Trump's Tariff Threat: Commercial Aircraft And Engines At Risk

Table of Contents

The Impact on Boeing and Airbus

The imposition of tariffs on imported components is a direct threat to the profitability and efficiency of both Boeing and Airbus. These aviation giants rely on a complex, globalized supply chain, sourcing materials and parts from numerous countries.

Disrupted Supply Chains

Trump's tariff threat directly impacts the availability and cost of crucial materials. Tariffs on imported titanium, aluminum, and advanced composites – essential for aircraft construction – would drastically increase production costs. This translates into:

- Increased production costs: Higher input costs inevitably lead to more expensive aircraft, impacting profitability and potentially pricing US manufacturers out of the market.

- Potential delays in aircraft deliveries: Supply chain disruptions due to tariff-related import restrictions could cause delays in manufacturing, leading to missed deadlines and potentially hefty penalties.

- Impact on profitability: Increased costs, coupled with potential delays and reduced sales, could significantly impact the bottom line for both Boeing and Airbus.

- Job losses in the supply chain: Higher costs could force suppliers to reduce their workforce or even shut down, resulting in significant job losses across the industry.

Retaliatory Tariffs

The imposition of tariffs on imported goods often triggers retaliatory measures from affected countries. The EU, a significant player in the aviation industry, could respond by imposing tariffs on US-made aircraft, escalating the trade war. This could result in:

- Reduced export opportunities for Boeing: Retaliatory tariffs would severely limit Boeing's access to the lucrative European market.

- Potential loss of market share to Airbus: A less competitive Boeing, burdened by higher production costs and reduced export opportunities, could lose market share to its European rival, Airbus.

- Negative impact on US employment: Reduced exports and decreased competitiveness could lead to job losses within the US aircraft manufacturing sector.

The Vulnerability of the Aircraft Engine Sector

The aircraft engine sector presents a unique vulnerability. Engine manufacturing is inherently global, with components often sourced from multiple countries, creating an incredibly intricate supply chain.

Globalized Manufacturing

The interconnectedness of the global aircraft engine manufacturing process makes it highly susceptible to disruption from tariffs. Companies like GE Aviation and Rolls-Royce rely on a complex web of international suppliers. Tariffs could severely disrupt this delicate balance.

- Increased costs for engine manufacturers: Tariffs on imported parts will directly impact engine production costs, making engines more expensive.

- Potential delays in engine deliveries: Supply chain disruptions due to tariffs could lead to delays in engine production and delivery, impacting airline operations.

- Impact on airline operations: Delays and increased costs associated with engine procurement could disrupt airline schedules and profitability.

Competition and Market Share

The imposition of tariffs could dramatically shift the competitive landscape within the aircraft engine sector, potentially favoring engine manufacturers in regions unaffected by the trade war. This could lead to:

- Loss of market share for US engine manufacturers: Higher costs and reduced competitiveness could see US engine manufacturers lose market share to competitors based in other countries.

- Potential consolidation in the industry: Some companies may struggle to survive in the face of increased costs and reduced competitiveness, leading to mergers and acquisitions.

- Impact on technological innovation: A less competitive market could stifle innovation and technological advancement within the US engine manufacturing sector.

Wider Economic Consequences

Trump's tariff threat extends far beyond the aircraft manufacturing industry itself, impacting the wider economy and international relations.

Impact on Airfares

The increased production costs resulting from tariffs are likely to be passed on to consumers in the form of higher airfares. This ripple effect could:

- Reduced consumer demand for air travel: Higher airfares could deter consumers from flying, impacting the travel industry and related sectors.

- Negative impact on tourism and the wider economy: Reduced air travel has a knock-on effect on tourism, hospitality, and other related industries.

Geopolitical Implications

A trade war involving the commercial aircraft industry carries significant geopolitical ramifications.

- Strain on international relations: Protectionist trade policies can damage international relations and create tensions between trading partners.

- Potential for escalation: Retaliatory measures could trigger further escalation of the trade conflict, potentially impacting other sectors.

- Impact on global trade: A trade war could disrupt global trade flows, impacting economic growth and stability.

Conclusion

Trump's tariff threat poses a serious and multifaceted risk to the commercial aircraft and engine industry. The potential for disrupted supply chains, retaliatory tariffs, increased production costs, and job losses is significant. The consequences extend far beyond the aviation sector, impacting airfares, tourism, and international relations. Understanding Trump's tariff threat and its impact on the commercial aviation industry is crucial for navigating the complexities of global trade. Stay informed about developments in this crucial area and consider the long-term implications of protectionist trade policies. Further research into the specific impact on various aircraft components and the strategies employed by manufacturers to mitigate these risks is highly recommended.

