Today's Stock Market: Analyzing Trump's China Tariff Plan And UK Trade Implications

Table of Contents

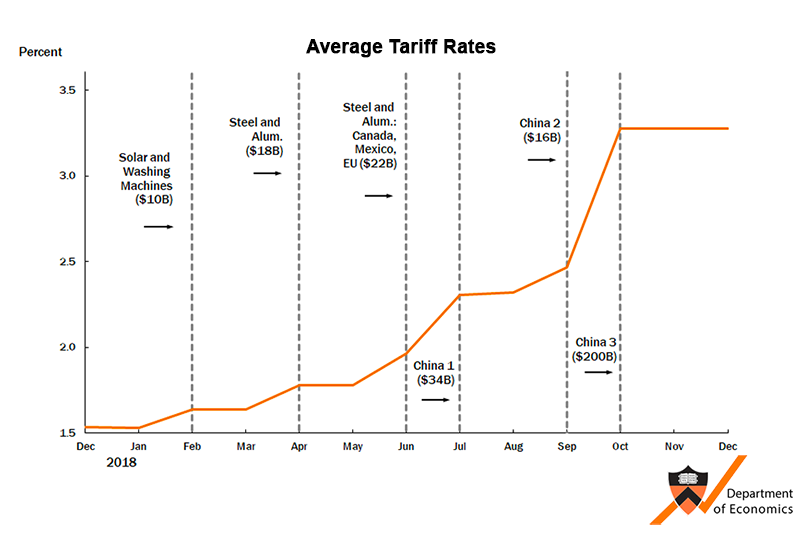

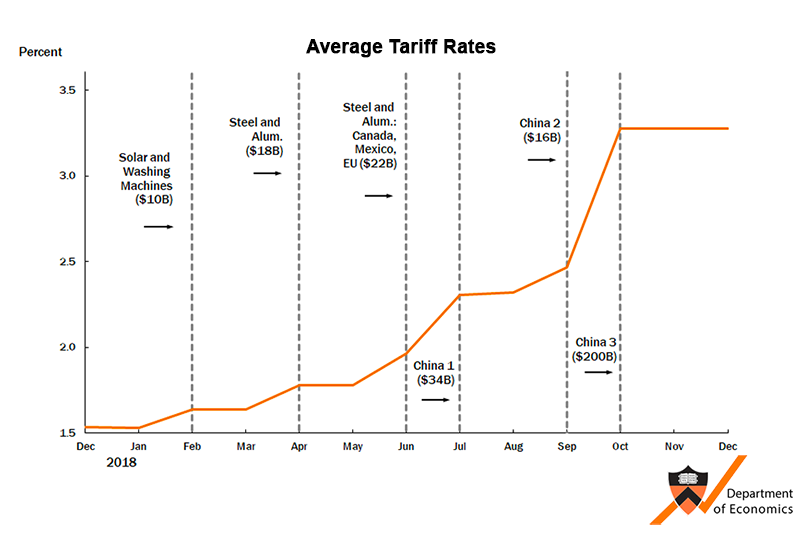

Trump's China Tariff Plan: A Retrospective Analysis

Trump's imposition of tariffs on Chinese goods, beginning in 2018, significantly altered the US-China trade relationship and sent ripples throughout the global economy. The rationale behind these tariffs was primarily to address what the Trump administration perceived as unfair trade practices by China, including intellectual property theft and forced technology transfer. However, the long-term economic effects remain a subject of ongoing debate.

-

Short-term effects: Initially, the tariffs led to increased prices for certain imported goods in the US, impacting consumer spending. China retaliated with its own tariffs, affecting US exports, particularly in the agricultural sector (soybeans, for example). This led to market uncertainty and volatility.

-

Long-term effects: The long-term impacts are still unfolding. While some argue the tariffs spurred domestic manufacturing in certain sectors, others point to increased costs for businesses and consumers, reduced global trade, and damage to the overall economic relationship between the two superpowers.

-

Sectoral Impact: The technology sector, particularly concerning semiconductors and telecommunications equipment, was significantly impacted. The agricultural sector also experienced considerable hardship due to retaliatory tariffs imposed by China.

-

Specific Tariff Rates and Affected Industries:

- Steel and aluminum: 25% tariff

- Certain consumer goods: 25% tariff (varied)

- Agricultural products: varying tariff rates leading to significant losses for US farmers.

-

Economic Consequences (Illustrative Data): [Insert relevant charts and data here, illustrating the impact on GDP growth, inflation, trade deficits, etc. Source the data appropriately].

The Ripple Effect: Global Market Volatility and Uncertainty

Trump's China tariffs didn't just affect the US and China; they contributed to increased global market volatility and uncertainty. The trade war heightened geopolitical risk, leading to investor apprehension and impacting investment decisions worldwide.

