Thursday's CoreWeave (CRWV) Stock Decline: A Detailed Explanation

Table of Contents

Market-Wide Factors Influencing CRWV Stock Performance

Several broad market forces likely contributed to Thursday's CoreWeave stock decline. Understanding these factors provides crucial context for analyzing the company's specific situation.

Overall Market Sentiment

Thursday saw a general downturn in the broader market, impacting the tech sector significantly. This negative market sentiment played a role in CRWV's price drop.

- The Nasdaq Composite and S&P 500 both experienced declines, indicating a broader market sell-off.

- Prevailing economic anxieties, such as persistent inflation and the potential for further interest rate hikes, fueled investor uncertainty and risk aversion. This "market volatility" led to widespread selling across various sectors, including technology.

- Investor sentiment was negatively impacted by concerns about future economic growth, causing a flight to safety and reducing appetite for riskier assets like technology stocks.

Sector-Specific Trends

The cloud computing and data center industry, where CoreWeave operates, wasn't immune to the overall market downturn. While CRWV experienced a steeper decline, other companies in the sector also saw their stock prices fall.

- Competitors like NVIDIA (NVDA) and companies associated with Amazon Web Services (AWS) also experienced price drops, though perhaps less significant than CRWV's. This suggests that sector-specific headwinds might have played a role in the decline.

- A potential slowdown in cloud computing spending due to macroeconomic factors could have pressured the entire sector, impacting investor confidence in companies like CoreWeave. Analyzing the performance of "cloud computing stocks" relative to the broader market provides valuable insight.

Company-Specific News and Events Impacting CRWV Stock

In addition to market-wide factors, company-specific news and events might have contributed to CRWV's stock decline. Let's examine the potential factors.

Absence of Positive Catalysts

The absence of positive news or catalysts can contribute to sell-offs, particularly in a volatile market. Investors often react negatively when expectations aren't met.

- There were no significant earnings reports, major partnership announcements, or new product launches from CoreWeave on Thursday. The lack of such "positive catalysts" may have disappointed investors who were expecting some positive news to offset the negative market sentiment.

- The absence of any positive news during a period generally characterized by earnings season for many tech companies further exacerbated the negative impact.

Potential Negative News or Rumors

While no major negative news was officially released by CoreWeave, the absence of positive news, combined with broader market concerns, might have fueled speculation and negative sentiment.

- Analyst downgrades or negative commentary from financial news sources, even if not directly impacting CoreWeave, could contribute to a negative perception and increased selling pressure. Monitoring "analyst downgrades" and "negative press" is crucial for understanding stock price movements.

- Concerns about CoreWeave's future financial prospects or competitive landscape, even if unfounded, could have prompted investors to sell their shares, creating a self-fulfilling prophecy. Evaluating "financial concerns" and the "CRWV stock forecast" from reputable sources can help gauge the long-term outlook.

Technical Analysis of the CRWV Stock Decline

Technical analysis can offer additional insights into the CRWV stock decline. Examining chart patterns and trading volume provides a different perspective.

Chart Patterns and Trading Volume

Analyzing the CRWV stock chart reveals significant selling pressure.

- A substantial increase in trading volume accompanied the price drop, suggesting a significant number of investors were selling their shares. High "trading volume" often correlates with significant price movements.

- The stock might have broken through key support levels, triggering further selling by technical traders. Analyzing "support and resistance" levels on the chart helps to understand these technical triggers. Studying moving averages can provide further context.

Short Selling Activity

Increased short selling activity could have exacerbated the price decline. Short sellers profit from a stock's price decline.

- While the precise amount of short selling isn't always publicly available immediately, a surge in short interest could have contributed to the downward pressure on CRWV's stock price. Monitoring "short interest" and "short selling" data provides valuable insights into market sentiment.

