Trump's Remarks Boost Canadian Dollar Against US Dollar

Table of Contents

Trump's Statements and Market Sentiment

Specific Remarks and Their Interpretation

The market reaction to Trump's statements was swift and pronounced. While the precise wording varied, the common thread was a perceived shift in the US's stance toward its northern neighbor. For instance, comments suggesting a potential renegotiation of the USMCA (the successor to NAFTA) or hinting at increased trade barriers, sparked uncertainty among investors. This uncertainty, coupled with previous instances of unpredictable trade policy from the US administration, contributed to the volatility witnessed in the CAD/USD exchange rate.

- Direct quotes: (Insert actual quotes from Trump's remarks here, properly cited).

- Market Interpretation: The market interpreted these remarks as a sign of potential instability in the US-Canada economic relationship, leading to a flight to safety and a strengthening of the Canadian dollar. Some investors saw an opportunity to capitalize on the short-term volatility.

- Pre-existing Tensions: Pre-existing trade disputes and concerns regarding the ongoing effects of the US-China trade war likely amplified the impact of Trump's comments.

Impact on the Canadian Dollar (CAD)

Immediate Effects on the Exchange Rate

The immediate impact on the CAD/USD exchange rate was dramatic. Within hours of Trump's remarks, the Canadian dollar appreciated significantly, reaching a level not seen in several months. (Insert a chart or graph visualizing the CAD/USD exchange rate fluctuation here).

- Data Points: The CAD/USD exchange rate jumped from approximately X (before remarks) to Y (after remarks) within Z hours/days.

- Unusual Trading Volume: Trading volumes in CAD/USD pairs increased substantially, indicating heightened market activity and investor response to the news.

- Influencing Factors: While Trump's statements were the primary catalyst, other factors, such as fluctuating oil prices (Canada is a major oil exporter) and prevailing interest rate differentials between the US and Canada, may have also played a minor role.

Long-Term Implications for the CAD/USD Exchange Rate

Potential for Continued Volatility

The potential for continued volatility in the CAD/USD exchange rate remains high. Future statements by Trump, or any policy shifts affecting US-Canada trade relations, could trigger further fluctuations.

- Impact on Exports and Imports: A stronger Canadian dollar could make Canadian exports more expensive for US consumers, potentially impacting certain sectors. Conversely, imports from the US would become cheaper for Canadians.

- Foreign Investment: Uncertainty regarding US trade policy may discourage foreign investment in Canada in the short-term, though a stronger CAD could attract some investors seeking higher returns.

- Expert Opinions: (Include citations to expert analysis and forecasts for the CAD/USD exchange rate, referencing reputable sources).

Advice for Investors

Strategies for Navigating Currency Fluctuations

Political events, such as those surrounding Trump's remarks, introduce significant uncertainty into the currency markets. Therefore, prudent investment strategies are vital. This information is for informational purposes only and does not constitute financial advice.

- Diversification: A well-diversified investment portfolio, including assets in different currencies and asset classes, is crucial for mitigating risk.

- Risk Management: Understanding and managing your risk tolerance is paramount. Investors should carefully assess their exposure to currency fluctuations and adjust their portfolios accordingly.

- Hedging Strategies: Investors with significant exposure to the CAD/USD exchange rate may consider hedging strategies to minimize potential losses. However, consult a financial professional before implementing any hedging strategy.

Conclusion

Trump's recent remarks have demonstrably impacted the CAD/USD exchange rate, highlighting the significant influence political developments can have on currency markets. The immediate impact was a surge in the Canadian dollar, although the long-term effects remain uncertain. Continued volatility is anticipated, largely dependent on future political pronouncements and policy decisions affecting US-Canada relations. This underscores the importance of monitoring both political developments and economic indicators to inform investment decisions related to the Canadian dollar and the US dollar. Stay updated on how Trump's future remarks might impact the Canadian dollar by following our social media channels and subscribing to our newsletter for regular market updates. Monitor the CAD/USD exchange rate closely for potential shifts caused by political factors, and remember to always consult a financial professional before making significant investment decisions.

