Trump Appointee's Bold Bitcoin Prediction Following Market Volatility

Table of Contents

The Appointee's Prediction and its Context

The prediction originates from [Appointee's Name], a former [Appointee's Former Position] under the Trump administration. Known for [brief description of their financial expertise or relevant experience], [Appointee's Name] has previously [mention any previous statements on cryptocurrencies or related financial markets]. Their recent statement, made on [Date], boldly predicts that Bitcoin will [State the exact prediction, e.g., reach $100,000 by the end of 2024, experience a significant price correction, etc.]. This long-term/short-term (specify) Bitcoin prediction follows a period of significant market fluctuation, marked by [mention specific market events that led to the prediction, e.g., recent price drops, regulatory announcements, etc.].

- Appointee's Name: [Appointee's Name]

- Former Position: [Appointee's Former Position]

- Exact Wording of the Bitcoin Prediction: [Quote the prediction as accurately as possible]

- Date of the Prediction: [Date]

- Relevant Market Conditions: [Detailed description of market conditions, including specific price movements, regulatory news, or other relevant events]

Analysis of the Prediction's Validity

Analyzing the validity of this Bitcoin prediction requires careful consideration of various factors. While [mention supporting arguments, e.g., increasing adoption rates, institutional investment, technological advancements like the Lightning Network] might support a bullish outlook, several counterarguments exist. Concerns surrounding [mention counterarguments, e.g., regulatory uncertainty, macroeconomic headwinds, potential for further price corrections] could significantly impact Bitcoin's price trajectory. Experts remain divided. [Mention specific expert opinions and their reasoning, citing sources if possible]. The prediction's accuracy hinges on the interplay of these factors, making it challenging to definitively assess its validity.

- Supporting Arguments: [List bullet points with supporting evidence for the prediction]

- Counterarguments: [List bullet points with counterarguments and evidence against the prediction]

- Expert Opinions: [Summarize expert opinions, citing sources whenever possible]

Implications for Bitcoin Investors

This bold Bitcoin prediction has significant implications for investors. Depending on their risk tolerance and investment timeline, different strategies are appropriate. Conservative investors might choose to [Suggest a conservative strategy, e.g., hold a smaller portion of their portfolio in Bitcoin, diversify heavily into other asset classes], while moderate investors might consider [Suggest a moderate strategy, e.g., maintaining their current Bitcoin holdings, carefully monitoring market developments]. Aggressive investors might see this as an opportunity to [Suggest an aggressive strategy, e.g., increase their Bitcoin holdings, considering it a potential buying opportunity]. Regardless of the chosen strategy, risk management is crucial.

- Conservative Investment Strategy: [Detailed description of a conservative approach]

- Moderate Investment Strategy: [Detailed description of a moderate approach]

- Aggressive Investment Strategy: [Detailed description of an aggressive approach]

- Importance of Due Diligence: Thorough research and understanding of market dynamics are paramount before making any investment decisions.

Alternative Cryptocurrencies and Market Diversification

Diversification is key to mitigating risk in the volatile cryptocurrency market. While Bitcoin dominates the market, investing solely in it exposes investors to significant risk. A well-diversified portfolio should include alternative cryptocurrencies (altcoins) with different functionalities and use cases. This approach helps to reduce the impact of any single cryptocurrency's price fluctuations on the overall portfolio performance. Researching and carefully selecting altcoins based on their fundamentals and potential is crucial for a successful diversified strategy.

Conclusion

[Appointee's Name]'s bold Bitcoin prediction has sparked considerable debate. While supporting factors exist, significant risks remain. The prediction's validity ultimately depends on the interplay of various market forces. For investors, this underscores the need for careful consideration, risk management, and diversification. Stay informed about the latest developments affecting Bitcoin prediction and make strategic decisions based on your risk tolerance. Don’t forget to conduct your own research before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

A Rogue One Actors Take How Andor Season 2 Will Reshape Star Wars

May 08, 2025

A Rogue One Actors Take How Andor Season 2 Will Reshape Star Wars

May 08, 2025 -

Artis Goesteren Sms Dolandiriciligi Sikayetleri Ne Yapmaliyiz

May 08, 2025

Artis Goesteren Sms Dolandiriciligi Sikayetleri Ne Yapmaliyiz

May 08, 2025 -

Pakistans Global Trade Ahsans Plea For Tech Adoption In Manufacturing

May 08, 2025

Pakistans Global Trade Ahsans Plea For Tech Adoption In Manufacturing

May 08, 2025 -

Ethereum Price Holds Above Key Support Could 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could 1 500 Be Next

