Tracking Global Commodity Markets: 5 Essential Charts To Watch

Table of Contents

1. Crude Oil Price Chart: A Benchmark for Global Energy

The crude oil price chart serves as a benchmark for the global energy sector and is a crucial indicator for understanding broader economic trends. Two key benchmarks are Brent crude and West Texas Intermediate (WTI) crude, with prices influenced by a complex interplay of factors. Analyzing crude oil price charts allows you to gauge energy prices and their impact on various sectors.

Keywords: Crude oil price chart, Brent crude, WTI crude, oil price forecast, OPEC, energy prices, oil market analysis

-

Impact of geopolitical instability on oil prices: Geopolitical events, such as conflicts or sanctions, often lead to significant volatility in oil prices due to supply disruptions or concerns about future availability. Monitoring news related to major oil-producing regions is critical when interpreting oil price charts.

-

The role of OPEC in managing oil supply: The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in influencing oil prices through its production quotas and agreements. Understanding OPEC's decisions and their impact is crucial for accurate price forecasting.

-

Relationship between oil prices and inflation: Oil price increases can contribute to higher inflation rates, impacting consumer prices and the overall economy. Tracking the relationship between oil prices and inflation is vital for assessing macroeconomic conditions.

-

Analyzing future contracts (futures charts): Futures contracts allow traders to speculate on future oil prices, providing valuable insight into market sentiment and expectations. Examining futures charts provides a forward-looking perspective on potential price movements. (Example of a simple line chart showing Brent Crude prices over the past year could be inserted here.)

2. Gold Price Chart: A Safe Haven Asset

The gold price chart is closely watched as gold is considered a safe haven asset, often rising in value during times of economic uncertainty or geopolitical instability. It's frequently used as an inflation hedge and a portfolio diversifier. Analyzing gold price charts helps understand investor sentiment and the perceived risk in global markets.

Keywords: Gold price chart, gold investment, precious metals, inflation hedge, safe haven asset, gold market trends

-

Gold's performance during periods of high inflation: Gold typically performs well during periods of high inflation, as its value tends to hold or increase when the purchasing power of fiat currencies declines.

-

The impact of central bank policies on gold prices: Central bank policies, such as interest rate changes and quantitative easing, can significantly influence gold prices. Higher interest rates can make gold less attractive relative to interest-bearing assets.

-

Correlation between gold and the US dollar: Gold prices often have an inverse relationship with the US dollar. A weaker dollar typically leads to higher gold prices, as it becomes cheaper for investors holding other currencies to buy gold.

-

Analyzing long-term gold price trends: Examining long-term trends in gold prices can reveal cyclical patterns and long-term value appreciation, helping to assess investment strategies. (Example of a simple line chart showing Gold prices over the past decade could be inserted here.)

3. Agricultural Commodity Price Charts (e.g., Corn, Wheat, Soybeans): Food Security and Global Trade

Agricultural commodity price charts, focusing on staples like corn, wheat, and soybeans, are crucial for understanding global food security and trade dynamics. These commodities are sensitive to weather patterns, global demand, and government policies, impacting food prices worldwide.

Keywords: Agricultural commodity prices, corn price chart, wheat price chart, soybean price chart, food prices, agricultural markets, global food security

-

The impact of weather events on crop yields: Extreme weather events, such as droughts or floods, can significantly impact crop yields and subsequently drive up prices.

-

The role of government subsidies and trade policies: Government subsidies and trade policies can influence agricultural commodity prices by affecting production levels and market access.

-

The relationship between agricultural commodity prices and food inflation: Changes in agricultural commodity prices directly affect food prices, influencing consumer spending and overall inflation.

-

Analyzing seasonal price patterns: Agricultural commodity prices often exhibit seasonal patterns reflecting planting, harvesting, and storage cycles. Understanding these patterns is crucial for effective price forecasting. (Example charts showing seasonal price fluctuations for corn, wheat, or soybeans could be inserted here.)

4. Industrial Metal Price Charts (e.g., Copper, Aluminum): Gauging Global Economic Growth

Industrial metal price charts, particularly those for copper and aluminum, serve as important indicators of global economic activity. Demand for these metals is directly tied to industrial production and infrastructure development. Tracking these prices offers valuable insights into the health of the global economy.

Keywords: Industrial metal prices, copper price chart, aluminum price chart, base metals, industrial production, economic indicators

-

Correlation between industrial metal prices and economic growth: Strong economic growth typically leads to increased demand for industrial metals, driving up prices. Conversely, economic downturns reduce demand and put downward pressure on prices.

-

Impact of infrastructure projects on metal demand: Large-scale infrastructure projects, such as building roads, bridges, and power grids, significantly increase demand for industrial metals.

-

The role of supply chain disruptions on metal prices: Supply chain disruptions, such as those experienced during the COVID-19 pandemic, can significantly impact metal prices by limiting supply.

