Trade War Resolution? Market Sentiment Following US-China Trade Discussions

Table of Contents

Impact on Global Stock Markets

The US-China trade war has significantly impacted global stock market volatility. Fluctuations in trade negotiations directly correlate with changes in major market indices like the S&P 500, Dow Jones Industrial Average, and the Shanghai Composite. Periods of positive news regarding trade talks often lead to rallies, while negative developments trigger sell-offs and increased uncertainty. This interconnectedness highlights the global nature of financial markets and the pervasive influence of US-China relations.

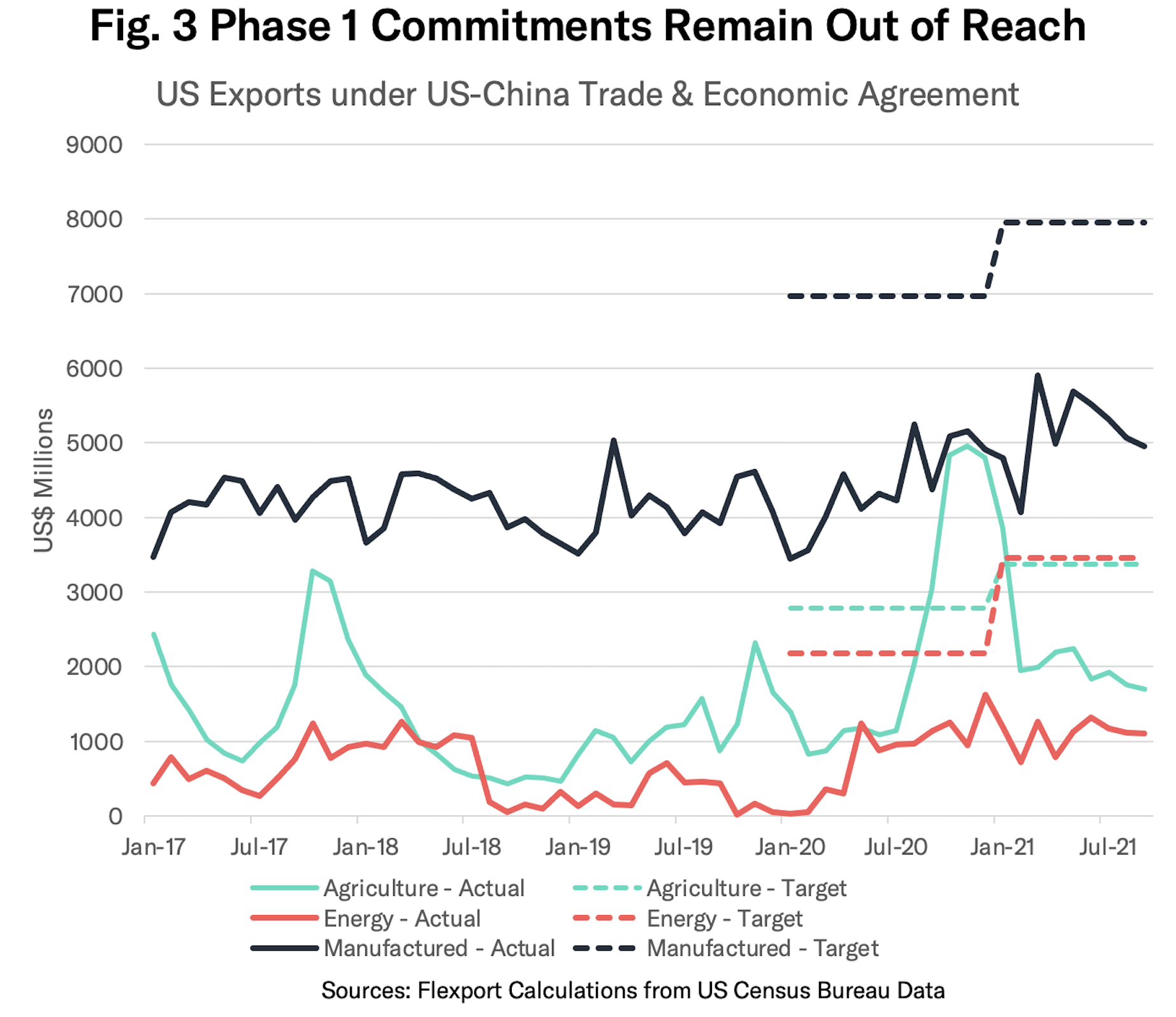

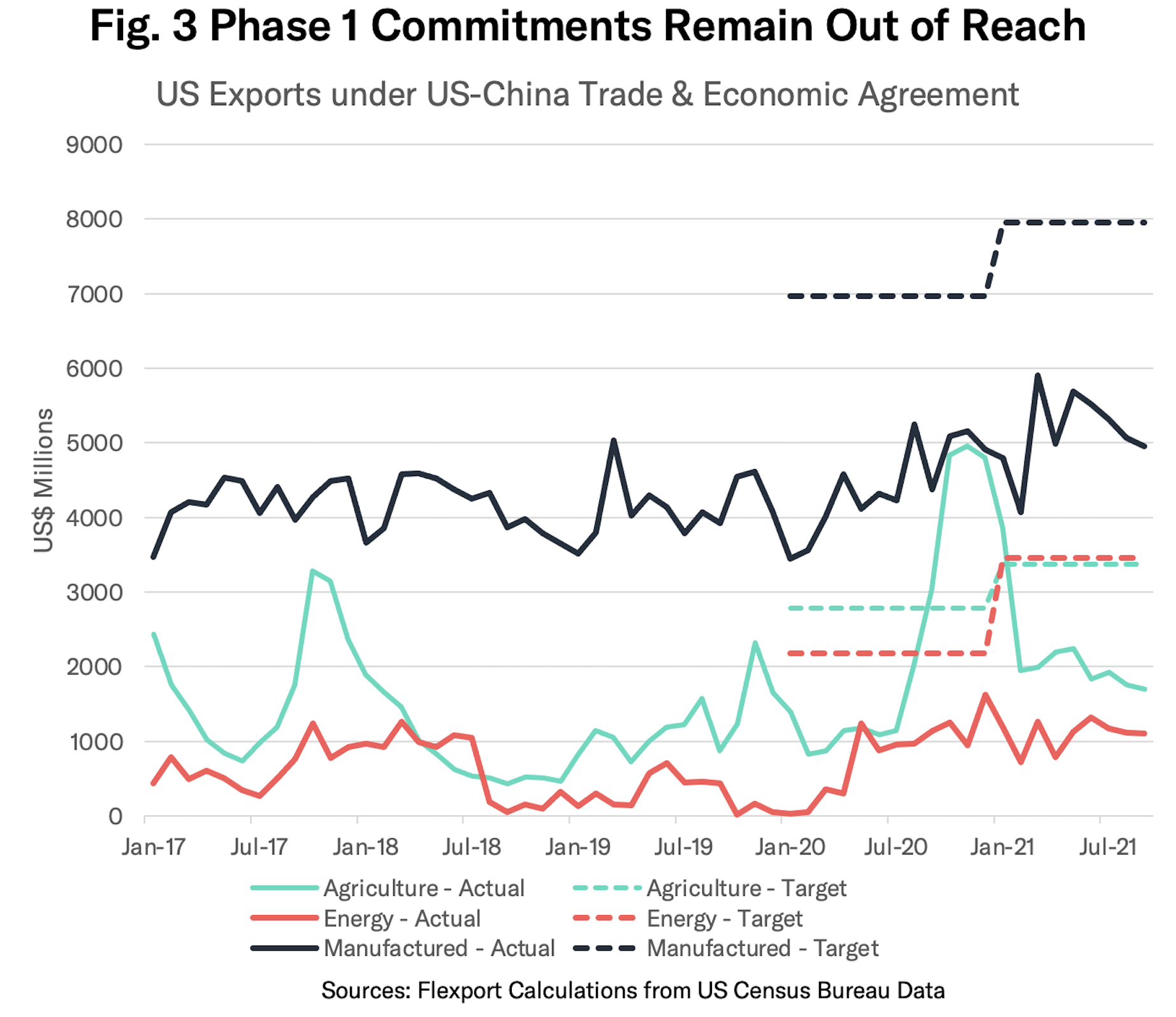

- Specific examples: The announcement of a "Phase One" trade deal in 2020 led to a short-term surge in US equities, while subsequent escalations in trade tensions caused significant market corrections.

- Sector-specific impacts: Technology companies, heavily reliant on global supply chains, have been particularly vulnerable to trade war disruptions. Conversely, some sectors, such as domestic agriculture in the US, have experienced both benefits and drawbacks.

- Expert opinions: Many financial analysts emphasize the need for continued monitoring of trade developments, cautioning against complacency even during periods of apparent détente. The long-term effects on investment strategies are still unfolding.

