Tongling's Warning: US Tariffs Impact Copper Market

Table of Contents

Tongling's Financial Performance and the Tariff Impact

Tongling's recent financial performance clearly reflects the negative impact of US tariffs. The imposition of tariffs on Chinese copper imports has directly affected their profitability and operational efficiency. Analysis of their financial reports reveals a clear downturn, impacting export volumes, profit margins, and overall investment strategies.

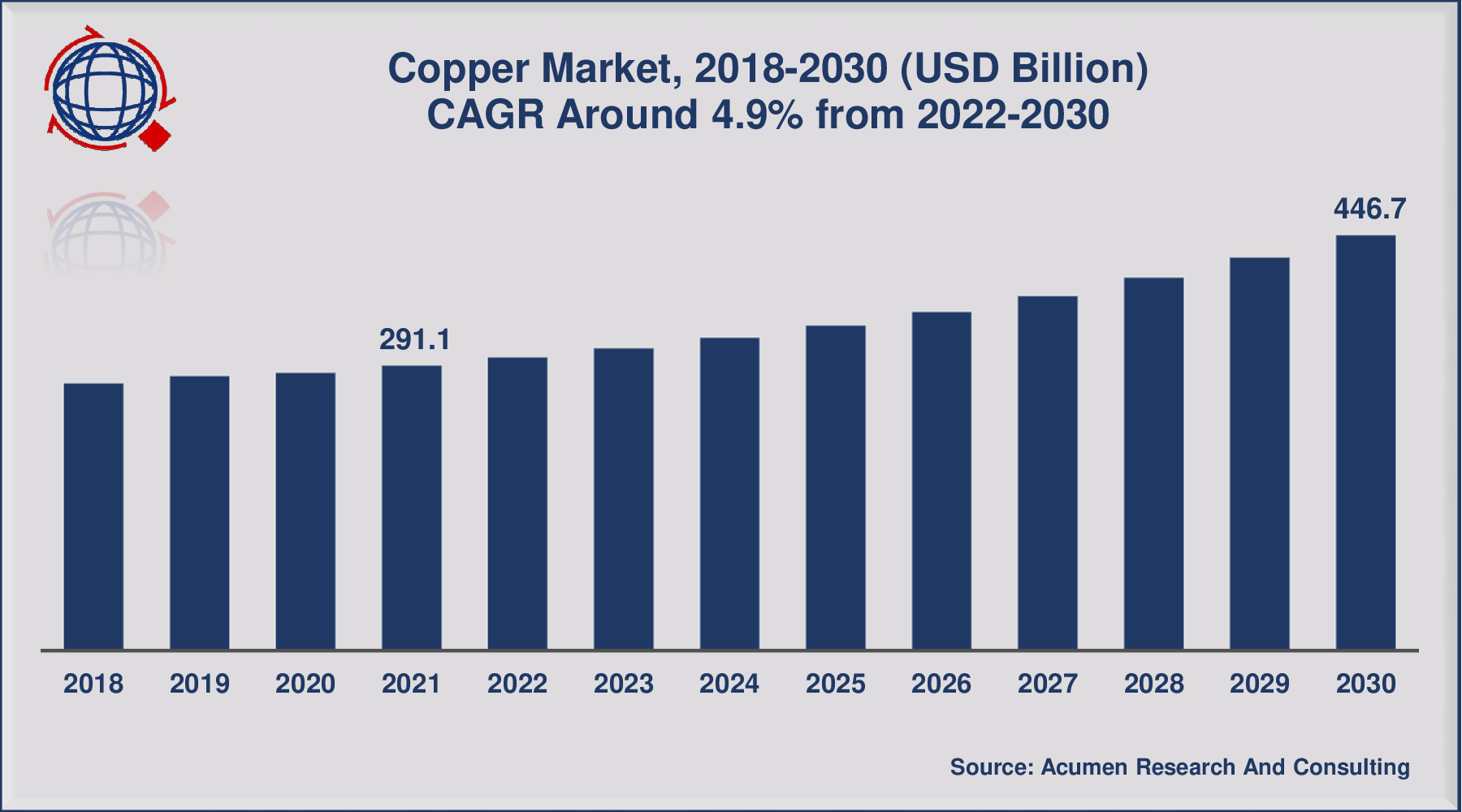

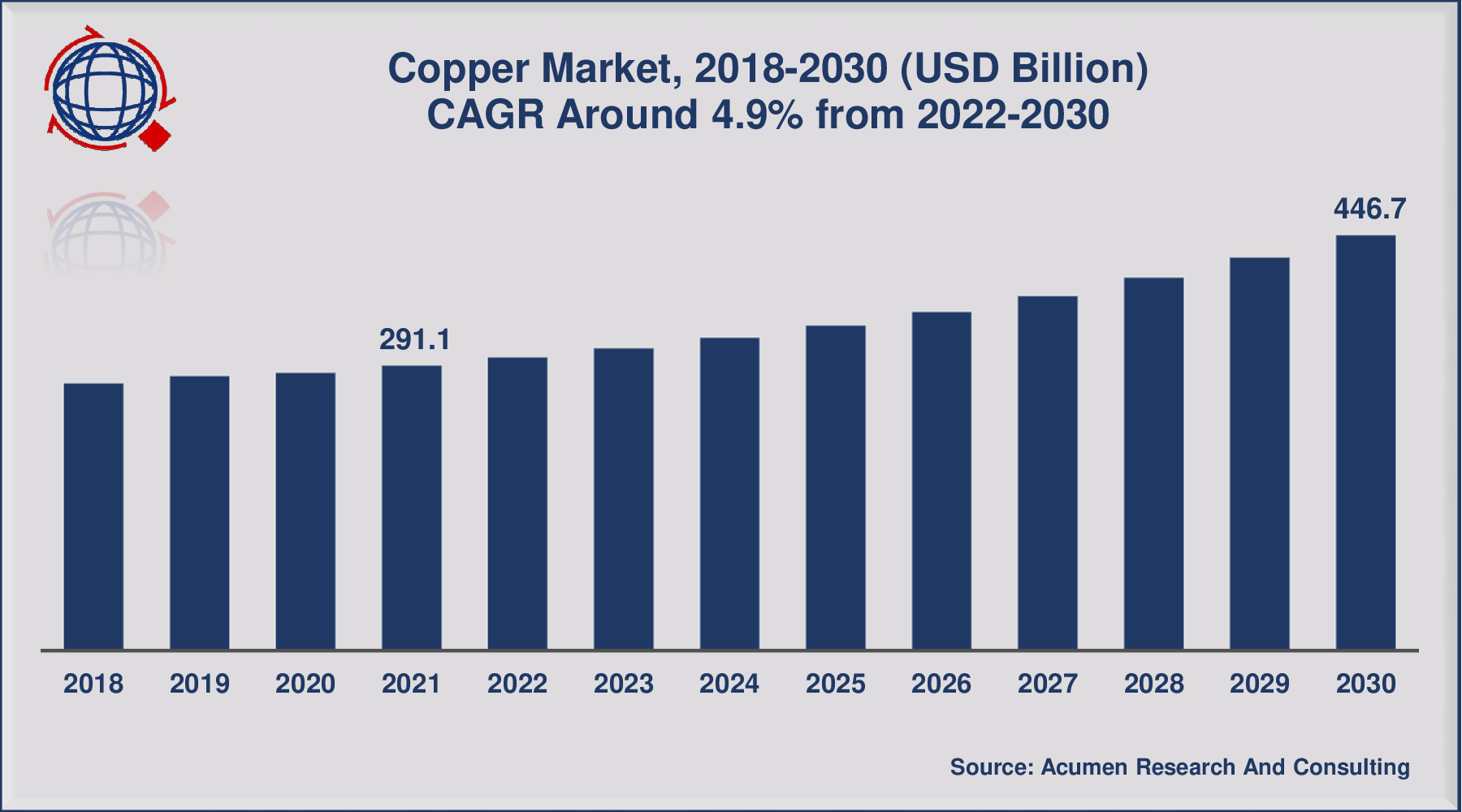

(Insert a relevant chart or graph here showing Tongling's financial performance before and after the tariff implementation)

Key indicators demonstrating the tariff's impact on Tongling include:

- Decreased export volume to the US: Tariffs have made Chinese copper less competitive in the US market, leading to a significant drop in exports to this key region.

