Trump Tax Cuts: Key Provisions Of The House GOP Plan

Table of Contents

The Trump administration's proposed tax cuts, spearheaded by the House GOP, represent a significant overhaul of the US tax code. This article delves into the key provisions of this plan, examining its impact on individuals, corporations, and the overall economy. Understanding these provisions is crucial for navigating the complexities of post-Trump tax law and its lasting effects.

Individual Income Tax Changes

The Trump tax cuts significantly altered individual income tax rates and deductions. Key changes included:

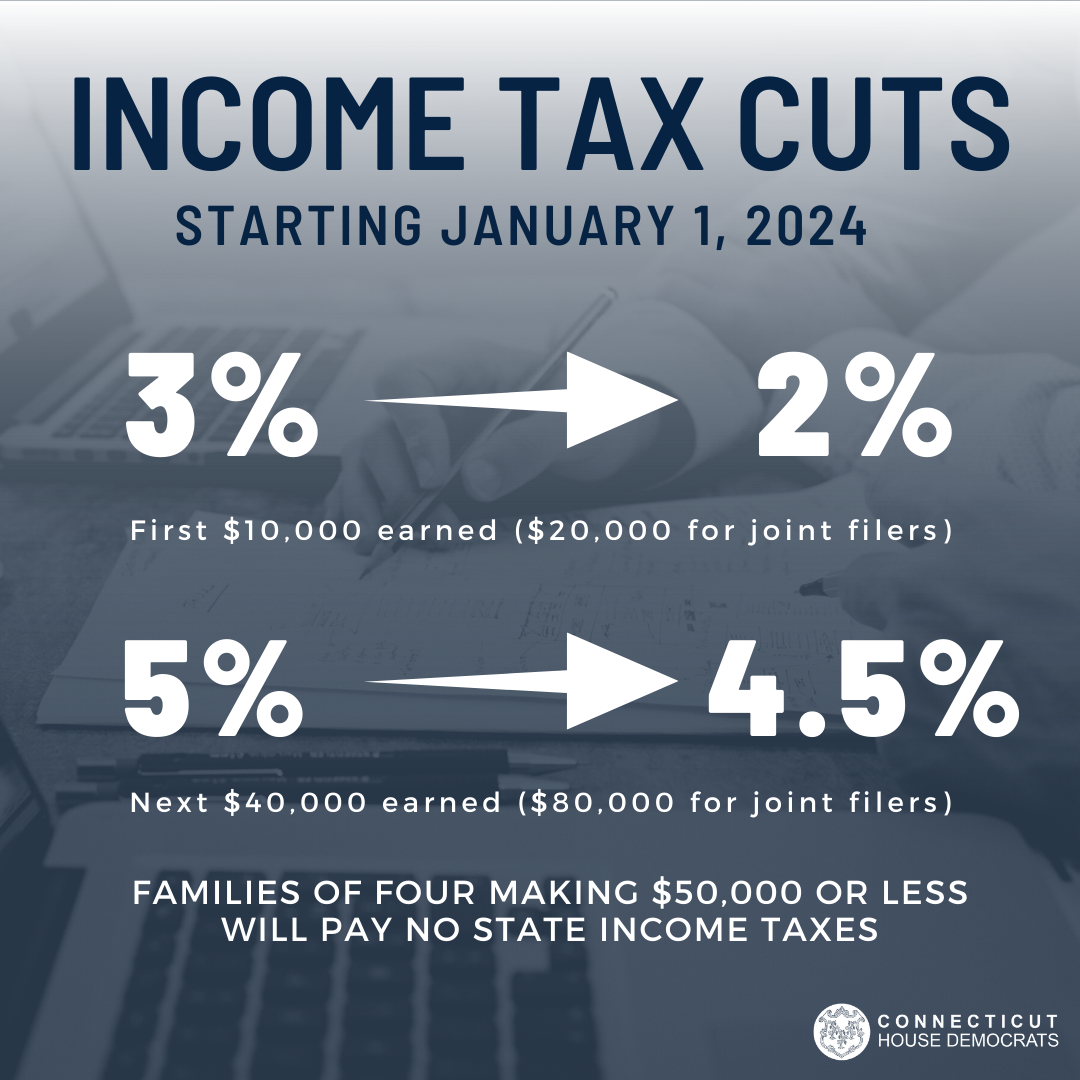

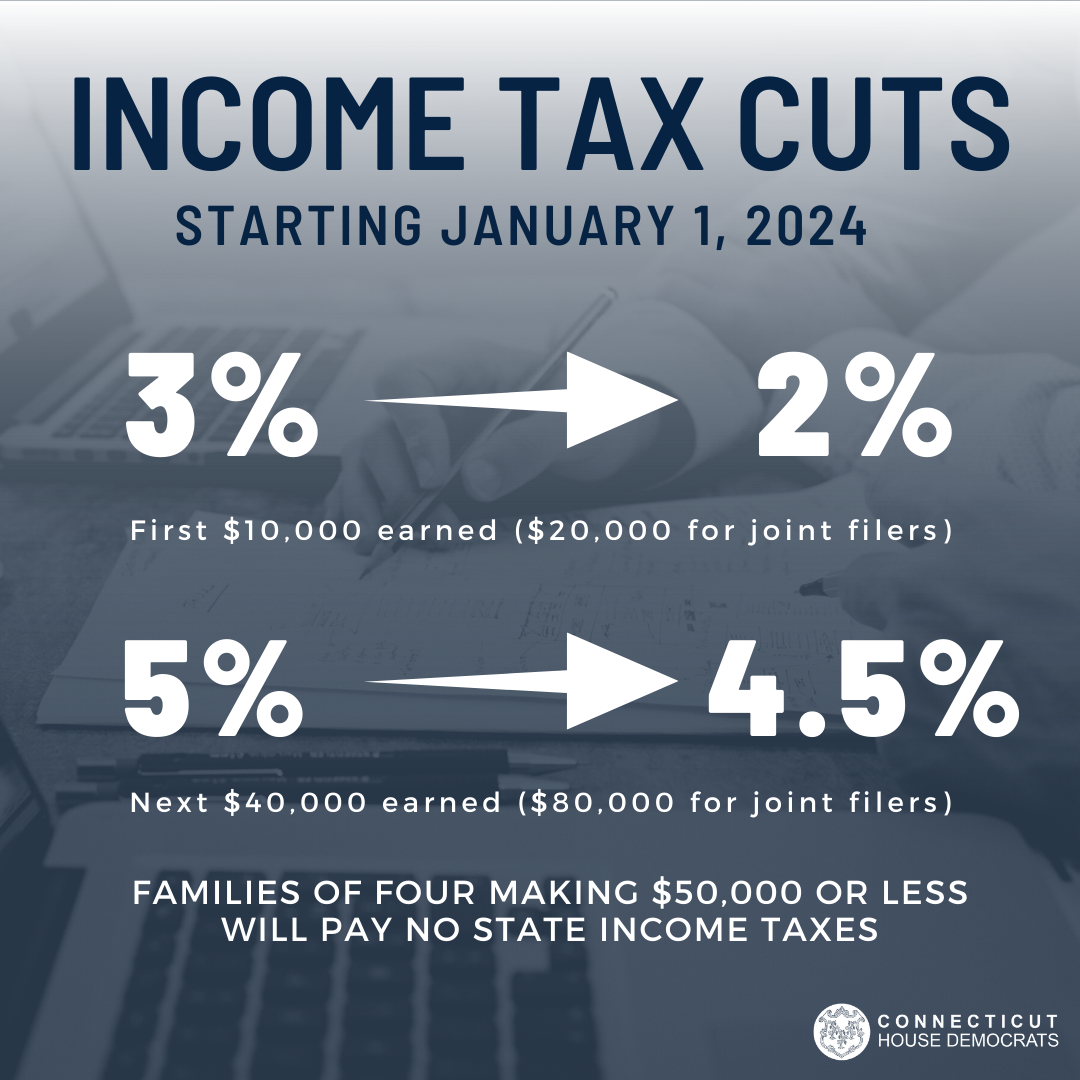

Reduced Tax Brackets

The House GOP plan proposed a reduction in the number of individual income tax brackets, simplifying the tax system while lowering rates for many.