May 08, 2025 -

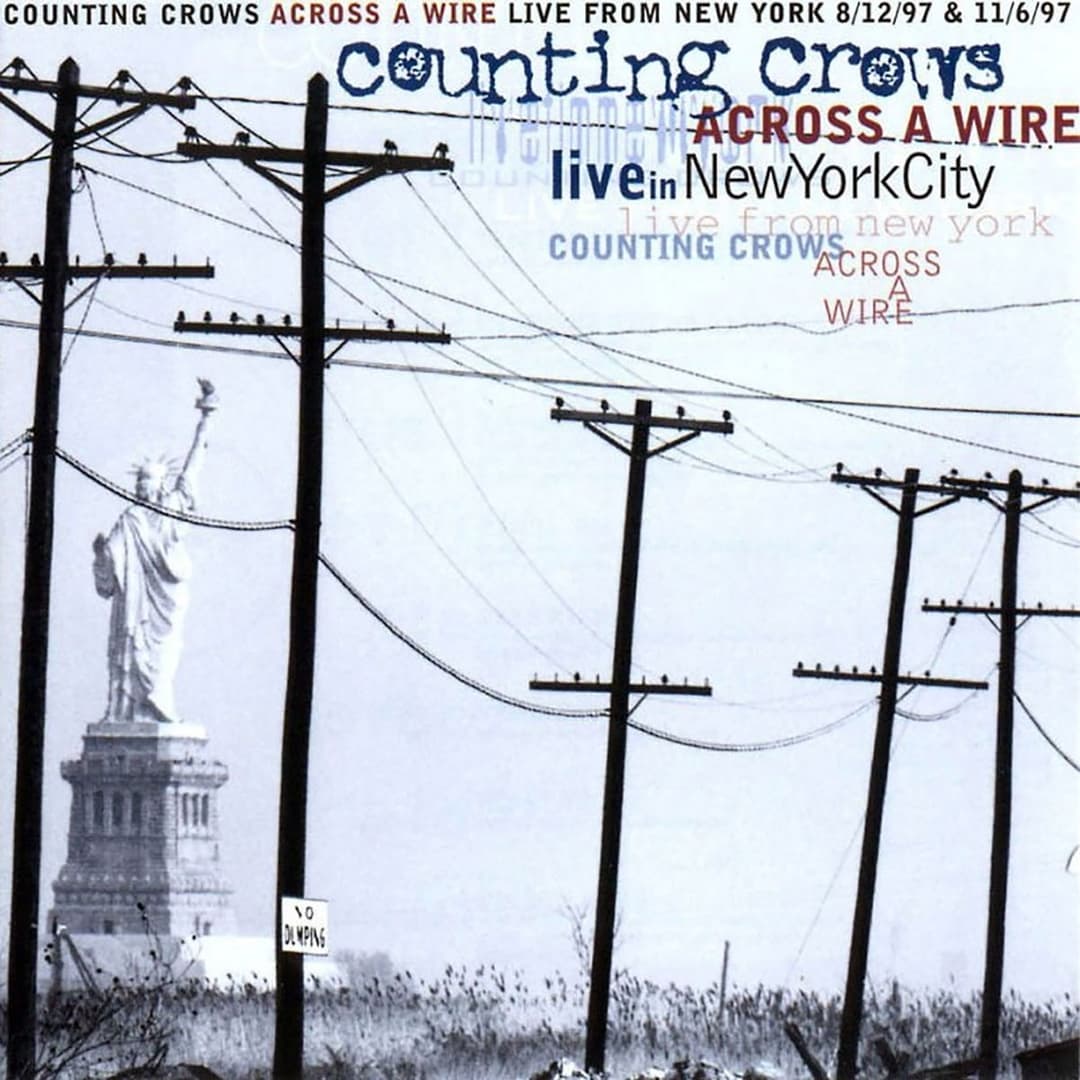

The Significance Of Slip Out Under The Aurora In Counting Crows Discography

May 08, 2025

The Significance Of Slip Out Under The Aurora In Counting Crows Discography

May 08, 2025