Trump's Trade War Legacy: A Wall Street Bets Perspective.

Table of Contents

The Initial Shockwaves: Tariffs and Market Reactions

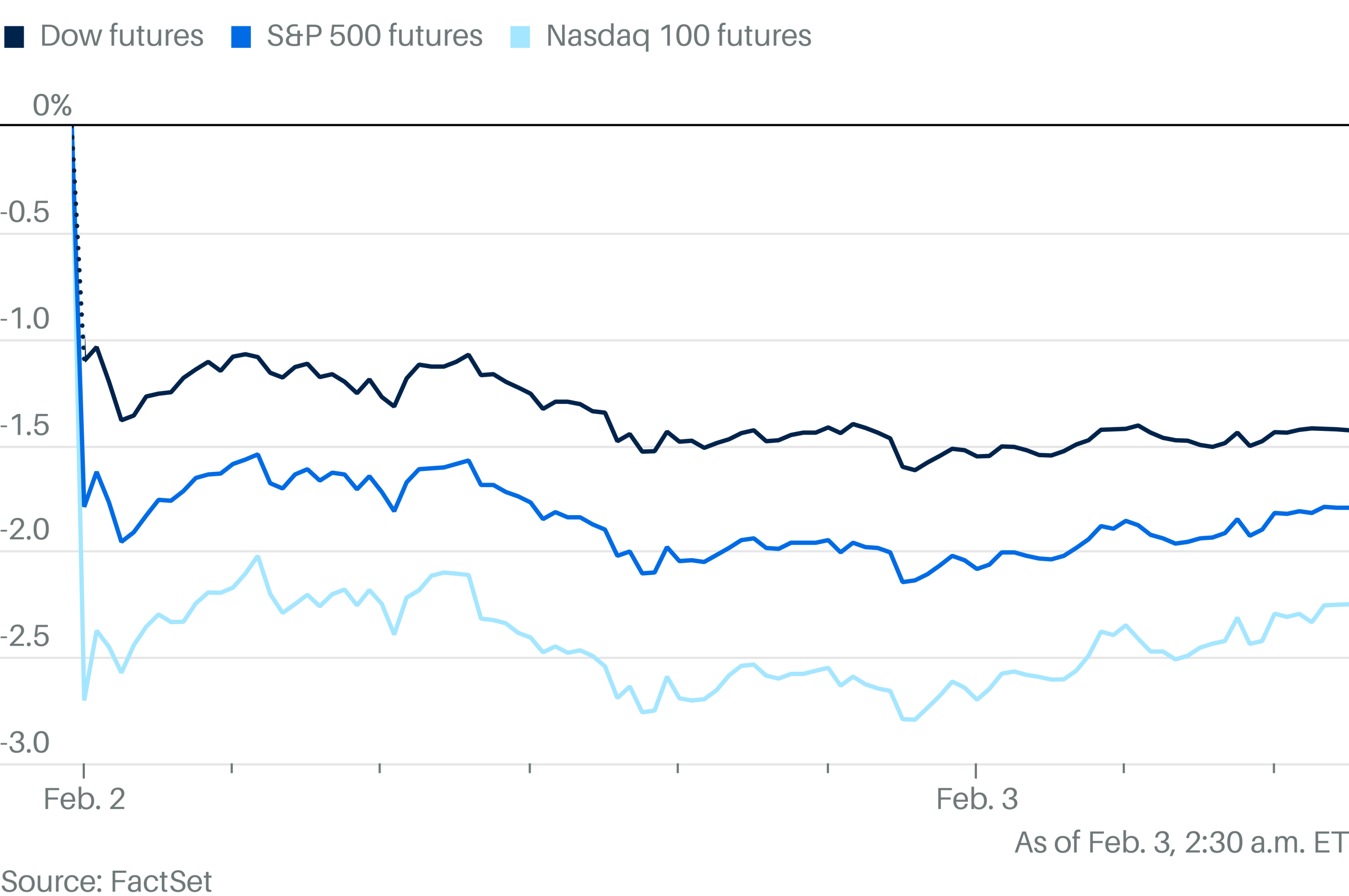

The imposition of tariffs, particularly on steel, aluminum, and goods from China, sent immediate shockwaves through various sectors. Agriculture, heavily reliant on export markets, felt the brunt of retaliatory tariffs, while manufacturing faced increased input costs. This initial uncertainty triggered significant market volatility.

- Stocks significantly affected: Shares of companies heavily involved in international trade, particularly those with significant exposure to China, experienced sharp declines. Examples include agricultural companies reliant on Chinese exports and manufacturers using imported steel and aluminum.

- Short-term market volatility and investor sentiment: The unpredictable nature of tariff announcements created a climate of fear and uncertainty, leading to sharp market fluctuations and a significant drop in investor confidence.

- Wall Street Bets reaction: The unpredictable nature of the trade war fueled significant activity within the Wall Street Bets community. Meme stocks related to companies impacted by tariffs experienced wild swings, reflecting the speculative and often contrarian trading strategies employed by many users.

