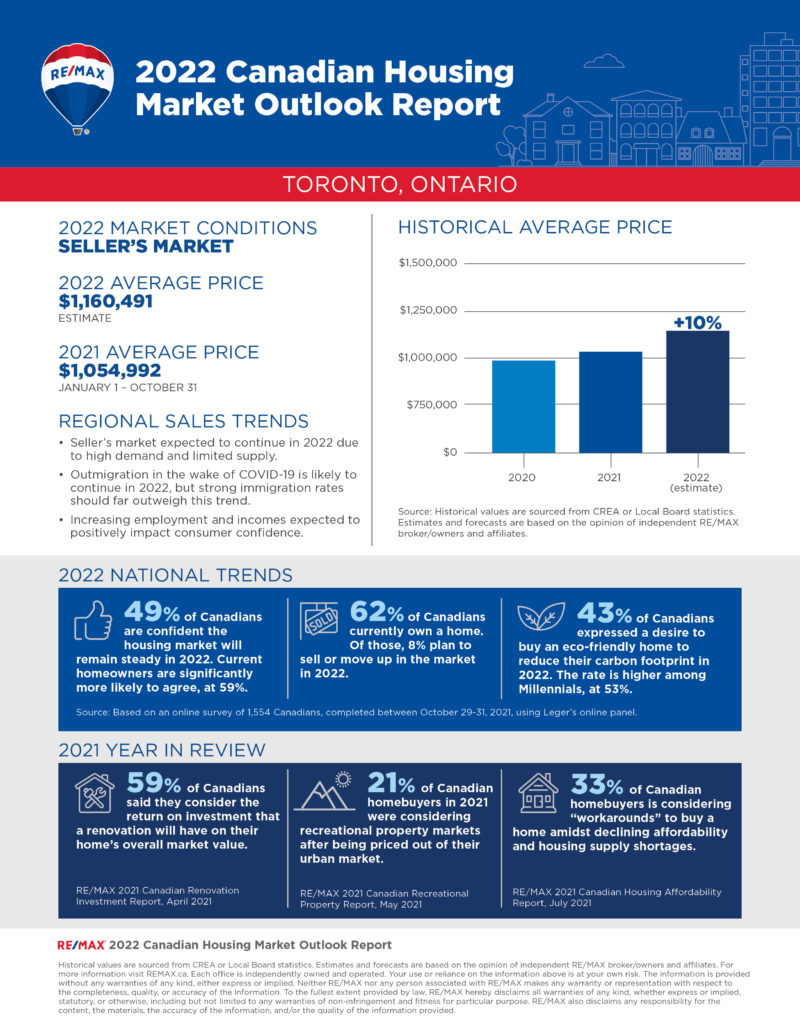

Toronto Housing Market: 23% Sales Plunge, 4% Price Reduction

Table of Contents

Causes of the Toronto Housing Market Slowdown

Several interconnected factors have converged to create the current slowdown in the Toronto housing market. Understanding these causes is crucial for anyone involved in Toronto real estate.

Rising Interest Rates

The Bank of Canada's aggressive interest rate hikes throughout 2022 and 2023 have significantly impacted mortgage affordability. The increase in borrowing costs has dramatically reduced the purchasing power of potential homebuyers.

- Higher interest rates lead to increased monthly mortgage payments, making homeownership less accessible for many.

- The increased cost of borrowing reduces the amount buyers can afford to spend on a property, leading to decreased demand.

- The average monthly mortgage payment has increased by approximately 25% since January 2022, according to the Canadian Real Estate Association (CREA). This substantial increase has priced many potential buyers out of the market.

Economic Uncertainty

Global and national economic headwinds, including persistent inflation and fears of a recession, have dampened buyer confidence. This uncertainty is leading to a more cautious approach to large financial commitments like purchasing a home.

- Inflation erodes purchasing power, reducing the disposable income available for housing expenses.

- Concerns about job security and potential economic downturn make consumers hesitant to take on significant debt.

- Statistics Canada reports a decrease in consumer confidence, reflecting a broader sentiment of economic uncertainty impacting the housing market.