-

Analyzing cyclical price trends: Industrial metal prices often exhibit cyclical trends reflecting the business cycle. Understanding these cycles is essential for long-term investment strategies. (Example charts showing copper or aluminum price trends could be inserted here.)

5. Broad Commodity Index Charts: A Holistic View of the Market

Broad commodity index charts, such as the Bloomberg Commodity Index or the S&P GSCI, provide a holistic view of the commodity market’s performance. These indices track the prices of a diversified basket of commodities, offering a comprehensive picture of overall market trends. They’re useful tools for diversification and risk management.

Keywords: Commodity index charts, commodity index tracking, diversified commodity investments, market diversification, commodity market performance

-

Understanding the composition of different commodity indices: Different commodity indices have varying compositions, weighting different commodities differently. Understanding the composition is crucial for interpreting the index's performance.

-

Using indices to track overall market trends: Commodity indices provide a convenient way to track overall commodity market trends and compare performance against other asset classes.

-

Benefits of diversification through commodity indices: Investing in commodity indices offers diversification benefits by reducing the risk associated with investing in individual commodities.

-

Comparing different commodity index performances: Comparing the performance of different commodity indices reveals variations in weighting schemes and sector exposure. (Example chart showing the performance of a major commodity index over time could be inserted here.)

Conclusion

Tracking global commodity markets effectively requires consistent monitoring of key price trends across various sectors. The five charts highlighted above—crude oil, gold, agricultural commodities, industrial metals, and broad commodity indices—provide a comprehensive overview, allowing for better-informed decisions regarding commodity trading and investment strategies. Mastering the art of tracking global commodity markets requires consistent monitoring. Start utilizing these five essential charts today to improve your understanding of global commodity market trends and develop effective investment strategies. Learn more about effective commodity market analysis techniques at [link to relevant resource].

Featured Posts

-

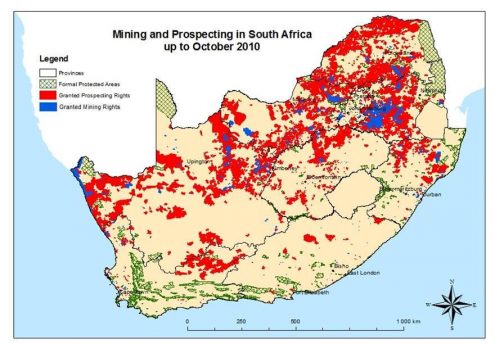

A Toxic Time Bomb The Environmental Impact Of Abandoned Gold Mines

May 06, 2025

A Toxic Time Bomb The Environmental Impact Of Abandoned Gold Mines

May 06, 2025 -

Los Angeles Wildfires A Case Study In The Dangers Of Disaster Gambling

May 06, 2025

Los Angeles Wildfires A Case Study In The Dangers Of Disaster Gambling

May 06, 2025 -

Social Media As An Economic Barometer Decoding Recession Signals

May 06, 2025

Social Media As An Economic Barometer Decoding Recession Signals

May 06, 2025 -

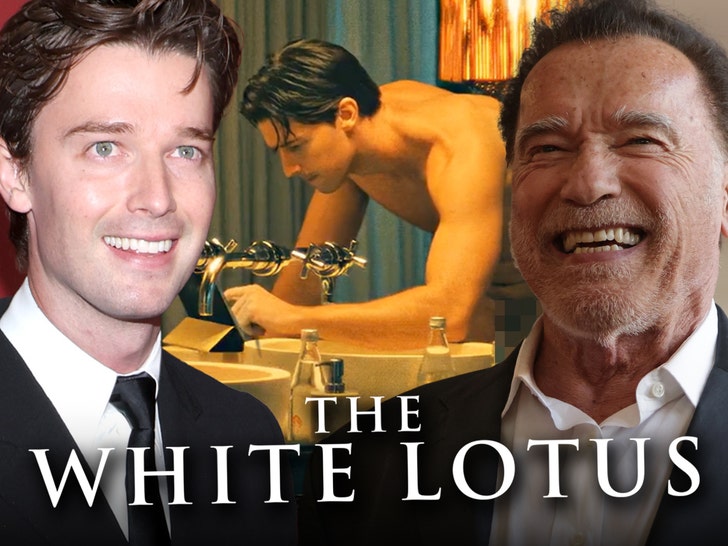

Patrick Schwarzeneggers Nudity Arnold Schwarzenegger Weighs In

May 06, 2025

Patrick Schwarzeneggers Nudity Arnold Schwarzenegger Weighs In

May 06, 2025 -

Westpac Wbc Profit Decline Margin Pressure Impacts Earnings

May 06, 2025

Westpac Wbc Profit Decline Margin Pressure Impacts Earnings

May 06, 2025

Latest Posts

-

Actor Chris Pratt On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025

Actor Chris Pratt On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025 -

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratt Comments On Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratt Comments On Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025

Arnold Schwarzenegger Supports Son Patricks Nude Role

May 06, 2025