Trump Endorsement Of XRP: Institutional Investors Take Notice

Table of Contents

The Potential Impact of a Trump Endorsement on XRP's Price

A Trump endorsement of XRP could have seismic effects on its price, triggering both short-term volatility and potentially long-term growth.

Short-Term Price Volatility

News of a Trump endorsement would likely cause immediate market upheaval.

- Increased Trading Volume: We can anticipate a massive surge in trading activity as investors rush to buy or sell XRP.

- Potential Price Surges: A "Trump bump," similar to the price spikes seen after other celebrity endorsements in the crypto space, is highly probable. The sheer volume of speculative buying could drive prices significantly higher.

- Increased Market Speculation: The uncertainty surrounding the endorsement's impact would fuel intense speculation, further driving price fluctuations.

Historical examples, such as Elon Musk's influence on Dogecoin, demonstrate the power of celebrity endorsements to impact crypto prices dramatically. The potential for a similar, and potentially even larger, effect with a Trump endorsement is substantial.

Long-Term Price Implications

Beyond the initial volatility, a Trump endorsement could have significant long-term implications for XRP's value.

- Increased Legitimacy: An endorsement from a prominent figure like Trump could lend XRP a degree of legitimacy, attracting investors who might otherwise be hesitant.

- Enhanced Investor Confidence: This increased legitimacy could boost investor confidence, leading to sustained price growth.

- Potential for Increased Adoption: Wider adoption by businesses and individuals could follow increased institutional investment, further driving up the price.

A Trump administration might also be more open to regulatory frameworks that benefit XRP, potentially fostering a more favorable environment for its growth and increasing its appeal to institutional investors. Furthermore, the endorsement might catalyze partnerships and collaborations that accelerate XRP's adoption.

Institutional Investors' Reaction to a Potential Trump Endorsement

Institutional investors, known for their cautious approach, would likely respond to a Trump endorsement with a mix of caution and opportunity.

Increased Scrutiny and Due Diligence

Despite the potential upside, institutional investors wouldn't blindly jump in.

- Thorough Risk Assessments: They'd conduct extensive due diligence, analyzing the risks associated with XRP and the potential impact of a Trump endorsement.

- Increased Regulatory Compliance Checks: Concerns about regulatory uncertainty would lead to meticulous checks to ensure compliance with all applicable laws.

- Diversified Investment Strategies: Institutional investors would likely incorporate XRP into their portfolios strategically, diversifying their holdings to mitigate risks.

The inherent volatility of the cryptocurrency market and the regulatory uncertainty surrounding cryptocurrencies in general are key concerns for institutional investors. They require solid risk mitigation strategies.

Potential for Increased Investment

However, if the endorsement is seen as a positive signal, it could unlock significant institutional investment.

- Diversification of Portfolios: XRP, with its low transaction fees and high transaction speeds, offers an attractive addition to diversified portfolios.

- Allocation of Funds towards Emerging Crypto Assets: Institutional investors are constantly seeking opportunities in emerging markets, and XRP could become a focal point.

- Long-Term Strategic Investment: Some institutional investors may view a Trump endorsement as a signal of long-term growth potential, leading to strategic, long-term investments.

The advantages of XRP, such as its speed and efficiency compared to other cryptocurrencies, make it a compelling asset for institutional investors looking to leverage blockchain technology.

Analyzing the Political and Economic Context

Understanding Trump's past stances on crypto and the broader geopolitical implications is crucial.

Trump's Stance on Cryptocurrencies

Trump's past statements on digital assets offer some insights, though they aren't entirely consistent.

- Support for Blockchain Technology: He has expressed some interest in and understanding of the potential benefits of blockchain technology.

- Potential Criticisms of Centralized Financial Systems: His past rhetoric suggests a potential preference for decentralized systems, which could align with his potential support for XRP.

However, inconsistencies exist between his past statements and a potential endorsement of a specific cryptocurrency. A thorough analysis of his motivations and policy positions is necessary to fully understand the implications.

Geopolitical Implications

A Trump endorsement of XRP would carry significant geopolitical implications.

- US Dominance in the Crypto Space: It could reinforce the US's position as a leader in the cryptocurrency market.

- Impact on International Relations: It could impact US relations with countries that have differing regulatory approaches to cryptocurrencies.

- Competition with Other Cryptocurrencies: It would likely intensify competition among various cryptocurrencies, potentially leading to market consolidation.

This endorsement could fundamentally shift the global balance in the crypto market, potentially creating new alliances and rivalries among nations.

Conclusion: Trump Endorsement of XRP: A Turning Point for Institutional Investment?

A potential Trump endorsement of XRP could dramatically impact its price, prompting significant short-term volatility and potentially long-term growth. Institutional investors would respond cautiously, conducting thorough due diligence, but the potential for increased investment is significant given XRP's advantages. The political and geopolitical ramifications of such an endorsement are substantial, potentially reshaping the global crypto landscape.

Key Takeaway: The potential Trump endorsement of XRP represents a pivotal moment. Its outcome could significantly affect the price of XRP, investor confidence, and the overall trajectory of the cryptocurrency market. It presents both considerable risk and immense potential reward.