Increased Inventory

The increased number of properties listed for sale in the Toronto area has shifted the balance of power in favour of buyers. The higher supply of homes compared to demand has put downward pressure on prices.

- Increased inventory gives buyers more choices and negotiating power.

- Sellers are often forced to accept lower offers or reduce their asking prices to attract buyers in a more competitive market.

- The number of active listings in the Greater Toronto Area (GTA) has increased by approximately 15% since the beginning of the year, according to the Toronto Real Estate Board (TREB).

Impact of the 23% Sales Plunge and 4% Price Reduction

The significant drop in sales and the price correction are having a multifaceted impact on the Toronto housing market, affecting sellers, buyers, and the broader economy.

Impact on Sellers

Sellers are facing several challenges in the current market:

- Longer listing times: Properties are staying on the market for significantly longer periods than in previous years.

- Price reductions: Many sellers are forced to reduce their asking prices to attract buyers.

- Potential losses: Some sellers may even experience losses if they purchased their property at a higher price point. Sellers need to adapt their strategies, including potentially adjusting pricing and enhancing marketing efforts to attract buyers in this more competitive environment.

Impact on Buyers

The current market presents several opportunities for buyers:

- Increased negotiation leverage: Buyers have more power to negotiate lower prices and favourable terms.

- Potentially lower prices: The price correction offers buyers the chance to acquire properties at more affordable prices.

- Increased selection: The greater number of listings provides buyers with a wider range of choices. Buyers should leverage this increased selection and their enhanced negotiating position to secure favorable deals.

Impact on the Toronto Economy

The slowdown in the Toronto housing market has broader economic consequences:

- Impact on related industries: The construction sector and real estate services industries are directly affected by the reduced activity.

- Job market: Employment in related industries may be impacted, leading to potential job losses or slower growth.

- Overall economic growth: The housing market's contribution to the overall economic growth of Toronto will be lessened.

Predictions and Future Outlook for the Toronto Housing Market

Predicting the future of the Toronto housing market is complex, but analyzing short-term and long-term trends can offer some insight.

Short-Term Forecasts

Experts predict a period of relative price stability in the next 6-12 months, with sales volume potentially remaining subdued until interest rates stabilize. However, some believe a gradual market recovery could begin in late 2024, depending on interest rate movements and broader economic conditions.

- Price stability is expected in the short term, with minimal further price decreases predicted.

- Sales volume is likely to remain relatively low until buyer confidence improves.

- A potential market recovery could begin in late 2024, depending on several factors.

Long-Term Trends

The long-term outlook for Toronto's real estate market remains positive due to several factors:

- Population growth: Continued population growth in the Greater Toronto Area will fuel demand for housing.

- Infrastructure developments: Ongoing infrastructure investments will enhance the city's attractiveness and support housing demand.

- Government policies: Government policies and regulations will play a significant role in shaping the market's long-term trajectory.

Conclusion: Navigating the Toronto Housing Market Slowdown

The Toronto housing market is experiencing a significant slowdown, characterized by a 23% plunge in sales and a 4% price reduction. This correction is primarily driven by rising interest rates, economic uncertainty, and increased inventory. This has created both challenges and opportunities for buyers and sellers. Buyers now have greater negotiation power and more choices, while sellers must adapt to a more competitive environment, often requiring price adjustments and improved marketing strategies. Staying informed about the latest Toronto housing market trends is crucial for making informed decisions. Contact a real estate expert today to discuss your options in this dynamic Toronto real estate market.