- Bracket Changes: The plan reduced the number of brackets, resulting in lower marginal tax rates across the board compared to previous years. Specific rates varied depending on income level.

- Tax Savings Examples: A family earning $75,000 annually might have experienced a considerable reduction in their tax liability, while those with higher incomes saw more modest savings. The exact amount depended on the specific details of their tax situation (deductions, credits, etc.).

- Keywords: Trump tax cuts individual rates, tax bracket changes, individual income tax reform.

Standard Deduction Increase

A key element of the Trump tax cuts was a substantial increase in the standard deduction. This impacted many taxpayers, especially those with lower to middle incomes.

- New Standard Deduction Amounts: The standard deduction amounts were significantly raised for single, married filing jointly, and head-of-household filers. For example, the standard deduction for single filers was substantially increased, while married couples saw a proportionate increase.

- Comparison to Previous Amounts: The increase represented a considerable jump compared to previous years, impacting the number of taxpayers who itemized their deductions. Many who previously itemized found the standard deduction more advantageous.

- Keywords: Increased standard deduction, Trump tax reform standard deduction, standard deduction increase.

Child Tax Credit Expansion

The proposed tax plan also featured an expansion of the child tax credit, providing greater relief to families.

- Increased Credit Amount: The maximum amount of the child tax credit was increased, offering more financial assistance to families with children.

- Eligibility Requirements: While the eligibility requirements remained largely unchanged, the increased credit amount benefited a wider range of families.

- Impact on Families: This expansion aimed to provide significant tax relief to families, particularly those with multiple children.

- Keywords: Child tax credit expansion, Trump tax plan child tax credit, child tax credit increase.

Corporate Tax Rate Reduction

The Trump tax cuts also included substantial changes to corporate taxation.

Lower Corporate Tax Rate

A significant feature of the plan was a drastic reduction in the corporate tax rate.

- New Corporate Tax Rate: The plan dramatically lowered the corporate tax rate from its previous level, making the US more competitive globally, proponents argued.

- Comparison to Previous Rates: This represented a major shift in US tax policy, aiming to stimulate business investment and job creation.

- Impact on Business Investment: The expectation was that this reduction would lead to increased business investment and ultimately boost economic growth.

- Keywords: Corporate tax rate cut, Trump tax cuts corporate tax, corporate tax reform.

Pass-Through Businesses

The plan also addressed the taxation of pass-through businesses, such as S-corporations and partnerships.

- Deduction Options: The plan offered various deduction options for pass-through businesses, aiming to simplify taxation and provide tax relief.

- Benefits and Drawbacks: While the changes aimed to benefit these businesses, the complexity of the new rules led to some debate about their actual impact.

- Keywords: Pass-through business taxation, Trump tax cuts pass-through entities, pass-through business tax reform.

Economic Impact and Consequences

The Trump tax cuts sparked considerable debate regarding their economic consequences.

Projected Economic Growth

Proponents argued the tax cuts would stimulate economic growth through increased investment and job creation.

- Arguments for Increased Investment: Lower taxes were expected to incentivize businesses to invest more, leading to job growth and higher wages.

- Potential Inflationary Pressures: However, critics warned that the tax cuts could lead to inflationary pressures, potentially eroding any gains in real income.

- Keywords: Trump tax cuts economic impact, tax cuts and economic growth, economic effects of tax cuts.

National Debt Implications

A major concern surrounding the Trump tax cuts was their potential impact on the national debt.

- Projected Increase in the Deficit: The tax cuts were projected to significantly increase the federal budget deficit, leading to concerns about long-term fiscal sustainability.

- Long-Term Fiscal Sustainability Concerns: The increased deficit raised questions about the ability of the government to meet its future obligations.