Shifting Investor Sentiment and Risk Appetite

Investor sentiment has swung wildly in response to the ebb and flow of US-China trade discussions. Periods of escalating tensions have fueled risk aversion, prompting investors to shift funds towards safer haven assets like gold and government bonds. Conversely, periods of progress in trade negotiations have often led to increased risk appetite and a renewed interest in higher-yielding equities. This shift reflects a fundamental change in investor confidence, directly linked to the perceived stability of the global economic order.

- Investment flows: We've seen significant capital flight away from emerging markets during periods of heightened trade war uncertainty, with investors prioritizing stability over higher potential returns.

- Risk appetite indicators: Bond yields have shown inverse correlations with trade war escalations, reflecting investors' increasing demand for safer investments during uncertain times.

- The role of uncertainty: The inherent unpredictability of the trade negotiations continues to be a major factor shaping investor decisions. Clarity and transparency are crucial for restoring confidence and encouraging long-term investment strategies.

Analysis of Specific Trade Concessions and Their Market Reception

The market's response to specific trade concessions during US-China trade talks has been varied and often nuanced. While tariff reductions have generally been met with positive sentiment, the reception to concessions related to intellectual property rights and technology transfer has been more complex. The market's reaction often depends on the perceived fairness and adequacy of the concessions from both sides.

- Specific examples: The initial tariff reductions agreed upon in the "Phase One" deal were met with optimism, although lingering concerns about other trade issues limited the market's enthusiasm.

- Long-term implications: The long-term effects of any trade concessions will depend on their effective implementation and enforcement. Any perceived lack of commitment by either side could quickly reverse initial positive market reactions.

- Addressing concerns: The market’s response often reflects whether the concessions adequately address the underlying concerns of both the US and China. A perception of an unbalanced deal can lead to negative sentiment regardless of any immediate positive impacts.

The Role of Geopolitical Factors

The impact of US-China trade relations extends far beyond the purely economic sphere. Broader geopolitical factors, including global political stability, tensions in other regions, and the overall international climate significantly influence market sentiment. These interconnected factors create a complex web of influences, making it challenging to isolate the specific impact of trade talks on market reactions.

Conclusion

The market's reaction to US-China trade discussions underscores the profound interconnectedness of global finance and geopolitics. The impact on global stock markets, investor sentiment, and specific trade concessions has been substantial and volatile. A potential trade war resolution, while highly desirable, is contingent on various factors, including the willingness of both sides to compromise. The ongoing uncertainty surrounding the US-China trade relationship highlights the crucial need for continuous monitoring and analysis.

Call to Action: Stay updated on the evolving US-China trade situation and its impact on market sentiment. Monitor developments closely through reputable financial news sources and expert analysis to make informed investment decisions regarding US-China trade war resolution. Understanding the nuances of these complex negotiations is crucial for navigating the volatile global market environment.

Featured Posts

-

Analyzing Manon Fiorots Progress Towards A Championship Match

May 12, 2025

Analyzing Manon Fiorots Progress Towards A Championship Match

May 12, 2025 -

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025

Sylvester Stallones Favorite Rocky Movie The Franchises Most Emotional Entry

May 12, 2025 -

2025 Indy Car Season Outlook Rahal Letterman Lanigan Racings Prospects

May 12, 2025

2025 Indy Car Season Outlook Rahal Letterman Lanigan Racings Prospects

May 12, 2025 -

Jessica Simpson Kimono Cardigan Walmarts 29 Bestselling Find

May 12, 2025

Jessica Simpson Kimono Cardigan Walmarts 29 Bestselling Find

May 12, 2025 -

Mon Atelier D Art Une Rencontre Inattendue Avec Sylvester Stallone

May 12, 2025

Mon Atelier D Art Une Rencontre Inattendue Avec Sylvester Stallone

May 12, 2025

Latest Posts

-

University Of Oregon Basketball New Recruit From Australia

May 13, 2025

University Of Oregon Basketball New Recruit From Australia

May 13, 2025 -

Oregon Ducks Secure Top Tier Talent From Australia

May 13, 2025

Oregon Ducks Secure Top Tier Talent From Australia

May 13, 2025 -

Kelly Graves Lands Australian Star Recruit

May 13, 2025

Kelly Graves Lands Australian Star Recruit

May 13, 2025 -

Cp Music Productions A Legacy In Music One Father Son Performance At A Time

May 13, 2025

Cp Music Productions A Legacy In Music One Father Son Performance At A Time

May 13, 2025 -

The Sound Of Family Cp Music Productions Father And Son Duo

May 13, 2025

The Sound Of Family Cp Music Productions Father And Son Duo

May 13, 2025