Trump's Pardon: Reality TV Couple Freed From Bank Fraud And Tax Convictions

Table of Contents

The Reality TV Couple's Crimes

The reality TV couple, [Insert Couple's Names Here], faced serious charges involving intricate schemes of bank fraud and tax evasion. Their crimes spanned several years and involved a complex web of financial manipulations designed to enrich themselves at the expense of both lenders and the government.

-

Bank Fraud Charges: The couple was accused of securing multiple loans by fraudulently misrepresenting their assets and income. This included submitting falsified financial statements, using shell corporations to hide their true financial status, and employing other deceptive practices to obtain millions of dollars in loans they had no reasonable expectation of repaying.

-

Tax Evasion Charges: Further compounding their offenses, [Insert Couple's Names Here] were charged with systematically underreporting their income to the IRS, avoiding millions of dollars in taxes. They allegedly used offshore accounts, complex financial structures, and other sophisticated methods to conceal their true earnings.

-

Original Sentencing: Following a lengthy trial, the couple was found guilty on multiple counts of bank fraud and tax evasion. The court handed down significant sentences, including substantial prison time and hefty fines. This verdict sent a clear message about the severity of their financial crimes.

-

Public Reaction and Media Coverage: Even before the pardon, the case garnered significant public attention and intense media scrutiny. Many voiced their outrage at the couple's actions, and there was widespread anticipation regarding the sentences that would be imposed.

Trump's Justification for the Pardon

The reasons cited by President Trump for issuing the pardon remain highly debated. While official statements claimed the pardon was based on [Insert Trump's Stated Justification, e.g., "compassionate grounds" or "rehabilitation"], critics argue that the justification lacked transparency and failed to meet established criteria for presidential clemency.

-

Direct Quotes from Trump: [Insert direct quotes from Trump's statements or tweets regarding the pardon].

-

Analysis of Justification Merit: Legal experts largely criticized the justification, arguing that it set a dangerous precedent and undermined the principles of justice and equal application of the law. Many questioned whether the reasons given aligned with the established standards for granting presidential pardons, which typically consider factors such as rehabilitation, extraordinary circumstances, and public interest.

-

Comparison to Other Pardons: The pardon was compared to other pardons granted during the Trump presidency, highlighting inconsistencies and suggesting potential bias or political motivations behind the decision. This led to accusations of favoritism and abuse of executive power.

Public and Political Reaction to Trump's Pardon

The pardon generated intense public and political backlash, with widespread criticism coming from across the political spectrum. The reaction highlighted the deep divisions within American society regarding justice, fairness, and the use of presidential power.

-

Public Outcry: Public outrage manifested in protests, online petitions, and widespread condemnation of the decision in both traditional and social media. Many felt the pardon was a slap in the face to the justice system and sent a message that the wealthy and powerful could evade consequences for their actions.

-

Political Criticism: Democratic politicians vehemently criticized the pardon, condemning it as an abuse of power and an affront to the rule of law. While some Republicans voiced concerns, many remained largely silent or offered only muted criticism.

-

Expert Legal Commentary: Legal scholars widely condemned the decision, arguing that it eroded public trust in the justice system and set a dangerous precedent for future cases involving similar crimes. Concerns were raised about the potential for future presidents to use pardons for political gain or to shield their allies from accountability.

The Long-Term Implications of the Pardon

The pardon's long-term implications extend beyond the specific case, impacting public perception of justice and raising concerns about the future use of presidential clemency.

-

Potential for Future Abuse of Power: Critics argue that this pardon encourages the abuse of presidential power and sets a dangerous precedent for future administrations. It undermines the integrity of the judicial process and suggests that the wealthy and well-connected can evade accountability for their crimes.

-

Impact on Fairness and Equality: The pardon raised concerns about fairness and equality under the law, fueling perceptions that the justice system is not applied equally to all citizens. Many questioned whether individuals without the same connections or resources would have received similar treatment.

-

Legal Precedent: This case could set a concerning legal precedent, potentially influencing future decisions regarding presidential pardons and impacting the overall administration of justice. The decision has prompted renewed calls for judicial reform and greater transparency in the pardoning process.