- Lower profit margins due to increased production costs: The added tariff costs are absorbed, reducing profit margins and squeezing the company's overall profitability.

- Potential for job losses and reduced investment: The decreased profitability might lead to cost-cutting measures, potentially resulting in job losses and a reduction in future investments in research and development.

- Mitigation Strategies: Tongling is actively seeking ways to mitigate the negative effects. These strategies include diversifying export markets, exploring cost-cutting measures, and potentially investing in production facilities outside of China to circumvent the tariffs.

The Broader Impact on the Global Copper Market

The impact of US tariffs extends far beyond Tongling, creating ripples throughout the global copper market. The increased costs and decreased trade volume have caused significant price fluctuations and supply chain disruptions.

(Insert a relevant chart or graph here illustrating copper price fluctuations since the implementation of tariffs)

The implications for the broader market include:

- Increased copper prices in some regions: Reduced supply from China, due to tariffs, has caused price increases in certain regions, impacting consumers and downstream industries.

- Supply chain disruptions: The disruption in trade flows has created uncertainty and complexity in the supply chain, leading to delays and increased costs for businesses.

- Shift in global copper trade patterns: Companies are seeking alternative copper sources, leading to a shift in global trade patterns and potentially impacting relationships between countries.

- Impact on downstream industries using copper: Industries heavily reliant on copper, such as construction, electronics, and renewable energy, are feeling the pressure of higher copper prices and supply chain disruptions.

Geopolitical Implications and Future Predictions

US trade policy on copper imports carries significant geopolitical implications, influencing international relations and global trade dynamics. The ongoing trade tensions highlight the complex interplay between economic policy and international relations.

Predictions regarding future copper prices and the overall market outlook remain uncertain, influenced by several factors:

- Potential for further tariff escalation: The possibility of further tariff increases or the extension of existing tariffs adds to the uncertainty surrounding future copper prices.

- Predictions for future copper demand and supply: Future demand and supply dynamics will play a key role in shaping copper prices, with factors such as economic growth and technological advancements influencing the market.

- The role of other countries in influencing copper markets: The actions and policies of other major copper-producing and consuming nations will influence the global copper market dynamics.

- Long-term outlook for the copper market considering the current situation: The long-term outlook depends on a resolution of trade tensions, the diversification of supply chains, and the continued demand for copper in various industries.

Conclusion: Navigating the Copper Market's Uncertain Future After Tongling's Warning

Tongling's experience serves as a cautionary tale, highlighting the significant impact of US tariffs on the copper market. The decreased profitability of Tongling, coupled with broader market fluctuations and supply chain disruptions, underscores the need for a comprehensive understanding of the evolving geopolitical landscape. Businesses involved in the copper market must adapt their strategies, diversify their sources, and closely monitor the situation to navigate this uncertain environment. Stay updated on the impact of US tariffs on the copper market, monitor the Tongling Nonferrous Metals Group's response to trade barriers, and analyze the latest copper price trends related to US tariffs to make informed business decisions. Understanding these dynamics is critical for success in the evolving copper market.

Featured Posts

-

From Scatological Documents To Engaging Podcast An Ai Driven Approach

Apr 23, 2025

From Scatological Documents To Engaging Podcast An Ai Driven Approach

Apr 23, 2025 -

Victory For Sf Giants Flores And Lees Stellar Performances

Apr 23, 2025

Victory For Sf Giants Flores And Lees Stellar Performances

Apr 23, 2025 -

Sf Giants Flores And Lee Power Win Against Brewers

Apr 23, 2025

Sf Giants Flores And Lee Power Win Against Brewers

Apr 23, 2025 -

Greene Urges Boe To Adopt A Cautious Approach To Quantitative Easing

Apr 23, 2025

Greene Urges Boe To Adopt A Cautious Approach To Quantitative Easing

Apr 23, 2025 -

Us Immigration A Canadian Perspective On The Trump Years Impact

Apr 23, 2025

Us Immigration A Canadian Perspective On The Trump Years Impact

Apr 23, 2025