Trump's Remarks Boost Canadian Dollar: A Market Analysis

Table of Contents

Trump's Remarks and Their Market Impact

Specific remarks made by Trump regarding trade policy with Canada, though not explicitly stated as positive, were interpreted by many as a softening of his previously aggressive stance. This context is crucial; previous threats of tariffs and trade restrictions had significantly weakened the Canadian dollar. The subtle shift in tone, however, was enough to spark a wave of optimism among investors.

- Market Analyst Interpretation: Many market analysts viewed Trump's seemingly less hostile tone as a sign of potential easing of trade tensions between the US and Canada. This positive sentiment directly fueled increased demand for the Canadian dollar.

- Immediate Market Reaction: The immediate aftermath saw a noticeable increase in trading volume for the Canadian dollar, with the USD/CAD exchange rate experiencing a sharp decline. This indicated a rapid influx of investment into Canadian assets.

- Role of Speculation: Speculation played a significant role. The ambiguity in Trump's remarks allowed for various interpretations, leading to a surge in speculative trading activity and further boosting the Canadian dollar's value.

Analyzing the Strengthening Canadian Dollar

While Trump's remarks were a catalyst, other factors contributed to the Canadian dollar's rise. A confluence of positive economic indicators and geopolitical events strengthened the currency's position.

- Canadian Economic Strength: Canada's robust economy, characterized by strong commodity prices (particularly oil and natural gas), relatively low inflation, and steady economic growth, provided a solid foundation for the Canadian dollar's appreciation. Higher interest rates compared to some other economies also made it more attractive to investors.

- US Dollar Weakness: The relative weakness of the US dollar against other major currencies also played a role, making the Canadian dollar appear more attractive by comparison in the USD/CAD exchange rate.

- Geopolitical Influences: Global geopolitical stability, or at least the absence of significant negative events impacting North America, contributed to a more favorable investment climate for the Canadian dollar.

The Impact on USD/CAD Exchange Rates

Trump's remarks triggered a noticeable shift in the USD/CAD exchange rate. Before his statements, the USD/CAD pair had been trading within a specific range reflecting the prevailing market sentiment. However, the positive interpretation of his comments resulted in a rapid decline in the USD/CAD rate, indicating a strengthening of the Canadian dollar.

- Exchange Rate Fluctuations: Charts clearly illustrate the immediate drop in the USD/CAD exchange rate following Trump's remarks, followed by a period of consolidation as the market absorbed the news. (Note: A chart would be inserted here in a published article.)

- Impact on Canadian Businesses: The fluctuation in the exchange rate has significant implications for Canadian businesses. Exporters benefit from a stronger Canadian dollar as their goods become cheaper for international buyers. Conversely, importers face higher costs for goods purchased in foreign currencies.

- Short-Term and Long-Term Effects: The short-term effect was a clear appreciation of the Canadian dollar. The long-term effect remains uncertain and depends on various factors, including continued trade relations between the US and Canada, global economic conditions, and future political developments.

Implications for Investors and Traders

The fluctuating Canadian dollar presents both opportunities and risks for investors and traders.

- Investment Strategies: Investors can utilize various strategies, including currency trading (forex), to capitalize on the Canadian dollar's volatility. Hedging strategies can also help mitigate risks associated with currency fluctuations.

- Risks and Uncertainties: Political uncertainty remains a significant risk factor. Sudden shifts in US-Canada relations or unexpected economic developments could significantly impact the Canadian dollar's value.

- Market Monitoring: Continuous monitoring of market trends, news related to US-Canada relations, and key economic indicators is crucial for making informed investment decisions involving the Canadian dollar.

Conclusion

Trump's remarks had a significant impact on the Canadian dollar, triggering a noticeable surge in its value. This increase wasn't solely attributed to his comments but also to a combination of factors such as a strong Canadian economy, the relative weakness of the US dollar, and overall geopolitical stability. The implications for investors are significant, with both opportunities and risks associated with navigating this volatile market. Understanding the interplay of these economic and political forces is crucial for success in the Canadian dollar market.

Call to Action: Stay informed on the latest developments affecting the Canadian dollar. Monitor market trends and news related to US-Canada relations and economic indicators to make informed decisions regarding investing and trading in the Canadian dollar market. Learn more about effective strategies for navigating fluctuations in the Canadian dollar exchange rate.