Conclusion: Trump's pardon of the reality TV couple for bank fraud and tax evasion remains a deeply divisive issue. This case exemplifies the complexities surrounding presidential clemency and raises critical questions about fairness, justice, and the potential for abuse of power. Understanding the details of this pardon and the ensuing public and political reaction is crucial for fostering informed discussions about the future application of presidential pardons and the proper administration of justice. To stay informed on further developments concerning Trump's pardons and other significant legal cases, continue to follow our news and analysis. Keywords: Trump's Pardon, Presidential Pardon, Bank Fraud, Tax Evasion, Clemency, Legal Analysis

Featured Posts

-

Toxic Chemicals From Ohio Train Derailment Months Long Lingering Effects

May 29, 2025

Toxic Chemicals From Ohio Train Derailment Months Long Lingering Effects

May 29, 2025 -

Guia Practica De Los Arcanos Menores Del Tarot

May 29, 2025

Guia Practica De Los Arcanos Menores Del Tarot

May 29, 2025 -

Stranger Things 5 Details And Speculation On The Final Season

May 29, 2025

Stranger Things 5 Details And Speculation On The Final Season

May 29, 2025 -

Ftc To Challenge Activision Blizzard Acquisition Approval

May 29, 2025

Ftc To Challenge Activision Blizzard Acquisition Approval

May 29, 2025 -

Nike Air Jordan 9 Retro Cool Grey Your Guide To Online Shopping And Pricing

May 29, 2025

Nike Air Jordan 9 Retro Cool Grey Your Guide To Online Shopping And Pricing

May 29, 2025

Latest Posts

-

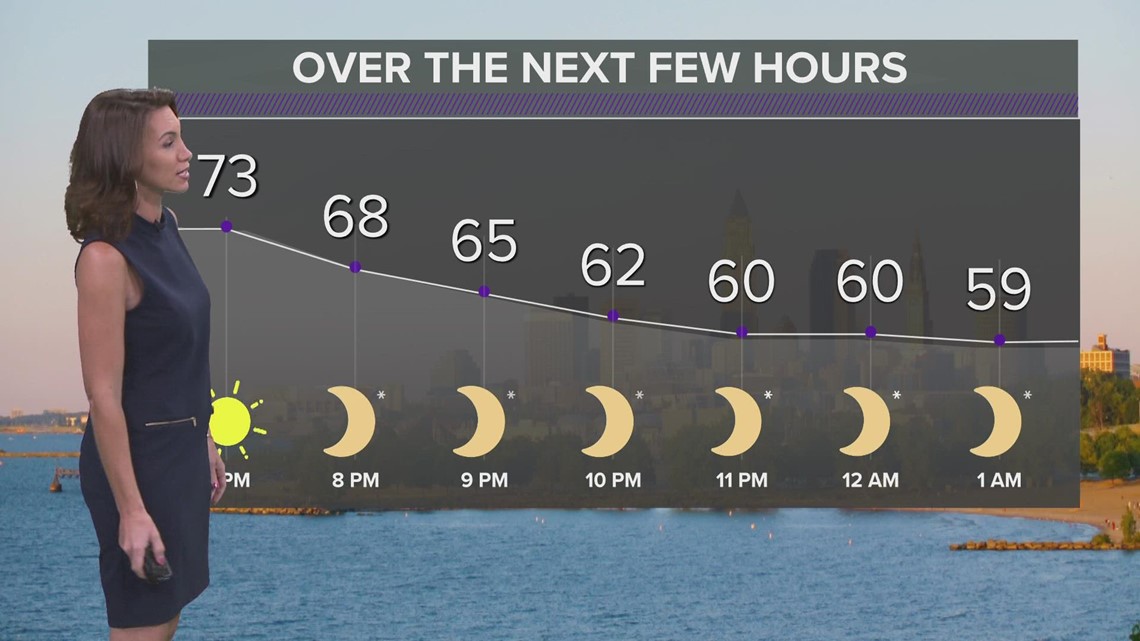

Northeast Ohio Weather Tuesdays Sunny Skies And Dry Conditions

May 31, 2025

Northeast Ohio Weather Tuesdays Sunny Skies And Dry Conditions

May 31, 2025 -

Northeast Ohio Tuesday Forecast Sunny And Dry

May 31, 2025

Northeast Ohio Tuesday Forecast Sunny And Dry

May 31, 2025 -

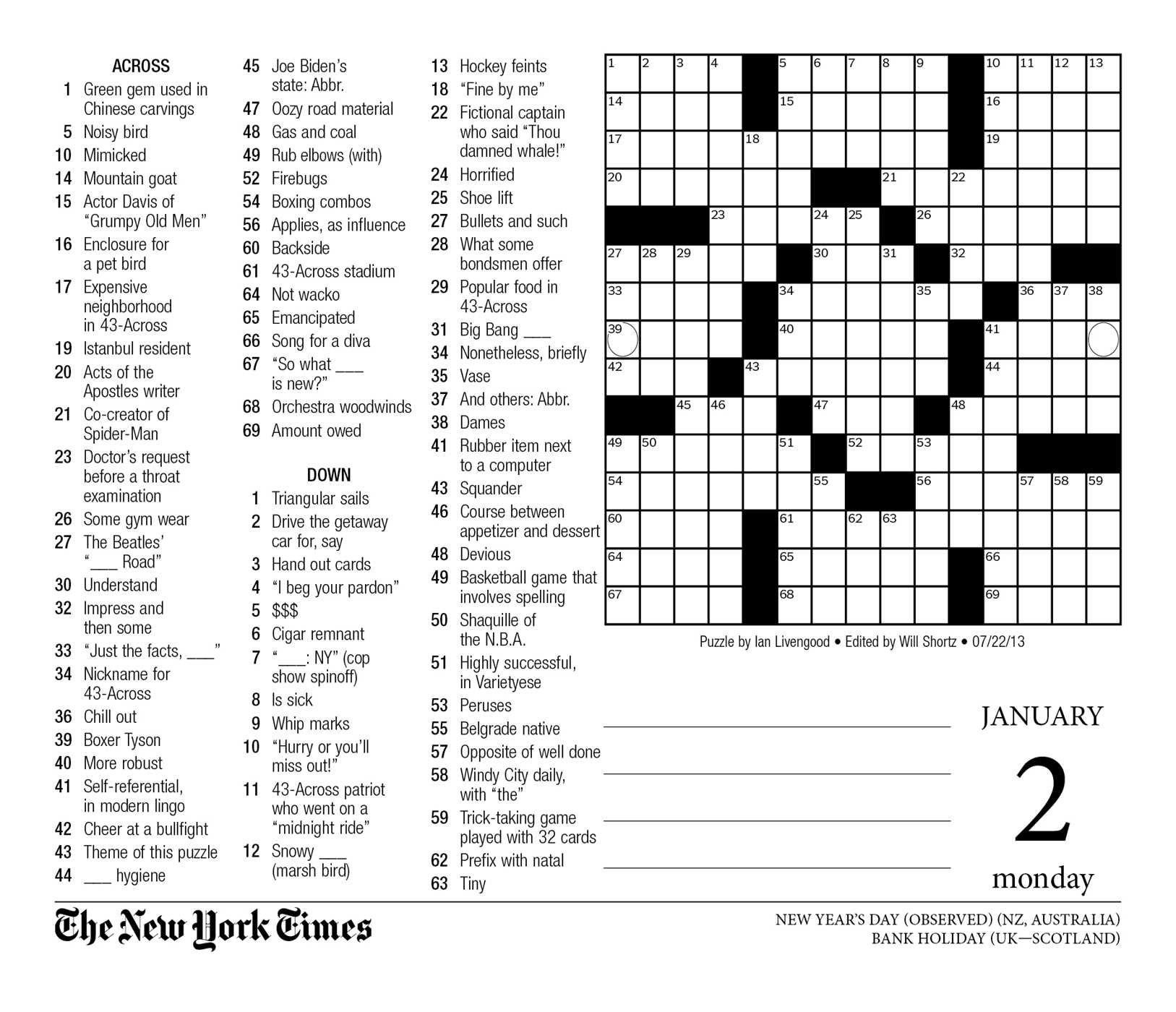

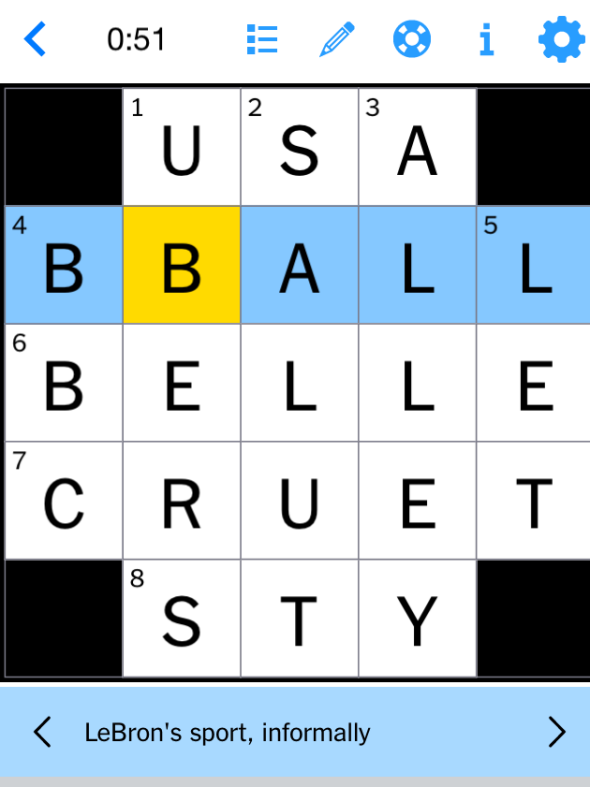

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025 -

Nyt Mini Crossword Answers For Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Answers For Saturday May 3rd

May 31, 2025 -

Nyt Mini Crossword Saturday April 19 Clues And Solutions

May 31, 2025

Nyt Mini Crossword Saturday April 19 Clues And Solutions

May 31, 2025