Trump Administration's Approval Of Nippon-U.S. Steel Deal: What It Means

Table of Contents

Details of the Nippon-U.S. Steel Deal

The merger agreement between Nippon Steel Corporation and U.S. Steel Corporation resulted in a significant consolidation within the global steel industry. Driven by a desire to enhance competitiveness and achieve synergies, both companies saw the merger as a strategic move to navigate challenging market conditions. The combined entity created a steel behemoth with a vastly expanded global reach and market share.

- Market share implications: The combined company now holds a substantially larger share of the global steel market, impacting both domestic and international competition.

- Geographic reach of the combined company: The merger significantly expanded the geographic footprint, providing access to new markets and resources. This global presence allows for greater diversification and reduced reliance on any single market.

- Synergies and anticipated cost savings: The primary justification for the merger was to realize substantial synergies through economies of scale, streamlining operations, and optimizing resource allocation. These cost savings were projected to improve profitability and competitiveness.

Trump Administration's Rationale for Approval

The Trump administration's approval of the Nippon-U.S. Steel deal was based on several factors, including projected job creation, a boost to domestic steel production, and considerations of national security. While concerns about reduced competition existed, the administration weighed these against the potential benefits. Specific conditions were likely imposed to mitigate any negative impacts.

- Job creation promises: The merger was presented as a means to secure and potentially create American jobs within the steel industry. This was a key factor in the administration's decision-making process.

- Boost to domestic steel production: Increased production capacity and efficiency were anticipated, strengthening the domestic steel industry's position in the global market.

- Impact on American competitiveness in the global steel market: The administration viewed the merger as a way to improve the competitiveness of American steel producers against foreign rivals, particularly in light of global trade dynamics.

Economic Impact of the Nippon-U.S. Steel Deal

The economic consequences of the Nippon-U.S. Steel deal are multifaceted and complex. While proponents claimed benefits like job creation, critics raised concerns about potential job losses in competing firms, price increases, and reduced competition.

- Job displacement in competing steel companies: Smaller steel producers faced potential challenges due to increased competition from the newly formed giant, potentially leading to job losses and business closures.

- Potential price increases for steel products: Concerns arose regarding the potential for higher steel prices due to reduced competition, impacting downstream industries and consumers.

- Impact on small and medium-sized businesses reliant on steel: Businesses using steel as a key input material were vulnerable to price hikes and supply chain disruptions resulting from the merger.

Political and Geopolitical Implications

The Nippon-U.S. Steel deal has significant political and geopolitical implications, particularly regarding US-Japan trade relations and global steel market dynamics. The deal's approval reflected the complex interplay of economic and strategic considerations.

- Strengthening of US-Japan economic ties: The merger signified a strengthening of economic ties between the U.S. and Japan, reflecting a collaborative approach to global industrial challenges.

- Impact on trade negotiations and tariffs: The deal could influence future trade negotiations and tariff policies, particularly concerning steel imports.

- Shift in global steel production capacity: The combined entity's increased production capacity could shift global steel production dynamics, impacting global supply chains and pricing.

Conclusion

The Nippon-U.S. Steel deal presents a complex picture with both potential benefits and drawbacks. While it promises increased efficiency and competitiveness for the merged entity, concerns remain regarding job displacement, price increases, and reduced competition. Understanding these multifaceted implications is critical for navigating the evolving landscape of the global steel market. Staying informed on further developments concerning this landmark Nippon-U.S. Steel merger and its long-term effects is crucial. Continue to research the impacts of the Nippon-U.S. Steel deal to stay ahead of the curve.

Featured Posts

-

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025 -

Dazi Trump Del 20 Conseguenze Per Nike Lululemon E Altri Brand

May 25, 2025

Dazi Trump Del 20 Conseguenze Per Nike Lululemon E Altri Brand

May 25, 2025 -

Kyle Walkers Night Out Annie Kilner Spotted On Solo Errands

May 25, 2025

Kyle Walkers Night Out Annie Kilner Spotted On Solo Errands

May 25, 2025 -

Zhizn Posle Evrovideniya Sudby Pobediteley Za Poslednee Desyatiletie

May 25, 2025

Zhizn Posle Evrovideniya Sudby Pobediteley Za Poslednee Desyatiletie

May 25, 2025 -

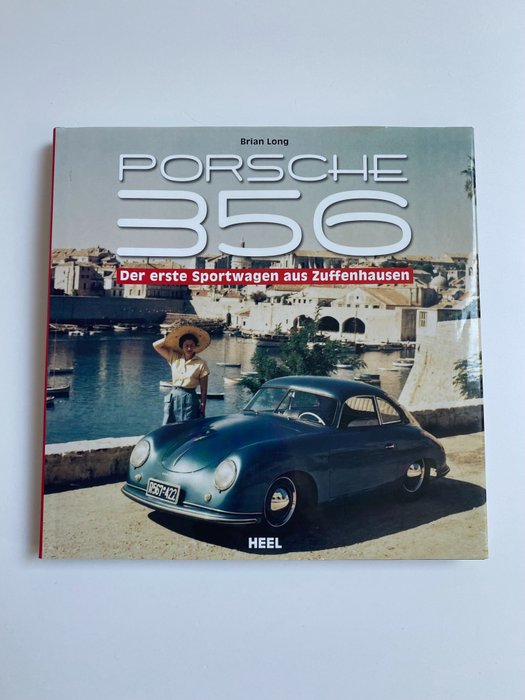

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Latest Posts

-

Top 5 Action Packed Episodes Of Lock Up Season 5 Your Viewing Guide

May 25, 2025

Top 5 Action Packed Episodes Of Lock Up Season 5 Your Viewing Guide

May 25, 2025 -

Dr Terrors House Of Horrors A Review Of The Ultimate Horror Attraction

May 25, 2025

Dr Terrors House Of Horrors A Review Of The Ultimate Horror Attraction

May 25, 2025 -

Lock Up Season 5 5 Action Filled Episodes Tv Guide Review

May 25, 2025

Lock Up Season 5 5 Action Filled Episodes Tv Guide Review

May 25, 2025 -

5 Must See Action Episodes From Lock Up Season 5 A Viewers Guide

May 25, 2025

5 Must See Action Episodes From Lock Up Season 5 A Viewers Guide

May 25, 2025 -

Casting Coriolanus Snow Ralph Fiennes And Kiefer Sutherland In The Spotlight

May 25, 2025

Casting Coriolanus Snow Ralph Fiennes And Kiefer Sutherland In The Spotlight

May 25, 2025