Featured Posts

-

Fortnite Cowboy Bebop Giveaway How To Claim Your Free Rewards

May 02, 2025

Fortnite Cowboy Bebop Giveaway How To Claim Your Free Rewards

May 02, 2025 -

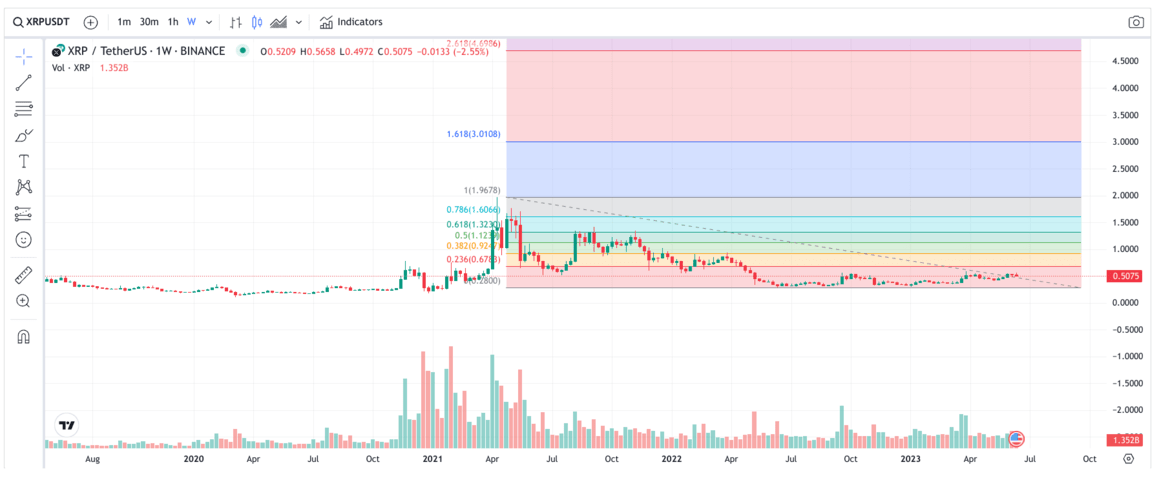

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 02, 2025

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 02, 2025 -

Lionesses Vs Spain Tonight Tv Channel Kick Off Time And How To Watch

May 02, 2025

Lionesses Vs Spain Tonight Tv Channel Kick Off Time And How To Watch

May 02, 2025 -

The Crucial Role Of Mental Health Awareness Insights From Dr Shradha Malik

May 02, 2025

The Crucial Role Of Mental Health Awareness Insights From Dr Shradha Malik

May 02, 2025 -

Celebrate International Harry Potter Day With Official Merchandise

May 02, 2025

Celebrate International Harry Potter Day With Official Merchandise

May 02, 2025

Latest Posts

-

Investigation Launched Police Probe Into Mp Rupert Lowes Activities

May 02, 2025

Investigation Launched Police Probe Into Mp Rupert Lowes Activities

May 02, 2025 -

Reform Party Implodes Amidst Leaked Farage Messages

May 02, 2025

Reform Party Implodes Amidst Leaked Farage Messages

May 02, 2025 -

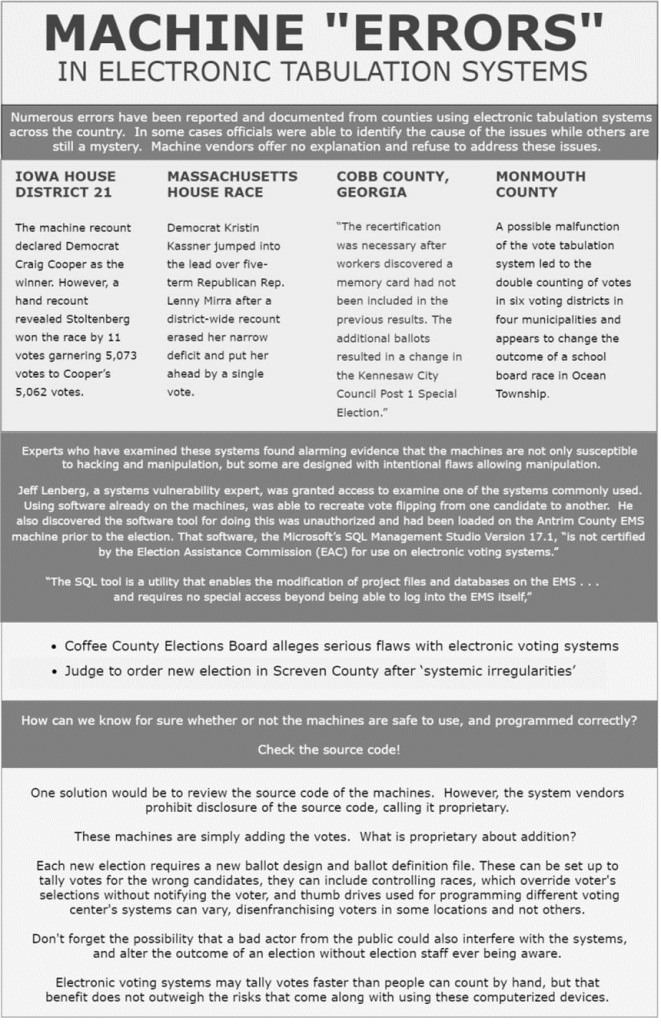

Improving Election Integrity With A Robust Poll Data System

May 02, 2025

Improving Election Integrity With A Robust Poll Data System

May 02, 2025 -

Reform Civil War Erupts Lee Anderson Slams Rupert Lowe

May 02, 2025

Reform Civil War Erupts Lee Anderson Slams Rupert Lowe

May 02, 2025 -

Farages Whats App Messages Expose Rift In Reform Party

May 02, 2025

Farages Whats App Messages Expose Rift In Reform Party

May 02, 2025