Today's Stock Market: Dow, S&P 500, Nasdaq - May 29th

Table of Contents

Dow Jones Industrial Average Performance on May 29th

The Dow Jones Industrial Average (Dow) experienced a [Insert Percentage Change]% change on May 29th, closing at [Insert Closing Value]. Trading volume was [Insert Volume], reflecting [Insert Description of Volume - e.g., higher-than-average activity indicating increased market volatility].

Several factors contributed to the Dow's performance. [Insert Description of Major News - e.g., Concerns over rising inflation following the release of the latest CPI data] played a significant role, impacting investor sentiment. Furthermore, the performance of individual companies within the Dow heavily influenced the overall index movement.

- Key Movers and Shakers: [List 2-3 companies with significant positive and negative performance and briefly explain why]. For example, Company X saw a [Percentage]% increase due to [Reason], while Company Y experienced a [Percentage]% decrease due to [Reason].

- Impact of Economic Indicators: The release of [Specific Economic Indicator, e.g., inflation data] significantly impacted investor confidence, leading to [Explain the impact - e.g., increased selling pressure]. Interest rate announcements from the Federal Reserve also played a part, creating uncertainty in the market.

- Short-Term and Long-Term Implications: The Dow's movement on May 29th suggests [Short-term implication - e.g., a period of consolidation or further volatility]. Long-term implications remain uncertain and will depend on future economic data and geopolitical events.

S&P 500 Index Movement on May 29th

The S&P 500, a broader market index, mirrored the Dow's trend to some extent, experiencing a [Insert Percentage Change]% change on May 29th, closing at [Insert Closing Value]. However, the sectors driving this performance differed.

The technology and energy sectors played a significant role in shaping the S&P 500's performance.

- Top-Performing and Underperforming Sectors: [List top 2-3 performing and underperforming sectors with brief explanations. For example, the Energy sector outperformed due to rising oil prices, while the Consumer Discretionary sector underperformed due to concerns about slowing consumer spending].

- Correlation with the Dow: The S&P 500's movement generally correlated with the Dow's, but [Explain any divergence and reasons]. This discrepancy highlights the differences in the composition of the two indices.

- Market Sentiment: The S&P 500's performance reflects a [Describe the market sentiment – e.g., cautious and uncertain] market sentiment, indicating investors are closely monitoring economic developments.

Nasdaq Composite Index Summary for May 29th

The Nasdaq Composite, heavily weighted towards technology stocks, saw a [Insert Percentage Change]% change on May 29th, closing at [Insert Closing Value]. The performance of major technology companies significantly influenced the Nasdaq's overall movement.

- Performance of Major Tech Companies: [Mention 2-3 major tech companies and their performance, explaining the reasons behind their movements. E.g., Apple's stock price increased due to positive earnings reports, while Meta experienced a decline due to concerns about advertising revenue].

- Influence of Technological Advancements/Regulatory Changes: [Discuss any technological advancements or regulatory changes that influenced the Nasdaq’s performance].

- Comparison to Dow and S&P 500: Compared to the Dow and S&P 500, the Nasdaq exhibited [Explain the comparison – e.g., greater volatility], reflecting the tech sector's sensitivity to market shifts.

Overall Market Sentiment and Outlook

Based on the performance of the Dow, S&P 500, and Nasdaq on May 29th, the overall market sentiment can be characterized as [Describe overall market sentiment – e.g., cautiously optimistic but volatile]. Uncertainty remains, driven by several factors.

- Potential Catalysts for Future Market Movements: Upcoming economic reports, particularly [Mention specific reports], and geopolitical events could significantly impact the market's direction.

- Expert Opinions and Forecasts: [If available, mention reputable sources and their short-term outlook].

- Investment Strategies: Given the current market conditions, investors may consider [Suggest suitable investment strategies – e.g., diversifying their portfolios or adopting a more cautious approach].

Conclusion

Today's stock market, as represented by the Dow, S&P 500, and Nasdaq, exhibited significant fluctuations on May 29th. The performance of each index was influenced by various factors, including economic indicators, company-specific news, and overall market sentiment. Investors should remain vigilant and monitor key economic data and geopolitical events for a clearer outlook. To stay informed about today's stock market: Dow, S&P 500, and Nasdaq, subscribe to our daily market updates or consult with a financial advisor. Check back tomorrow for an analysis of today's market performance!

