Trump's Economic Policies And Their Real-World Impact

Table of Contents

Tax Cuts and Jobs Act of 2017: A Deep Dive

The Tax Cuts and Jobs Act (TCJA) of 2017 was a cornerstone of Trump's economic agenda. It aimed to stimulate economic growth through significant tax reductions for corporations and individuals.

Corporate Tax Rate Reduction: Impact on Investment, Job Creation, and Corporate Profits

- The Reduction: The TCJA slashed the top corporate tax rate from 35% to 21%, the lowest in decades. This was touted as a major incentive for businesses to invest, expand, and create jobs.

- Projected vs. Actual Growth: While proponents predicted significant economic expansion, the actual boost in GDP growth was less dramatic than anticipated. Some studies suggest the effect was muted by other economic factors. (Source: Congressional Budget Office reports)

- Impact on National Debt: The tax cuts significantly increased the national debt, raising concerns about long-term fiscal sustainability. (Source: Treasury Department data)

- Income Inequality: Critics argued the tax cuts disproportionately benefited corporations and high-income earners, exacerbating income inequality. (Source: Studies from the Brookings Institution and Tax Policy Center)

- Stimulating Business Investment: Supporters maintained the lower tax rate encouraged businesses to reinvest profits, leading to increased capital expenditures and job creation. However, evidence of a substantial increase in business investment remains debated.

Individual Tax Cuts: Effects on Household Income and Consumer Spending

- Changes to Tax Brackets, Deductions, and Credits: The TCJA altered individual tax brackets, increased the standard deduction, and modified the child tax credit.

- Impact on Different Income Groups: While many households saw a temporary increase in disposable income, the benefits were not evenly distributed, with higher-income individuals receiving a larger share of the tax cuts. (Source: Tax Policy Center analysis)

- Stimulus Effect: Proponents argued the tax cuts would boost consumer spending and fuel economic growth. The impact on consumer spending was mixed, with some evidence suggesting increased spending but also concerns about the sustainability of this effect.

- Regressive Nature: Critics argued the tax cuts were regressive, providing greater benefits to wealthier individuals and widening the gap between the rich and the poor.

Deregulation Efforts: Unleashing the Market or Sacrificing Protections?

Trump's administration pursued a significant deregulation agenda, aiming to reduce the burden of government regulations on businesses.

Impact on Environmental Regulations: Analysis of the Rollback of Environmental Protections and its Consequences

- Specific Examples: The administration rolled back environmental regulations, including aspects of the Clean Power Plan and weakened vehicle emission standards.

- Environmental Impact and Public Health: These actions raised concerns about increased pollution, negative impacts on public health, and accelerated climate change. (Source: Environmental Protection Agency reports and scientific studies)

- Economic Trade-offs: While deregulation may offer short-term economic benefits to some industries, the long-term costs associated with environmental damage and public health issues are significant.

Financial Deregulation: Assessing the Risks and Rewards

- Changes to Dodd-Frank: The Trump administration sought to weaken the Dodd-Frank Act, a law enacted after the 2008 financial crisis to prevent future financial meltdowns.

- Potential Impact on Financial Stability: Critics warned that reducing financial regulations increased the risk of another financial crisis. (Source: Financial stability reports from the Federal Reserve)

- Arguments For and Against: Supporters argued that excessive regulation stifled economic growth, while critics emphasized the importance of strong regulatory oversight to protect the financial system.

Trade Policies: Tariffs, Trade Wars, and Global Impacts

Trump's trade policies were characterized by a protectionist approach, including the imposition of tariffs on imported goods.

The Impact of Tariffs on Specific Industries: Case Studies of Winners and Losers

- Tariffs on Steel and Aluminum: Tariffs imposed on steel and aluminum, for example, benefited some domestic producers but led to higher prices for consumers and retaliatory tariffs from other countries.

- Trade Disputes with China: The trade war with China involved significant tariffs on billions of dollars worth of goods, disrupting global supply chains and affecting various industries. (Source: World Trade Organization reports)

- Retaliatory Tariffs: Other countries retaliated with their own tariffs, harming US exporters and creating uncertainty in the global trading system.

Renegotiation of Trade Agreements (e.g., USMCA): Assessment of the Outcomes

- NAFTA and USMCA: The renegotiation of NAFTA led to the creation of the United States-Mexico-Canada Agreement (USMCA), which made some changes to trade rules and regulations.

- Impact on Various Sectors: The impact of USMCA on different sectors varied, with some sectors benefiting from the revised agreement while others experienced negative consequences.

- Arguments For and Against Renegotiation: Proponents argued the new agreement would benefit American workers and businesses, while critics raised concerns about its effectiveness and potential negative impacts.

The Impact of COVID-19 on Trump's Economic Legacy

The COVID-19 pandemic significantly impacted the trajectory of Trump's economic policies.

Economic Response to the Pandemic: Analysis of Government Spending and Stimulus Packages

- The CARES Act: The CARES Act provided significant economic relief, including stimulus checks, loans to businesses, and unemployment benefits.

- Effectiveness of Measures: The effectiveness of these measures was debated, with some arguing they prevented a deeper economic downturn while others criticized their design and implementation. (Source: Economic analyses from various think tanks and universities)

- Increase in National Debt: The pandemic response led to a substantial increase in the national debt, further exacerbating existing fiscal concerns.

