Trump's Tariff Relief: 8% Stock Market Surge On Euronext Amsterdam

Table of Contents

The Trump Administration's Tariff Relief Announcement

The Trump administration's announcement of tariff relief sent shockwaves through global markets. While specifics remain somewhat opaque, the relief primarily targeted certain sectors previously burdened by high tariffs imposed during the earlier trade disputes. This unexpected move marked a potential shift in the administration's trade strategy.

- Specific industries affected: Reports suggest that the relief focused on industries like automotive parts, certain agricultural products, and some technology components. Precise details remain somewhat limited pending official publications.

- Magnitude of tariff reduction: The reduction varied significantly depending on the product and its origin, with some tariffs being completely eliminated while others experienced a partial reduction. Further clarification from official sources is required for complete transparency.

- Timeline of implementation: The implementation timeline was not immediately clear, with some suggesting a phased rollout over several months. Official communications are crucial to determine the exact timeframe.

- Official statements or press releases: [Insert links to official statements and press releases once available]. Finding verifiable sources is key to understanding the official position.

The geopolitical implications are substantial. This could signal a more conciliatory approach to trade negotiations, potentially de-escalating tensions with key trading partners. However, the long-term implications and whether this is a sustained policy shift or a temporary measure remain to be seen.

Euronext Amsterdam's Response to Trump's Tariff Relief

Euronext Amsterdam reacted swiftly and decisively to the news of Trump's tariff relief. The market experienced an immediate and substantial surge, with several indices registering significant gains.

- Specific stock indices that experienced significant gains: The AEX index, a key benchmark for Euronext Amsterdam, saw the largest jump. [Insert specific data points once available].

- Volume of trading activity: Trading volume increased dramatically, indicating strong investor interest and engagement in the market. [Insert specific data points once available].

- Investor sentiment analysis: Investor sentiment shifted dramatically from cautious to optimistic, evidenced by the rapid increase in share prices.

- Comparison to other European stock exchanges: While other European exchanges also experienced some positive movement, the surge at Euronext Amsterdam was noticeably more pronounced, suggesting a disproportionate benefit from the tariff relief announcement.

The significant surge in Euronext Amsterdam specifically can be attributed to several factors, including its heavy involvement in sectors directly impacted by the tariff changes. Further research is needed to definitively determine the reasons behind the disproportionate increase.

Impact on Specific Sectors within Euronext Amsterdam

The tariff relief announcement had a marked effect on various sectors within Euronext Amsterdam. Some industries experienced disproportionately higher growth than others.

- Percentage increase in specific sectors: The technology and automotive sectors, for example, reported particularly strong gains. [Insert specific data points once available].

- Leading companies within those sectors and their stock performance: Specific companies within these high-performing sectors saw their stock prices rise significantly. [Insert specific examples once available].

- Analysis of why those specific sectors were affected: This can be attributed to the fact that these sectors were directly impacted by the previous tariffs imposed by the Trump administration.

- Sectors less affected: Sectors with less direct exposure to the affected goods saw more modest gains, or possibly no effect at all.

The disparity in the impact across different sectors highlights the selective nature of Trump's tariff relief and its varied consequences.

Long-Term Implications and Future Outlook

The long-term effects of Trump's tariff relief on Euronext Amsterdam and the broader European economy remain uncertain. Several potential scenarios are possible.

- Sustained growth or temporary boost?: The surge could be a sustained upward trend, or it could prove to be a temporary boost.

- Impact on international trade relationships: The implications for international trade relations and future negotiations need to be thoroughly analyzed.

- Potential for further policy changes: The possibility of future policy changes, either by the current administration or a subsequent one, adds further complexity to the outlook.

Financial analysts offer varied perspectives on the future. [Insert expert opinions and predictions once available from reputable financial sources]. The uncertainty necessitates close monitoring of both US trade policy and the Euronext Amsterdam market.

Conclusion: Understanding the Impact of Trump's Tariff Relief on Euronext Amsterdam

Trump's surprise announcement of tariff relief resulted in an unprecedented 8% surge in the Euronext Amsterdam stock market. This significant market rally was primarily driven by the positive impact of the relief on specific sectors heavily reliant on international trade, particularly technology and automotive components. While the long-term effects remain uncertain, the immediate response highlights the sensitivity of global markets to changes in US trade policy. The uneven impact across different sectors within Euronext Amsterdam suggests a complex interplay of factors influencing market performance.

Stay updated on the latest developments in Trump's trade policy and its impact on Euronext Amsterdam and global markets. Follow us for more analysis on Trump's tariff relief and its influence on international stock markets.