Featured Posts

-

Young Thug Addresses Infidelity In Leaked Song Snippet

May 10, 2025

Young Thug Addresses Infidelity In Leaked Song Snippet

May 10, 2025 -

4 Unconventional Randall Flagg Theories And Their Impact On Stephen Kings Universe

May 10, 2025

4 Unconventional Randall Flagg Theories And Their Impact On Stephen Kings Universe

May 10, 2025 -

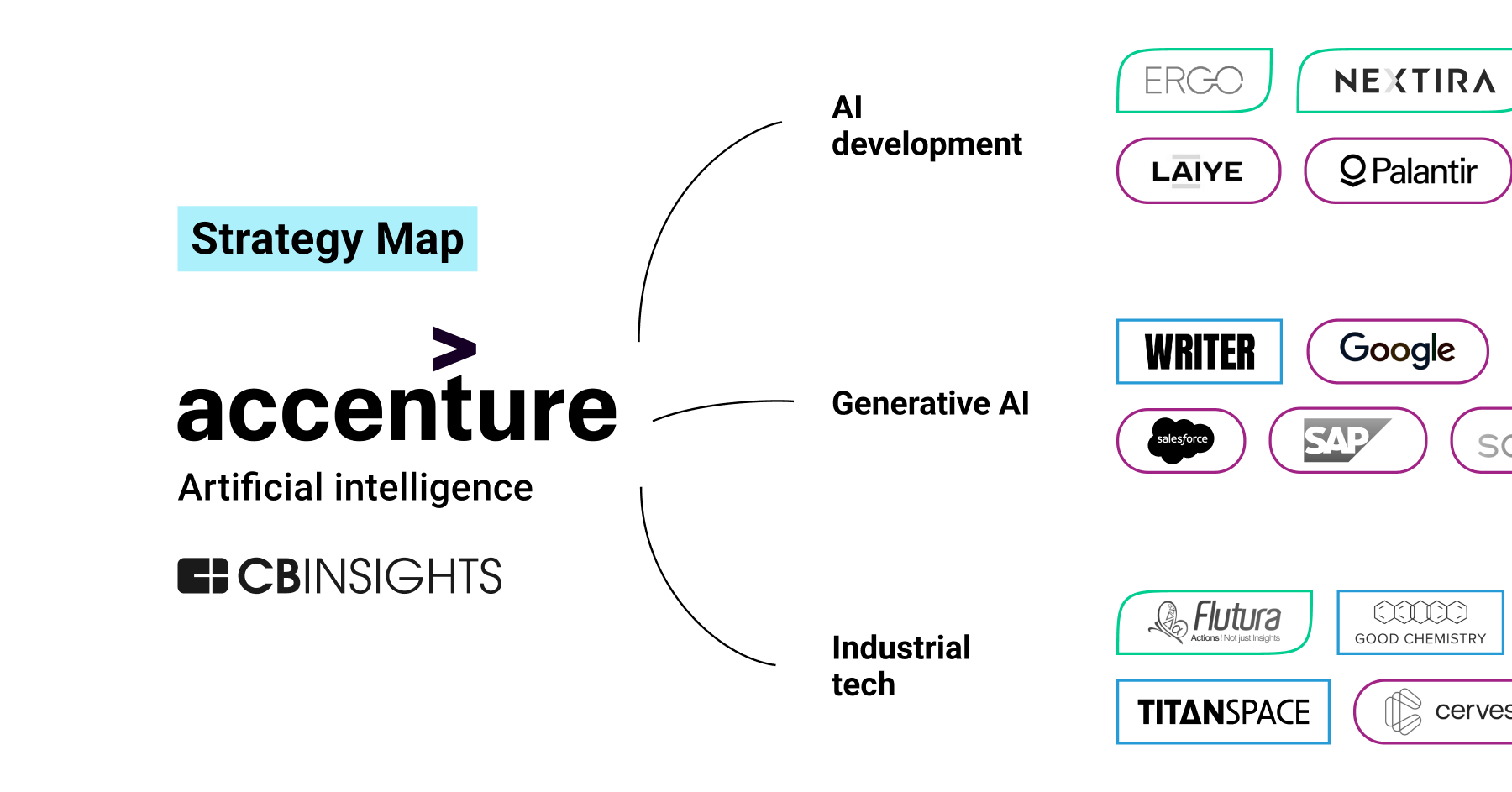

Apples Ai Strategy A Critical Analysis

May 10, 2025

Apples Ai Strategy A Critical Analysis

May 10, 2025 -

Controversia Por Arresto De Estudiante Transgenero El Debate Sobre Banos Y Genero

May 10, 2025

Controversia Por Arresto De Estudiante Transgenero El Debate Sobre Banos Y Genero

May 10, 2025 -

Sharing Transgender Experiences Impact Of Trumps Policies

May 10, 2025

Sharing Transgender Experiences Impact Of Trumps Policies

May 10, 2025