-

Increased Volatility: Stock markets around the globe experienced significant fluctuations in response to escalating trade tensions. Uncertainty about future trade policies created a climate of risk aversion.

-

Impact on Investor Confidence: The trade war significantly eroded investor confidence, leading to reduced investment in both domestic and international markets. Businesses delayed investment decisions due to the unpredictable trade environment.

-

Supply Chain Disruptions: Tariffs and retaliatory measures disrupted global supply chains, leading to increased production costs and shortages of certain goods. This negatively impacted stock prices of companies reliant on global supply chains.

-

Examples of Market Fluctuations: [Insert specific examples of market downturns or significant stock price changes directly linked to news about trade disputes].

-

Alternative Investment Strategies: During periods of high uncertainty, investors may consider diversifying their portfolios across different asset classes (bonds, real estate, commodities) to mitigate risk. Defensive investment strategies, focusing on less volatile sectors, may also be considered.

The UK's Post-Brexit Trade Landscape and its Global Impact

Brexit introduced further complexity to the global trade landscape. The UK's departure from the European Union significantly altered its trade relations with the EU and other global partners, creating uncertainty for both UK businesses and international investors.

-

Impact on UK Trade Relations: Brexit resulted in new trade barriers between the UK and the EU, impacting trade flows and increasing costs for businesses. The UK has been working to negotiate new trade agreements with countries outside the EU.

-

Consequences for UK Businesses and Investors: UK businesses face new regulatory hurdles and potential trade disruptions. Investors face uncertainty regarding future market access and potential investment returns.

-

Global Supply Chain Implications: Changes in trade relationships between the UK and the EU, along with the overall uncertainty around Brexit, have further complicated global supply chains, adding to existing pressures from the US-China trade tensions.

-

Key Changes in Trade Agreements: [Insert bullet points highlighting key changes in trade agreements and their impact on market access and trade flows].

-

Potential US-UK Trade Deal: The possibility of a future US-UK trade deal remains a significant factor influencing investor sentiment regarding UK assets. The potential benefits and challenges of such a deal are still being assessed.

Strategies for Navigating Today's Stock Market

Navigating today's stock market requires a strategic approach that prioritizes risk management and diversification. The ongoing uncertainties related to global trade and geopolitical risks necessitate a cautious and adaptable investment strategy.

-

Risk Mitigation: Investors should carefully assess their risk tolerance and adjust their portfolio accordingly. Diversification across different asset classes and geographic regions can help reduce overall portfolio volatility.

-

Portfolio Diversification: A well-diversified portfolio should include a mix of stocks, bonds, and potentially other asset classes, such as real estate or commodities, to mitigate risks associated with specific sectors or regions.

-

Long-Term Investing: A long-term investment horizon can help investors weather short-term market fluctuations. Focusing on fundamental analysis and investing in high-quality companies with strong fundamentals can reduce exposure to short-term market sentiment.

-

Investment Strategies for Different Risk Tolerance Levels:

- Conservative: Focus on low-risk investments like government bonds and high-quality dividend stocks.

- Moderate: A balanced portfolio with a mix of stocks and bonds, potentially including some real estate investments.

- Aggressive: Higher allocation to stocks, potentially including emerging market equities and higher-growth companies.

-

Resources for Further Research: [Suggest relevant financial news websites, investment platforms, and financial planning resources].

Conclusion

This article has analyzed the multifaceted impact of Trump's China tariff plan and the UK's post-Brexit trade landscape on today's stock market. We've explored the complexities of global trade relations and their profound effect on investor confidence and market volatility. Understanding the dynamics of today's stock market, particularly the ongoing implications of Trump's China tariffs and UK trade developments, is crucial for effective investment strategy. Continue to stay informed and adapt your approach to navigate the complexities of this ever-evolving market. Conduct thorough research and consider consulting with a financial advisor before making any investment decisions related to today's stock market.

Featured Posts

-

Shane Lowry On Rory Mc Ilroys Masters Victory So Happy For Him

May 11, 2025

Shane Lowry On Rory Mc Ilroys Masters Victory So Happy For Him

May 11, 2025 -

Hakkari Iftar Programi Hakim Ve Savcilar Bir Arada

May 11, 2025

Hakkari Iftar Programi Hakim Ve Savcilar Bir Arada

May 11, 2025 -

Ludogorets Naema Antoan Baroan

May 11, 2025

Ludogorets Naema Antoan Baroan

May 11, 2025 -

Werder Bremen Dominates Holstein Kiel A Resounding Victory

May 11, 2025

Werder Bremen Dominates Holstein Kiel A Resounding Victory

May 11, 2025 -

Faber Announces 100 Support For Royal Distinctions For Asylum Volunteers

May 11, 2025

Faber Announces 100 Support For Royal Distinctions For Asylum Volunteers

May 11, 2025