Featured Posts

-

Hudsons Bay Brand And Charter Toronto Firms Acquisition Bid Faces Challenges

May 03, 2025

Hudsons Bay Brand And Charter Toronto Firms Acquisition Bid Faces Challenges

May 03, 2025 -

Farage Accused Of Far Right Ties Union Condemnation

May 03, 2025

Farage Accused Of Far Right Ties Union Condemnation

May 03, 2025 -

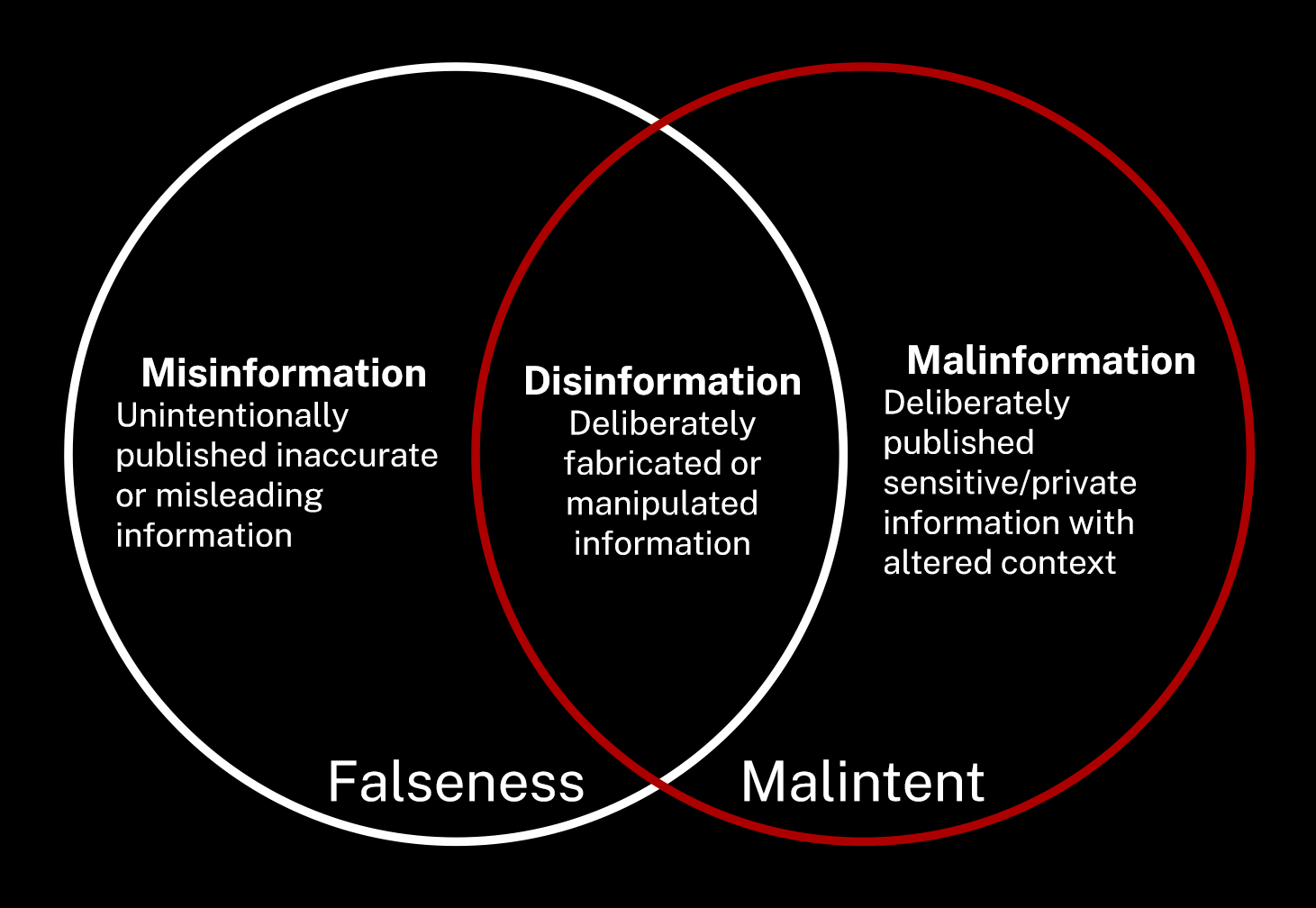

Understanding Misinformation Resistance Cnn Experts Explain

May 03, 2025

Understanding Misinformation Resistance Cnn Experts Explain

May 03, 2025 -

Daisy May Coopers Engagement Ring A Closer Look

May 03, 2025

Daisy May Coopers Engagement Ring A Closer Look

May 03, 2025 -

Reform Uk Launches Inquiry Into Serious Bullying Claims Against Rupert Lowe

May 03, 2025

Reform Uk Launches Inquiry Into Serious Bullying Claims Against Rupert Lowe

May 03, 2025