Call to Action: Stay tuned for further updates on the potential Trump endorsement of XRP and how it could reshape the landscape of institutional investment in cryptocurrencies. Follow us for the latest news and analysis on this developing story and its implications for the future of XRP and the broader crypto market.

Featured Posts

-

Rogues Place In The Marvel Universe Avenger Or Mutant

May 08, 2025

Rogues Place In The Marvel Universe Avenger Or Mutant

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Jary

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Jary

May 08, 2025 -

Canada Post On The Brink Another Strike Possible This Month

May 08, 2025

Canada Post On The Brink Another Strike Possible This Month

May 08, 2025 -

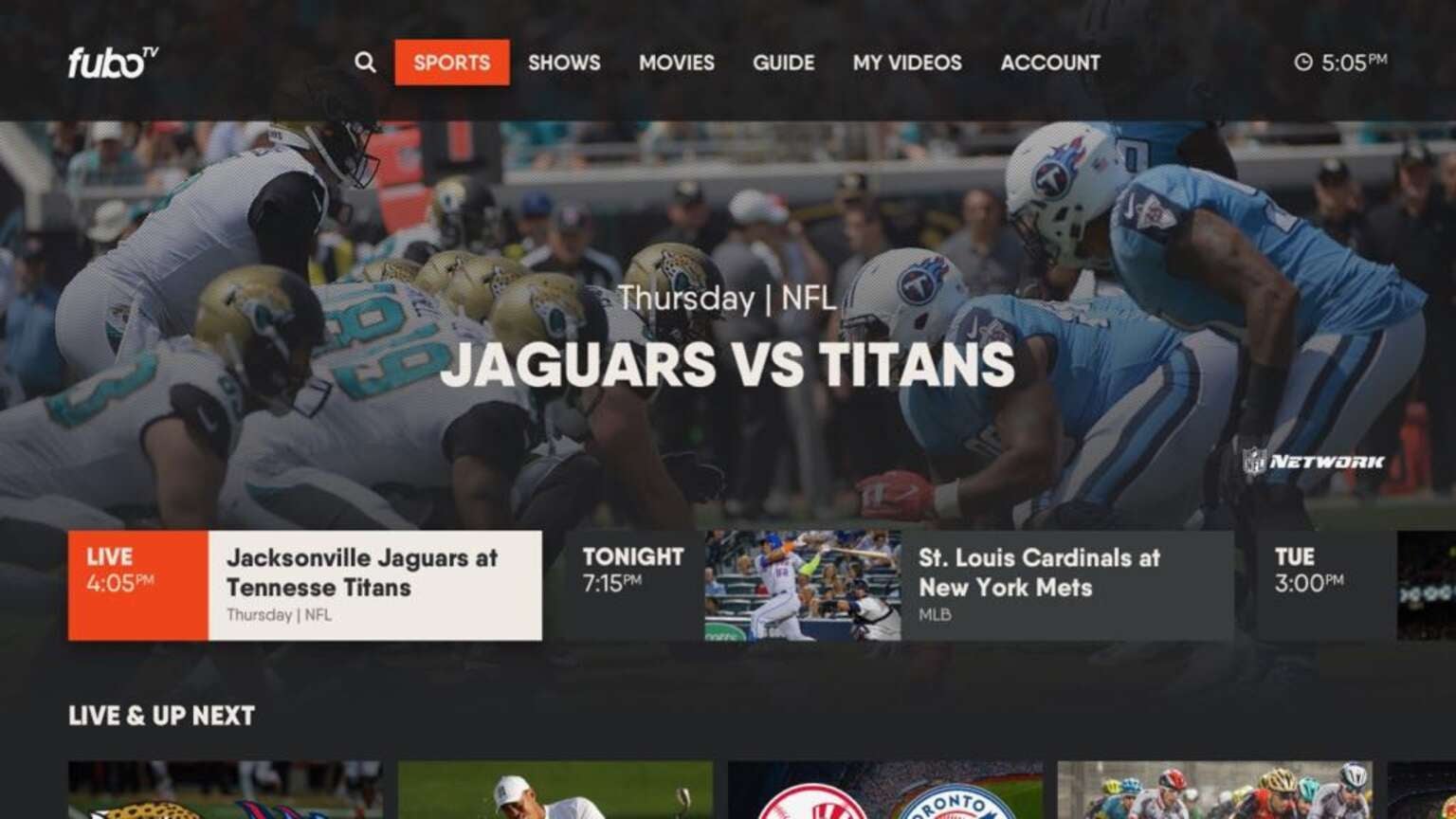

How To Stream Los Angeles Angels Baseball Games Without Cable Tv In 2025

May 08, 2025

How To Stream Los Angeles Angels Baseball Games Without Cable Tv In 2025

May 08, 2025 -

T Mobile Hit With 16 Million Fine Over Three Years Of Data Breaches

May 08, 2025

T Mobile Hit With 16 Million Fine Over Three Years Of Data Breaches

May 08, 2025