Trump Tax Bill Passes House: Key Changes And Implications

Table of Contents

The landmark Trump tax bill's passage through the House represents a monumental shift in US tax legislation. This article dissects the key changes, analyzing their implications for individuals, businesses, and the overall economy. We'll explore potential benefits and drawbacks, offering clarity on what this means for taxpayers and the nation's financial future.

Individual Tax Changes

Changes to Income Tax Brackets

The Trump tax bill significantly altered income tax brackets. While specific rates varied depending on the version of the bill, the general trend involved a reduction in the number of brackets and adjustments to the rates themselves. For instance:

- Higher-income earners: May have seen reduced tax rates in some brackets, potentially leading to significant tax savings.

- Lower-income earners: Might have experienced minor changes, with some brackets potentially experiencing slight rate increases or decreases.

- Middle-income earners: Experienced a more complex impact, depending on their specific income level and deductions.

The impact on taxpayers varied drastically depending on their income bracket. High-income individuals benefited the most from lower rates, while the effects on lower and middle-income taxpayers were more nuanced and required a detailed analysis of individual circumstances.

Standard Deduction and Itemized Deductions

The bill also made considerable changes to the standard deduction and itemized deductions. These changes impacted how taxpayers reduced their taxable income:

- Increased Standard Deduction: The standard deduction amount was significantly increased, benefiting many taxpayers. This simplification meant fewer people needed to itemize.

- Limitations on Itemized Deductions: Limits were placed on certain itemized deductions, such as state and local tax (SALT) deductions. This impacted taxpayers who previously relied heavily on these deductions to lower their tax burden.

- Impact on Charitable Giving: Changes to itemized deductions could potentially discourage charitable giving, as the incentive to itemize was reduced for many taxpayers.

The interplay between the increased standard deduction and the limitations on itemized deductions had a cascading effect, influencing many taxpayers' tax strategies.

Child Tax Credit Modifications

The child tax credit also underwent modifications under the Trump tax bill. Changes included:

- Increased Credit Amount: The maximum credit amount was increased.

- Expanded Eligibility: Eligibility requirements may have been broadened.

- Partial Refundability: The bill may have introduced partial refundability for the child tax credit, benefiting low-income families.

These changes significantly impacted families with children, potentially offering substantial tax relief, especially to low and middle-income households.

Corporate Tax Rate Reductions

Impact on Business Investment

The most significant change for businesses was the reduction in the corporate tax rate. This decrease was intended to stimulate:

- Increased Business Investment: Lower tax rates theoretically incentivize businesses to invest more in expansion, equipment, and job creation.

- Enhanced Corporate Profitability: Reduced tax burdens directly boosted corporate profitability, potentially leading to higher stock prices and dividends.

- Potential Downsides: Concerns existed about the potential for increased national debt due to lower corporate tax revenue.

While proponents argued for significant economic growth, critics raised concerns about the long-term fiscal implications.

International Tax Implications

The bill also introduced changes to international tax rules impacting multinational corporations:

- Repatriation of Foreign Profits: Changes may have encouraged the repatriation of profits held overseas, increasing domestic investment.

- Tax Havens: Measures aimed at curbing the use of tax havens were incorporated.

These changes reshaped the landscape for multinational companies, potentially impacting their global strategies and tax planning.

Long-Term Economic Implications

National Debt and Deficit

A major concern surrounding the Trump tax bill was its potential effect on the national debt and deficit:

- Increased Deficit: The significant tax cuts led to projections of a larger budget deficit.

- Long-Term Fiscal Sustainability: Concerns were raised regarding the long-term fiscal sustainability of the US government.

- Economic Expert Opinions: Various economic experts offered divergent projections, reflecting the complexity of the issue.

The debate about the long-term fiscal impact continues, with economists offering differing perspectives.

Economic Growth Projections

The bill's proponents predicted significant economic growth:

- Increased Economic Activity: The tax cuts were intended to boost economic activity through increased investment and consumer spending.

- Job Creation: Job creation was a key argument in favor of the tax cuts.

- Inflationary Pressures: The potential for increased inflation was also a concern. Economic models produced conflicting predictions.

The actual effects on economic growth, inflation, and job creation remained subjects of ongoing debate and analysis.

Conclusion

The Trump tax bill, upon passing the House, introduced sweeping changes to the US tax code. These changes affected individual tax brackets, standard deductions, the child tax credit, corporate tax rates, and international tax rules. While proponents argued for increased economic growth and job creation, critics raised concerns about the potential impact on the national debt and deficit. The long-term effects of these changes are still unfolding and require continued monitoring and analysis.

Understanding the intricacies of the newly passed Trump tax bill is crucial for taxpayers and businesses alike. Stay informed about upcoming regulations and their effects by following news and updates on the Trump tax bill and its implementation. Consult with a tax professional to determine how these changes specifically affect your financial situation.