The Pandemic’s Effect on Trump's Economic Policies: How the Crisis Altered the Trajectory of His Agenda

- Disruption to Trade and Supply Chains: The pandemic severely disrupted global trade and supply chains, highlighting the interconnectedness of the global economy.

- Changes in Public Perception: The economic fallout from the pandemic significantly altered public perception of Trump's economic policies and his administration's handling of the crisis.

Conclusion: Assessing the Long-Term Effects of Trump's Economic Policies

Trump's economic policies produced mixed results. While the Tax Cuts and Jobs Act led to short-term economic gains and low unemployment, it also significantly increased the national debt and arguably exacerbated income inequality. Deregulation efforts brought potential economic benefits but at the cost of environmental protection and increased risks. Trade policies created uncertainty in the global trading system, benefiting some industries while harming others. The COVID-19 pandemic significantly altered the course of his economic agenda. The long-term effects of these policies continue to unfold, requiring ongoing analysis and discussion.

To further explore these complexities and gain a more nuanced understanding of Trump's economic policies and their lasting impact, we encourage you to consult additional resources like government reports, academic studies, and analyses from reputable economic institutions. Further research into Trump's economic policies and their real-world impact is crucial for informed public discourse.

Featured Posts

-

Impact Of Tariffs Walmart And Target Executives In Meeting With President Trump

Apr 23, 2025

Impact Of Tariffs Walmart And Target Executives In Meeting With President Trump

Apr 23, 2025 -

581 Million Deal Cmocs Acquisition Of Lumina Gold Reshapes The Global Mining Landscape

Apr 23, 2025

581 Million Deal Cmocs Acquisition Of Lumina Gold Reshapes The Global Mining Landscape

Apr 23, 2025 -

Hollywoods Double Strike Understanding The Issues And Potential Fallout

Apr 23, 2025

Hollywoods Double Strike Understanding The Issues And Potential Fallout

Apr 23, 2025 -

Faster Entry At Target Field Go Ahead With Facial Recognition Technology

Apr 23, 2025

Faster Entry At Target Field Go Ahead With Facial Recognition Technology

Apr 23, 2025 -

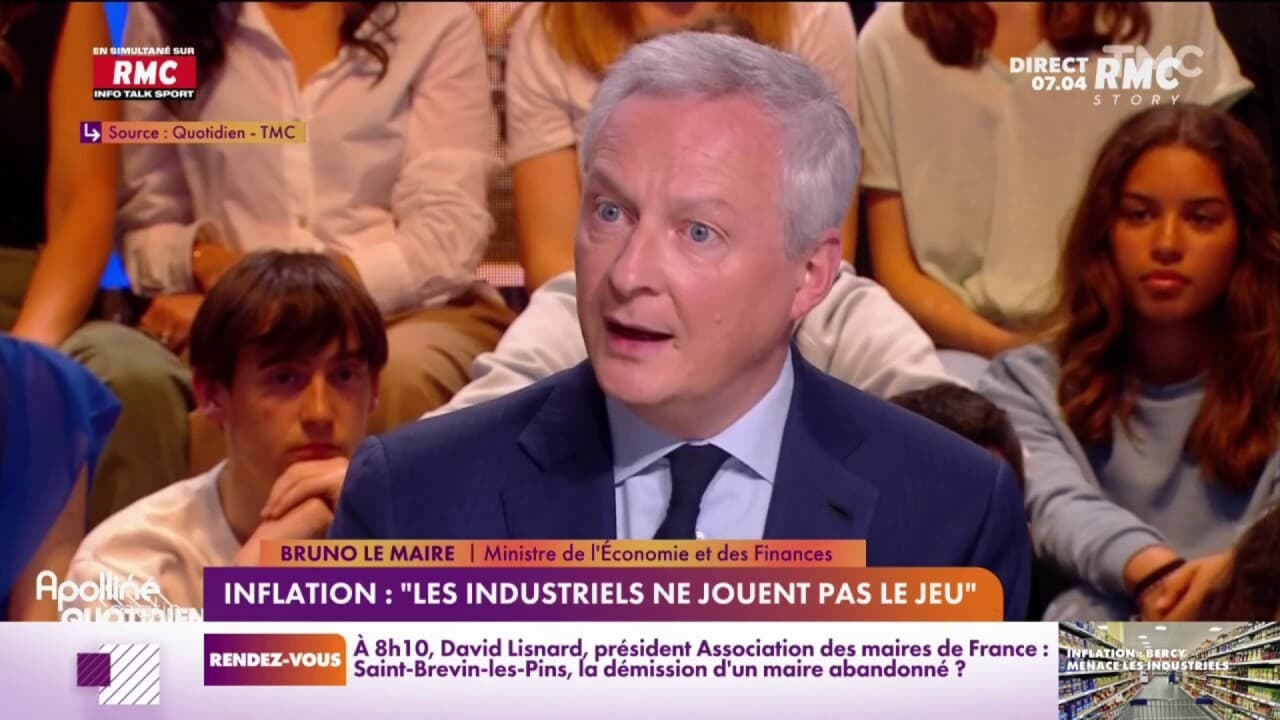

Morning Retail Nutriscore Quels Industriels Jouent Vraiment Le Jeu

Apr 23, 2025

Morning Retail Nutriscore Quels Industriels Jouent Vraiment Le Jeu

Apr 23, 2025