The Unfolding Bond Crisis: What Investors Need To Know

Table of Contents

Rising Interest Rates and Their Impact on Bond Values

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When interest rates rise, the value of existing bonds with lower coupon rates declines. This is because newly issued bonds offer higher yields, making older bonds less attractive. This impact is particularly significant for investors holding long-term bonds. Rising interest rates are actively eroding the value of many existing bond portfolios.

- Impact on Different Bond Types:

- Government Bonds: While generally considered less risky, government bonds are still susceptible to interest rate fluctuations, especially longer-term maturities.

- Corporate Bonds: Corporate bonds, particularly those with lower credit ratings, are more vulnerable to interest rate increases, as their yields must compete with higher-yielding alternatives.

- High-Yield Bonds (Junk Bonds): These bonds carry higher risk and are extremely sensitive to interest rate changes, potentially leading to significant capital losses during a rising rate environment.

Understanding interest rate risk, bond valuation, and the shape of the yield curve is paramount during a bond crisis. The duration and maturity of your bonds significantly influence their sensitivity to interest rate changes.

Inflation's Role in the Bond Crisis

High inflation significantly erodes the purchasing power of fixed-income investments like bonds. When inflation outpaces the return on a bond, the investor's real return is negative. This means their investment is losing value in terms of what it can actually buy.

Central banks typically respond to inflation by raising interest rates, aiming to cool down the economy and curb price increases. This response, while intended to combat inflation, exacerbates the bond crisis by further depressing bond prices as explained above.

- Inflation and Bond Market Performance:

- High inflation generally leads to lower bond prices and higher yields.

- Periods of unexpected inflation can cause significant volatility in the bond market.

- Inflation-protected securities (TIPS) can offer some protection against inflation, but they are not immune to interest rate fluctuations.

Navigating this requires close monitoring of central bank policy, understanding monetary policy's influence on inflation, and considering the use of inflation-protected securities as a potential hedge.

Geopolitical Risks and Their Influence on the Bond Market

Global events introduce significant uncertainty into the bond market. Wars, political instability, and trade disputes can all trigger a "flight to safety," where investors move their money into perceived safer assets, like government bonds. This increased demand can temporarily lower yields on government bonds, but it can also increase volatility and uncertainty across the broader bond market.

- Examples of Geopolitical Impacts:

- The Russian invasion of Ukraine significantly impacted global bond markets, causing increased volatility and uncertainty.

- Escalating trade tensions between major economies can lead to capital flight and negatively affect bond market sentiment.

- Political instability in a country can negatively impact the value of its sovereign debt.

Understanding geopolitical risk, the implications for sovereign debt, and the assessment of credit risk are crucial for navigating the complexities of the bond market downturn fueled by global events and their impact on the global economy and market volatility.

Strategies for Navigating the Bond Crisis

The current environment demands a proactive approach to bond portfolio management. Investors need to carefully reassess their risk tolerance and adjust their investment strategies accordingly.

- Practical Actions for Investors:

- Re-evaluate Risk Tolerance: Understand your comfort level with potential losses and adjust your portfolio accordingly.

- Adjust Portfolio Diversification: Diversify across different asset classes, not just bonds, to reduce overall portfolio risk. Consider including alternative investments.

- Consider Shorter-Term Bonds: Shorter-term bonds are less sensitive to interest rate changes than longer-term bonds.

- Explore High-Quality Bonds: Focus on bonds with higher credit ratings to minimize credit risk.

Effective portfolio diversification, robust risk management, strategic asset allocation, and exploration of alternative investments are key to navigating this bond market volatility. Careful bond portfolio management is essential.

Conclusion: Understanding and Mitigating the Bond Crisis Risk

The unfolding bond crisis highlights the interconnectedness of interest rates, inflation, and geopolitical risks. Rising interest rates erode the value of existing bonds, high inflation diminishes purchasing power, and geopolitical uncertainty introduces significant volatility. Understanding these factors is crucial for mitigating risk and protecting your investment portfolio. Proactive portfolio management, including diversification and a reassessment of risk tolerance, is vital during this period of heightened uncertainty. Don't let the unfolding bond crisis catch you off guard. Consult a financial advisor today to develop a comprehensive strategy for mitigating bond market risks and building a resilient investment portfolio in this challenging climate.

