Trade Truce Fuels S&P 500's 3%+ Rally

Table of Contents

The Trade Truce: A Catalyst for Market Growth

The recent trade agreement, characterized by tariff negotiations and de-escalation of tensions, has acted as a crucial catalyst for the market's impressive growth. This unexpected de-escalation significantly reduces geopolitical risk and uncertainty, which had previously weighed heavily on investor sentiment. The agreement, while details remain to be fully disclosed, includes commitments to future negotiations and hints at substantial tariff reductions. This positive development has dramatically improved market confidence.

- Specific details of the trade truce agreement: While specifics are still emerging, early reports indicate a reduction in tariffs on certain key goods, coupled with a commitment to further negotiations on remaining trade disputes. This phased approach suggests a willingness to find a mutually beneficial resolution.

- Reduction of geopolitical risks and uncertainty: The truce significantly diminishes the immediate threat of further escalating trade wars, removing a major source of uncertainty that had been hindering investment decisions. This newfound stability allows businesses to better plan for the future, boosting investor confidence.

- Investor sentiment shifts following the announcement: The announcement was met with immediate and enthusiastic market reaction. Investor sentiment shifted dramatically, moving from pessimism and risk aversion to optimism and a willingness to embrace riskier assets. This is evident in the significant increase in trading volume and the broad-based nature of the rally across various sectors.

- Comparison with previous market reactions to trade-related news: Unlike previous instances of trade-related news which often led to market volatility and declines, this truce has been met with a consistently positive response, suggesting a change in the prevailing market perception of the risk.

Sector-Specific Performance During the Rally

The S&P 500 rally wasn't uniform across all sectors. While the entire index benefited, certain sectors experienced more significant gains than others. Analyzing this sector-specific performance reveals valuable insights into the market's reaction to the trade truce.

- Performance analysis of various S&P 500 sectors: Technology and consumer discretionary stocks, particularly those heavily impacted by previous tariffs, saw some of the most significant gains. Financials also experienced a positive surge, reflecting increased confidence in the overall economic outlook.

- Sectors most significantly impacted by the trade truce: Sectors directly exposed to international trade, such as technology and manufacturing, experienced disproportionately higher gains due to the reduced trade barriers and uncertainty.

- Potential sector rotation based on the changed market landscape: The trade truce may lead to sector rotation, as investors shift their focus from defensive sectors to those expected to benefit most from the improved trade environment. This requires careful consideration of investment strategies.

- Insights into investment strategies: Understanding the sector-specific performance allows investors to tailor their portfolios, potentially increasing exposure to sectors poised to benefit most from the ongoing trade de-escalation.

Long-Term Implications and Investor Outlook

While the immediate market reaction to the trade truce has been positive, the long-term implications require careful consideration. Assessing the sustainability of this rally and identifying remaining risks is crucial for investors.

- Assessment of the long-term impact on economic growth: The trade truce has the potential to boost global economic growth by reducing trade barriers and increasing cross-border investment. However, the extent of this impact depends on the successful implementation and longevity of the agreement.

- Analysis of potential risks and uncertainties: Geopolitical risks remain, including the possibility of future trade disputes or unforeseen global events. Furthermore, the long-term economic effects of the truce need to be fully evaluated.

- Expert opinions and predictions on the future trajectory of the S&P 500: Many market analysts remain cautiously optimistic, predicting continued growth, but caution against overconfidence. The market’s direction will likely depend on further economic data and developments in global trade negotiations.

- Guidance on risk management strategies: Investors should implement effective risk management strategies, including diversification and careful asset allocation, to protect their portfolios in this dynamic environment.

Understanding Market Volatility Following the Rally

While the S&P 500 experienced a significant rally, investors should anticipate potential market corrections. Understanding and preparing for volatility is key to long-term investment success.

- Discussion of potential market corrections: Following sharp rallies, corrections are common. Investors should not be surprised if the market experiences a pullback in the coming weeks or months.

- Importance of risk mitigation and portfolio diversification: Diversifying your investment portfolio across various asset classes and sectors is crucial to mitigate risks associated with market corrections.

- Analysis of the volatility index (VIX): Monitoring the VIX, a measure of market volatility, can provide valuable insights into potential market swings and inform investment decisions.

- Recommendations for navigating market volatility and maintaining a long-term strategy: A long-term investment horizon and a well-diversified portfolio are essential for navigating market volatility and achieving long-term investment goals.

Conclusion

The unexpected trade truce has undeniably fueled a significant rally in the S&P 500, exceeding 3%, offering a much-needed boost to investor confidence. While the long-term implications remain to be seen, understanding the sector-specific impacts and managing potential volatility are crucial for effective investment strategies. The impact of this trade truce on various sectors, the potential for future market corrections, and the overall outlook for the S&P 500 require careful monitoring.

Call to Action: Stay informed about the evolving global trade landscape and its impact on the S&P 500. Monitor the market closely and adapt your investment strategies accordingly to capitalize on opportunities presented by this trade truce and potential future market shifts. Learn more about navigating market volatility and building a robust investment portfolio by exploring our resources on [link to relevant resources].

