Today's Stock Market: Dow Futures, Earnings Reports, And Market Movers

Table of Contents

Dow Futures: A Glimpse into the Day's Trading

Understanding Dow Futures Contracts

Dow futures contracts are agreements to buy or sell the Dow Jones Industrial Average (DJIA) at a specific price on a future date. They are a valuable tool for predicting market direction and managing risk.

- Dow futures reflect investor sentiment before the actual market opening. They offer a preview of how the market might react to overnight news and anticipated events.

- Changes in Dow futures can indicate potential gains or losses for the Dow Jones Industrial Average during the trading day. A significant upward movement in Dow futures suggests a positive opening, and vice versa.

- Analyzing Dow futures charts provides valuable insight into short-term market trends. Technical analysis of Dow futures can reveal potential support and resistance levels.

Interpreting Dow Futures Data

Interpreting Dow futures data requires considering several factors. Simply looking at the price is insufficient for accurate stock market analysis.

- Consider the volume of contracts traded alongside price movements. High volume amplifies the significance of price changes, indicating strong conviction in the market's direction.

- Pay attention to the gap between the closing price of the previous day and the opening of futures trading. A significant gap can reveal overnight news or unexpected events affecting investor sentiment.

- Factor in overnight news and global events that might affect the market. Geopolitical tensions, economic announcements, and unexpected company news can all influence Dow futures prices.

Impact of Earnings Reports on Stock Prices

Upcoming Earnings Announcements

Several key companies are releasing earnings reports today, potentially impacting the broader market. Analyzing these reports is a critical aspect of today's stock market analysis.

- [Company A]: (e.g., A large technology company with significant market capitalization; mention sector and analyst expectations - positive or negative).

- [Company B]: (e.g., A major financial institution; mention sector and analyst expectations - positive or negative).

- [Company C]: (e.g., A leading pharmaceutical company; mention sector and analyst expectations - positive or negative).

Analyzing Earnings Reports

Analyzing earnings reports involves focusing on key financial metrics:

- Highlight the importance of comparing reported earnings to analysts' expectations. "Beating" expectations often leads to positive price movements, while "missing" them can cause declines.

- Explain the concept of "beating" or "missing" earnings expectations. This is a crucial element in understanding short-term stock market trends.

- Discuss how earnings reports can influence stock prices, both immediately and in the long term. Positive surprises can lead to sustained growth, while negative surprises may result in protracted declines.

Identifying Today's Market Movers

News and Events Driving Market Activity

Various news and events can significantly impact market movement, affecting today's stock market trends.

- Mention any significant economic announcements (e.g., inflation data, interest rate changes). These announcements often trigger substantial market volatility.

- Discuss any geopolitical events or tensions influencing investor sentiment. Global uncertainty can lead to risk aversion and market corrections.

- Analyze impactful industry-specific news (e.g., regulatory changes, technological breakthroughs). Specific industry news can impact individual stocks and sectors disproportionately.

Sector Performance and Stock Selection

Analyzing sector performance is crucial for informed investment strategies.

- Mention the correlation between sector performance and broader market trends. Some sectors are more sensitive to market fluctuations than others.

- Discuss the importance of diversification in mitigating risk. Diversifying your portfolio across different sectors reduces your exposure to sector-specific risks.

- Briefly explain strategies like sector rotation. Sector rotation involves shifting investments from underperforming to outperforming sectors.

Conclusion

This analysis of today's stock market highlights the importance of monitoring Dow futures, carefully reviewing earnings reports, and identifying key market movers. By combining these insights, investors can make more informed decisions and potentially navigate market volatility more effectively. Understanding these components is key to effective stock market analysis and developing sound investment strategies.

Call to Action: Stay informed about today's stock market and its key drivers by regularly checking for updates on Dow futures, earnings releases, and significant market movers. Understanding these components empowers you to make better investment decisions in today's dynamic market. Keep up-to-date with the latest analysis of today's stock market to optimize your investment strategy.