Speculation ran rampant, with investors employing hedging strategies to mitigate potential losses. The focus shifted towards understanding the intricacies of global trade and the potential impact on specific sectors.

Winners and Losers: Sectoral Impacts and Investment Strategies

The trade war created a stark dichotomy, with some sectors benefiting from protectionist measures while others suffered significant losses.

- Industries that thrived: Domestic industries producing goods previously subject to significant foreign competition experienced a boost, benefiting from increased demand and reduced foreign competition. This included certain segments of the manufacturing and agricultural sectors.

- Sectors that experienced losses: Industries heavily reliant on global supply chains and export markets, particularly those heavily involved in trade with China, faced significant challenges and revenue declines.

- Successful and unsuccessful investment strategies: Investors who anticipated the impact on specific sectors and adapted their portfolios accordingly, potentially benefiting from both short-selling and long positions in specific stocks, saw success. On the other hand, investors who failed to account for the complexities of the trade war often experienced significant losses.

The investment landscape shifted dramatically. Investors needed to develop a deeper understanding of global supply chains and international trade dynamics to navigate this volatile environment.

The Global Fallout: International Trade Relations and Market Instability

Trump's trade policies extended far beyond US borders, significantly impacting international trade relations and global market stability.

- Impact on global supply chains and manufacturing: The disruptions to global supply chains led to increased production costs and delivery delays, impacting businesses worldwide. Manufacturing output decreased, leading to economic slowdown in multiple countries.

- Strained relationships with key trading partners: The trade war significantly strained relationships with key trading partners like China, leading to increased geopolitical tensions and uncertainty.

- Increased uncertainty in global markets: The unpredictable nature of the trade war heightened uncertainty in global markets, making investment decisions more complex and challenging.

These global factors significantly affected investment strategies on Wall Street, forcing investors to consider geopolitical risks in their portfolio allocations.

The Long-Term Legacy: Lasting Economic Impacts and Future Predictions

The long-term consequences of Trump's trade war continue to unfold, leaving lasting impacts on both the US and global economies.

- Long-term effects on inflation and consumer prices: Tariffs led to increased prices for certain goods, contributing to inflation and impacting consumer purchasing power. The full extent of these effects remains to be seen.

- Changes to global trade patterns and supply chain dynamics: Companies are now more likely to diversify their supply chains to reduce reliance on a single country, leading to a restructuring of global trade patterns.

- Potential future risks and opportunities for investors: Understanding the evolving trade landscape remains crucial for investors to navigate future risks and opportunities. This includes analyzing the resilience of companies against future disruptions.

Wall Street is now adapting to this new post-trade-war landscape, incorporating geopolitical considerations and supply chain resilience into their investment analyses.

A Lasting Impression: Trump's Trade War and Wall Street's Future

Trump's trade war left an undeniable mark on Wall Street, characterized by short-term volatility, significant sectoral shifts, and lasting economic consequences. While some sectors benefited from protectionist measures, others suffered substantial losses. The unpredictable nature of the trade war impacted investor sentiment and necessitated the adoption of complex hedging strategies, particularly notable within the Wall Street Bets community. The long-term impact will continue to influence global trade patterns and investor decision-making.

Ultimately, the overall impact on investors and the market remains a complex issue with both positive and negative consequences. To fully understand the lasting impact of Trump's trade war, further research is needed. Analyze the Wall Street Bets perspective on trade policies and delve deeper into the long-term effects of Trump's trade war legacy on specific industries. Consider exploring the performance of companies significantly impacted by tariffs, examining their resilience and adaptation strategies. This will provide a more comprehensive understanding of this complex and multifaceted historical event.

Featured Posts

-

Uerduen Gazze Deki Kanser Hastasi Cocuklari Kabul Ediyor Bir Umut Isigi

May 29, 2025

Uerduen Gazze Deki Kanser Hastasi Cocuklari Kabul Ediyor Bir Umut Isigi

May 29, 2025 -

Joshlin Disappearance Kelly Smiths Angry Denial Of Involvement

May 29, 2025

Joshlin Disappearance Kelly Smiths Angry Denial Of Involvement

May 29, 2025 -

Q Music Fights Back Against Council Defending Democratic Values

May 29, 2025

Q Music Fights Back Against Council Defending Democratic Values

May 29, 2025 -

Arne Slot De Ideale Ajax Trainer Een Analyse

May 29, 2025

Arne Slot De Ideale Ajax Trainer Een Analyse

May 29, 2025 -

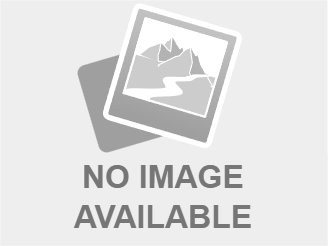

Real Madrid Vs Celta Vigo 3 2 Three Key Talking Points Explained

May 29, 2025

Real Madrid Vs Celta Vigo 3 2 Three Key Talking Points Explained

May 29, 2025