Trump Issues 10% Tariff Baseline Warning

Table of Contents

Understanding the 10% Tariff Baseline Warning

The 10% tariff baseline warning, while not a formally implemented tariff, signifies a serious potential threat. It essentially serves as a declaration of intent, indicating the administration's willingness to impose tariffs at this level or higher on a range of imported goods. This announcement followed [insert specific event or circumstance that led to the warning, e.g., trade negotiations with a specific country, concerns about national security]. The scope of this warning is broad, encompassing various sectors and potentially impacting a wide range of goods, including, but not limited to, steel, aluminum, consumer electronics, and agricultural products.

- Target industries affected: Manufacturing, agriculture, retail, and technology.

- Potential impact on import/export businesses: Increased costs, reduced competitiveness, potential losses, and supply chain disruptions.

- Geopolitical implications: Strained relationships with trading partners, potential retaliatory tariffs, and increased trade tensions.

Economic Impacts of the 10% Tariff Baseline

A 10% tariff baseline could significantly impact the economy. Inflation is a major concern. Depending on the specific goods affected and the elasticity of demand, consumer prices could increase by a noticeable margin. For instance, a 10% tariff on imported steel could lead to a corresponding increase in the price of cars and appliances.

The influence on international trade could be dramatic. Other countries might retaliate with their own tariffs, leading to a trade war and harming global economic growth. This could disrupt established trade relationships, potentially leading to the reshaping of global supply chains. Businesses face increased costs, potentially leading to job losses as companies struggle to remain competitive. Some may even consider relocating production to avoid the tariffs.

- Consumer price increases: A potential increase in the price of a wide range of goods, from consumer electronics to food products.

- Impact on specific industries: Manufacturing (especially those relying on imported raw materials), agriculture (for imported fertilizers or machinery), and retail (due to increased import costs).

- Potential job displacement: Job losses in industries heavily reliant on imports, potentially affecting both blue-collar and white-collar workers.

- Retaliatory tariffs from other nations: A potential escalation of trade tensions, leading to reciprocal tariffs and further economic damage.

Responses to the Trump 10% Tariff Baseline Warning

Businesses are responding in various ways. Many are exploring alternative sourcing options, shifting their supply chains away from affected countries. Others are adjusting their pricing strategies to absorb some of the increased costs, while some are lobbying the government to reconsider the tariff policy.

Governmental responses vary. Some governments may offer financial aid or subsidies to affected businesses to help them weather the storm. Trade negotiations are also likely to intensify as countries attempt to mitigate the negative impacts of the tariffs. Consumers, facing potentially higher prices, may adjust their purchasing habits, opting for cheaper alternatives or reducing overall consumption.

- Business strategies for mitigating tariff impacts: Diversifying sourcing, price adjustments, lobbying, and automation.

- Governmental support measures: Financial aid for businesses, trade negotiations, and potential renegotiation of trade agreements.

- Consumer behavior changes: Reduced consumption, increased demand for domestically produced goods, and shifts in purchasing preferences.

Long-Term Implications of the Tariff Warning

The long-term implications of this 10% tariff baseline warning are significant. It could lead to a fundamental shift in global supply chains, as businesses seek to reduce their reliance on imports from affected regions. This could also have a long-term effect on economic growth, potentially slowing down global expansion and hindering innovation. Finally, the sustainability of such tariffs in the long run remains questionable. The ongoing trade tensions and potential retaliatory measures could destabilize the global economy.

- Shift in global supply chains: Businesses will likely diversify their sources of raw materials and finished goods.

- Long-term effects on economic growth: Reduced global trade could lead to slower economic growth, impacting job creation and investment.

- Changes in international trade agreements: Existing trade agreements might be renegotiated, and new ones may emerge to adapt to the changing global trade landscape.