Featured Posts

-

Sobolenko Skandal Na Turnire V Madride Podrobniy Razbor Situatsii

May 13, 2025

Sobolenko Skandal Na Turnire V Madride Podrobniy Razbor Situatsii

May 13, 2025 -

Season 2 Of Landman First Look At Ali Larter On The Oil Rigs

May 13, 2025

Season 2 Of Landman First Look At Ali Larter On The Oil Rigs

May 13, 2025 -

Documenting Chris And Megs Wild Summer

May 13, 2025

Documenting Chris And Megs Wild Summer

May 13, 2025 -

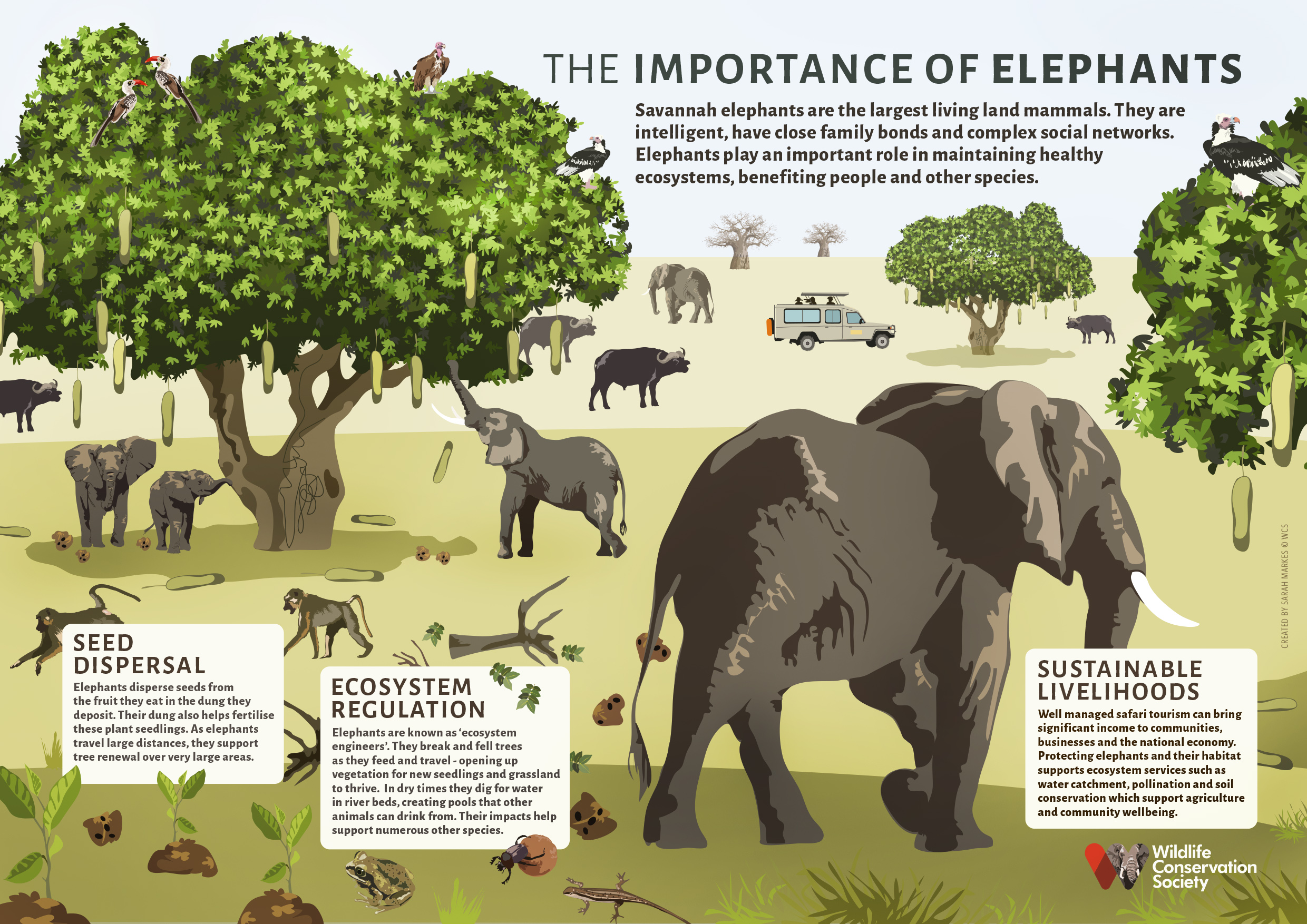

The Wonder Of Animals Their Behaviors Habitats And Importance

May 13, 2025

The Wonder Of Animals Their Behaviors Habitats And Importance

May 13, 2025 -

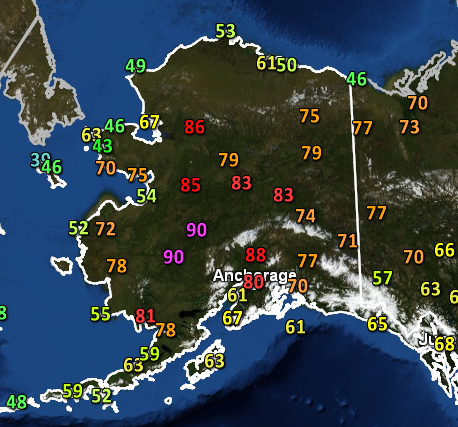

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Impacts

May 13, 2025

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Impacts

May 13, 2025