Trump's Tariff Relief Comments Boost European Stocks; LVMH Falls

Table of Contents

European Stock Market Surge Following Tariff Relief Hints

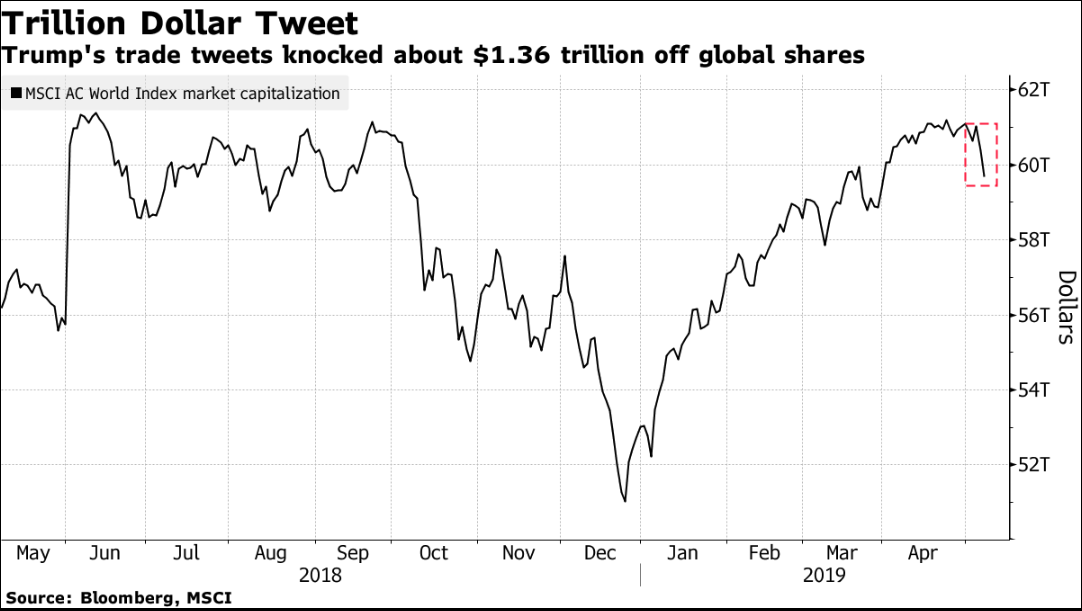

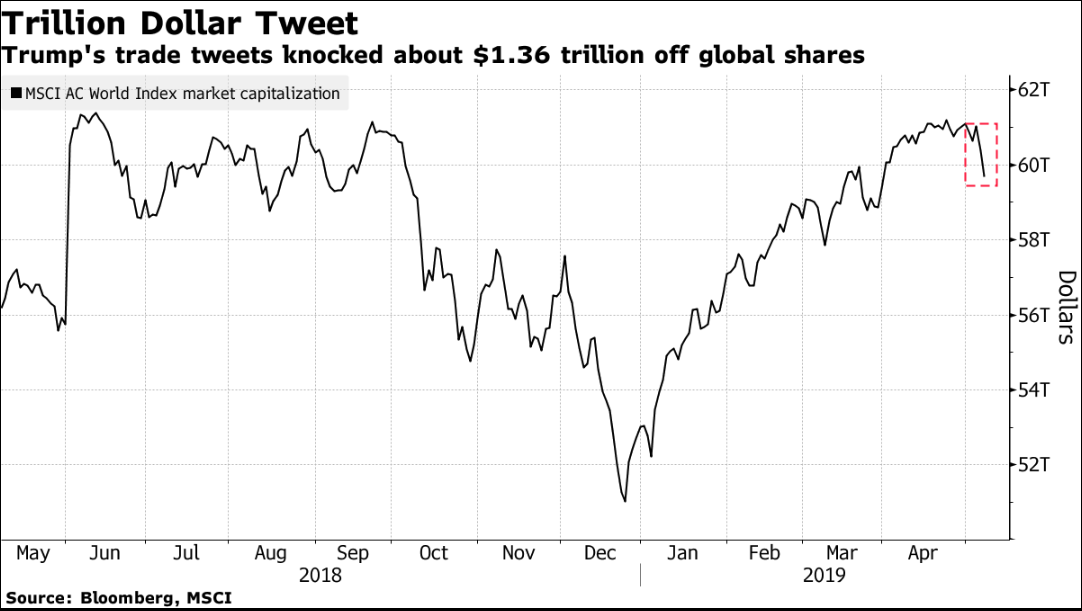

Trump's statements, even without concrete policy changes, injected a dose of optimism into the market. This positive sentiment significantly boosted investor confidence in the European Union's economic outlook.

Positive Sentiment and Investor Confidence

The implication of reduced trade tensions led to a surge in various European stock market indices. The uncertainty surrounding trade wars, a major factor impacting global markets for the past few years, eased considerably.

- The DAX (German stock market index) saw a 2% increase.

- The CAC 40 (French stock market index) rose by 1.8%.

- Luxury goods and automotive sectors experienced particularly strong gains, reflecting expectations of increased trade and consumer spending.

The reduction in trade war anxieties fostered a more positive outlook on European economic growth, encouraging investors to increase their holdings.

Reduced Trade War Uncertainty

The potential for reduced tariffs significantly impacts European businesses. Decreased trade barriers translate into:

- Higher trade volumes between the EU and the US.

- Increased profitability for European companies exporting to the US.

- Improved supply chain efficiency, reducing logistical complexities and costs.

This positive outlook contributed to the significant gains observed across several European stock markets.

LVMH's Decline Despite Positive Market Sentiment

While the overall market reacted positively to Trump's tariff relief comments, LVMH bucked the trend, experiencing a notable decline. This divergence requires a closer look at sector-specific factors and market dynamics.

