Trump Reassures Markets: No Plans To Dismiss Fed Chair Powell

Table of Contents

Trump's Statements and Market Reaction

Trump's seemingly altered stance on Powell followed a period of significant market turbulence. While the President has previously voiced his displeasure with Powell's interest rate hikes, his recent comments have been more conciliatory. Although specific quotes can vary depending on the source and date, the overall message has been one of a lessened immediate threat to Powell's position. For instance, reports suggested a shift from overt criticism to a more measured tone, emphasizing the need for a collaborative approach.

The immediate market response to these reassurances was largely positive. The stock market rallied, indicating investor confidence in the continued stability of the Federal Reserve's leadership. Bond yields, which had previously risen due to uncertainty, saw a slight decrease, reflecting reduced risk aversion.

- Specific quote from Trump regarding Powell's job security: (Insert a verifiable quote here if available. If not, paraphrase a reliable news report.) For example: "While I have my disagreements with Chairman Powell on monetary policy, I am not planning to replace him at this time." (This is a hypothetical example; use an actual quote if possible).

- Stock market indices' performance following the statements: (Cite specific index performance data, e.g., "The Dow Jones Industrial Average rose by X points following the announcement.")

- Changes in bond yields and other market indicators: (Provide data on changes in bond yields, the VIX volatility index, etc.)

The positive market reaction stemmed from the perceived reduction in uncertainty. Investors fear unpredictable political interference in the Fed's operations, as such interference can lead to erratic monetary policy and market instability. Trump's apparent backing down, however temporary, removed this immediate source of anxiety.

The Importance of Fed Chair Independence

The Federal Reserve's independence is a cornerstone of a healthy and stable US economy. The Fed's ability to make decisions based on economic data and analysis, free from political pressure, is crucial for controlling inflation, managing interest rates, and ensuring the stability of the financial system.

Political interference in the Fed's decision-making process carries significant risks:

- Impact of political pressure on interest rate decisions: Politically motivated interest rate decisions can lead to misallocation of capital and economic distortion.

- Risk of inflation or deflation due to political influence: Attempts to manipulate interest rates for short-term political gain can lead to long-term economic instability, causing either runaway inflation or damaging deflation.

- Damage to the credibility and reputation of the Federal Reserve: Political interference erodes public trust in the Fed's impartiality and expertise.

Trump's reassurances, while potentially short-lived, contribute to maintaining, at least temporarily, the perception of Fed independence. Conversely, any indication of a more direct threat to Powell's job security could severely damage market confidence and the Fed's credibility.

The Future of Monetary Policy under Trump and Powell

Despite the apparent truce, the future trajectory of monetary policy under Trump and Powell remains uncertain. While Trump's recent statements suggest a less confrontational approach, potential areas of disagreement persist. These disagreements could relate to:

- Prediction of future interest rate hikes or cuts: The Fed's decisions on interest rate adjustments will continue to depend on economic indicators and the ongoing global economic climate.

- Potential changes in quantitative easing or other monetary policy tools: The Fed may adjust its quantitative easing strategy depending on economic developments.

- Likelihood of future conflicts between the executive branch and the Federal Reserve: The potential for future clashes remains, especially as economic conditions evolve and political priorities shift.

Analyzing Trump's Motives

Trump's seemingly changed attitude toward Powell could stem from several factors. The recent market volatility might have prompted a reassessment of the risks associated with a public clash with the Fed Chair. Furthermore, political considerations, such as upcoming elections and the need to maintain a stable economy, may also have played a significant role.

Conclusion

President Trump's recent reassurances regarding Federal Reserve Chairman Jerome Powell have, for now, calmed market anxieties surrounding a potential dismissal. However, the long-term relationship between the executive branch and the independent Federal Reserve remains a crucial factor influencing economic stability. Understanding the intricacies of the Trump Powell Fed Chair dynamic is essential for navigating the complexities of the current economic landscape. Stay informed on further developments by following our updates on the evolving relationship between the President and the Federal Reserve Chair. Continue to monitor the situation and understand the implications of Trump Powell Fed Chair news for your investment decisions.

Featured Posts

-

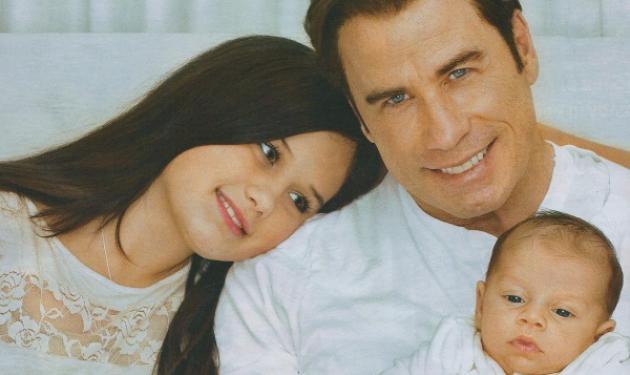

John Travoltas Daughter Ella Bleu Unveils A Breathtaking New Look

Apr 24, 2025

John Travoltas Daughter Ella Bleu Unveils A Breathtaking New Look

Apr 24, 2025 -

Golden States Bench Duo Hield And Payton Key To Win Vs Portland

Apr 24, 2025

Golden States Bench Duo Hield And Payton Key To Win Vs Portland

Apr 24, 2025 -

I Sygklonistiki Anartisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Sygklonistiki Anartisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025 -

Sk Hynixs Ai Fueled Dominance In The Dram Industry

Apr 24, 2025

Sk Hynixs Ai Fueled Dominance In The Dram Industry

Apr 24, 2025 -

Ai And Blockchain Converge Chainalysiss Strategic Acquisition Of Alterya

Apr 24, 2025

Ai And Blockchain Converge Chainalysiss Strategic Acquisition Of Alterya

Apr 24, 2025