production Photos

May 04, 2025

Will Arnett And Bradley Coopers Is This Thing On Production Photos

May 04, 2025 -

Is This Thing On Late Night Shoot Bradley Cooper Directs Will Arnett In Nyc

May 04, 2025

Is This Thing On Late Night Shoot Bradley Cooper Directs Will Arnett In Nyc

May 04, 2025