Sector-Specific Factors

LVMH's underperformance stems from several factors that weren't directly addressed by Trump's comments:

- Exposure to specific markets: LVMH's sales in certain regions more susceptible to trade tensions might have been negatively impacted.

- Product category vulnerability: Some LVMH product categories could be disproportionately affected by tariffs or other trade-related factors.

- Internal company performance: Any internal company news or financial reports released around the same time could have influenced the stock price independently of Trump's comments.

Luxury Goods Market Volatility

The luxury goods market is inherently volatile, highly sensitive to geopolitical events and consumer confidence. Factors influencing LVMH's decline include:

- Changing consumer spending habits: Shifts in consumer preferences or economic downturns in key markets could negatively affect demand for luxury goods.

- Currency fluctuations: Exchange rate shifts can impact LVMH's profitability and stock valuation.

- Intense competition: The luxury goods sector is highly competitive, with established and emerging brands vying for market share.

Analyzing the Disparity in Market Reactions

The differing reactions to Trump's tariff relief comments highlight the complexity of market responses to news events. Analyzing the disparity reveals important insights.

Differing Exposure to Trade Policies

The extent to which European companies are exposed to US trade policies varies significantly. This varying exposure explains the different reactions:

- Companies with a large proportion of US exports benefited significantly from the easing of trade tensions.

- Others, less reliant on the US market, were less affected by the news. Geographic diversification plays a crucial role in mitigating risk.

Understanding this differing exposure is key to interpreting market responses.

Market Speculation and Short-Term Fluctuations

Short-term market speculation and rapid reactions can exaggerate the true impact of policy announcements. Initial reactions are often driven by emotion and speculation rather than a thorough assessment of the long-term effects.

Conclusion: Understanding the Impact of Trump's Tariff Relief Comments

In summary, while Trump's tariff relief comments created a positive market sentiment, leading to a surge in European stocks, LVMH's decline demonstrates the importance of considering both broad market trends and company-specific factors. The luxury goods market's inherent volatility and LVMH's unique exposure to various risks contributed to its contrasting performance. Understanding these nuances is crucial for investors and market analysts.

To stay informed about the ongoing impact of "Trump's tariff relief comments" and similar events, follow reputable financial news sources for updates on trade policy developments and their market implications. Staying informed about changes in trade policy is vital for navigating the complexities of the global market.

Featured Posts

-

The Importance Of Middle Managers Benefits For Companies And Employees

May 25, 2025

The Importance Of Middle Managers Benefits For Companies And Employees

May 25, 2025 -

Tisice Prepustenych Analyza Krizy Na Nemeckom Pracovnom Trhu

May 25, 2025

Tisice Prepustenych Analyza Krizy Na Nemeckom Pracovnom Trhu

May 25, 2025 -

Teenager Rearrested After Shop Owners Fatal Stabbing

May 25, 2025

Teenager Rearrested After Shop Owners Fatal Stabbing

May 25, 2025 -

Apple Price Target Lowered But Wedbush Stays Bullish Is It Right For You

May 25, 2025

Apple Price Target Lowered But Wedbush Stays Bullish Is It Right For You

May 25, 2025 -

Indonesia Classic Art Week 2025 Perpaduan Seni Dan Porsche

May 25, 2025

Indonesia Classic Art Week 2025 Perpaduan Seni Dan Porsche

May 25, 2025

Latest Posts

-

Hands On With The Fujifilm X Half Whimsical Design And Fun Features

May 25, 2025

Hands On With The Fujifilm X Half Whimsical Design And Fun Features

May 25, 2025 -

Fathers Desperate Rowing Journey To Fund Sons 2 2 Million Treatment

May 25, 2025

Fathers Desperate Rowing Journey To Fund Sons 2 2 Million Treatment

May 25, 2025 -

Dc Love Story A Tragedy

May 25, 2025

Dc Love Story A Tragedy

May 25, 2025 -

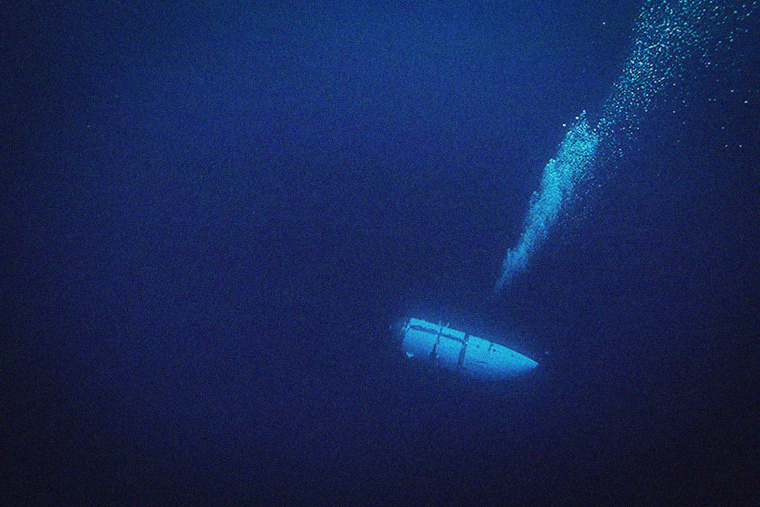

Unlocking The Mystery The Audio Evidence Of The Titan Subs Implosion

May 25, 2025

Unlocking The Mystery The Audio Evidence Of The Titan Subs Implosion

May 25, 2025 -

The Sound Of Disaster Analyzing The Titan Sub Implosion Footage

May 25, 2025

The Sound Of Disaster Analyzing The Titan Sub Implosion Footage

May 25, 2025