Featured Posts

-

Steffi Graf Und Andre Agassi Enthuellen Ihr Pickleball Geheimnis

May 30, 2025

Steffi Graf Und Andre Agassi Enthuellen Ihr Pickleball Geheimnis

May 30, 2025 -

Danmarks Fremtid Holder Vejret Pa Besked Fra Personens Navn

May 30, 2025

Danmarks Fremtid Holder Vejret Pa Besked Fra Personens Navn

May 30, 2025 -

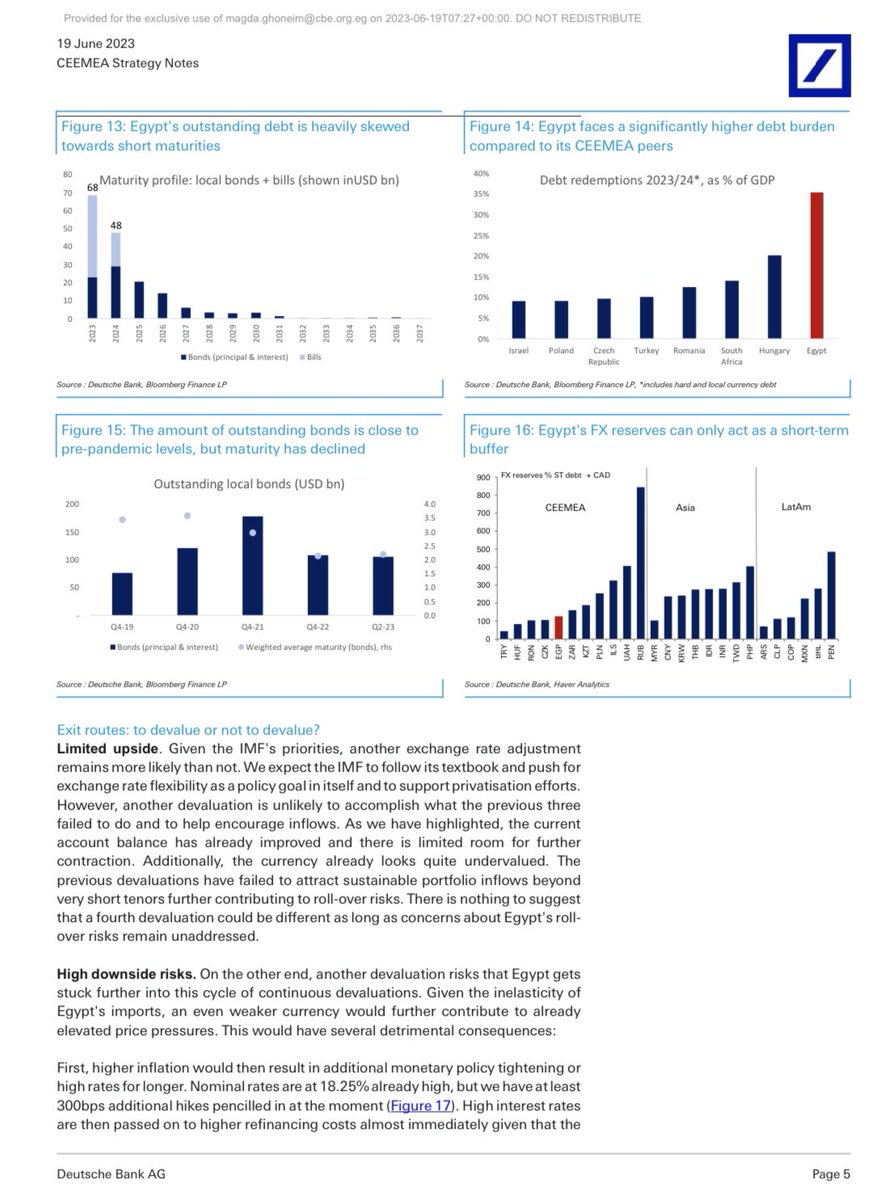

Dwytshh Bnk Khtt Altwse Fy Alimarat Leam 2024

May 30, 2025

Dwytshh Bnk Khtt Altwse Fy Alimarat Leam 2024

May 30, 2025 -

Cyberpunk 2 Cd Projekt Reds Plans And Challenges

May 30, 2025

Cyberpunk 2 Cd Projekt Reds Plans And Challenges

May 30, 2025 -

Measles In Texas A Look At The Recent Increase In Unconnected Cases

May 30, 2025

Measles In Texas A Look At The Recent Increase In Unconnected Cases

May 30, 2025

Latest Posts

-

May 23rd Orange County Sports Recap Scores And Player Performance

May 31, 2025

May 23rd Orange County Sports Recap Scores And Player Performance

May 31, 2025 -

Cau Long Thuy Linh Kho Khan Ngay Vong Loai Thuy Si Mo Rong 2025

May 31, 2025

Cau Long Thuy Linh Kho Khan Ngay Vong Loai Thuy Si Mo Rong 2025

May 31, 2025 -

Thuy Linh Doi Mat Thu Thach Lon Tai Vong 1 Thuy Si Mo Rong 2025

May 31, 2025

Thuy Linh Doi Mat Thu Thach Lon Tai Vong 1 Thuy Si Mo Rong 2025

May 31, 2025 -

Orange County High School Sports Friday May 23rd Scores And Stats

May 31, 2025

Orange County High School Sports Friday May 23rd Scores And Stats

May 31, 2025 -

Novak Djokovic Unutulmaz Bir Basari Hikayesi

May 31, 2025

Novak Djokovic Unutulmaz Bir Basari Hikayesi

May 31, 2025