Featured Posts

-

Cavaliers Vs Heat Game 2 Your Complete Guide To Watching The Nba Playoffs

Apr 30, 2025

Cavaliers Vs Heat Game 2 Your Complete Guide To Watching The Nba Playoffs

Apr 30, 2025 -

Complicated Seating Plans The Case Of A Papal Funeral

Apr 30, 2025

Complicated Seating Plans The Case Of A Papal Funeral

Apr 30, 2025 -

Basel Greenlights Funding Eurovision Village 2025 Secured

Apr 30, 2025

Basel Greenlights Funding Eurovision Village 2025 Secured

Apr 30, 2025 -

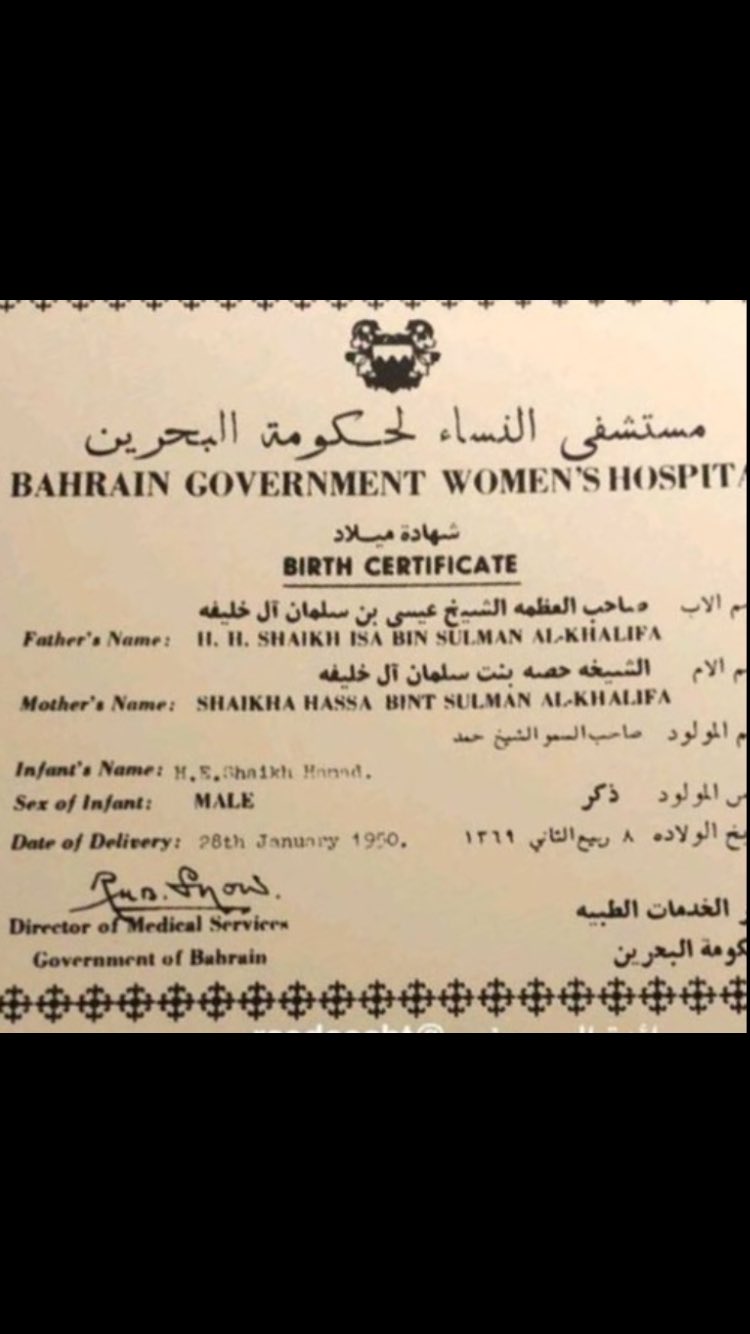

Asrar Shhadt Mylad Bywnsyh Hqayq Sadmt

Apr 30, 2025

Asrar Shhadt Mylad Bywnsyh Hqayq Sadmt

Apr 30, 2025 -

Kentucky Facing Storm Damage Assessment Delays A Comprehensive Look

Apr 30, 2025

Kentucky Facing Storm Damage Assessment Delays A Comprehensive Look

Apr 30, 2025