- Keywords: Trump tax cuts national debt, fiscal impact of tax cuts, national debt and tax cuts.

Conclusion

The House GOP tax plan under the Trump administration represented a sweeping restructuring of the US tax code, impacting individuals and corporations alike. While proponents pointed to potential economic growth and job creation, opponents highlighted concerns about the national debt and potential inequities. Understanding the key provisions – from the reduced individual tax brackets and expanded child tax credits to the significantly lower corporate tax rate – remains crucial for anyone seeking to navigate the complexities of post-Trump tax law. To learn more about the long-term effects and further details of the Trump tax cuts and their impact on your specific financial situation, consult with a qualified tax professional. Researching the specifics of the Trump tax cuts will ensure you're well-informed about this landmark legislation.

Featured Posts

-

Tory Lanez Stabbed In Prison Report Details Emergency Hospital Transport

May 13, 2025

Tory Lanez Stabbed In Prison Report Details Emergency Hospital Transport

May 13, 2025 -

Navi Mumbai News Nmmcs Aala Unhala Niyam Pala Campaign Tackles Heatwave

May 13, 2025

Navi Mumbai News Nmmcs Aala Unhala Niyam Pala Campaign Tackles Heatwave

May 13, 2025 -

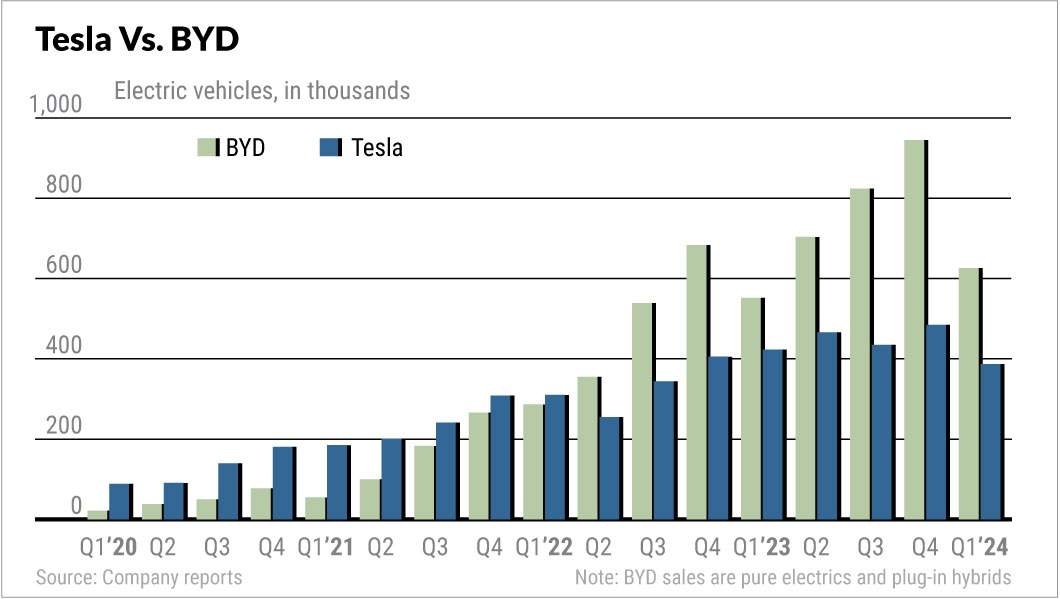

Byd Vs Tesla Trumpin Rooli Kilpailussa

May 13, 2025

Byd Vs Tesla Trumpin Rooli Kilpailussa

May 13, 2025 -

Vittoria Ceretti And Leonardo Di Caprio A Low Key Met Gala Arrival

May 13, 2025

Vittoria Ceretti And Leonardo Di Caprio A Low Key Met Gala Arrival

May 13, 2025 -

James Cordens Comeback Teaming Up With Sir Ian Mc Kellen And A Baby Reindeer Star

May 13, 2025

James Cordens Comeback Teaming Up With Sir Ian Mc Kellen And A Baby Reindeer Star

May 13, 2025