Featured Posts

-

Ritka 100 Forintos Ermek Ertekesitheto E A Te Penzermed

May 29, 2025

Ritka 100 Forintos Ermek Ertekesitheto E A Te Penzermed

May 29, 2025 -

Eight Hour Standoff In Seattle Ends In Two Arrests For Shooting

May 29, 2025

Eight Hour Standoff In Seattle Ends In Two Arrests For Shooting

May 29, 2025 -

Whats App A 15 Year Journey To The I Pad

May 29, 2025

Whats App A 15 Year Journey To The I Pad

May 29, 2025 -

Bryan Cranstons Silent Masterclass The Funniest Tv Performance Of 2025

May 29, 2025

Bryan Cranstons Silent Masterclass The Funniest Tv Performance Of 2025

May 29, 2025 -

Paris Sees Clashing Rallies Le Pens Accusations And The Counter Movement

May 29, 2025

Paris Sees Clashing Rallies Le Pens Accusations And The Counter Movement

May 29, 2025

Latest Posts

-

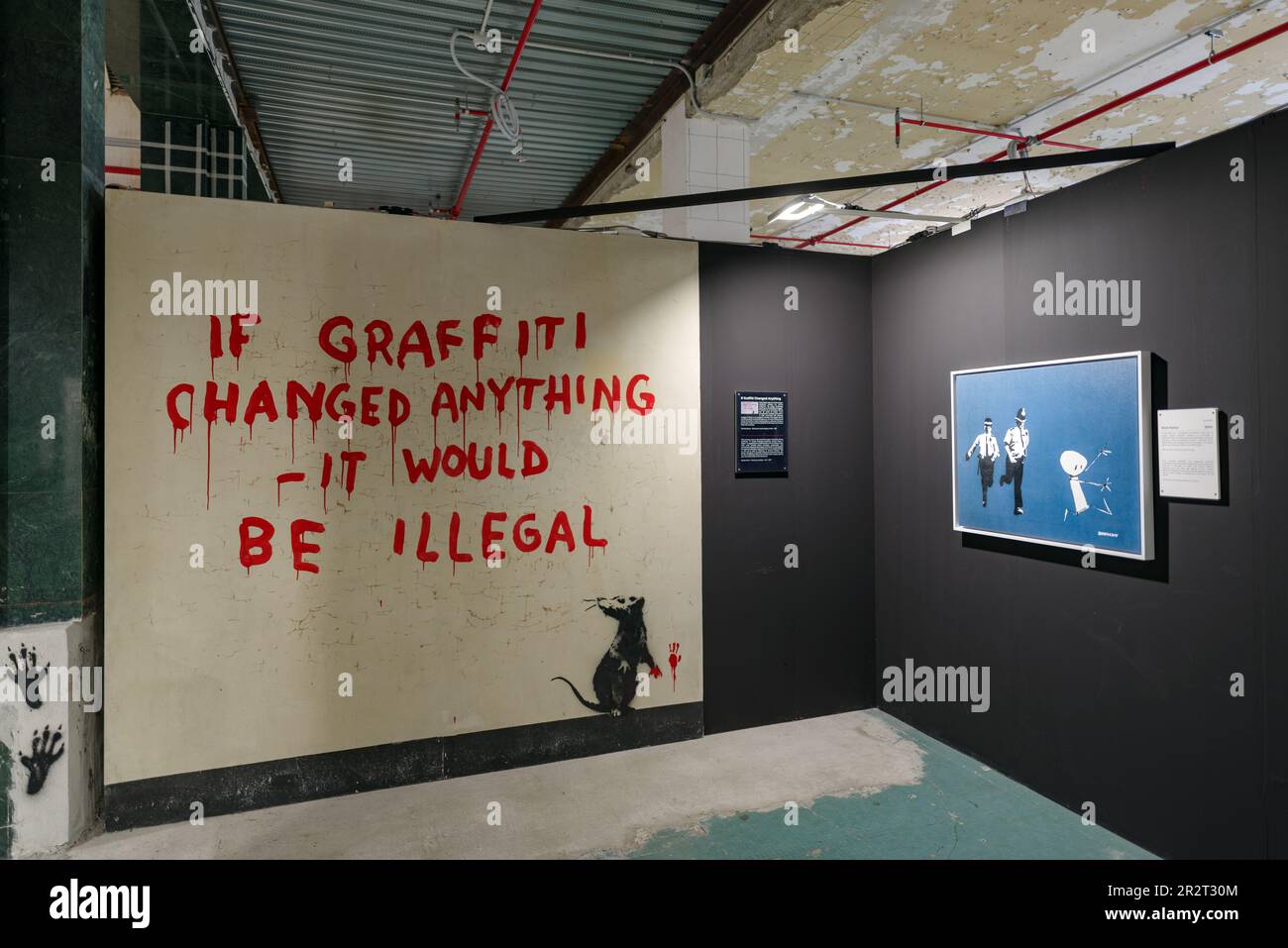

The Immersive Banksy Experience Now Open In Vancouver

May 31, 2025

The Immersive Banksy Experience Now Open In Vancouver

May 31, 2025 -

Waking Up To A Banksy Two Homeowners Very Different Stories

May 31, 2025

Waking Up To A Banksy Two Homeowners Very Different Stories

May 31, 2025 -

Authenticating A Potential Banksy The Westcliff Bournemouth Case

May 31, 2025

Authenticating A Potential Banksy The Westcliff Bournemouth Case

May 31, 2025 -

Former Nypd Commissioner Bernard Kerik Dead At 69 Remembering His Service

May 31, 2025

Former Nypd Commissioner Bernard Kerik Dead At 69 Remembering His Service

May 31, 2025 -

Vancouvers Epic Banksy Exhibit Review And Visitor Guide

May 31, 2025

Vancouvers Epic Banksy Exhibit Review And Visitor Guide

May 31, 2025