Conclusion

This analysis of Thursday's CoreWeave (CRWV) stock decline highlights the complex interplay of market-wide factors and company-specific news. While the overall market sentiment and sector-specific trends played a role, the absence of positive catalysts and potential negative market sentiment likely contributed significantly to the drop. Understanding the technical aspects further clarifies the price movement. Investors should carefully consider these factors and conduct thorough due diligence before making any investment decisions related to CRWV stock. Stay informed about future CoreWeave (CRWV) developments and market trends to make informed decisions about your investment strategy. Continue monitoring the CRWV stock price and news for further insights into the company’s performance. Understanding the nuances of CRWV stock price fluctuations is crucial for successful long-term investing.

Featured Posts

-

Bp Executive Pay 31 Reduction Announced

May 22, 2025

Bp Executive Pay 31 Reduction Announced

May 22, 2025 -

Become A Wyoming Guided Fishing Advisory Board Volunteer

May 22, 2025

Become A Wyoming Guided Fishing Advisory Board Volunteer

May 22, 2025 -

Vstuplenie Ukrainy V Nato Poslednie Zayavleniya Evrokomissara

May 22, 2025

Vstuplenie Ukrainy V Nato Poslednie Zayavleniya Evrokomissara

May 22, 2025 -

Revised Core Weave Ipo Price 40 Per Share

May 22, 2025

Revised Core Weave Ipo Price 40 Per Share

May 22, 2025 -

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 22, 2025

Teletoon S Spring Lineup Jellystone And Pinata Smashling Highlight New Shows

May 22, 2025

Latest Posts

-

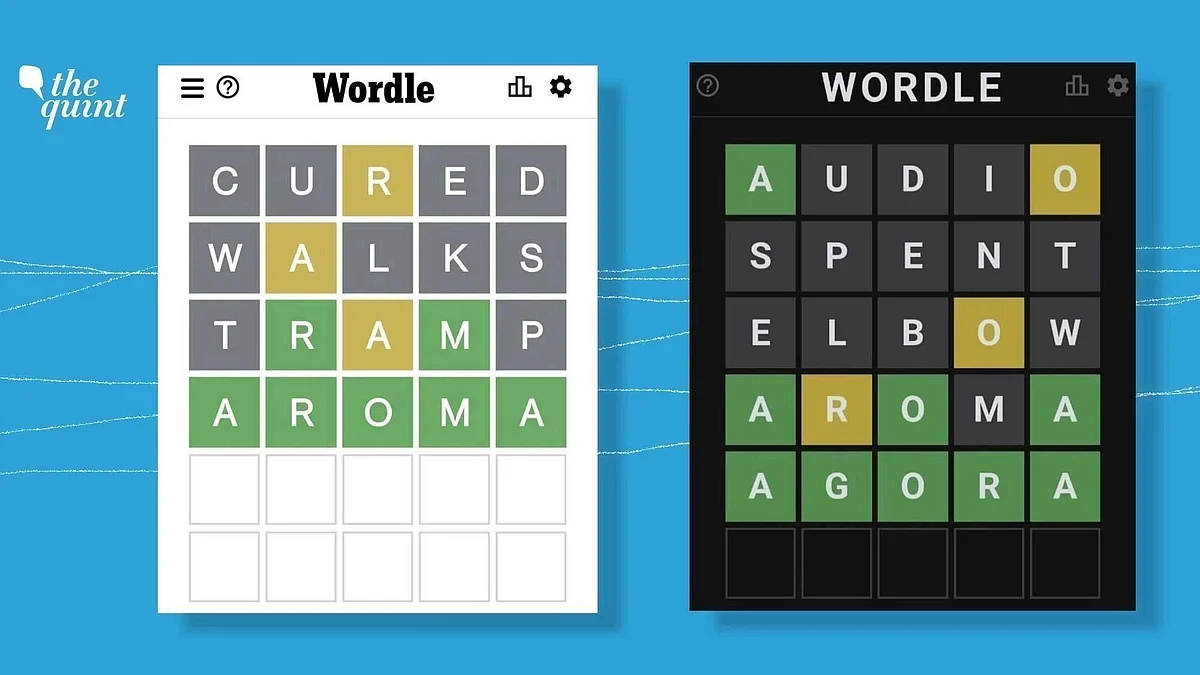

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025