Featured Posts

-

Big Rig Rock Report 3 12 Big 100 Trucking Industry Update

May 23, 2025

Big Rig Rock Report 3 12 Big 100 Trucking Industry Update

May 23, 2025 -

Holly Willoughbys Itv Exit Whats Next For The Network

May 23, 2025

Holly Willoughbys Itv Exit Whats Next For The Network

May 23, 2025 -

Medical Research Paper Details Egan Bernals Recovery From Critical Injuries

May 23, 2025

Medical Research Paper Details Egan Bernals Recovery From Critical Injuries

May 23, 2025 -

Netflix Cobra Kai Unveiling The Karate Kid Connection

May 23, 2025

Netflix Cobra Kai Unveiling The Karate Kid Connection

May 23, 2025 -

Rio Tinto Rebuts Forrests Wasteland Claims Pilbaras Future Defended

May 23, 2025

Rio Tinto Rebuts Forrests Wasteland Claims Pilbaras Future Defended

May 23, 2025

Latest Posts

-

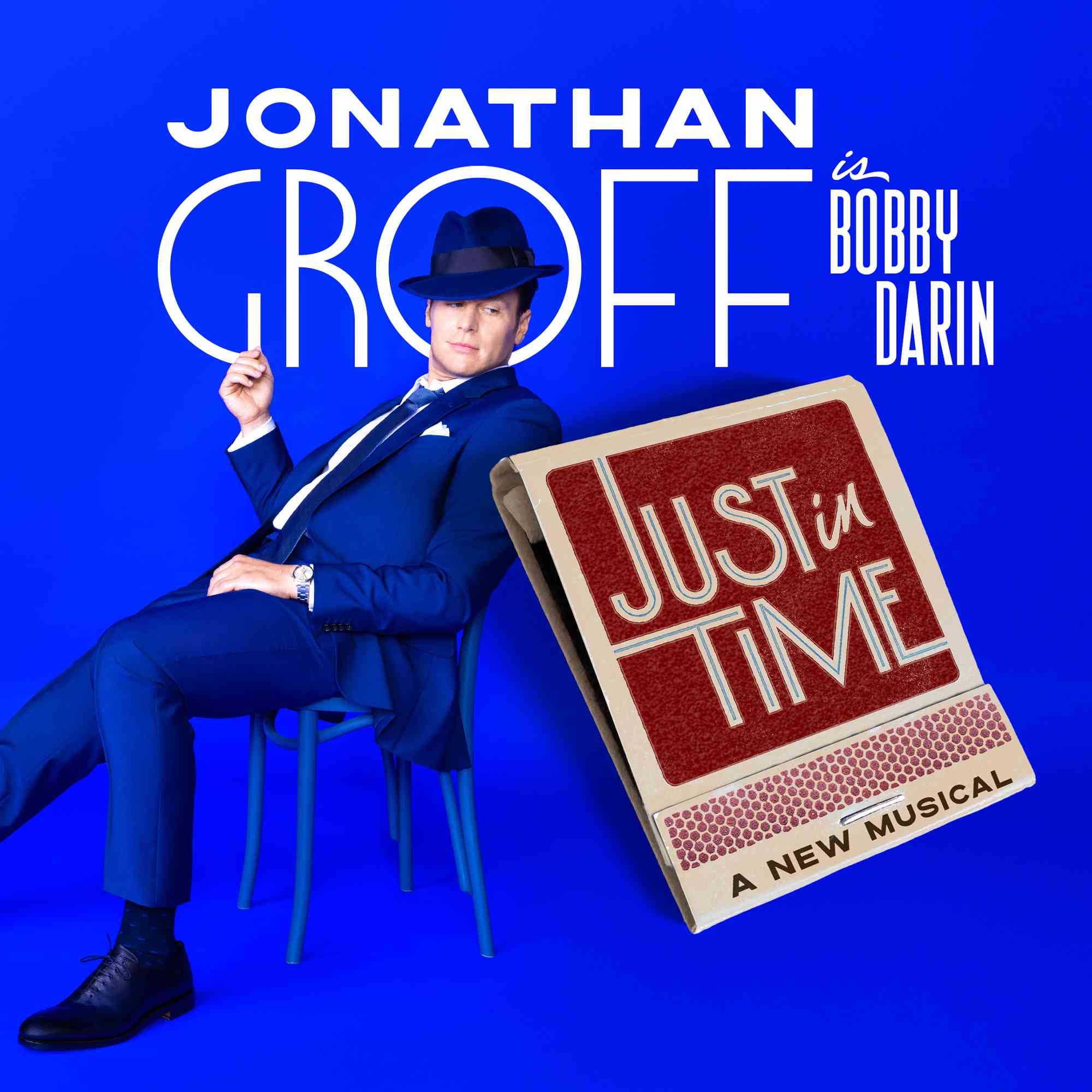

Broadway Buzz Jonathan Groffs Just In Time And The Intensity Of Channeling Bobby Darin

May 23, 2025

Broadway Buzz Jonathan Groffs Just In Time And The Intensity Of Channeling Bobby Darin

May 23, 2025 -

Jonathan Groffs Just In Time Performance Bobby Darin And The Raw Energy Of Live Theatre

May 23, 2025

Jonathan Groffs Just In Time Performance Bobby Darin And The Raw Energy Of Live Theatre

May 23, 2025 -

Jonathan Groff On Just In Time Channeling Bobby Darin And The Power Of Performance

May 23, 2025

Jonathan Groff On Just In Time Channeling Bobby Darin And The Power Of Performance

May 23, 2025 -

Jonathan Groff Channels Bobby Darin In Just In Time A Primal Need To Perform

May 23, 2025

Jonathan Groff Channels Bobby Darin In Just In Time A Primal Need To Perform

May 23, 2025 -

Jonathan Groffs Just In Time Opening Night Lea Michele And Fellow Stars Celebrate

May 23, 2025

Jonathan Groffs Just In Time Opening Night Lea Michele And Fellow Stars Celebrate

May 23, 2025