Conclusion: Navigating the Uncertainty of the Trump 10% Tariff Baseline Warning

The potential economic consequences of the "Trump Issues 10% Tariff Baseline Warning" are far-reaching, impacting various sectors and potentially leading to higher consumer prices, job losses, and strained international relations. It's crucial for businesses and consumers to understand the implications of this warning and adapt accordingly. Stay informed about further developments by consulting resources like government websites (e.g., the U.S. Department of Commerce, relevant ministry websites in other countries) and reputable financial news sources. Proactive adaptation and vigilance are key to navigating this complex and evolving economic landscape created by the "Trump Issues 10% Tariff Baseline Warning" and similar trade policy changes.

Featured Posts

-

Ostraya Kritika Trampa I Maska Ot Stivena Kinga

May 10, 2025

Ostraya Kritika Trampa I Maska Ot Stivena Kinga

May 10, 2025 -

Nyt Spelling Bee April 1st 2025 Complete Guide To Solving Todays Puzzle

May 10, 2025

Nyt Spelling Bee April 1st 2025 Complete Guide To Solving Todays Puzzle

May 10, 2025 -

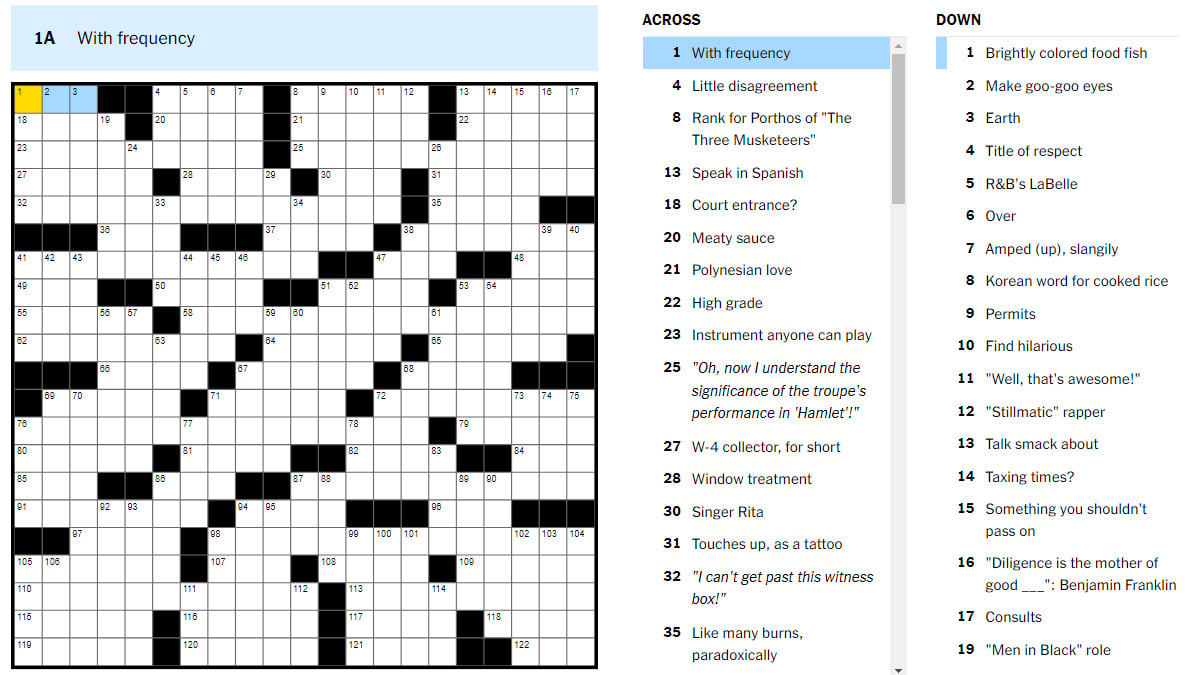

Nyt Crossword April 12 2025 Complete Guide To Solving The Saturday Puzzle

May 10, 2025

Nyt Crossword April 12 2025 Complete Guide To Solving The Saturday Puzzle

May 10, 2025 -

High Potential 5 Compelling Theories About David And The He Morgan Brother

May 10, 2025

High Potential 5 Compelling Theories About David And The He Morgan Brother

May 10, 2025 -

Summer Walker Reveals Perils Of Childbirth

May 10, 2025

Summer Walker Reveals Perils Of Childbirth

May 10, 2025