Featured Posts

-

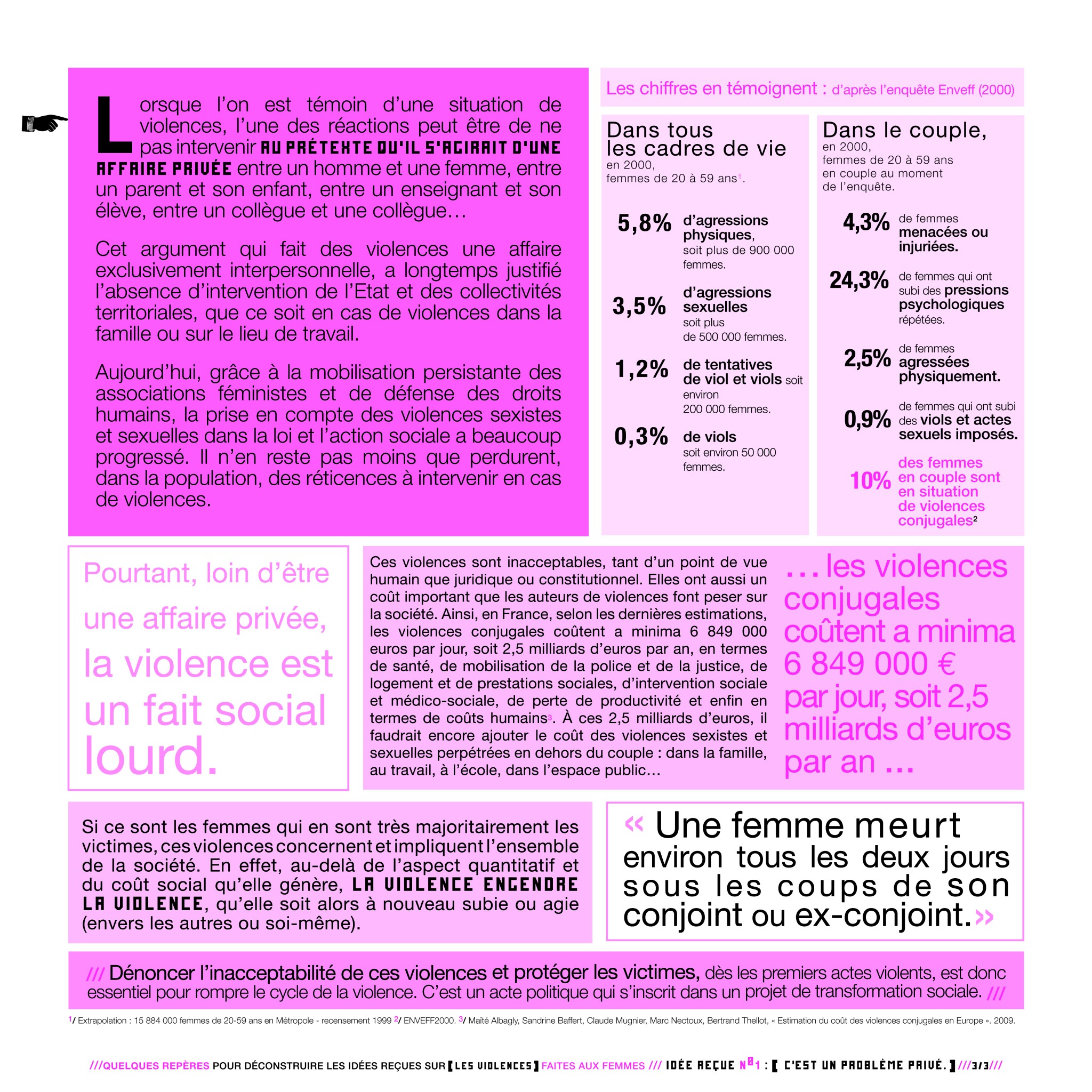

Mathieu Avanzi Deconstruire Les Idees Recues Sur L Enseignement Du Francais

May 25, 2025

Mathieu Avanzi Deconstruire Les Idees Recues Sur L Enseignement Du Francais

May 25, 2025 -

Banco Master Acquired By Brb Shifting Dynamics In Brazils Financial Market

May 25, 2025

Banco Master Acquired By Brb Shifting Dynamics In Brazils Financial Market

May 25, 2025 -

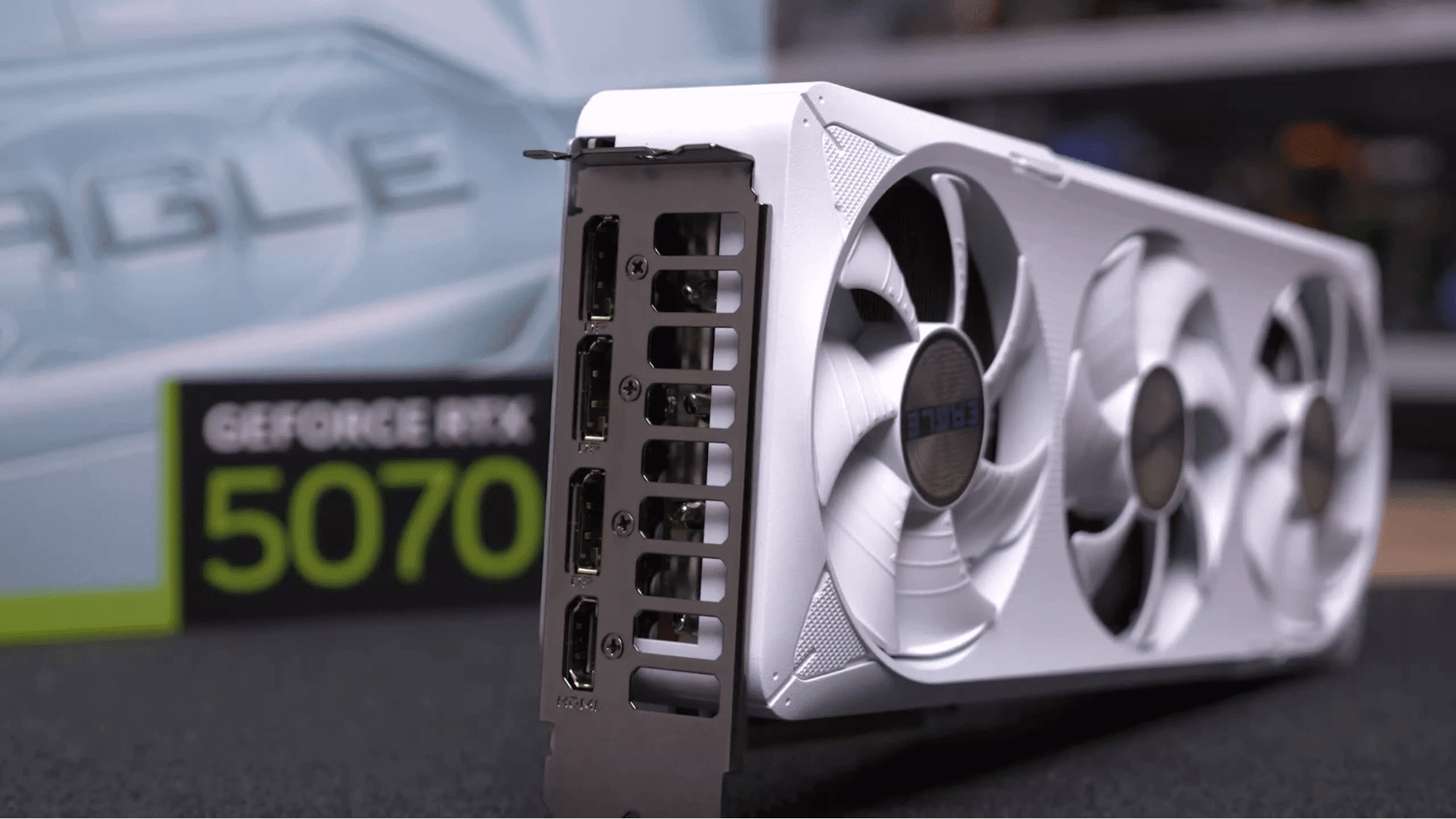

The Nvidia Rtx 5060 A Case Study In Graphics Card Launches

May 25, 2025

The Nvidia Rtx 5060 A Case Study In Graphics Card Launches

May 25, 2025 -

Waiting By The Phone A Personal Account

May 25, 2025

Waiting By The Phone A Personal Account

May 25, 2025 -

Le Francais Pour Tous La Vision De Mathieu Avanzi

May 25, 2025

Le Francais Pour Tous La Vision De Mathieu Avanzi

May 25, 2025

Latest Posts

-

The Nvidia Rtx 5060 Performance Controversy And Consumer Protection

May 25, 2025

The Nvidia Rtx 5060 Performance Controversy And Consumer Protection

May 25, 2025 -

Elon Musk And Dogecoin Is The Relationship Over

May 25, 2025

Elon Musk And Dogecoin Is The Relationship Over

May 25, 2025 -

Nvidias Rtx 5060 A Disappointing Launch And What It Means For The Future

May 25, 2025

Nvidias Rtx 5060 A Disappointing Launch And What It Means For The Future

May 25, 2025 -

Rtx 5060 A Critical Review Of Nvidias Latest Release And Its Fallout

May 25, 2025

Rtx 5060 A Critical Review Of Nvidias Latest Release And Its Fallout

May 25, 2025 -

The Nvidia Rtx 5060 A Case Study In Graphics Card Launches

May 25, 2025

The Nvidia Rtx 5060 A Case Study In Graphics Card Launches

May 25, 2025