Featured Posts

-

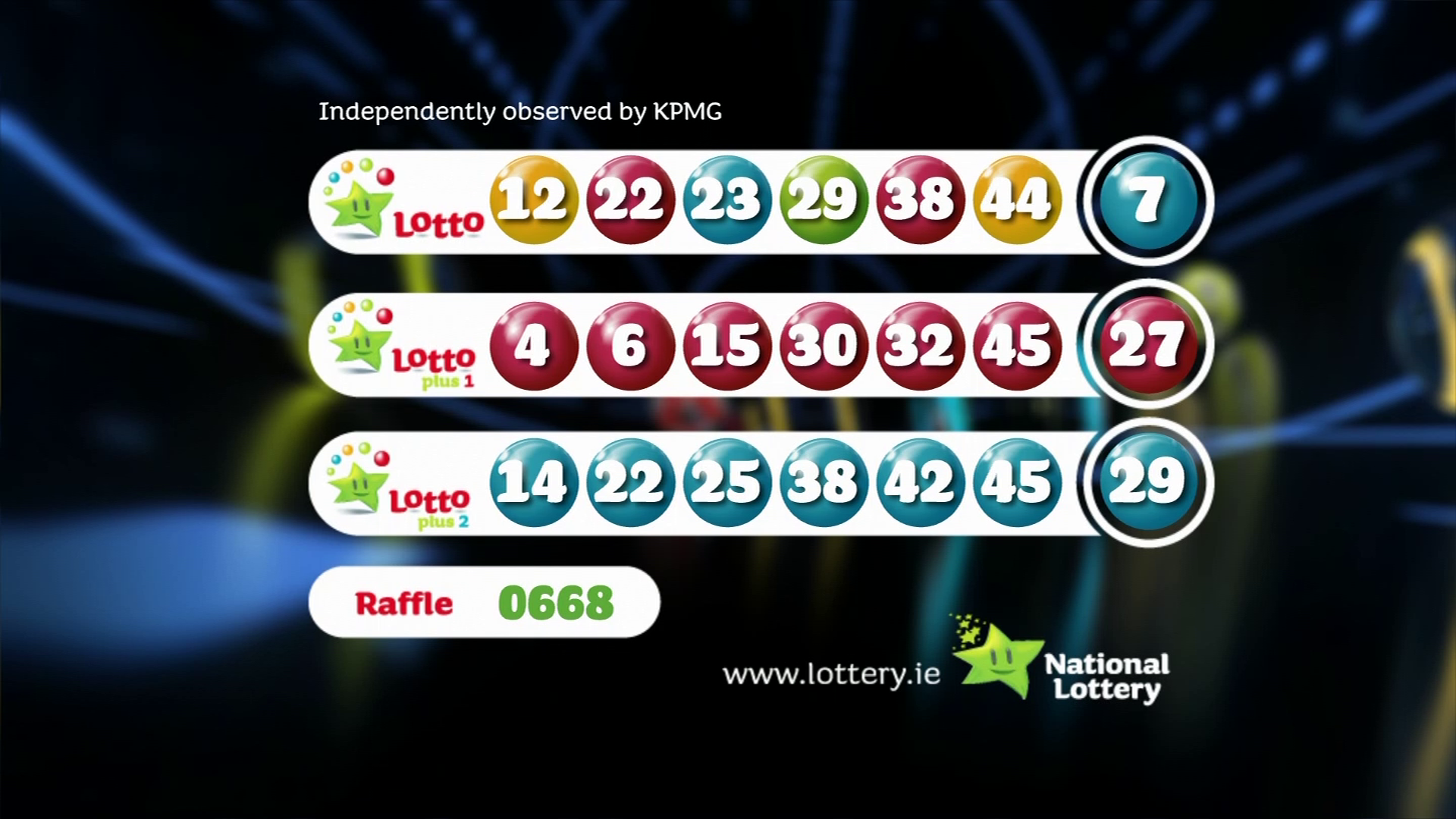

Saturday April 12th Lotto Draw Winning Numbers Announced

May 08, 2025

Saturday April 12th Lotto Draw Winning Numbers Announced

May 08, 2025 -

Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Ky Nakamy Wjwhat Awr Ntayj

May 08, 2025

Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Ky Nakamy Wjwhat Awr Ntayj

May 08, 2025 -

Saving Private Ryans Reign Ends A New Best War Film

May 08, 2025

Saving Private Ryans Reign Ends A New Best War Film

May 08, 2025 -

Arsenal Vs Psg Semi Final Preview And Potential Lineup

May 08, 2025

Arsenal Vs Psg Semi Final Preview And Potential Lineup

May 08, 2025 -

How To Stream Los Angeles Angels Baseball Games Without Cable Tv In 2025

May 08, 2025

How To Stream Los Angeles Angels Baseball Games Without Cable Tv In 2025

May 08, 2025